Executive Summary

When distributions are taken from tax-deferred retirement accounts, ordinary income taxes are due. However, sometimes funds may simply need to be moved from one retirement account to another – perhaps because an employee is retiring or switching jobs and chooses to move their 401(k) from their old employer to another 401(k), or to an IRA account, or because a client wishes to work with a new financial advisor and chooses to move all of their accounts over to the new advisor’s firm. Whatever the reason, there are specific rules for different types of money movement that financial advisors should understand to make sure their clients’ accounts are protected from unnecessary taxable distributions.

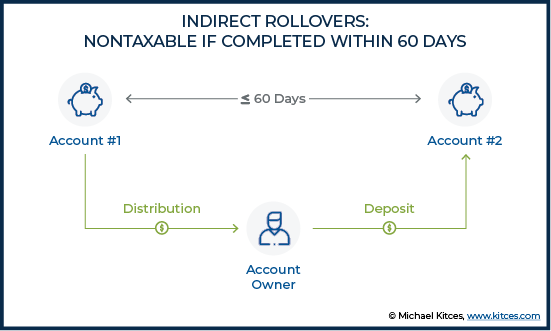

There are two categories of money movement between retirement accounts: Indirect and Direct transactions. For an Indirect Rollover, the account owner withdraws funds to be moved from the originating account and takes actual custody of the funds. The full amount of funds withdrawn must be deposited into the target account within 60 days. One caveat for Indirect Rollovers from employer-sponsored retirement plans is that there is generally a mandatory 20% withholding for Federal income taxes that the plan sponsor makes directly to the IRS, with the balance of the funds sent to the account owner. This means that, in order to avoid the tax withholding itself to be considered a taxable distribution from the account, the employee must ‘make up’ for the withheld amount by depositing funds from another source into the target account within the 60-day Indirect Rollover window. This withholding does not apply to IRA accounts, including IRA-based employer plans such as SIMPLE IRAs and SEP IRAs. Taxpayers are also limited to one Indirect Rollover between IRA or Roth IRA accounts every 365 days; any additional attempted Indirect Rollovers would be considered an account contribution and can potentially result in a 6% excess contribution penalty annually until corrected.

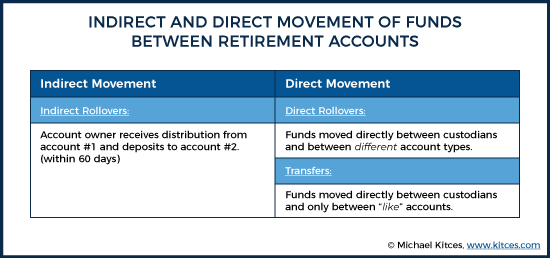

In addition to Indirect Rollovers, there are two types of Direct methods to move funds between accounts: Direct Rollovers and Direct Transfers. Direct Rollovers move funds between two retirement accounts, but unlike an Indirect Rollover, the funds are never in the account holder’s custody, nor is there any mandatory tax withholding. For Direct Rollovers, funds are moved from the trustee of one account directly to the trustee of the second account (where each account is a different type of accounts, e.g., 401(k) to IRA or vice versa). Direct Rollovers also have no time limit in which the transaction must take place, and there is no limit to how many Direct Rollovers can be done in a given year. While Direct Rollovers are not taxable events, they are reportable events and as such, are reported on Form 1099-R.

Similar to Direct Rollovers, Direct Transfers are made directly between the trustees of each account and don’t involve the account holder ever having custody of the funds being transferred. What distinguishes a Direct Transfer from a Direct Rollover, though, is that the accounts in a Transfer must be ‘like’ accounts (e.g., IRA to IRA, 401(k) to 401(k), etc.). Like Rollovers (including both Direct and Indirect), Like Rollovers, Transfers are not taxable events, but unlike rollovers, they are not reportable events and thus do not require submission of any forms to the IRS. Transfers are also different from Rollovers as they can accommodate funds designated as RMDs.

