Executive Summary

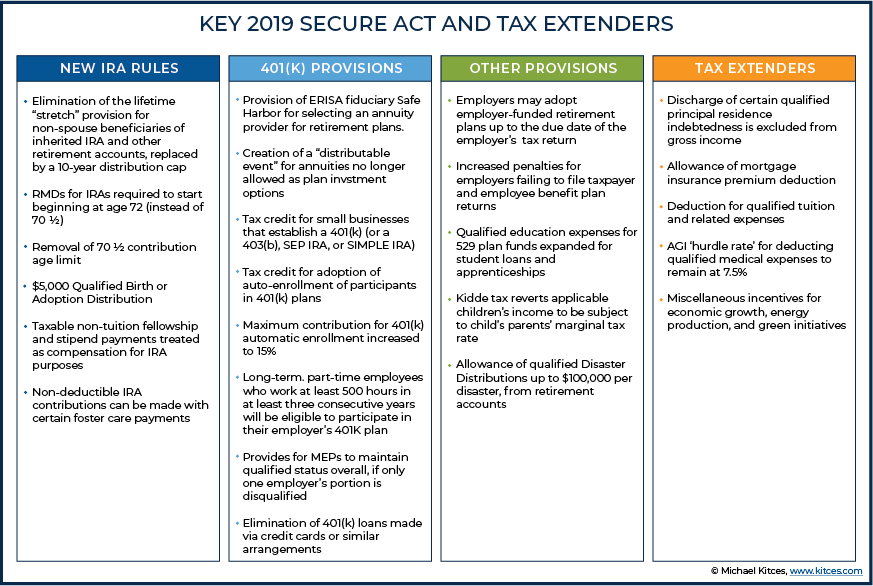

Sweeping legislative tax or retirement reforms typically happen only once every decade or so, but the final weeks of 2019 brought the second major piece of Congressional action in the past 24 months, as the SECURE Act (along with a series of year-end tax extenders), which was passed in the House this past summer, finally made its way through the Senate and was signed into law by the President. The legislation will have substantive repercussions as financial advisors help clients plan for their retirements for years to come.

In the context of financial advisors and the clients they serve, the first, and probably most notable change resulting from the SECURE Act, is the elimination of the so-called “stretch” provision for most (but not all) non-spouse beneficiaries of inherited IRAs and other retirement accounts. Under current law, non-spouse designated beneficiaries can take distributions over their life expectancy, but for many retirement account owners who pass away in 2020 and beyond, beneficiaries will have ‘only’ 10 years to empty the account. On the one hand, without any other distribution requirements within those 10 years, designated beneficiaries will have some flexibility around the timing of those distributions; however, certain types of “see-through” trusts that have been drafted to serve as beneficiaries of retirement accounts may find that they’re no longer able to make annual distributions to the trust under the new rules (only to suddenly have both the IRA and trust forcibly liquidated at the end of the 10-year window).

Other notable retirement planning changes under the SECURE Act include lifting the restriction on making contributions to a traditional IRA after age 70 ½ (as long as there is earned income to contribute in the first place), and an age increase for the onset of RMDs from age 70 ½ to age 72. However, as was the case with the IRS’s recent proposal to update the RMD life-expectancy tables, since only about 20% of retirees take no more than only the amount that they’re actually required to take, any changes in the rules around RMDs will have little effect on the remaining 80% who are already withdrawing more out of their accounts than the IRS requires. In addition, the SECURE Act does not change the age at which an individual can make a Qualified Charitable Distribution from their IRA, which remains at age 70 ½ and now creates a unique 1- or 2-year window where IRA distributions may qualify as charitable contributions, but not as RMDs (that haven’t yet begun).

Beyond the changing or elimination of various age-based thresholds for retirement accounts, the SECURE Act also includes an allowance for a penalty-free distribution up to $5,000 for a qualified birth or adoption, the creation of a Fiduciary Safe Harbor for selecting a “Lifetime Income Provider” (i.e., annuity company) for ERISA fiduciaries (thus assuaging at least some liability concerns around using lifetime income annuities in qualified plans), a substantial increase in the tax credit available to small businesses when establishing a retirement plan (as well as a brand new tax credit for small businesses that adopt an “auto-enroll” provision in their retirement plans), an increase in the allowable auto-enrollment “default” 401(k) plan contribution, improved access to employer plans for long-term part-time workers, and a significant reduction in the barriers to creating and maintaining Multiple Employer Retirement plans (which in theory will help to create economies of scale for lower plan costs when a group of small employers band together to provide a retirement plan)… as well as several other miscellaneous, smaller retirement provision changes.

Other notable non-retirement provisions attached to the SECURE Act include a repeal of the TCJA-introduced Kiddie Tax changes (reverting away from a requirement to use trust tax brackets and back to using the parents’ top marginal tax bracket), adjustments to the medical expense deduction threshold (back to 7.5%-of-AGI again for 2019 and 2020!), expanded provisions for 529 college savings plans to be used for Apprenticeships and (up-to-$10,000 of) student loan repayments, and a series of Tax Extenders for the mortgage insurance premium deduction and the higher education tuition and fees deduction.

