If you want to operate your small company legally, you likely need some business licenses and permits. There are federal, state, and local licenses and permits you might have to apply for. It all depends on your business.

So, do you know which types of business licenses and permits you need to keep things legal? Read on to learn more about your responsibilities.

What are business licenses and permits?

Licenses and permits allow a business to operate in their locality or perform specific functions (e.g., license to collect sales tax). You must apply for and obtain the required licenses and permits before you can do the things they let you do. Without a necessary small business license, you could face consequences.

The licenses and permits you need depend on a number of factors, such as what you do and where your business is located. To stay compliant, check with your state and locality for specific permissions your business needs.

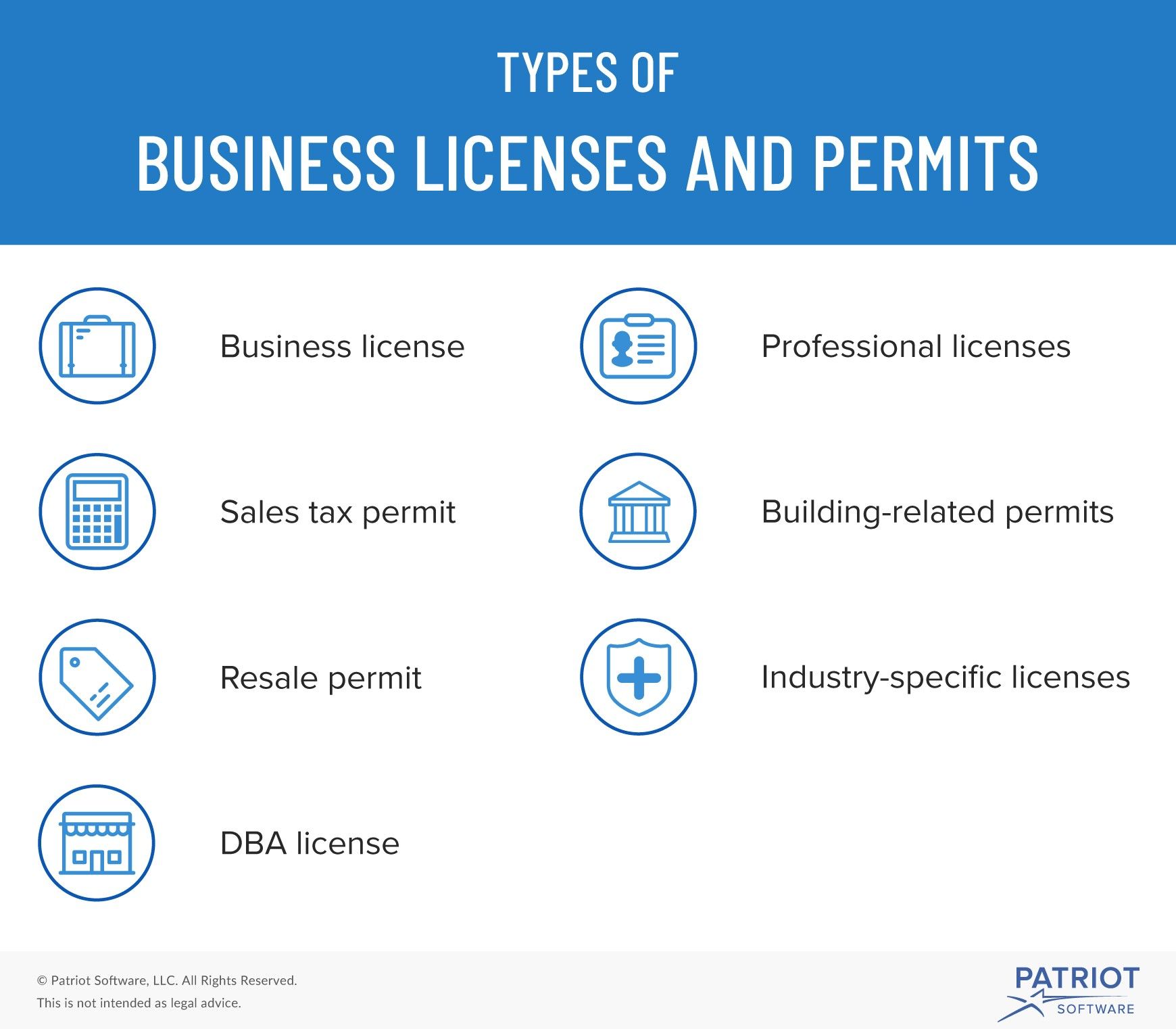

Types of business licenses and permits

You should familiarize yourself with common types of licenses and permits so you have an idea of what you’ll need to operate. Keep in mind that this is not an all-inclusive list.

Business license

All businesses should have a general business license to operate. You may need to apply for this with your locality if you didn’t register with your state to form your business structure.

A business that registers with their state (e.g., LLC) might not need to apply for a business license with their locality. Check with your city or county for more information.

Sales tax permit

Most businesses need to obtain a sales tax permit before they can sell products and collect sales tax from customers.

If you are required to collect sales tax, you need a permit. You must collect sales tax if you have nexus (a presence) in a state with sales tax laws that apply to your offerings.

Some states charge businesses a fee to apply for sales tax. Although most states require you to apply for a permit online through your state’s government website, some have a mail-in option.

Resale permit

Depending on your business, you might—in addition to a sales tax permit—need to get a resale permit.

Businesses with resale certificates are not required to pay sales tax when they purchase goods that are part of the products they sell.

Resellers, retailers, and businesses with tax-exempt status might consider applying for this type of permit.

DBA license

If you want to operate your business under a different name than your company’s legal name, you need to apply for a doing business as (DBA) license.

To obtain a DBA license, apply with your state and pay a registration fee. And, depending on your business location, you might also need to publish a notice about your doing business as name in the local newspaper.

Professional licenses

Sometimes, required business licenses apply to workers. Depending on your industry, you and your employees may need to have professional licenses before you can work for your business.

Here are a few examples of professionals who need licenses:

- Doctors, nurses, and other medical professionals

- Lawyers

- Nail technicians

- Cosmetologists

- Engineers

- Certified Public Accountants (CPAs)

Building-related permits

Your locality may require you to obtain building and/or zoning permits if you plan on building or making changes to a building. If you run your business out of your home, you may also need zoning permits.

You might also need to get a sign permit before putting up a business sign.

Industry-specific licenses

Depending on your industry, you may need additional licenses or permits to operate. Here are just a few of the special licenses and permits you may need:

- Liquor license

- Health permit

- Firearms license

- Tobacco license

- Fire department permit

Getting a business license or permit

The steps you need to follow for obtaining a business license depend on if you’re applying for a federal, state, or local license. For example, if you need a state business license, you would apply through your state.

You might also be curious about business license and permit fees. Do you have to pay for each license and permit? How much do they cost? Not all licenses come with fees. And for the ones that do, the business license cost depends. Fees might be as low as $25 or as high as hundreds of dollars.

For more information on applying for licenses and permits, visit the Small Business Administration’s website.

Do you have your business licenses and permits? Great! Once you’re open for business, don’t forget to manage your accounting books. Use Patriot’s online accounting software to track your expenses and income. Start your free trial now!

This is not intended as legal advice; for more information, please click here.

Leave a Reply