Ultimately, the key point is that each of the various ways funds can move between retirement accounts has its own distinct set of rules and requirements. Direct Rollovers are generally preferable over Indirect Rollovers, as they are subject to neither the 60-day time limit nor the 20% mandatory withholding, but do require to be reported to the IRS. On the other hand, Transfers do not need to be reported to the IRS and are used when an individual simply needs to change custodians or consolidate accounts involving the same kind of account.

From time to time and for a variety of reasons, retirement account owners decide (or in some, cases, are forced) to move retirement money from one retirement account to another. For example, an employee who leaves or retires from a job with a 401(k) plan may opt to move their 401K funds into an IRA account. Or an IRA owner may choose to move their IRA account from one custodian to another, often in order to work with a new financial advisor!

Broadly speaking, when moving funds between retirement accounts, there are two ways in which those retirement dollars can be moved: indirectly (e.g., by distributing the money out of one account to the owner, who takes possession of the cash for some limited period of time, and then re-deposits it to a new account), and directly (i.e., where the funds move, or are treated as moved, directly from one retirement account provider to another). The distinction is important because moving funds indirectly from one account to another (or in more limited situations, out of, and then back into, the same account), an individual must follow the rules to satisfy an “Indirect Rollover”. Whereas to move funds Directly, without triggering adverse tax consequences, either a Transfer or a Direct Rollover can be used, depending upon the situation.

Indirect Movements Of Retirement Assets Are Accomplished Via Indirect (60-Day) Rollovers

Indirect Rollovers are transactions where a retirement account owner receives a distribution from their account, that they intend to subsequently re-contribute to another (or in some cases, the same original) account. This distribution is often in the form of a check, made payable to the retirement owner themselves as an individual (as opposed to another retirement account for the same owner’s benefit), but can also be a direct deposit into a non-retirement account designated by the owner, such as a brokerage, savings, or checking account (which in turn may be owned individually, jointly, or via a revocable living trust).

In either case, once the distributed funds have been received by the retirement account owner (either actually received because the funds are now in the requested account, or constructively received because the check has been received by the owner), they have 60 days to re-deposit the distributed amount, or any portion thereof, into another eligible retirement account (or back into the same account).

The 60-day ‘clock’ begins to ‘tic’ when an individual receives their distribution, with “Day 1” of the 60-day window being the following calendar day. And to timely complete the rollover, the funds must actually be in the receiving account by the end of Day 60 (simply having it in the mail by the 60th day does not work!). This re-deposit of funds completes the Indirect Rollover process, preserving the tax-deferred status of the rolled-over funds.

Notably, while 60 days may seem like a lot of time to complete such a transaction, over the years a countless number of taxpayers have missed the deadline for one reason or another, and have subsequently found themselves faced with an unwanted tax bill on income from the distribution (taxpayers under the age of 59 ½ would also potentially be subject to an early withdrawal penalty of 10%).

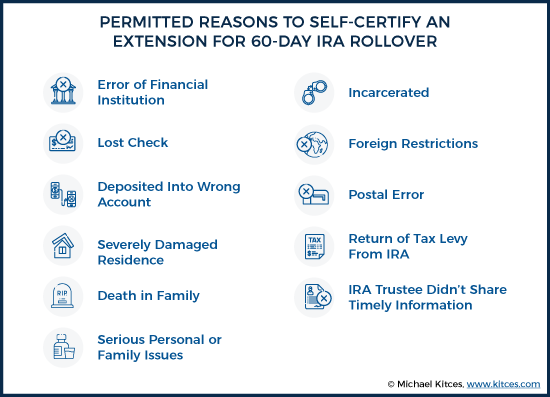

For years, the IRS was inundated with Private Letter Rulings (PLRs) requesting an extension of the 60-day-rollover window, some of which were granted, and others not… though all came at the expense of both the taxpayer’s time and money to make the PLR request in the first place.

Since 2016, the frequency of such requests has dropped, thanks to the self-certified corrective procedures outlined by the IRS in Notice 2016-47, in which taxpayers can themselves “certify” that their rollovers comply with rollover requirements, despite missing the 60-day-rollover window, by submitting a letter to the financial institution that receives the rollover. However, this self-certification process can only provide relief from the penalty only when a taxpayer’s failure to complete the rollover within 60 days was due to one of eleven reasons specified by the IRS .