Ultimately, the key point is that, although not nearly as sweeping as the Tax Cuts and Jobs Act of 2017, the SECURE Act of 2019 makes numerous updates to the rules around retirement plans in an effort to increase access to employer-sponsored retirement plans, and (hopefully) takes a positive step towards addressing the so-called retirement crisis. But as with other legislation in recent years, what legislation may give with one hand, it takes with the other, and in practice, many financial advisors may spend more time dealing with what is lost under the SECURE Act – in particular, the stretch IRA – than what is gained. At the very least, though, financial advisors will be busy in months ahead as they re-evaluate plans for clients impacted by the new and updated provisions introduced by the SECURE Act.

It appeared that as the clock was about to strike midnight last Wednesday, the proposed Setting Every Community Up for Retirement Enhancement (SECURE) Act (Division O of HR 1865) would turn into a pumpkin once again. After months of speculation about the bill’s future, since passing the House in the summer of 2019, it appeared that being stuck in the grind of Washington was a fait accompli.

But at the last moment, a final push by some in Washington (including, no doubt, a fair amount of lobbyists), got the SECURE Act attached to a year-end appropriations bill that Congress ‘had’ to pass (and ultimately did on Thursday, December 19) in order to keep our government up and running.

Thus, the bill which seemed destined to remain in legislative purgatory for the foreseeable future was suddenly whisked back to life, quickly passed by both the House and Senate and sent to the President’s desk to be signed.

In analyzing the extent of the SECURE Act’s changes, they are not nearly as broad and as substantial as the Tax Cuts and Jobs Act passed two years ago. But that said, the changes may be just as impactful to many taxpayers, particularly those with substantial tax-favored retirement savings.

In addition, a second bill included in the appropriations package, the Taxpayer Certainty and Disaster Relief Act of 2019, also has implications for certain retirement savers.

What follows is an analysis of not every section of the legislation, but the major changes made by these laws which are most likely to impact financial advisors in planning for and with their clients.

Ding, Dong, The ‘Stretch’ Retirement Account is Dead (Replacing With A New 10-Year Rule)

One of the most significant changes made by the SECURE Act to impact financial advisors is the elimination of the ‘Stretch’ provisions for most non-spouse beneficiaries of defined contribution plans and IRA accounts (HR 1865, Sec. 401)… a popular retirement-and-estate planning provision that has been under threat of elimination since first proposed in legislation all the way back in 2012.

Under current law for those who have already passed away (or do by the end of 2019), designated beneficiaries (generally, living human beings, and certain qualifying trusts) are eligible to stretch distributions over their life expectancy (or in the case of a qualifying trust, over the oldest applicable trust beneficiary’s life expectancy).

However, for most designated beneficiaries who inherit in 2020 (i.e., where the retirement account owner themselves dies in 2020 and beyond), the new standard under the SECURE Act will be the ‘10-Year Rule’.

Under this 10-Year Rule, the entire inherited retirement account must be emptied by the end of the 10th year following the year of inheritance. Similar to the existing 5-year rule for non-designated beneficiaries, though, within the 10-year period, there are no distribution requirements. Thus, designated beneficiaries will have some flexibility when it comes to timing distributions from the inherited account(s) for maximum tax efficiency… as long as the entire account balance has been taken by the end of the 10th year after death.

Example 1: On January 20, 2020, Josh’s father passed away, leaving Josh his $400,000 IRA. Josh, who is currently age 60, is still working and earns roughly $150,000 per year, but plans to retire in 5 years, at age 65.

Given the fact that Josh’s income will substantially decrease when he retires, it may make sense for him to avoid taking any distributions from the inherited IRA while he is still working (i.e., during the first 5 years of the distribution window provided by the 10-Year Rule). Instead, he can opt to distribute the funds during years 6-10, when he expects his income to be much lower after his wages are gone (and before he begins Social Security benefits).

Eligible Designated Beneficiaries Not Subject To The New 10-Year Rule

Notably, while the new general rule under the SECURE Act will be the 10-Year Rule, there are four groups of designated beneficiaries to which the new 10-Year Rule will not apply.

These beneficiaries, referred to as “Eligible Designated Beneficiaries”, are:

- Spousal beneficiaries;

- Disabled (as defined by IRC Section 72(m)(7)) beneficiaries;

- Chronically ill (as defined by IRC Section 7702B(c)(2), with limited exception) beneficiaries;

- Individuals who are not more than 10 years younger than the decedent

- Certain minor children (of the original retirement account owner), but only until they reach the age of majority.

For these Eligible Designated Beneficiaries, it’s ‘business as usual’ – the same rules that applied to them before the SECURE Act will continue to apply after the SECURE Act. They can take distributions over the beneficiary’s life expectancy (and spousal beneficiaries may still engage in a spousal rollover as well). As a result, the ‘Stretch’ isn’t truly ‘dead’, but it will only live on via a small percentage of post-2019 beneficiaries.

In the case of the “Special Rule for Minor Children”, though, the Eligible Designated Beneficiary category is only a limited reprieve, as such minor children will be able to take age-based requirement minimum distributions… until they reach the age of majority, and then the 10-year rule still ‘kicks in’.

It is important to emphasize that the Special Rule for Minor Children applies only to the “child of the employee [or IRA owner] who has not reached majority”. As such, minor children would appear to be ineligible for similar treatment if a retirement account was inherited from a non-parent, such as a grandparent.

Example 2: Jed is a 40-year-old IRA owner with a 5-year-old daughter. The age of majority in the state where Jed and his daughter live is 21.

