In last few weeks I have got several mails and comments asking about the tax benefit on NPS. This post explains the tax deduction availa/ble for NPS under 3 sections: 80CCD(1), 80CCD(2) and 80CCD(1B).

Tax Benefit on NPS Tier 1 and/or 2?

NPS has two Tiers – 1 and 2.

NPS Tier 1 is the long term investment, which has restricted withdrawals and meant primarily for retirement planning. On maturity, you can withdraw maximum of 60% of corpus as lumpsum and rest has to be used for annuity purchase.

NPS Tier 2 is for managing short to medium term investment. You can invest and withdraw anytime as per your wish. This is an optional feature and you are asked if you need Tier 2 account while opening NPS.

All the tax benefit related to NPS is available to investment in NPS Tier 1 account only.

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

NPS – Tax Benefits

NPS Tax Benefits:

NPS tax benefits are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). We discuss each below:

1. Section 80CCD(1)

Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction. [This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction]. Self employed can also claim this tax benefit. However the limit is 10% of their annual income up to maximum of Rs 1.5 Lakhs.

2. Section 80CCD(1B)

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction. This was introduced in Budget 2015.

Also Read: Should You invest in NPS to take tax benefit u/s 80CCD(1B)

3. Section 80CCD(2)

Employer’s contribution up to 10% of basic plus DA is eligible for deduction under this section above the Rs 1.5 lakh limit in Sec 80CCD(1). This is also beneficial for employer as it can claim tax benefit for its contribution by showing it as business expense in the profit and loss account. Self employed cannot claim this tax benefit.

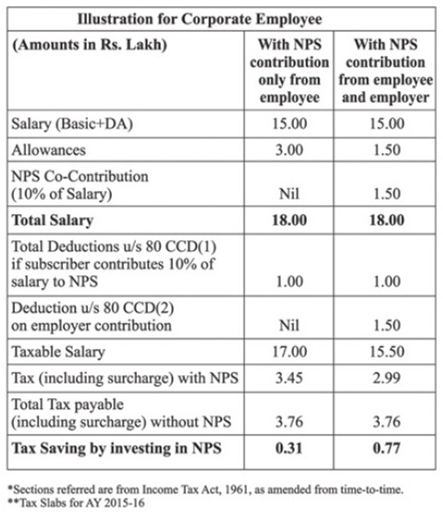

Below is the illustration on how introducing NPS can help you save tax under Section 80CCD(2).

NPS – Illustration of Tax Exemption on Employer Contribution

Tax Benefit for Compulsory NPS deduction:

The earlier pension structure was replaced by NPS in most central and state government jobs since 2004. So anyone who joined after that has compulsory deduction for NPS. The deduction is 10% of basic salary and dearness allowance (DA) and the employer too contributes the matching amount. The confusion for most employees is how they take tax benefit on their compulsory NPS deduction?

Here is an example:

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Let’s take the easy part first. Employee’s contribution in NPS would be eligible for tax deduction u/s 80CCD(1).

The employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

I hope this would have cleared the confusion on how NPS helps you save tax.

Leave a Reply