Even then, the IRS can overrule the self-corrected late rollover upon examination if it does not believe the taxpayer met the requirements outlined in the Notice. Thus, even if the Indirect Rollover was made for one of the permitted reasons to self-certify an extension, it still behooves the taxpayer to complete the process within the 60-day rollover window if possible, to ensure the preservation of retirement assets.

20% Mandatory Withholding Applies To Indirect Rollovers Distributed From Employer-Sponsored Retirement Plans

Depending upon the source of an Indirect Rollover, other restrictions and rules can apply as well.

For instance, when distributions eligible for rollover (more on this below) are made from 401(k), 403(b), and similar employer plans, they are generally subject to mandatory withholding of 20% for Federal income taxes (exceptions include distributions of employer securities when they are the only assets of the plan).

As a result, individuals wishing to move the entire account balance through an Indirect Rollover must generally have other assets available to make up for any amounts that need to be withheld. And then wait to have the withhold refunded to them at the end of the year when they file their tax return and show that they didn’t actually owe the taxes that were withheld (because the account was in fact timely rolled over).

Example #1: Andrew is a 50-year-old participant in a former employer’s 401(k) plan. Recently, Andrew decided to roll his $200,000 401(k) balance to an IRA, and without fully understanding the impact of his decision, he requested a complete distribution of his 401(k), via check, made payable to him, personally.

When Andrew’s check arrives in the mail, it will not be for the $200,000 balance he has in his 401(k), but rather, for only $200,000 – $40,000 (20% of the balance being withheld) = $160,000. At the same time, Andrew’s check is sent, the plan will also send $200,000 x 20% = $40,000 to the IRS as withholdings for Federal income taxes.

If Andrew wants to avoid a tax bill, he will have to come up with $40,000 of from another source, on top of the $160,000 he receives from the plan, in order to get $200,000 of cumulative retirement money back into an eligible retirement plan within the 60-day rollover window. Because if $200,000 left the original retirement account, then $200,000 must appear in the new retirement account to be fully treated as a rollover… even if Andrew, personally, did not receive the entire $200,000 distribution!

Thus, if instead Andrew only rolls over 100% of the money he received from the plan – the $160,000 check – then the $40,000 sent to the IRS for withholdings will, itself, be treated as a distribution, and Andrew will owe Federal income tax on that $40,000 amount (plus a 10% early distribution penalty, unless an exception were to apply).

In either case, to the extent the amounts withheld create (or increase) an overpayment of Andrew’s Federal income tax (because the withholding is mostly or entirely unnecessary if a rollover actually does occur), that overpayment would be recoverable by Andrew as a refund once he has filed his Federal income tax return at the end of the year.

Navigating The Once-Per-Year Indirect Rollover Rule For IRA And Roth IRA Accounts

The 20% mandatory withholding rule noted above does not apply to distributions from IRAs, including IRA-based employer plans, such as SIMPLE IRAs and SEP IRAs. It applies only to distributions from traditional employer retirement plans (e.g., 401(k)s, profit-sharing plans, etc.). However, such IRA account distributions are subject to their own separate restriction (that does not apply to plan distributions from non-IRA retirement accounts).

More specifically, IRC Section 408(d)(3)(B) limits an IRA/Roth IRA owner to no more than one IRA-to-IRA or Roth IRA-to-Roth IRA (combined) Indirect Rollover per 365 days. And the restriction applies universally across all such indirect rollovers that occur (i.e., one IRA-to-IRA indirect rollover means no other IRA or Roth IRA distribution from any account can be indirectly rolled over to any other account within that 365 day period). To the extent someone still tries to make another indirect “rollover” during the one-year period, when not permitted to, it is considered an excess contribution to the new account, and is subject to a 6% excess contribution penalty for each year it remains in the IRA/Roth IRA without being corrected.

Direct Rollovers and Transfers Of Retirement Accounts Can Preclude Indirect Rollover Complications

If dealing with a 60-day deadline, potential mandatory tax withholding, and limits on the number of transactions that can be completed in a year sounds unappealing – and it is! – then the better option to move retirement account money is directly between accounts.