Sadly, Jed dies is an auto accident, and leaves his IRA to his daughter. His daughter will have to take ‘regular’ lifetime RMDs, beginning the year after she inherits, until she reaches age 21. Once she turns 21, the 10-year rule will apply, requiring the entire inherited IRA to be fully depleted over the next decade (i.e., by the end of the year in which she turns 31).

New Planning Challenges For Trusts Named As Retirement Account Beneficiaries

It is always good practice for all beneficiary designations of retirement accounts to be periodically reviewed to see if they are still in line with, and best serve, the account owner’s wishes. However, the changes introduced by the SECURE Act will make it even more necessary to review any situations where trusts are named as retirement account beneficiaries.

In general, trusts created to serve as the beneficiary of a retirement account are drafted in such a manner as to comply with the “See-Through Trust” rules, which allow the trust to stretch distributions over the oldest applicable trust beneficiary. Broadly speaking, there are two types of such trusts; Conduit Trusts and Discretionary Trusts. Both types of trust could be unfavorably impacted by the SECURE Act.

For instance, many Conduit Trusts are drafted in a manner that only allows for the required minimum distribution to be disbursed from an inherited IRA to the trust each year, with a corresponding requirement for that amount to be passed directly out to the trust beneficiaries. In light of the changes made by the SECURE Act, for those beneficiaries subject to the 10-Year Rule, there is only one year where there is an RMD… the 10th year!

As a result of this change, Conduit Trusts drafted with language similar to that referenced above might not allow the trustee to take any distributions of the inherited account until the 10th year after death (because prior to that 10th year, any IRA distributions would be ‘voluntary’). And then, in the 10th year, the entire balance would have to come out in one year to the trust… and be passed entirely along to the trust beneficiaries (as a mandated RMD that under the Conduit provisions ‘must’ be passed through). The end result could be what would amount to a very high tax bill, as the entire value of the retirement account is lumped into a single tax year as a distribution to the beneficiary. Not to mention the loss of any protection of such assets (after they are distributed from the trust).

Discretionary Trusts may not fare much better though, if at all. Such trusts often require that all, or a substantial portion of retirement account distributions, remain in the trust (and not distributed out to the trust beneficiaries). In such circumstances, amounts retained by the trust are subject to trust tax rates, which are highly compressed as compared to individual tax rates.

For example, in 2019, trusts reach the highest Federal tax bracket of 37% at just $12,750 of taxable income! Given that such trusts will have, at best, 10 years to spread out distributions from inherited retirement accounts (since an accumulation trust itself would now often be subject to the 10-year rule, as a See-Through-But-Likely-Not-Eligible-Designated-Beneficiary Trust), significant amounts of wealth could evaporate in the form of high trust taxes.

Individuals may not want their beneficiaries to burn through their inheritance (hence the possible need for a trust in the first place), but it is even less likely that they want the IRS to do so instead!

Notably, it is not yet clear whether the IRS will allow all See-Through Trusts to actually see through the trust to an Eligible Designated Beneficiary. The SECURE Act specifically provides that such trusts can (subject to certain rules) be treated as an Eligible Designated Beneficiary when the applicable trust beneficiary is a disabled or chronically ill person. The law is silent, however, as to how a trust benefiting other Eligible Designated Beneficiaries (i.e., a spouse, a minor child, or a beneficiary within 10 year of the deceased retirement owner’s age) should be treated. Thus, it remains ambiguous. Future IRS guidance will likely be needed to address this question.

The Effective ‘Stretch’ Date For Collective Bargaining Agreement, TSP, and other Government Plans is January 1, 2022

For the most part, the changes to the ‘Stretch’ rules created by the SECURE Act will impact beneficiaries beginning in 2020. However, Congress did carve out a few exceptions to this rule, as follows:

- Plans maintained pursuant to a collective bargaining agreement have an effective of January 1, 2022 (unless the collectively bargained agreement terminates sooner).

- Governmental plans, such as 403(b) and 457 plans sponsored by state and local governments, and the Thrift Savings Plan sponsored by the Federal government (and in which Congresspersons, themselves, participate) are not impacted until January 1, 2022.

- Annuities in which individuals have already irrevocably annuitized over a life or joint life expectancy, or in which an individual has elected an irrevocable income option that will begin at a later point, are exempt entirely (and simply follow the already-binding contractual provisions of the annuitized contract).

Required Minimum Distributions (RMDs) To Begin At 72

Another big headline from the SECURE Act (Section 114) is a shift to push back the onset of RMDs from age 70 ½ to age 72. It’s not a huge change, but any RMD relief is welcome news for those who don’t want them and will only take them because they are forced to do so.

As an added benefit, people understand the concept of turning 72 a lot more than they do turning 70… and ½ (and figuring out their first RMD age factor, which in turn varied depending on whether their birthday was in the first or last 6 months of the year, due to the ½ year age trigger). Therefore, explaining when RMDs need to begin, and the calculation of the first RMD, should become at least a little bit easier for advisors in the future.

Mirroring current law, individuals upon reaching the requisite age (now age 72 instead of 70 ½) will still be able to delay their first RMD until April 1 of the year following the year for which they must take their first RMD (the required beginning date). Thus, an individual turning 72 on February 2, 2021 can timely take their first RMD until as late as April 1, 2022. However, if the first RMD is not taken in the year an individual turns 72, but is instead taken the following year (by April 1), a second RMD will also still need to be distributed that year (the year the individual turns 73) by the end of the year. But either way, the first age-72 RMD will always be calculated using the age 72 life expectancy factor.

