As a business owner, you have a lot on your plate. And sometimes, you need to hire outside workers with special skills to complete certain tasks at your business. To accomplish these tasks, you might consider hiring an independent contractor.

Does the above scenario sound all too familiar to you? If you hired a contractor during the year, you might need to file Form 1099-MISC. So, what is Form 1099-MISC?

What is Form 1099-MISC?

Form 1099-MISC, Miscellaneous Income, is an information return businesses use to report certain payment types, such as income paid to an independent contractor. You might also need to use Form 1099-MISC to report other income, such as rents or royalties.

Form 1099-MISC recipients

One of the most common uses of IRS Form 1099-MISC is to report independent contractor payments, or nonemployee compensation. Basically, Form 1099-MISC is like Form W-2 but for contractors.

Unlike employees, you don’t need to withhold taxes from your independent contractors’ compensation. Instead, contractors use Form 1099-MISC to make tax payments based on what you paid them.

You must send Form 1099-MISC to any contractors you paid $600 or more to throughout the year.

You might also need to fill out Form 1099-MISC for other types of payments, which you will learn more about later.

Types of 1099 payments

Many business owners use Form 1099-MISC to report nonemployee compensation. However, reporting independent contractor payments isn’t the only reason to file Form 1099-MISC.

You must file Form 1099-MISC if you make any of the following payments over $600:

- Royalties

- Rent

- Fishing boat proceeds

- Medical and health care payments

- Substitute payments in lieu of dividends or interest

- Crop insurance proceeds

- Excess golden parachute payments

- Gross proceeds paid to an attorney

- Nonemployee compensation

- Other payment types

The type of payment can also impact your Form 1099-MISC due date (mentioned later).

Check out the IRS 1099 instructions for a list of payments that you should report on Form 1099-MISC.

Filling out Form 1099-MISC

When you hire an independent contractor, you should have them fill out Form W-9. Use Form W-9 to fill out Form 1099-MISC.

When filling out Form 1099-MISC, include:

- The payment type (e.g., nonemployee compensation)

- Your name, address, and TIN (Taxpayer Identification Number)

- The recipient’s name, address, and TIN

- How much you paid the recipient during the year

- Any federal or state tax withheld

- Section 409A deferrals or income

Remember, you only need to fill out Form 1099-MISC for each contractor you paid $600 or more to during the year.

Filing Form 1099-MISC

After you finish filling out Form 1099-MISC, make sure you send the correct copies to the IRS and the recipient. You must also send Form 1096, Annual Summary and Transmittal of U.S. Information Returns, to the IRS. Form 1096 is a summary form of IRS Forms 1099-MISC.

You can either mail or e-File Forms 1099-MISC. You must e-File if you need to file 250 or more information returns throughout the year.

If your state participates in the Combined Federal/State Filing Program (CF/SF), the IRS will send your e-Filed 1099 forms to your state.

Check out a list of states that participate in CF/SF below:

Form 1099 due date

You are responsible for distributing and filing Form 1099-MISC by the correct due date.

If you’re reporting nonemployee compensation, the deadline to distribute and file Form 1099-MISC is January 31. Send Form 1099-MISC to the independent contractor and IRS by this due date.

If you use Form 1099-MISC to report a different type of payment other than nonemployee compensation (e.g., royalties), your Form 1099-MISC due date is February 28.

If you file the form electronically, your due date is March 31.