By contrast to moving money indirectly, where there is only one option (the Indirect, 60-day, Rollover), there are two different ways to move money directly. Such direct movements of retirement dollars can be accomplished either by a “Direct Rollover” or by a “Transfer”.

Notably, as discussed further below, there are some important differences between Direct Rollovers and Transfers. However, since they are both ways to move retirement money directly, they share more similarities than differences… so much so, in fact, that though technically incorrect, the two terms are often used by individuals – including financial advisors, and even retirement account experts – interchangeably (even though they’re actually not).

Direct Movements Of Retirement Account Dollars Are Not Subject To The 60-Day-Rollover Rule

One feature shared by both Direct Rollovers and Transfers is that neither transaction is subject to the 60-Day rollover window because when Transfers and Direct Rollovers are made, the retirement account owner never has control over the funds in the first place.

In many instances, such direct movements of retirement accounts are accomplished by the distributing custodian sending funds directly to the new custodian (upon receiving instructions from the retirement account owner to do so).

Alternatively, a Direct Rollover or a Transfer can be completed by having the distributing custodian issue a check to the owner but made payable to the new retirement account for benefit of the owner. For instance, as IRS Regulation Section 1.401(a)(31)-1, Q & A –4 explains:

Providing the distributee with a check and instructing the distributee to deliver the check to the eligible retirement plan is a reasonable means of direct payment, provided that the check is made payable as follows: [Name of the trustee] as trustee of [name of the eligible retirement plan].

For example, if the name of the eligible retirement plan is ‘Individual Retirement Account of John Q. Smith,’ and the name of the trustee is ‘ABC Bank,’ the payee line of a check would read ‘ABC Bank as trustee of Individual Retirement Account of John Q. Smith.’ [emphasis added]

As IRS Regulation Section 1.401(a)(31)-1, Q & A –4 indicates, even if a check is given to a retirement account owner (to forward to the new custodian), as long as the check is made payable to the new retirement account (and not the owner personally), the transaction is considered a Direct movement of retirement funds rather than a distribution to be indirectly rolled over. Since the owner cannot cash the check in their own account, the IRS does not treat the owner as having constructive receipt of those funds, and therefore the owner is not subject to the restrictions that are applicable when completing Indirect Rollovers.

Direct Movements Of Money Avoid Mandatory Withholding And Once-Per-Year Rollover Issues

In addition to removing the 60-day time limit to complete an Indirect Rollover, moving retirement money Directly from one retirement account to another also eliminates other inconveniences that are inherent with Indirect Rollovers.

For instance, both Direct Rollovers and Transfers allow a retirement account owner to avoid mandatory Federal tax withholdings when moving retirement funds between accounts. As such, there is no need to make up for the ‘missing’ amount with other funds when completing a Direct Rollover of the entire account balance.

Similarly, there are no limits on the number of times that an individual can complete a Direct Rollover or Transfer each year. Thus, while it might drive a custodian (or an advisor) up the proverbial wall, an individual can move their retirement funds directly from one custodian to another today, only to move the same funds directly to another custodian next week. And Directly to yet another custodian the week after that. And… well, you get the point.

The various benefits associated with Direct movements of retirement dollars (as compared to moving such funds via indirect, 60-day rollovers) makes it the preferable option in all but the rarest of circumstances (such as when the cost to make a transfer relative to an account’s size makes it impractical, or when the transfer process will take much longer to complete than a direct rollover, and there is some urgency with which funds must be deposited into the receiving company). As such, individuals should be encouraged to use such options, even if there is an added cost when compared to moving funds indirectly (e.g., some custodians will process distributions requested by the account owner for free but will charge a fee for processing Direct Rollover and Transfer requests received from another financial institution).

Splitting The Direct Money Movement ‘Hair’: Differentiating Between Direct Rollovers And Transfers

Clearly, Direct Rollovers and Transfers have a lot in common, as the similar words themselves imply. As noted above, however, they are not the same. And while the differences may, at times, seem subtle, failure to appreciate those differences can in certain circumstances result in penalties and/or other problems.

But before we can dive into the differences, it’s first necessary to understand how to tell them apart in the first place!