Interestingly, this change actually (slightly) favors those who were born in the first half of the year, as the pushing back to age 72 ‘buys’ them two extra years of no-RMDs as compared to existing law. By contrast, those who are born in the second half of the year, where their first RMD is effectively for age 71 (as they reach age 70 ½ in the year they subsequently turn 71) will see the year in which they must begin taking RMDs shifted back by ‘just’ one year.

Notably, this change to the new required beginning date for RMDs only applies to those individuals who turn 70 ½ in 2020 or later. So even though an individual turning 70 ½ on December 20, 2019 will not yet be 72 in 2020, they will still be required to continue RMDs under the existing rules, and to take an RMD for 2020 (and each year thereafter).

Qualified Charitable Distributions (QCDs) Still Allowed At 70 ½

Since the SECURE Act was first passed by the House of Representatives during the summer of 2019, one of the most common questions has been “Will pushing back RMDs to 72 also mean that QCDs cannot be made until 72?” The answer is an emphatic “No.”

The SECURE Act makes no changes to the date at which individuals may begin to use their IRAs (and inherited IRAs) to make QCDs. Thus, even though an individual turning 70 ½ in 2020 will not have to take an RMD for 2020, they may still use their IRA to make a QCD of up to $100,000 for the year (after actually turning 70 ½ or later). Beginning in the year an individual turns 72, any amounts given to charity via a QCD will reduce the then-necessary RMD as well (while in the prior 1-2 years, it will simply allow the pre-tax IRA to be used for charitable contributions directly on a pre-tax basis).

New Exception To The 10% Early Withdrawal Penalty For Childbirth And Adoption

Section 113 of the SECURE Act introduces a new exception to the 10% early distribution penalty to the mix. More specifically, the exception allows up to $5,000 to be distributed penalty-free from an IRA or from a plan as a “Qualified Birth or Adoption Distribution”.

To meet the requirements of a Qualified Birth or Adoption Distribution, an individual must take a distribution from their retirement account at any point during the one-year period beginning on either the date of birth, or the date on which the adoption of an individual under the age of 18 is finalized.

Given this limitation, a Qualified Birth or Adoption Distribution will only be able to provide financial assistance once the qualifying event has occurred (i.e., account owners can’t take such a distribution to pay for initial adoption expenses prior to the date the adoption is finalized). On the other hand, the rules only stipulate that the distribution must occur after the qualifying event, which means an individual could still take a Qualified Birth or Adoption Distribution after the event to help replace the cash previously spent. In fact, the rules don’t even require that the distribution directly tie to qualifying expenses at all, merely that the distribution occurs after a qualifying event.

In addition, the $5,000 limit is a limit “with respect to any birth or adoption…”, and as such, appears to ‘replenish’ itself with each new birth or adoption (i.e., the $5,000 is a per-child limit). Furthermore, the exception applies on an individual basis. Therefore, if both of a child’s parents have available retirement assets, each can make a Qualified Birth or Adoption Distribution of up to $5,000 for each child born/adopted.

Finally, in the event a parent who took a Qualified Birth or Adoption Distribution is later able to “repay” such amount, they may do so back to the plan from which the distribution was made, or to an IRA. In other words, to the extent prior Qualified Birth or Adoption Distribution(s) have been made, those individuals will have the opportunity to make an additional contribution – over and above the standard contribution limits – to ‘repay’ themselves. Though notably, interested individuals may wish to wait for what will likely be future Treasury Regulations that explain the exact timing rules for such ‘re-contributions’.

Traditional IRA Contributions No Longer Prohibited At (And Beyond) Age 70 ½

In more good news for those closing in on age 70 ½, Section 107 of the SECURE Act lifts the prohibition on Traditional IRA contributions once an individual reaches the year in which they turn 70 ½. Which is significant because under current law, Traditional IRAs are the only retirement account for which contributions are not permitted due to (old) age in the first place!

Thus, beginning in 2020, individuals of any age will be allowed to contribute to a Traditional IRA. The requirement that such individuals have “compensation” – which is generally earned income from either wages or self-employment – to make such a contribution remains, though. As such, in general, only those individuals who are 70 ½ or older and who are still working (or who have a spouse that is still working and are contributing under the Spousal IRA rules), will be able to take advantage of this change.

The SECURE Act also contains an anti-abuse rule that coordinates post-70 ½ Traditional IRA contributions with QCDs. Under the rule, any QCD will be reduced by the cumulative amount of total post-70 ½ IRA contributions (but not below $0) that have not already been used to offset an earlier QCD. Effectively ensuring that individuals don’t just ‘recycle’ post-70 ½ IRA contributions into subsequent QCDs.

Example 3: Toby turns 70 ½ in 2020, but is still working part-time, earning $15,000 per year. In order to minimize his taxable income, Toby makes a $7,000 (including his over-age-50 catch-up) deductible contribution to his Traditional IRA. He continues to do the same for three more years (for a total of $28,000 of post-70 ½ Deductible Traditional IRA contributions), at which point he retires.

