Tata Capital Housing Finance Ltd. has come out with public issue of non-convertible debentures (NCD) offering up to 8.70% interest rate. The issue opens on January 7 and closes on January 17, 2020.

Tata Capital Housing Finance NCD – Significant Points:

- Offer Period: January 7 to 17, 2020

- Annual Interest Rates for Retail Investors: 8.01% to 8.70% depending on tenure

- Price of each bond: Rs 1,000

- Minimum Investment: 10 Bonds (Rs 10,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Credit Rating: “CRISIL AAA Stable” by CRISIL Limited and “ICRA AAA Stable” by ICRA

- NCD Size: Rs 500 crore with option to retain over-subscription upto Rs 2,000 crore

- NRIs are NOT eligible to apply to this NCD issue.

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE and NSE and will entail capital gains tax on exit through secondary market

Also Read – Know NCD – Investment Tips, TDS and Taxation

Tata Capital Financial NCD – Investment Options:

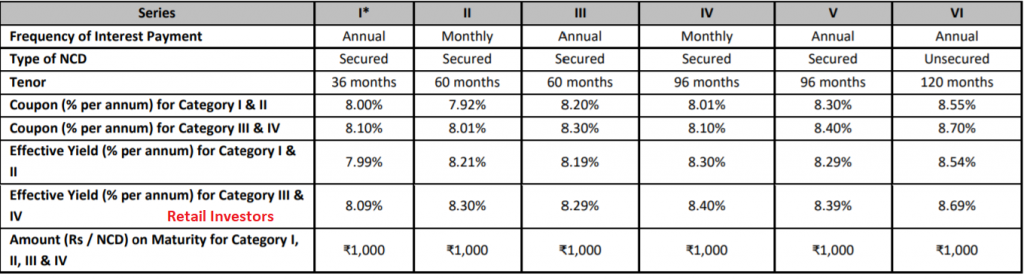

There are 6 options of investment in Tata Capital Housing Finance NCD.

Tata Capital Housing Finance Ltd NCD – Investment Options – January 2020

Company would allot the Series I NCDs, wherein the Applicants have not indicated their choice of the relevant Series of NCDs in the application form.

The bonds can be purchased in Demat Form.

Tata Capital Housing Finance NCD – Who can Apply?

This issue is open to all Indian residents, HUFs and Institutions.

- Category I – QIB Portion – 10% of the issue is reserved

- Category II – Corporate Portion – 10% of the issue is reserved

- Category II – HNIs – 40% of the issue is reserved

- Category III – Retail Individual Investors including HUFs – 40% of the issue is reserved

However NRIs cannot apply for this NCD.

Why you should invest?

- AAA Credit rating means very less likely hood of credit default

- Unique business model with a strong brand name and a track record of strong financial performance

- The interest rates are 2% higher than your regular Bank FDs

- No TDS if invested in Demat Form

- The NCD is secured, which means the above debt is backed by assets of the company

- The interest rate has started to go down, so a good time to lock in high interest rate.

Also Read: Highest Interest Rate on Recurring Deposits

Why you should not invest?

- There have been issues with some well rated companies like DHFL, IL&FS where rating agencies suddenly downgrade the rating. This risk always existed but it has come to forefront in last few months

- There are NCDs available in secondary market which have higher yields with similar rating. The problem is low liquidity and hence is difficult to buy in large numbers.

- The present Tax Free Bonds are offering yields up to 6.5% in secondary market, which is better investment for People in highest tax bracket.

- You can also invest in high rated company fixed deposits

Tata Capital Housing Finance Ltd NCD – January 2020

How to Apply?

If you have Demat account apply through that or ASBA facility provided by banks. It’s the easiest way to apply and also avoids a lot of hassle in terms of KYC and paper work

In case you don’t want to do it online, you can download the application form from Financial Institutions and submit to collection centers.

Recommendation:

- My recommendation is to invest some part of your Fixed Income investment in this NCD Issue

- You should always have diversified portfolio be it fixed deposit, NCD or equity investment

- Its good idea to remain invested till maturity because liquidity on exchanges is low and hence you would get lower than market value

If you plan to invest in this issue, do it on first day as most NCD issues are over-subscribed within few days of opening.

Leave a Reply