Simply put, a Transfer can only take place between two ‘like’ retirement accounts. In general, this is likely to be a movement of funds between two Traditional IRA accounts (including SEP IRA accounts and SIMPLE IRA accounts that have satisfied the two-year ‘seasoning’ rule), or between two Roth IRAs. Less commonly, it can occur when funds are moved from one qualified plan to another qualified plan, when both plans are maintained by the same employer.

On the other hand, Direct movements of money that are not between like plans are Direct Rollovers. So, for instance, anytime money is moved from a 401(k) or similar employer plan to an IRA (two unlike retirement accounts), it’s a Direct Rollover (and not a Transfer!).

Rollovers Are Reportable Events and Transfers Are Non-Reportable

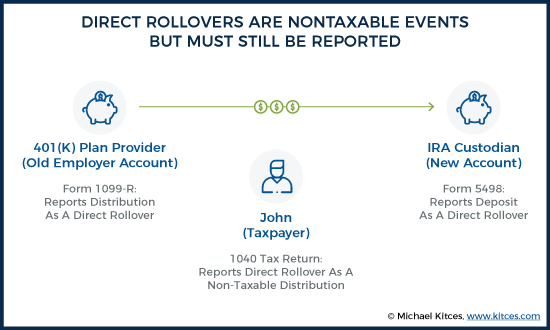

One significant difference between Transfers and Direct Rollovers is that only the latter is a ‘reportable’ event (i.e., actually triggers tax reporting forms to the IRS).

For instance, when an IRA is transferred from one institution to another, the sending firm does not issue an IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., to report the amount to the IRS. Similarly, the receiving firm does not (or at least they should not!) issue an IRS Form 5498, IRA Contribution Information, to report an amount contributed.

In simpler terms, when a Transfer is made between financial institutions, the IRS should be none-the-wiser. They should have no idea that such a transaction ever took place.

Example 2a: Carl has an IRA with Custodian A but decides to move it to Custodian B via an IRA-to-IRA Transfer that goes directly from one IRA account to the other.

Neither Custodian A nor Custodian B will report the Transfer transaction to the IRS. Furthermore, there are no reporting obligations for Carl on his personal income tax return related to the transaction.

By contrast, rollovers – all rollovers – are reportable events. If an Indirect Rollover is made (i.e., a distribution payable to the owner who can then subsequently roll it over within 60 days), the distributing firm will issue an IRS Form 1099-R assuming no such rollover is made, because the distributing firm doesn’t know whether that distribution will actually be timely rolled over or not. Thus, the Distribution Code reported in Box 7 of the form is likely to indicate Code 1 (Early distribution, no known exception), Code 2 (Early distribution, known exception), or Code 7 (Normal distribution).

And while the receiving custodian will file IRS Form 5498 to report the rollover contribution, it’s up to the taxpayer to properly report the distribution as rolled over on their income tax return in order to negate the tax bill that would otherwise be created.

Direct rollovers (other than direct rollovers made from pre-tax plan accounts to Roth accounts) are, by their very nature, nontaxable events. Despite their nontaxable character, however, they remain reportable events that must be reported by both the sending and receiving financial institutions, as well as the taxpayer on their personal income tax return. Thus, in these instances, Form 1099-R must still be filed, but the Distribution Code in Box 7 of the form will generally be completed with Code G (Direct rollover of a distribution to a qualified plan, a section 403(b) plan, a governmental section 457(b) plan, or an IRA) or Code H (Direct rollover of a designated Roth account distribution to a Roth IRA), to signify that it is not a taxable event.

Unfortunately, though, while that reporting may effectively indicate to a tax preparer or advisor that the amount distributed is nontaxable, receiving a 1099-R that generally reports taxable events for a supposedly-tax-free Direct Rollover can be rather confusing for certain taxpayers.

Example 2b: John has a 401(k) with an old employer but has decided to move it to an IRA via a Direct Rollover.

The 401(k) provider will report the distribution to the IRS using Form 1099-R and will use Code G as the Distribution Code in Box 7 of the form.

Furthermore, Box 2a of the form, which reports the taxable amount of the distribution, indicates “$0”.