In 2027, Toby has an unusually large charitable streak and decides to make a $40,000 ‘QCD’, his first such distribution, to charity. Despite following all the QCD rules, Toby will ‘only’ be entitled to claim a QCD of $40,000 – $28,000 = $12,000. The remaining $28,000 given to charity can be claimed as an itemized deduction.

Annuity-Related Rule Changes For 401(k) And Other Employer Retirement Plans

Those who have followed the SECURE Act closely are likely to be familiar with the fact that the insurance industry gave it rather full-throated support. And it’s no surprise why – several changes made by the SECURE Act make it much more likely that annuity options will work their way into 401(k) and similar defined contribution plan investment lineups.

Fiduciary Safe Harbor For The Selection Of A Lifetime Income (Annuity) Provider

Of all the annuity-related changes made by the SECURE Act, perhaps the most significant is Section 204, which provides for a Fiduciary Safe Harbor for ERISA fiduciaries selecting a “Lifetime Income Provider” (i.e., an annuity company).

To date, many ERISA fiduciaries have avoided including lifetime income annuities as plan investment options, largely out of fear that, at some time in the future, the annuity carrier could run into financial problems that jeopardize its ability to meet its obligations, and that such a failure could result in a liability for the plan and/or plan fiduciaries for having picked that turned-out-to-fail annuity provider in the first place. In fact, while there is nothing preventing the use of annuities inside 401(k) plans today, concerns like this are a large reason why it’s estimated that less than 10% of such plans include an annuity as an investment option.

The SECURE Act assuages this fear by creating new Section 404(e) of ERISA. This new Section provides that an ERISA fiduciary can meet the requirement outlined by ERISA Section 404(a)(1)(B) – to act “with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims” (the “prudent man rule”) – when selecting an annuity provider by engaging “in an objective, thorough, and analytical search” of carriers.

More specifically, fiduciaries will be required to satisfy two requirements when conducting such an annuity provider search.

First, they must review “the financial capability of [an] insurer to satisfy its obligations” and determine that “at the time of the selection, the insurer is financially capable of satisfying its obligations under the guaranteed retirement income contract”.

In what is a concerning provision to some, however, all that a plan fiduciary needs to do in order to arrive at this ‘conclusion’ is obtain a number of written representations from the insurer, itself! Such representations include that the insurer:

- Is properly licensed;

- Has met certain State insurance requirements for the year in question, along with the previous 7 years;

- Undergoes appropriate financial examination no less than once every five years; and

- Will notify the fiduciary of any changes to the above.

So long as a plan fiduciary has obtained these representations from an annuity carrier and has no reason to believe that such representations are inaccurate, they will be deemed to have met the can-meet-their-financial-obligations analysis part of the safe harbor requirement. In addition, such fiduciaries can continue to meet this requirement by obtaining updated representations from an insurer at least annually.

The second requirement of the SECURE Act’s new ERISA fiduciary safe harbor for lifetime income is that the fiduciary is to determine that “the cost (including fees and commissions) of the guaranteed retirement income contract offered by the insurer in relation to the benefits and product features” is “reasonable”. The SECURE Act goes on to emphasize, however, that there is no requirement for a fiduciary to select the least expensive option. Rather, new ERISA Section 404(e)(3) states:

“NO REQUIREMENT TO SELECT LOWEST COST.—Nothing in this subsection shall be construed to require a fiduciary to select the lowest cost contract. A fiduciary may consider the value of a contract, including features and benefits of the contract and attributes of the insurer (including, without limitation, the insurer’s financial strength) in conjunction with the cost of the contract.”

By completing the limited actions outlined above, fiduciaries of ERISA plans are able to obtain a substantial amount of liability protection, as described in new ERISA Section 404(E)(5):

LIMITED LIABILITY.—A fiduciary which satisfies the requirements of this subsection shall not be liable following the distribution of any benefit, or the investment by or on behalf of a participant or beneficiary pursuant to the selected guaranteed retirement income contract, for any losses that may result to the participant or beneficiary due to an insurer’s inability to satisfy its financial obligations under the terms of such contract. [emphasis added]

Portability Of Lifetime Annuity Income Options

While perhaps not as much of a barrier as the potential fiduciary liability (largely alleviated by the aforementioned safe harbor) of selecting an annuity provider as a plan investment option, a second significant issue that has prevented many plans from incorporating them into the investment mix is concerns over portability. More simply, what, for instance, would happen if existing or prior employees had already selected the annuity option, and the employer wanted to drop the annuity as an option from the plan (or merge into another company that didn’t include such an option in their plan)?

Under current law, participants who elected to invest in such options would often be left with a number of unpleasant options, such as liquidating the annuity.

The SECURE Act resolves this situation by creating a new ‘distributable event’ (e.g., separation of service, death, attainment of age 59 ½) that applies just to annuities when they are no longer allowed as an investment option within a plan. In such situations, participants will be allowed to distribute their plan annuity, in-kind, beginning 90 days prior to the elimination of the annuity as a plan investment option.

This provision is effective for plan years beginning on or after January 1, 2020.

Provisions To Encourage The Adoption And Use Of Retirement Plans Amongst Small Businesses

The annuity-related plan provisions were far from the SECURE Act’s only changes for plans. Some important provisions were also made for small businesses to further encourage their adoption and use of employer retirement plans for their employees.

