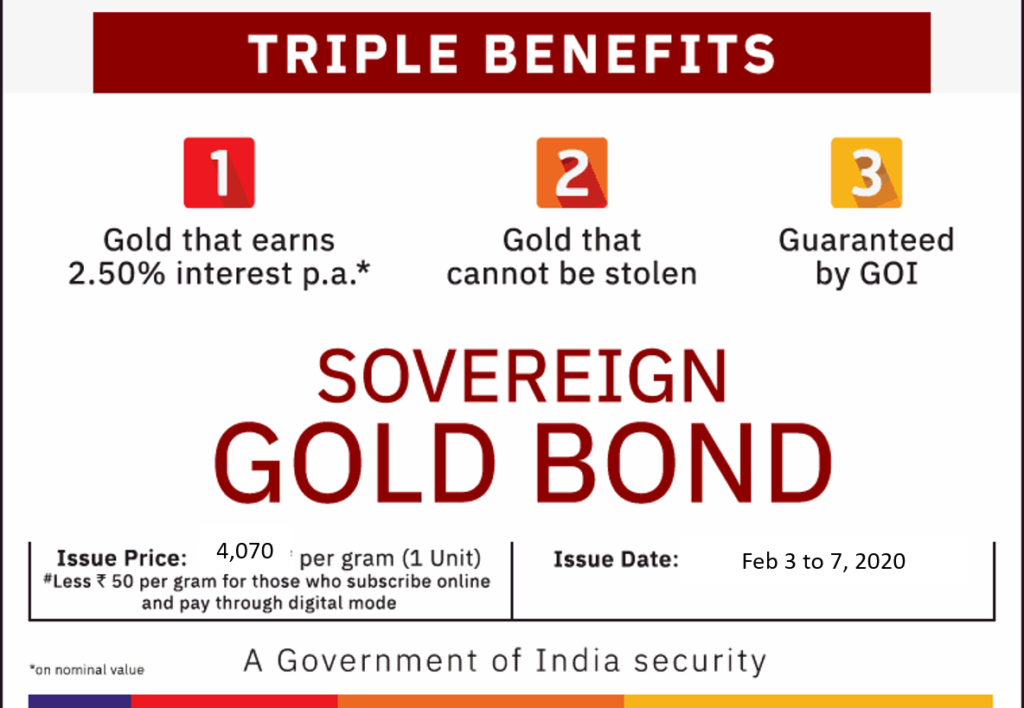

Government of India has launched the Series IX for FY 2019-20 of Sovereign Gold Bonds from February 3 to 7, 2020. These bonds are investment scheme where investors could buy gold in the form of Gold Bonds from Government of India.

Highlights Sovereign Gold Bond

Eligibility: Resident Individuals, HUFs, trusts, universities, charitable institutions, etc

Application Date: February 3 to 7, 2020

Price of each Bond: Rs 4,070. Discount of ₹50 per gram to those investors applying online and the payment against the application is made through digital mode (i.e. Rs 4,020)

Interest Rate: 2.50% per annum payable every 6 months in the bank account

Minimum Investment Limit: 1 bond

Date of Issue: February 11, 2020

Also Read: Investment Risks and How to deal with them

Maximum Investment Limit: 4,000 bonds per person/HUF per financial year

Tenure: 8 year [early exit possible from 5th year on wards interest payment dates]

Where to buy? Banks, Designated Post Offices and Stock Holding Corporation of India Ltd. (directly or through agents)

Application Form: You can download the form from RBI website or from respective banks. Also you can invest through your demat accounts.

KYC Documents: Voter ID, Aadhaar card/PAN or TAN /Passport i.e same as for purchase of physical gold

Payment Mode: Demand Draft, Cheque or Electronic Payment. Cash payment can only be done up to Rs 20,000.

Joint Holding: Possible (the maximum limit applies to first holder only)

Also Read: 25 Tax Free Incomes & Investments in India

Investment in the name of Minor is possible to be made by his/her guardian

Redemption Pricing: Based on previous week average price of closing price of gold of 999 purity as per India Bullion and Jewellers Association Ltd

Loan: bonds are allowed as collateral. The loan to value can be same as in case of physical gold

Listing: The bonds would be listed on stock exchange and can be sold/bought though demat account.

Taxation of Sovereign Gold Bond:

There are three parts to taxation:

1. The interest received is added to the income and taxed at the marginal tax slab. However there is NO TDS on the interest.

2. Budget 2016 has made gains on redemption of the bond exempted from capital gains tax. This means if the subscriber redeems the bond after 5 years, no tax would be payable on the gains.

3. However if the bond is sold, any gains would be considered as capital gains as in case of physical gold and taxed accordingly. If the bonds are sold with in 3 years of purchase its short term capital gains and is taxed at marginal tax rate. In case the sale is after 3 years its long term capital gains and is taxed at 20%, with indexation benefit.

Also Read: 13 Investments to Generate Regular Income

Should you Buy?

The last tranches of Sovereign Gold Bond are listed on stock exchanges and trading between Rs 3,600 to Rs 3,900 per bond (as of February 3, 2020). The prices are definitely lower than the fresh issue but the problem is you may not be able to buy as the traded volume is very low.

This also shows the liquidity problem that you may face in case you want to sell before maturity. So invest only if you want to retain bonds till maturity.

Sovereign Gold Bond – February 2020

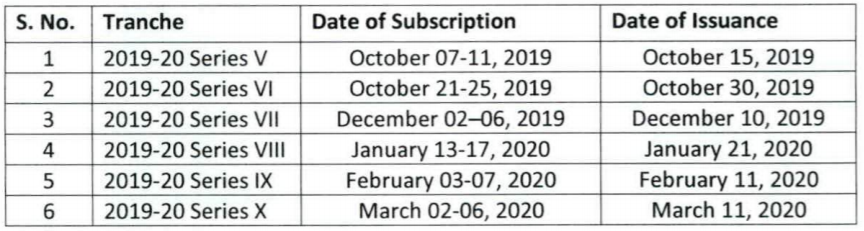

Gold Bonds Issue Schedule for FY 2019-20

The government has published the schedule for issuing gold bonds for FY 2019-20. These bonds would be open for subscription once every month till March 2020 as shown in the table below:

Sovereign Gold Bonds Schedule for FY 2019-20

This schedule will help you plan your investment accordingly.

Recommendation:

Invest in sovereign Gold bonds only if you wanted to invest in gold or need gold for marriage etc in next 5 to 8 years. These bonds are efficient way of investment as you need not worry about purity; there is no loss of making charges and no tension about safety and storage. Additionally you get 2.5% interest every year.

However you should NOT invest aggressively in gold as it would at best give inflation equivalent returns. Also remember exiting this bond mid-way might be difficult!

Leave a Reply