In addition, John’s IRA custodian will issue a Form 5498, reporting the amount deposited into the account to the IRS as a rollover contribution.

Finally, in what is often a perplexing aspect of the transaction for individuals, John will receive a copy of the 1099-R early in the year following the year of his rollover. The information on that 1099-R must be included in his tax return for the year, even though the distribution is nontaxable. (I.e., John must still report the gross amount of the distribution on his personal tax return, even as he subsequently reports that none of that gross distribution was a taxable distribution since it was a rollover.)

As a matter of good practice, advisors assisting clients with nontaxable Direct Rollovers should coach them on the nature of the reporting in advance to avoid surprises. This way, clients are not concerned upon receipt of the 1099-R. Of course, depending upon when such a Direct Rollover occurs, it can be more than a year from the time the transaction takes place until the taxpayer receives the 1099-R form to report the event. As such, as each new year begins, advisors should consider sending a reminder email or other message to clients who engaged in such transactions in the previous year, again reminding them of the (not-problematic-but-important-to-report) tax reporting form likely coming to them soon.

Or advisors can just wait for the confused, and sometimes panicked calls, to come in. Your choice!

Required Minimum Distributions (RMDs) Cannot Be Rolled Over, But Can Be Transferred

Another key difference between Direct Rollovers and Transfers is that various parts of the Internal Revenue Code include a number of restrictions on what can be rolled over from one account to another. These restrictions don’t apply to Transfers, but they do apply to Direct (and Indirect) Rollovers. The word “rollover” is, after all, right in the name!

Interestingly, instead of outlining what is allowed to be rolled over from one account to another, the Internal Revenue Code works somewhat in reverse. In layman’s terms, it says “Hey, you can roll over anything that comes out of a retirement account you want… as long as it’s not one of these things.”

Perhaps the most notable prohibition on what can be rolled over can be found in IRC Section 408(d)(3)(E), which prevents IRA required minimum distributions (RMDs) from being rolled over to another retirement account. A similar restriction for RMDs from qualified employer plans can be found under IRC Section 402(c)(4)(B), while IRC Section 403(b)(8)(B) and IRC Section 457(e)(16)(B) apply the same rule to RMDs from 403(b) and governmental 457(b) plans, respectively. Thus, in short, required minimum distributions are prohibited from being rolled over.

Example 3a: Claire is 75 years old and has funds in an old employer’s 401(k) plan. She has not yet taken her RMD for the year.

After meeting with an investment advisor, Claire decides that it would be in her best interest to move her funds to an IRA so that they can be managed more effectively. Claire’s advisor (correctly) suggests that she move the funds from her 401(k) to her IRA directly, so as to avoid the 60-day rollover deadline and mandatory withholding.

Despite the fact that Claire is going to move money directly from one retirement account to another, since the accounts are not ‘like’, the movement of funds will be a Direct Rollover.

As such, Claire must first take her RMD for the year from the existing 401(k) plan (because it cannot be rolled over) and then proceed with a Direct Rollover of any or all of the remaining plan balance.

Failure to adhere to the restrictions on what can be rolled over can lead to perpetual penalties. Specifically, any amounts that cannot be rolled over, but are nevertheless deposited into a retirement account, are considered an excess contribution. Such amounts are subject to a 6% penalty for each year the excess amount remains in the account, potentially tolling and compounding indefinitely (until fixed or caught!).

Example 3b: Allison is 75 years old and has funds in an old employer’s 401(k) plan. She has not yet taken her RMD for the year.

After seeing an ad for low-cost investment management at a large institution, Allison decides to move her 401(k) funds to an IRA maintained by that company. However, while Alison has read enough to know to do a Direct Rollover, she is unaware of the rule that prevents her 401(k) RMD amount from being rolled over. Accordingly, she moves her entire 401(k) balance into her IRA via a Direct Rollover.

As a result of this transaction, if left uncorrected, the amount of Alison’s 401(k) RMD would constitute an excess contribution to her traditional IRA and would, therefore, be subject to a 6% penalty each year that it continues to remain in the IRA.