Small Businesses Can Get A (Bigger) Tax Credit For Establishing A Retirement Plan

Under current IRC Section 45E, small businesses are eligible for a credit of up to $500 for up to three years for startup costs related to establishing a small business-sponsored retirement plan, such as a 401(k), 403(b), SEP IRA or SIMPLE IRA. Such businesses are defined (under IRC Section 408(p)(2)(C)(i)) as businesses with 100 or fewer employees receiving $5,000 or more of compensation.

Section 104 of the SECURE Act substantially increases in the potential credit amount available.

For tax years beginning January 1, 2020, the maximum credit available under IRC Section 45E (for up to three years) will be increased to the greater of:

- $500; or

- The lesser of:

- $250 × the number of non-highly-compensated employees eligible to participate in the plan; or

- $5,000.

Example 4a: West End Hardware has recently opened. Its owner is considering establishing an employer-sponsored retirement plan to cover himself, as well as his one employee, who is not highly compensated. If West End Hardware adopts a 401(k) plan, and its one non-highly-compensated employee is eligible to participate, it will be eligible to receive a credit of up to $500.

Example 4b: On The Wings Of Love Wedding Chapel has recently opened. Its owner is considering establishing an employer-sponsored retirement plan to cover herself, as well as her 14 employees, none of whom are highly compensated. If On The Wings Of Love Wedding Chapel adopts a 401(k) plan, and its 14 non-highly-compensated employee are eligible to participate, the business will be eligible to receive a credit of up to $250 x 14 = $3,500.

Example 4c: Abbey is considering establishing an employer-sponsored retirement plan to cover herself, as well as her 35 employees, none of whom are highly compensated. If she adopts a 401(k) plan, and its 35 non-highly-compensated employee are eligible to participate, she will be eligible to receive a credit of up to $5,000 (since the credit is limited to the lesser of $5,000 or $250 x 35 = $8,750).

New Credit For Adoption Of Auto-Enrollment By A Small Business

Auto-enrollment has been a proven way to increase participation in employer-sponsored retirement plans. As such, to encourage small businesses to incorporate such a provision into their plan, Section 105 of the SECURE Act establishes new IRC Section 45T, “Auto-Enrollment Option For Retirement Savings Options Provided By Small Employers”. The Section provides for a credit, separate and apart from other credits (such as the credit for retirement plan startup costs discussed above), of $500.

In order to qualify for the credit, a small business (defined, once again, under IRC Section 408(p)(2)(C)(i)) must adopt an “Eligible Automatic Enrollment Arrangement”, as defined by IRC Section 414(w)(3). In general, such arrangements require plans to treat participants as though they have elected for the employer to make contributions to the plan at a specified percentage of compensation, until affirmatively notified by the participant to do otherwise.

The credit is first available for tax years beginning in 2020, and can be claimed in the year the auto-enrollment option is first adopted by the plan, as well as the two following years (provided the provision continues to be maintained by the plan during those years).

Notably, the fact that the Auto-Enrollment Option tax credit is based on when the auto-enrollment option itself is added – not when the plan is created – means that even businesses that have already adopted 401(k) plans can still earn the credit by adding an auto-enrollment option in 2020 or beyond (if they haven’t already).

Additional Provisions To Increase 401(k) Participation

In recognizing the importance of participation in employer-provided retirement plans, the SECURE Act includes additional provisions to help employers encourage their employees to increase contributions, and to let (some) part-time employees participate when they were previously ineligible to do so.

Maximum Contribution Percentages For 401(k) Automatic Enrollment Increased

As noted above, automatic enrollment has been shown to be a major contributor to increased participation in employer plans. In addition, research has shown that automatically increasing an employee’s contribution rate increases the likelihood that they will contribute more to their plan.

Employers, however, are limited as to the amount of an employee’s compensation that they can automatically elect to defer for them into the employer’s 401(k) plan. Currently, the maximum percentage of compensation that an employer can set as the plan “default” for automatic enrollment is 10%. Beginning in 2020, however, Section 102 of the SECURE Act will allow plans to increase the default percentage to as high as 15% in any year after the first full plan year in which the employee’s compensation is automatically deferred into the plan.

Long-Term Part-Time Workers Provided Greater Access To Employer Plans

Under current law, employers can generally exclude employees from participating in a 401(k) if they have not worked at least 1,000 in a single plan year. This leaves many part-time workers, even those who have worked for many years, unable to participate in an employer’s plan.

The SECURE Act attempts to mitigate this issue by creating a ‘dual entitlement’ system for most employer retirement plans (though certain plans, such as collectively bargained plans, are exempt), in which the ‘old’ 1,000-hour rule still applies, but where employees must also be eligible to participate in the plan if they have worked at least 500 hours in at least three consecutive years. Thus, individuals must be eligible to participate in an employer plan upon completing either requirement.

Notably, part-time workers are not likely to earn as much as full-time workers, and therefore, may not be able to contribute as much to their 401(k)s as such persons. This could, absent other changes, impact certain plan testing such as the testing for nondiscrimination, and to determine if the plan is “top-heavy”. Accordingly, and to alleviate such concerns, the SECURE Act allows plans to exclude individuals from those testing calculations if they are participating in the plan only by virtue of the new 500-hours-for-3-years requirement.

