Being the industry’s most active RIA acquirer paid off handsomely for Focus Financial Partners last year.

But can that trajectory be sustained in an increasingly competitive M&A environment, underscored by Morgan Stanley’s blockbuster $13 billion purchase of E-Trade?

The closely-followed Focus, the only publicly traded company that owns RIAs, posted impressive growth in key metrics last year.

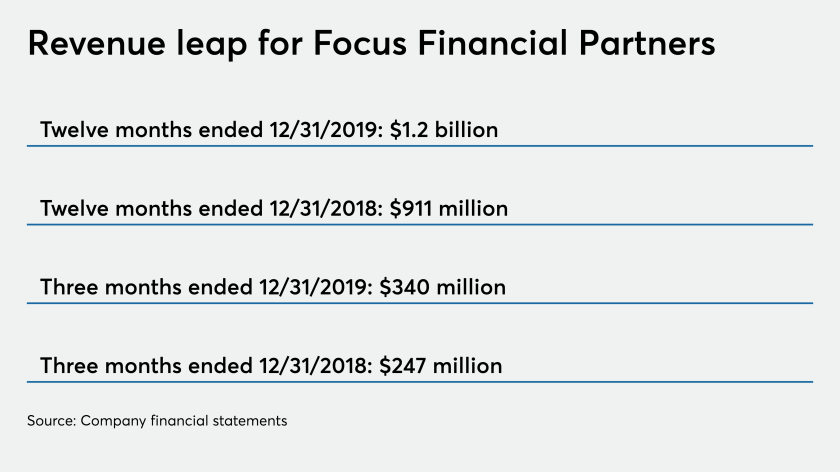

Revenue surpassed $1 billion for the first time and increased 37.5% from 2018. Adjusted net income jumped 42% and adjusted EBITDA climbed 33% to $270 million.

Focus’ affiliate partners were involved in 18 acquisitions in 2019, far outpacing rivals such as Mercer Advisors (11 deals); Wealth Enhancement Group (6); Mariner Wealth Advisors (5); Captrust (4) and Hightower Advisors (4).

Focus CEO Rudy Adolf cited the firm’s “strong performance of our partner portfolio” as the driving force behind Focus’s 2019 growth in the company’s fourth quarter earnings report release.

“We are operating at a leading scale for this industry,” Adolf said. “We are confident in the forward potential of our business as we advance toward our 2025 objectives.”

But that confidence may be overstated, industry observers say.

There were over 50 buyers for every seller last year, with more than half of purchasers having made previous acquisitions, says David Grau Jr., CEO of M&A consulting firm Succession Resource Group. As a result, he says, “The increased competition will begin to erode Focus’ M&A market share long-term.”

We are operating at a leading scale for this industry.

Rudy Adolf, CEO, Focus Financial Partners

That said, Grau adds that he expects “Focus affiliates will remain the largest buyer in 2020. … Their offices operate independently, which is attractive to sellers looking for someone like themselves, just 20 years younger, but as part of a larger network providing scale.”

As for competition, Echelon Partners managing director Carolyn Armitage notes that RIA M&A now has “a crowded field of high-quality, professional buyers offering attractive deal structures. Sellers have quite a delectable menu to choose from.”

Continuing to get deals done without overpaying will be Focus’ biggest challenge, according to M&A executives.

“Exiting advisors are becoming more aware of their options and knowledgeable about M&A trends,” Grau says, “and with current market conditions, they often have unreasonable expectations of value.”

The increased competition will begin to erode Focus’ M&A market share long-term.

David Grau Jr., CEO of Succession Resource Group

While many industry observers see Morgan Stanley’s acquisition of E-Trade as another indication of fierce — and expensive — M&A competition, Adolf portrayed it as a validation of the RIA model.

“It’s simply a reflection that the traditional [brokerage] model is broken and cannot compete with the winning model in this industry, which is the RIA fiduciary model,” Adolf said on a conference call to industry analysts. “When you’re on the losing side of the equation, you need to do consolidation.”

Perhaps not coincidentally, Focus also announced the acquisition of an advisory firm outside the U.S., adding Melbourne-based Mediq Financial Services as its second partner firm in Australia.

“Expanding our international presence is an important component of our growth strategy,” Adolf said in a statement.

While Focus has been expanding, industry analysts have become concerned about Focus’ debt level, which rose to an eyebrow-raising 4.27 times net leverage ratio at the end of last year’s third quarter.

Management did what they said they were going to do.

Matt Crow, president of Mercer Capital

But the same measure dropped to 4.00 at the end of 2019. “This level provides a great starting point for 2020,”Adolf said. ‘We will continue to deploy capital to the highest return opportunities while remaining within our target 3.5x to 4.5x range.”

Indeed, Focus’s fourth quarter earnings and presentation was well-received.

“Management did what they said they were going to do,” says Matt Crow, president of financial services consulting firm Mercer Capital. “The market responded by pushing Focus’s stock [of $33 in July 2018] above the IPO price for the first time since last summer. We estimate their run-rate adjusted EBITDA to be as much as $325 million, which at their current trading price suggests a multiple of 11X to 12X. Viewed from that perspective, Focus is growing into their valuation.”

Crow also noted the role the bull market played in Focus’s 2019 results.

“The S&P 500, Russell 2000, and S&P 400 Midcap indices all produced at least 35 more percentage points of return in 2019 than they did in 2018,” Crow says. “Even most bond strategies produced high single digit returns in 2019. That makes RIA same store sales numbers look really strong, fuels strong ROI on acquisitions and pushes up cash flows to materially reduce leverage ratios.”

Focus’ revenues for 2019 climbed to $1.2 billion, up from $910 million in 2018. Adjusted net income jumped 42% to $177 million from $125 million in 2018. Adjusted EBITDA rose 33% to $270 million last year, compared to $203 million in 2018.

Leave a Reply