Note that while Allison’s penalty is related to an RMD, the real issue here is not the 50% penalty that would apply to a failure to satisfy the 401(k) RMD (as that was satisfied because the amount – and in fact, the entire balance – left the prior 401(k) plan). Rather, the issue is that something that could not be rolled into the IRA (the 401(k) RMD amount) was deposited into the account, creating a subsequent excess contribution, subject to ‘just’ the 6% penalty assessed on such amounts (if not timely rectified)!

It’s worth noting here that for Roth conversions, the movement of assets from the tax-deductible traditional IRA account is always treated as a distribution, followed by a contribution to the ‘new’ Roth IRA account. In other words, Roth conversions are treated as rollovers; thus, RMDs (along with other amounts ineligible for rollover) cannot be converted to Roth accounts.

Again, though, while RMD amounts are not allowed to be rolled over between accounts, they are allowed to be Transferred between accounts. In such cases, the RMD can either come out of the first account prior to the Transfer, or from the second account after the transfer.

Example 3c: Brian is 75 years old and has funds in an IRA. He has not yet taken his RMD for the year.

After meeting with an investment advisor, Brian decides that it would be in his best interest to move his funds from his current IRA custodian to a new IRA custodian so that they can be managed more effectively. Brian’s advisor (correctly) suggests that he move the funds from his ‘old’ IRA to his ‘new’ IRA directly, so as to avoid the 60-day rollover deadline and any once-per-year rollover issues.

Despite the fact that Brian has not yet taken his RMD for the year, he can move the entire amount from his old IRA to his new IRA. Brian’s movement of retirement dollars will be between two IRAs. Thus, it is a Transfer and is not impacted by the rule preventing RMDs from being rolled over.

Brian must, of course, take his IRA RMD by the end of the year. But he may choose to do so either before or after the transfer to the new IRA is made.

Inherited IRAs, Like RMDs, Cannot Be Rolled Over, But Can Be Transferred

While RMDs are probably the single biggest source of money-that-can-be-transferred-but-can’t-be-rolled-over for most advisors, it’s not the only such amount.

For example, IRC Section 408(d)(3)(C) prohibits inherited IRAs from being rolled over. The same restriction, though, does not apply to Transfers of inherited IRA funds. As such, if an individual wishes to move funds from one inherited IRA to another inherited IRA, the only available option to do so is a trustee-to-trustee Transfer.

(Note: In general, the Internal Revenue Code prohibits the rolling over of funds distributed from any inherited retirement account; however, Section 829 of the Pension Protection Act of 2006 (PPA) created a limited exception to this rule via IRC Section 402(c)(11), which provides that distributions of inherited funds made to designated beneficiaries (only!) from employer retirement plans (only!) can be Directly Rolled over (only!) to the designated beneficiaries’ inherited IRA/Roth IRA accounts (only!).

While the phrase, “If it ain’t broken, don’t fix it” is perhaps not the best way to think about retirement accounts, the reality is that, for one reason or another, most people will move their retirement funds between retirement accounts one or more times over the course of their lifetimes.

When moving retirement funds, it is best to do so in a Direct manner, via either a Direct Rollover or (if feasible) a Transfer. In doing so, an individual can avoid complications that can otherwise occur when using a 60-day Indirect Rollover to accomplish the same goal, including not only the 60-day time limit itself, but also the mandatory withholding rules that apply to most plan distributions eligible to be rolled over, and the once-per-year rollover rule that applies to distributions from IRAs and Roth IRAs.

Simply making sure that funds are moved in a Direct manner, however, does not, on its own, ensure a troublesome- and penalty-free movement of retirement dollars. Rather, the Direct movement, itself, must be analyzed to determine which type of Direct method is being used; the Direct Rollover, or the Transfer?

When retirement dollars are moved between distributing and receiving accounts that are not ‘like’ retirement accounts, the result is a Direct Rollover. But a Direct Rollover is still a rollover, and as such, individuals must be careful to follow the required IRS reporting rules and to avoid moving amounts ineligible for rollover, such as required minimum distributions, in such a fashion. The only truly ‘clean’ way to shift retirement dollars from one account to another, without any tax reporting obligations, is with a Direct Transfer… albeit only available when such dollars are moving amongst like-kind accounts in the first place.

Leave a Reply