These changes apply to plan years beginning in 2021, but that doesn’t really tell the whole story. That’s because, separately, the SECURE Act does not require an employer to start ‘counting’ a 500-hour year as a 500-hour year for the purposes of this new rule until 2021. Thus, the earliest an employee would be eligible to participate in a 401(k) plan as a result of this change will be in 2024.

Barriers To Establishing/Maintaining Multiple Employer Retirement Plans (MEPs) Significantly Reduced

Multiple Employer Retirement Plans (MEPs) – not to be confused with Multiemployer Retirement Plans – are single retirement plans that are maintained for the benefit of two or more unrelated employers. The primary (potential) benefit of MEPs is that they allow for economies of scale, which should, at least in theory, result in lower costs, with the savings passed along to plans and plan participants.

But while MEPs have existed for quite some time, their adoption has been stymied, primarily due to two factors. First, for many years, the “nexus” rule required the employers participating in the MEP to have a significant common relationship, such as participating in the same trade association. Those rules were loosened via new Department of Labor (DOL) Guidance provided earlier this year, but still require employers participating in a MEP to have either common businesses, or reside within the same geographic locations.

The second critical factor that has prevented MEPs from seeing wider adoption has been the IRS’s “One Bad Apple” rule. In short, the IRS has long held that MEPs are a single plan, and that as such, a disqualifying act by any single employer would disqualify the entire plan. Understandably, this risk kept many employers who would have otherwise considered participating in such plans from doing so.

In the near future, this will no longer be a limiting factor. Section 101 of the SECURE Act provides that in the event a single employer fails to fulfill obligations, the IRS can essentially disqualify that employer’s portion of the plan, while allowing the ‘master plan’ (the MEP) to maintain its qualified status.

Notably, for employers to benefit from the new MEP rules provided for by the SECURE Act, the MEP will have to be administered by a “Pooled Plan Provider”, such as a Registered Investment Advisor. This may provide advisors with new opportunities to serve the retirement plan needs of business owners in a cost-effective manner.

Changes made by this section of the SECURE Act are not effective until plan years beginning in 2021.

Additional Miscellaneous Retirement Provisions Of The SECURE Act

In addition to the headline-grabbing retirement changes, the SECURE Act also makes a number of smaller changes to retirement planning that advisors should be aware of, including:

- Taxable Non-Tuition Fellowship And Stipend Payments Treated As Compensation For IRA Purposes – Beginning in 2020, individuals who have taxable stipends or other amounts paid to them to aid in the pursuit of a graduate or postdoctoral study can use those amounts as compensation for IRA/Roth IRA contribution purposes (SECURE Act Section 106).

- Nondeductible IRA Contributions Can Be Made With Certain Foster Care Payments – Effective upon enactment, individuals who receive “Difficulty of Care” payments (payments where a state has determined there is a need for additional compensation due to an individual’s physical, mental, or emotional handicap) as a “Qualified Foster Care Payment”, and exclude those amounts from gross income, can use such amounts to make nondeductible IRA contributions (provided such amounts don’t exceed the IRA contribution limits when added to amounts contributed based on “compensation” (SECURE Act Section 116).

- No More 401(k) Credit Cards – Effective upon enactment, 401(k) loans may no longer be made via credit cards, or similar arrangements. (Yes, this really was a thing, with growing concern that it was leading to excessive use of 401(k) plan loans, for people who may not have realized the tax consequences for failing to pay it back!) (SECURE Act Section 108).

- More Retirement Plans Can Be Adopted After Year-End – Under current law, if an employer wants to establish a qualified retirement plan for the year, they must generally do so by December 31st of that year (or the last day of the employer’s fiscal year). Section 201 of the SECURE Act amends this requirement for certain plans. Beginning in 2020, employers may adopt plans that are all entirely employer-funded, such as stock bonus plans, pension plans, profit sharing plans, and qualified annuity plans, up to the due date (including extensions) of the employer’s return (SECURE Act Section 201).

Given that these plans are all entirely employer-funded, the biggest benefactors of this change are likely to be business owners planning for their own tax liabilities, and who have few or no employees for whom plan contributions would have to be made.

- Increased Penalties For Failing To File Returns – Penalties for failing to file both ‘regular’ income tax returns and IRS Form 5500, for reporting employee benefit plans, are significantly increased, making timely filing returns more important than ever before (SECURE Act Sections 402 and 403).

SECURE Act’s Non-Retirement-Related Changes

While the bulk of the SECURE Act is targeted at making (what are, in some cases, debatable) improvements to the retirement system, as is often the case, Congress stuffed a few extra ‘goodies’ into the legislation it wanted to address as well. Of particular interest for advisors will be the changes made to 529 plans and the so-called “Kiddie-Tax”.

Qualified Education Expenses For 529 Plan Funds Expanded For Student Loans And Apprenticeships

Roughly two years after the list of qualified education expenses for which 529 plan funds could be used tax-free was expanded by the Tax Cuts and Jobs Act (which, for the first time, allowed up to $10,000 of 529 plan funds to be used annually for K – 12 expenses), Section 302 of the SECURE Act further expands that list.

First, the SECURE Act provides that Qualified Higher Education Expenses include expenses for Apprenticeship Programs that include fees, books, supplies and required equipment, provided the program is appropriately registered and certified with the Department of Labor.

