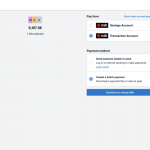

Running a business comes with inevitable tasks such as paying bills, a time consuming necessity. Batch payment files enable you to download an ABA file from Xero and upload it to your online banking site, saving you time by paying multiple bills at once. You can then easily send remittance to suppliers and reconcile your […]

Archives for 2019

New FASB standard aims to simplify accounting for income taxes

FASB issued a standard Wednesday that is intended to simplify accounting for income taxes. The standard removes specific exceptions to the general principles in FASB ASC Topic 740, Income Taxes. In addition, the standard eliminates the need for an organization to analyze whether the following apply in a given period: Exception to the incremental approach […]

SEC proposes expanding access to private markets

More investors would have access to private capital markets under a proposal issued Wednesday by the SEC. The proposal would amend the definition of “accredited investor” to permit more investors to participate in private offerings. Accredited investors are institutions and individuals deemed by the SEC to possess the knowledge and expertise to participate in private […]

Proposal would delay lease accounting effective date for federal entities

Implementation struggles experienced by federal agencies have prompted the Federal Accounting Standards Advisory Board (FASAB) to propose delaying the effective date of its standards for accounting for leases for two years. Under the proposal, Statement of Federal Financial Accounting Standards (SFFAS) 54, Leases: An Amendment of SFFAS 5, Accounting for Liabilities of the Federal Government, […]

6 Qualities Of Restaurant Bookkeeping Experts (& How To Ask About Them In Your Interviews)

Restaurant bookkeeping is a fairly unique process, and through our experience, we have learned that the front of the house operations has an effect on the bookkeeping, and understanding the ins and outs is extremely important.

The Top US Small Business Tax Deductions

This guest post was written by Joe Serrone, a Xero Silver Partner and Enrolled Agent & Tax Strategist at Polaris Tax & Accounting. Tax deductions are critical in order to reduce your tax liability because they directly reduce taxable income. Many small business owners are unaware of the deductions that are available to them so […]

Joint Home Loan & Tax Benefits – Section 80C, 24 & 80EE

A joint home loan is generally taken to enhance home loan eligibility. If your immediate family member is salaried or self-employed, he or she can be co-applicant for a home loan. In order to become co-applicant, he/she should be co-owner or joint owner of the property. Recently, I have come across one incident related to […]

Accounting body IASB proposes profit reporting standardisation

The International Accounting Standards Board (IASB) has proposed that listed companies must standardise their definitions of operating profit in financial statements in order to help investors when making comparisons. The international standard setting body is also proposing a new rule that would regulate how companies explain certain performance measures that go beyond generally accepted accountancy […]

More significant movement at the edge

In his latest Ecosystem column, Antony Savvas charts recent developments at the edge and new ownership for IoT corporate verticals. Partnerships have become a key focus for Vodafone Business’ strategy in recent times, and we have previously covered the company’s partnership with IBM and there is a newer partnership with Google – where Vodafone is […]

Timeline: Fiat Chrysler and Peugeot merger marks next round of consolidation

Fiat Chrysler and Peugeot maker PSA on Wednesday reached a binding agreement for their roughly $50 billion merger, as the auto industry scrambles to develop zero-emissions vehicles and tackle slowing demand.