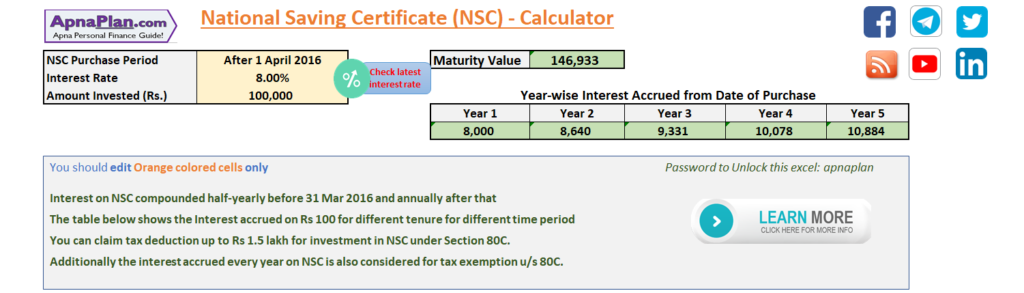

NSC (National Saving Certificate) is popular tax saving investment under section 80C. It has maturity of 5 years and is guaranteed by Government of India. Additionally, the interest earned every year on NSC is also eligible for tax deduction u/s 80C. We have designed a simple excel based NSC calculator where you can input the investment amount, interest rate and it will calculate the interest earned every year eligible for tax exemption and maturity value.

NSC Calculator

The interest earned on NSC is compounded annually and can be calculated using the compound interest formula:

NSC Maturity Amount = Amount Invested * (1 + Interest Rate) ^ 5

Using above formula, if you buy NSC for Rs 1 Lakh paying 8% interest, the maturity amount after 5 years would be Rs 1,46,933.

Click to Download NSC Calculator

NSC Calculator

Also Read: All you wanted to know about NSC

NSC Investment Rules:

NSC interest rates are market linked and are announced every quarter. As of 2020, NSC interest rates are 7.9% (Jan to Mar) (Click for latest interest rate for NSC)

The good thing about NSC is unlike PPF or Sukanya Samriddhi once invested the interest rate remains unchanged over the tenure of the deposit.

The minimum investment should be Rs 100.

There is NO maximum limit for investment in NSC. However the maximum tax exemption is Rs 1.5 Lakh u/s 80C.

NSC can be purchased in multiples of Rs 100.

If you do not redeem your NSC on maturity the amount would earn interest of just 4%. This is applicable for two years from maturity. After 2 years there would be no further interest paid.

TDS & Tax on NSC:

There is NO TDS on NSC.

The interest earned is taxed according to marginal income tax rates applicable to tax payer.

Download: Excel based Income Tax Calculator

Tax Benefit on NSC:

You can claim tax deduction up to Rs 1.5 lakh for investment in NSC under Section 80C. Additionally the interest accrued every year on NSC is also considered for tax exemption u/s 80C.

Download: Latest Tax Planning Guide eBook

Conclusion:

NSC generally offers higher interest rate than most tax saving bank fixed deposit schemes offering tax benefit u/s 80C. You can download the excel based NSC calculator to know the maturity amount and interest eligible for tax exemption every year.

Leave a Reply