In addition, and likely to be of greater interest to the majority of advisors, is the introduction of distributions for “Qualified Education Loan Repayments” as a qualified higher education expense. Such distributions may be used to pay the principal and/or interest of qualified education loans (as defined in IRC Section 221(d)), and are limited to a lifetime amount of $10,000 (not adjusted for inflation). Notably, in an anti-abuse coordination provision, any plan funds used to pay the interest on qualified student debt will render that interest paid ineligible for the above-the-line deduction for student loan interest under IRC Section 221.

The $10,000 lifetime limit is a per-person limit, and in addition to using the funds in a 529 plan to pay for the 529 plan beneficiary’s debt, an additional $10,000 may be distributed as a qualified education loan repayment to satisfy outstanding student debt for each of a 529 plan beneficiary’s siblings.

This change is effective retroactive to the beginning of 2019.

Kiddie-Tax Reverts To Pre-Tax Cuts And Jobs Act Rules!

Let’s do the time warp again!

Just two years ago, Congress passed the Tax Cuts and Jobs Act. And as part of that sweeping legislation, it changed the nature of the so-called Kiddie Tax, a tax on the unearned income of certain children. Prior to the Tax Cuts and Jobs Act, any income subject to the Kiddie Tax was taxable at the child’s parents’ marginal tax rate. By contrast, the Tax Cuts and Jobs Act made that income subject to trust tax rates.

For those children with more modest unearned income this often resulted in modest tax savings. But for those children with more significant unearned income, the compressed trust tax brackets typically led to a higher tax bill.

Now, just two years later, Congress has issued a mighty call to “Belay that order!”

In a complete and total reversal, the SECURE Act (Section 501), once again, makes any income subject to the Kiddie Tax taxable at the child’s parents’ marginal tax rate. The change is effective for 2020, with an additional kicker… taxpayers can elect to apply the old (or is it new?) rules to the current 2019 tax year, and back to 2018 as well! As such, advisors with clients who have children that had substantial unearned income in 2019 can simply choose to use the new rules (unless the ‘old’ rules at trust tax rates actually were more favorable in the case of extremely affluent parents), and for 2018 advisors should carefully evaluate the potential tax savings that may be achieved by filing an amended return and electing to apply the new/old rules back to that prior year.

Tax Extenders Bill Revives Zombie Tax Breaks… Again!

Congress has once again come through at the last minute to extend certain tax breaks in what, this year, is being called the “Taxpayer Certainty and Disaster Relief Act of 2019”.

Don’t let the name fool you though. Despite what it says, the bill provides little certainty for the future. The following tax benefits for individuals are reinstated retroactively to 2018, and made effective only through 2020:

- The exclusion from gross income for the discharge of certain qualified principal residence indebtedness;

- Mortgage insurance premium deduction; and

- Deduction for qualified tuition and related expenses.

Additionally, the AGI ‘hurdle rate’ that must be exceeded to deduct qualified medical expenses remains at 7.5% of AGI for 2019 and 2020 (it was already lowered to 7.5% for 2018 by the Tax Cuts and Jobs Act), lowered from the previous rate of 10% of AGI in 2017. Notably, this hurdle rate is also applicable to the exception to the 10% early distribution penalty for IRA and employer-sponsored retirement plan distributions.

Included in the Extenders bill, along with the above-referenced items, was the usual cast of characters, ranging from incentives for economic growth to energy production and green initiatives.

Retirement-Related Disaster Relief Provisions Of The Taxpayer Certainty and Disaster Relief Act of 2019

Finally, the Taxpayer Certainty and Disaster Relief Act of 2019 bill provides for Qualified Disaster Distributions from retirement accounts.

Individuals eligible for this relief are those who have principal residences in a Federally declared disaster area, and who suffered an economic loss as a result of that disaster. The disaster must have occurred from January 1, 2018, through 60 days after the enactment of the law.

In turn, Qualified Disaster Distributions for a qualifying disaster event must occur after the date of the disaster (and within 180 days after the bill’s enactment), can be made for up to $100,000 for each disaster, and receive these additional benefits:

- Are exempt from the 10% early distribution penalty;

- Are exempt from mandatory withholding requirements;

- Are treated as distributed evenly, over a 3-year period, unless a taxpayer elects to have the full amount taxed in the year of distribution; and

- May be repaid within 3 years of receiving the distribution.

In addition to the above relief, the Taxpayer Certainty and Disaster Relief Act of 2019 also extends relief to plan participants in the form of enhanced plan loans. The bill both increases the maximum allowable loan amount to $100,000 (from the ‘normal’ $50,000 amount), and to delay loan repayments for up to one year.

Passage of the SECURE Act will bring many important changes to the current retirement system, including the replacement of the lifetime stretch provision with a ten-year cap on required minimum distributions by beneficiaries with inherited retirement accounts, the RMD age requirement going up from age 70 ½ to age 72, and the ability for workers to continue contributing to their IRAs beyond age 70 ½.

Additionally, changes that will impact 401(k) plans are designed to make it easier for small business owners to establish plans for employees (through more flexible investment options and better MEP rules), and to encourage participants to save more (through more auto-enrollment and flexibility for higher auto-enrollment percentages).

Unfortunately, though, while the provisions of the SECURE Act are permanent, the remaining Tax Extenders included alongside the SECURE Act remain temporary, to potentially be revived yet again in 2020 and beyond!

Leave a Reply