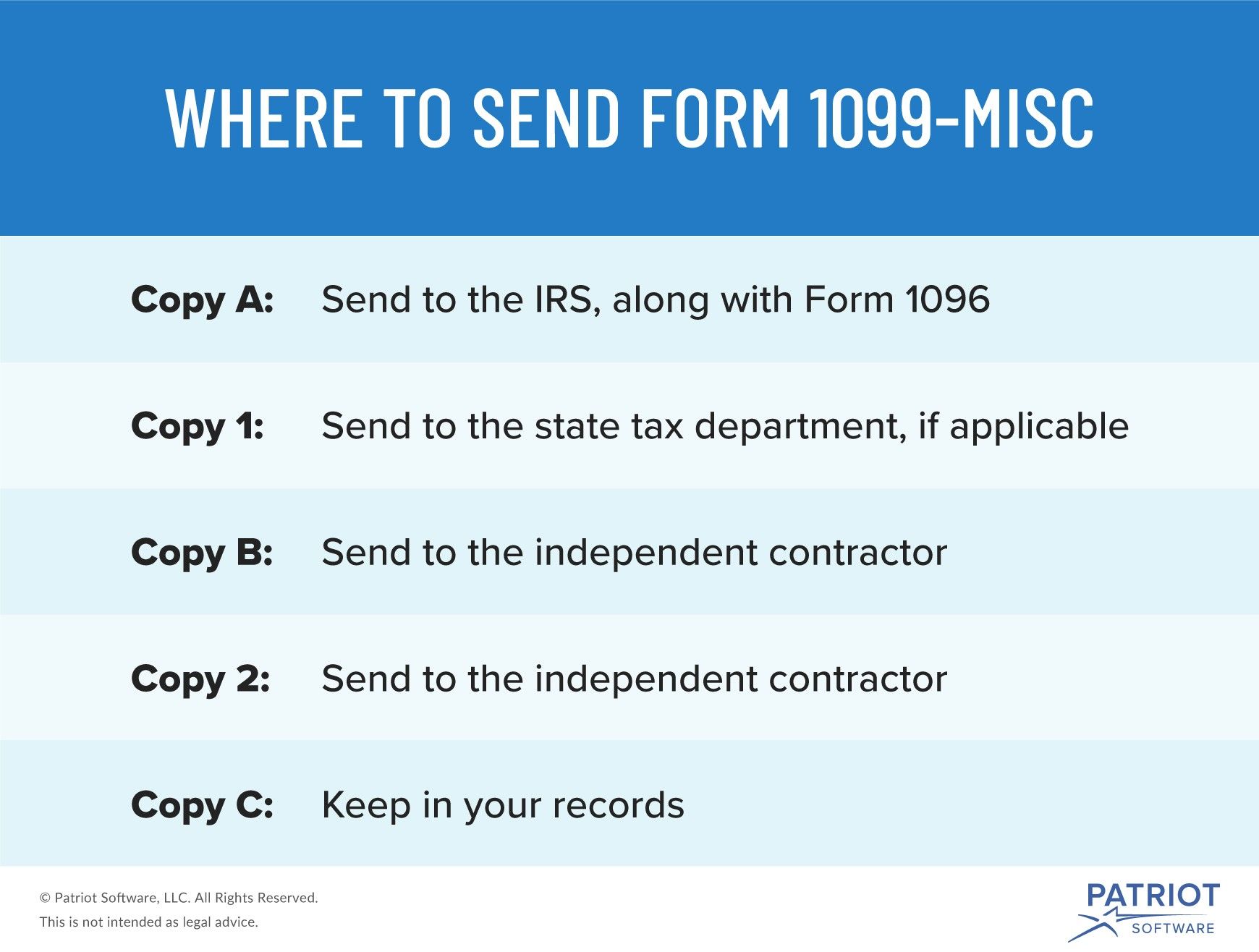

Form 1099-MISC copies

You must distribute multiple copies of Form 1099-MISC to various recipients. Each copy of Form 1099-MISC will either go to your contractor, the IRS, your business, or the state department (if applicable).

Here’s a breakdown of where you need to send each copy of Form 1099-MISC:

- Copy A: Send to the IRS, along with Form 1096

- Copy 1: Send to the state tax department, if applicable

- Copy B: Send to the independent contractor

- Copy 2: Send to the independent contractor

- Copy C: Keep in your records

Where to get Form 1099-MISC

You can view a sample of Form 1099-MISC on the IRS’s website. However, the sample is only for viewing. Do not print and/or file Form 1099-MISC from the IRS’s website.

Order official 1099-MISC forms either online from the IRS or from another authorized retailer. Make sure the forms you order are for the correct tax year.

Form 1099-MISC errors

Nobody’s perfect, so if you make a mistake on Form 1099-MISC, don’t worry. Instead, make sure you correct the error as soon as possible.

There are two types of errors you can make:

- Type 1

- Type 2

Type 1 errors include things like incorrect money amounts, codes, or checkboxes. Type 2 errors include a missing or incorrect TIN or payee name.

How you fix the issue depends on whether the error is a Type 1 or Type 2 error. Be sure to learn how to issue a corrected Form 1099 so you can quickly fix the error.

If you need to make a correction to an e-Filed Form 1099-MISC, check out the IRS’s Publication 1220. If you made a mistake, you would either need to make a One-transaction Correction or a Two-transaction Correction.

Upcoming Form 1099-MISC changes

There is talk about shaking up the way businesses report nonemployee compensation in 2020.

The IRS recently released a draft of a new form, Form 1099-NEC. Form 1099-NEC would specifically cover nonemployee compensation. Business owners would be required to use the new form instead of using Form 1099-MISC (box 7 for nonemployee compensation).

Business owners would still use Form 1099-MISC for other types of payments traditionally reported on the form (e.g., rents).

Although nothing is set in stone yet, the new Form 1099-NEC would help clear up confusion about due dates and keep nonemployee compensation separate from the mix of other payment types.

Stay tuned for more information about the possible new IRS form. And, check with the IRS if you have any questions about whether or not you need to file Form 1099-MISC.

Looking for an easy way to track independent contractor and vendor payments? Patriot’s accounting software lets you streamline the way you record payments, expenses, and income. Start your free trial today!

Have questions, comments, or concerns about this post? Like us on Facebook, and let’s get talking!

This article was updated from its original publication date of October 13, 2011.

This is not intended as legal advice; for more information, please click here.

Leave a Reply