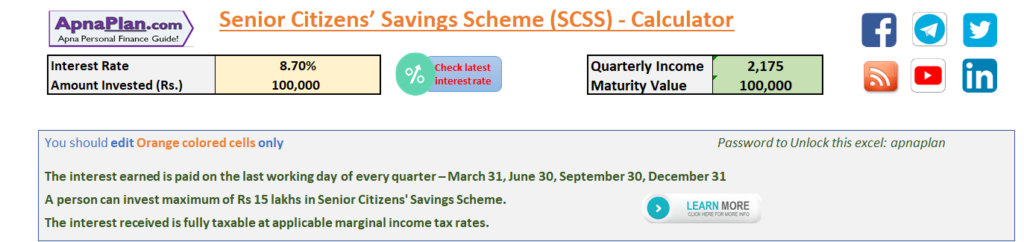

SCSS (Senior Citizens’ Savings Scheme) is an excellent investment for senior citizens as its safe (guaranteed by Government of India), pays guaranteed interest income every quarter and is eligible for tax saving u/s 80C. The next question is how much actual interest is credit to the account every quarter? We have come-up with a simple excel based SCSS calculator where you can input investment amount and interest and it gives you the quarterly interest payout and the maturity amount.

SCSS Calculator:

Calculating SCSS quarterly interest is pretty simple using the formula below:

Quarterly Interest Earned in SCSS = Principal Amount * Interest/4

Using this formula, if you invest Rs 1 Lakh at 8.7% interest, the quarterly interest payout is Rs 2,175 (1,00,000 * 8.7%/4)

Click to Download SCSS Calculator

SCSS Calculator

SCSS Investment Rules:

The interest earned is paid on the first working day of every quarter (April 1, July 1, October 1 & January 1) starting 2020. last working day of every quarter – March 31, June 30, September 30, December 31. The payout date remains constant irrespective of date of deposit. The payment can be made directly to depositor’s account through ECS or post dated cheques.

From April 1, 2016 the interest rate on SCSS is reset every quarter i.e. in April, July, October and January. For FY 2019-20 (January to March 2020) the interest rate is 8.60%. Check latest and historical interest rates here

Once invested the interest rate remains unchanged over the tenure of the deposit.

A person can invest maximum of Rs 15 lakhs in Senior Citizens’ Savings Scheme. You can open multiple accounts and joint account with your spouse only but the total investment across all accounts cannot exceed Rs 15 lakhs.

Spouses can open separate accounts with Rs 15 Lakh limit for each of them. So a couple can invest maximum of Rs 30 Lakhs.

The minimum investment is Rs 1,000 and can be increased in multiples of Rs 1,000 thereof.

Also Read: All you wanted to know about SCSS

SCSS Maturity:

Senior Citizens’ Savings Scheme matures at the end of five years from the date of deposit. There are 3 options on maturity:

1. Withdraw the amount by filling up Form E and submit the same along with Passbook.

2. The scheme can be extended by 3 years after maturity by submitting required Form B within 1 year of maturity. The extension is considered from the date of maturity and not from the date of submitting form.

3. In case the amount is neither withdrawn nor requested for extension with in 1 year of maturity, the account shall be treated as matured. The money can be withdrawn anytime after that. You would be paid interest applicable to Post office Savings Accounts (currently at 4%) from the date of maturity to the month preceding the withdrawal.

Early Withdrawal Penalty:

In case of emergency, an investor can foreclose the account after one year of opening it. The penalty for doing so is as follows:

- Within one year of opening SCSS Account – Cannot be closed

- Between one to two years of account opening – 1.5% of amount in SCSS account

- There is no penalty in case the account is closed in the extension period after maturity period of 5 years.

Also no loan is available against SCSS deposit.

Also Read: 13 Investments to Generate Regular Monthly Income

SCSS Tax Benefit, Taxation and TDS:

The investment up to Rs 1.5 lakhs in Senior Citizens’ Savings Scheme is eligible for tax deduction u/s 80C.

However the interest earned is fully taxable. The interest income is added to the income of the investor and taxed according to the marginal tax rate.

TDS at the rate of 10% is deducted, if the interest income is more than Rs 50,000 in financial year for Senior citizens. However if your total income for the year is below exempted limit of income tax, you can submit form 15H (for more than 60 years) or 15G (for less than 60 years) to the concerned bank/post office to avoid TDS hassles.

Conclusion:

Calculating interest payout on SCSS is simple and can be done as explained above. In case you have issue regarding the same just download simple excel based SCSS calculator.

Leave a Reply