Over the past few months alone, we have witnessed devastating natural disasters in Australia and New Zealand, social unrest in Hong Kong and now the Coronavirus outbreak globally. These series of unpredictable events have signalled to businesses the urgent need to instil stability and minimise disruption in their operations using technology.

Not only did these events put the modern workplace arrangements to the test, they have created an even more dire and compelling reason for businesses to accelerate the pace at which they are transforming their business practices and culture.

It was not too long ago when businesses were exploring flexible working arrangements to achieve better work-life integration. By leveraging collaboration tools like Google Docs and Hangout, as well as cloud accounting platforms such as Xero that seamlessly capture data from finance and other business functions (e.g. HR and supply chain), employees can gain access to work-related matters anytime, anywhere and on any device.

By establishing a strong digital-first foundation, where most, if not all, the business systems are on the cloud, it empowers the workforce to work from home when such crises occur. Beyond productivity and cost savings, this is an essential part of any business continuity plan, especially in the dynamic and globalised world that we live in today.

4 reasons to build cloud into your business continuity plan

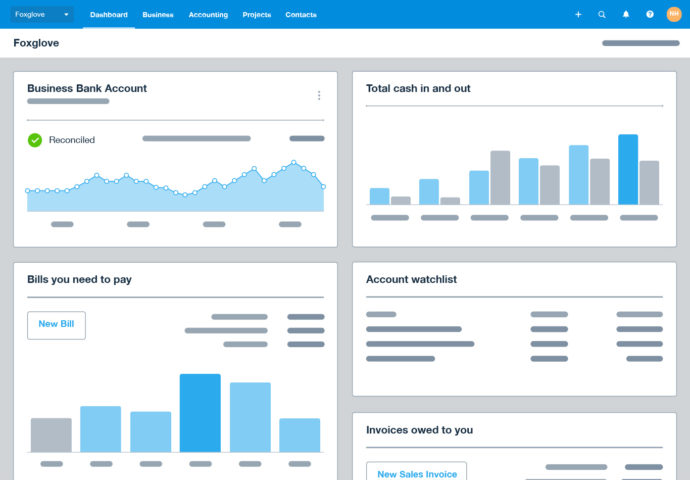

Seamless real-time connectivity: Using cloud tools can provide business owners and their advisors real-time access into the company’s data. For instance, when an accountant or bookkeeper adds an entry into the clients’ books using a cloud-based accounting software, the business owner can see it immediately, any time, anywhere and on any device, making it convenient for business owners who are on-the-move to still retain control and oversight of their businesses.

Being cloud-based also enables software to connect to other apps and tools. With bank feed integrations, business owners can have direct bank feed from their corporate bank account into the cloud accounting platform. The bank feed integration allows business owners and their advisors to view real-time financial data on their cloud accounting platform.

All you need is an internet connection and you can enjoy undisrupted work regardless of where you are working from.

Scalability and flexibility: Cloud solutions are scalable, meaning users only pay for what they need. A business may subscribe to a software solution based on the features, the number of users, and the amount of data that will be stored. They can choose to increase or decrease these capabilities as their business evolves. For businesses striving to survive during the economic uncertainty, prudent spending can go a long way.

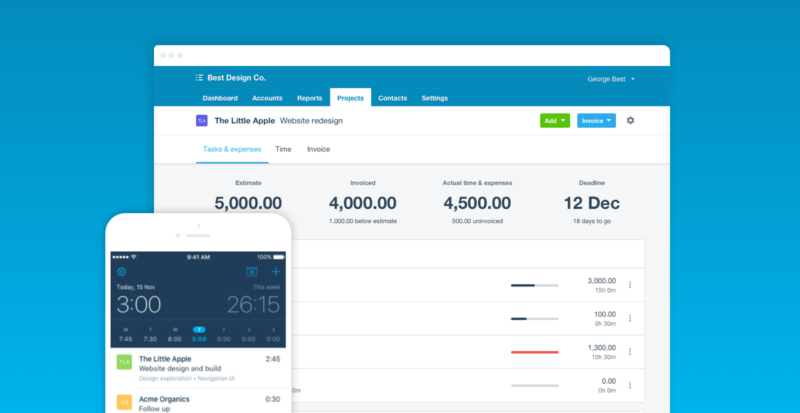

A cloud accounting platform such as Xero with built-in app integrations can streamline and integrate accounting, payroll, expenses, inventory and other related business functions all onto one platform. This also has the effect of eliminating silos that slow down communication, impair visibility and create management issues as your company scales or during a period of extended leave of absence due to a crisis.

In addition, cloud platforms have increasingly built in features that empowers users the flexibility to work from anywhere. Data extraction, which used to be a manual task and even require physical handling of documents, is now easily done simply by scanning the receipt, invoice or document using a mobile phone. This eliminates the need for accountants and bookkeepers to physically retrieve boxes of documents from their clients’ offices.

Improved data security: Cloud providers such as Amazon Web Services (AWS) employ complex security controls to safeguard their clients’ data housed in the data centres. With financial data on the cloud—instead of in physical books or on USB drives, both of which can be easily tampered with, lost or stolen. No matter where the employee is physically based, the business owner can limit access to certain users and also track who accesses the data and when, enabling greater transparency within the organisation.

A #human talent attraction and retention strategy: In a talent-scarce landscape, a remuneration package is not limited to dollars and cents. Businesses offering non-tangible benefits relating to culture and welfare have proven attractive for the modern workforce.

Today, the younger workforce values flexible hours and opportunities to develop their careers. Furthermore, against the backdrop of social unrest, providing your employees the peace of mind that they can choose to work from home using cloud technology, will certainly position your organisation as the best place to work.

Leave a Reply