Finance Minister in her Budget 2020 speech mentioned that she has made the income tax structure simple. Unfortunately, this is far from truth. What has happened is the budget has given one more option to calculate your taxes. More option means more complexity.

We have come up with the income tax calculator incorporating both the existing system and new system of taxation. You can fill up the details and know which works best for you.

![Income Tax Calculator for FY 2020-21 [AY 2021-22] - Excel Download](http://outsourcebookkeepingindia.com/wp-content/uploads/2020/02/income-tax-calculator-for-fy-2020-21-ay-2021-22-excel-download-1.png)

Income Tax Calculator for FY 2020-21 [AY 2021-22] – Excel Download

New Tax Regime

In case you want to opt for new tax regime, you will have to forgo most tax deductions and exemptions like standard deduction, Chapter VI A deductions, HRA benefit, LTA, home loan interest for self-occupied homes etc.

In most cases, with the new tax regime forgoing tax deductions, taxes work out to be higher.

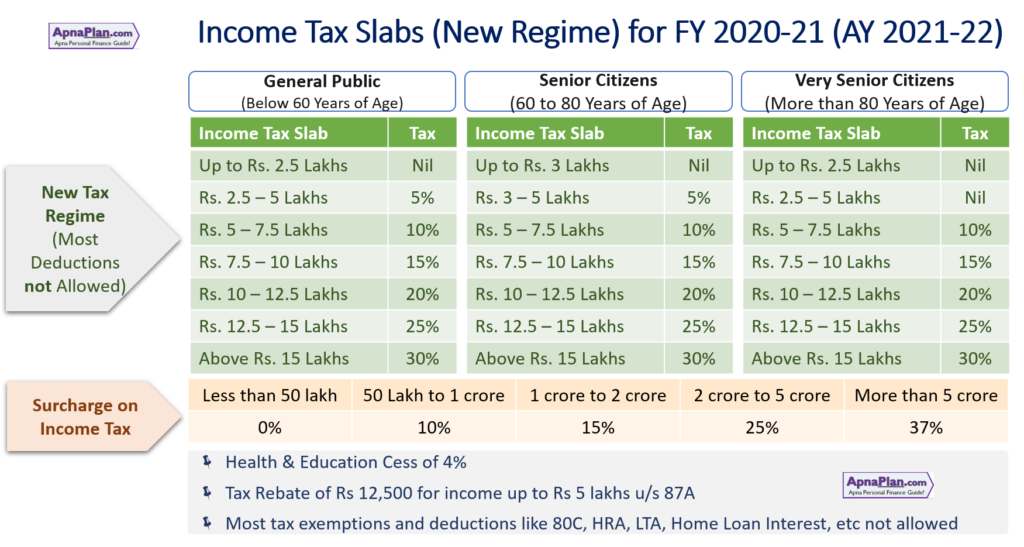

New Tax Regime Tax Slabs

The tax slabs for new tax regime is as follows:

Income Tax Slabs (New Regime) for FY 2020-21 (AY 2021-22)

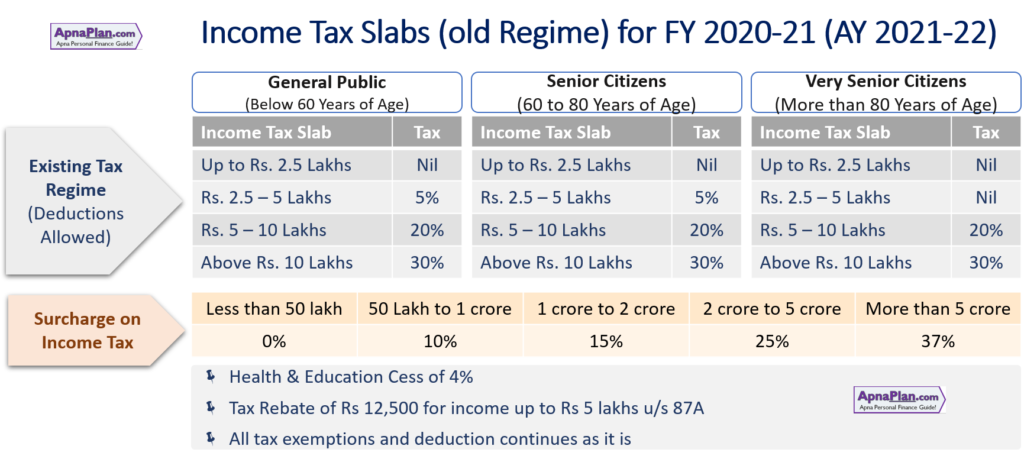

Existing Tax Regime Tax Slabs

There has been no change in the tax slabs if you follow existing tax regime.

Income Tax Slabs (Old Regime) for FY 2020-21 (AY 2021-22)

Download Income Tax Calculator

You can download the Income Tax Calculator for FY 2020-21 [AY 2021-22] from the link below.

Download Income Tax Calculator (FY 2020-21)

You can also download Income Tax Calculator for FY 2019-20, FY 2018-19, FY 2017-18, FY 2016-17, FY 2015-16, FY 2014-15, FY 2013-14, FY 2012-13 and FY 2011-12 by clicking on respective links.

Leave a Reply