The coronavirus pandemic is hitting close to home for financial advisor Liz Landau.

There’s an emergency containment zone 10 minutes away from her White Plains, New York, office in nearby New Rochelle. Her daughter is in self-quarantine after a study abroad semester in Italy was canceled. One of Landau’s clients — a hospital doctor who was exposed to a COVID-19 positive patient in Connecticut — is also in self-quarantine.

“People are reacting in different ways. I have a friend who bought 36 cans of Lysol yesterday,” she told Financial Planning Wednesday afternoon.

While some advisors debate whether to travel across the country for upcoming industry conferences and events, planners like Landau who live and work near centers of outbreak are grappling with more immediate and personal concerns.

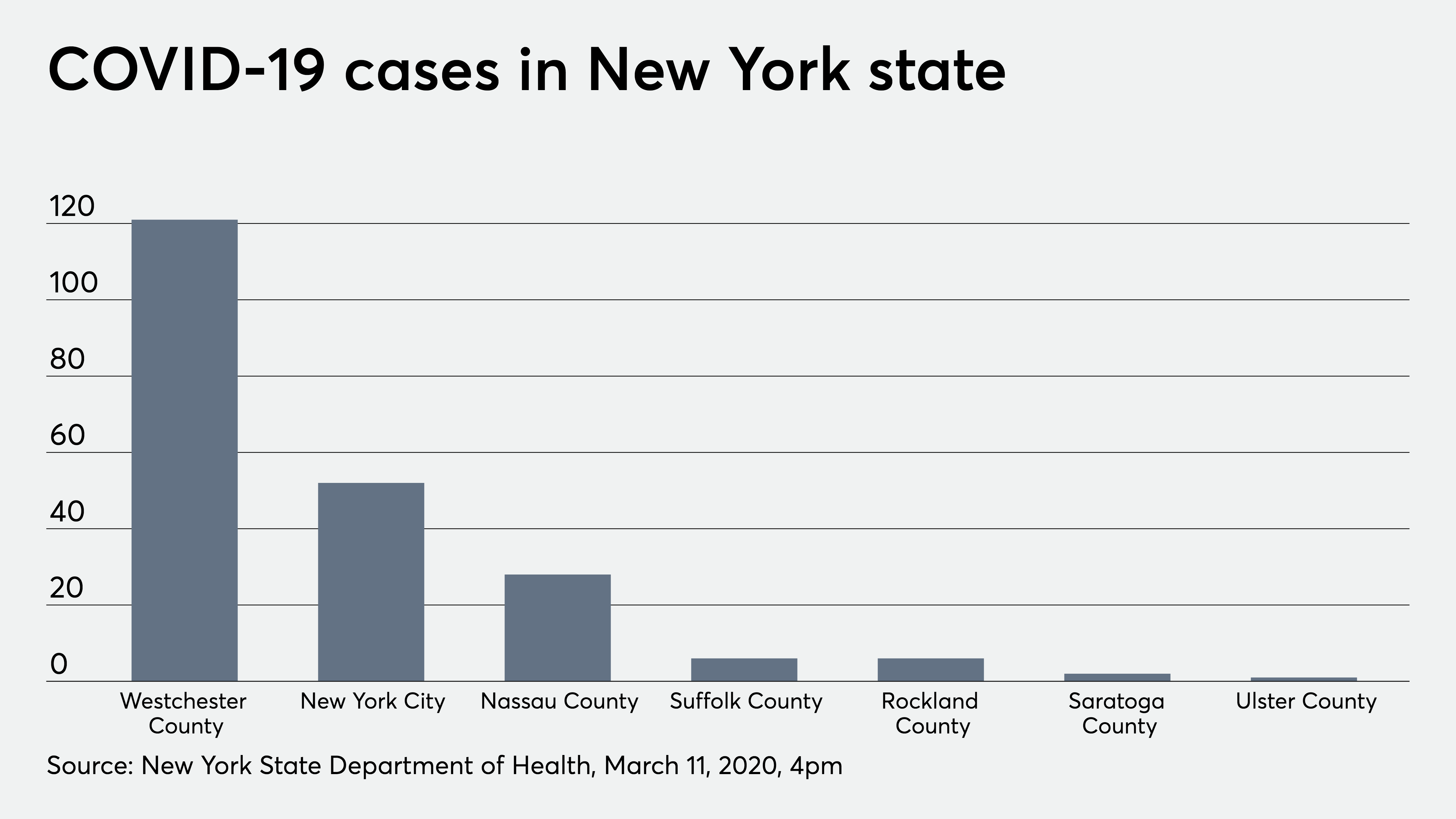

There are more than 1,200 confirmed cases of coronavirus in the U.S. as of March 12 — up from 70 at the beginning of the month. More than a hundred cases had been reported in New York’s Westchester County by March 11. State officials have traced over 50 of the cases in the county to one attorney in New Rochelle, which has a population of almost 80,000. Gov. Andrew Cuomo imposed a containment zone that went into effect Thursday.

Three advisors operating in Westchester County — Landau, Ralph Penny, a solo practitioner, and Paul Tramontozzi of Lob Planning Group — spoke with Financial Planning Wednesday and laid out how they and their clients have been impacted by the nearby coronavirus outbreak.

While the three advisors go about daily routines, their proximity to the virus is evident. Schools are closing. One of Landau’s clients canceled her honeymoon in Italy. Another client who owns a retail business is concerned about maintaining her income.

“The economic effects of this are going to have an impact on almost everyone,” Landau says.

Penny was planning a trip to Moscow for a wedding. That’s now in limbo.

None of Tramontozzi’s clients have been infected or quarantined. Nonetheless, the virus is top of mind, he says, noting that some clients are expressing concern for family members with health issues.

“Not all the calls are strictly financial. Sometimes people just want to talk to somebody,” he says. “This is where advisors are expected to earn their keep and put things in perspective for people.”

For some advisors, virtual technology has come in handy amid the pandemic. Landau and Tramontozzi already ran most of their meetings virtually.

“Now it’s one less stress that we have — having clients that are already comfortable with the fact that we are able to share things on our screen with them,” Tramontozzi says.

Penny is still running in-person meetings. “There haven’t been at this point any cancellations or fears,” he says.

Apart from people setting a little more distance from themselves than normal (there have been a lot of fist bumps and waving at his church as opposed to hugs and handshakes), it’s essentially been business as usual, according to Penny.

“You’ve just got to keep going on and certainly hope for the best,” he says. “Keep washing your hands and use Purell.”

As for market volatility, “this is not my first rodeo,” Penny says, noting that he hasn’t received many concerned calls from clients about their portfolios.

Tramontozzi, who is affiliated with LPL Financial, says he is grateful to be part of a larger organization during this time. LPL designated a section of their portal to intra-day updates of the market as well as the independent BD’s continuity plans.

What’s clear is there is still uncertainty — especially around geographic locations that have been hit as hard as Westchester County and Seattle.

“This is a time where communication is most important,” Tramontozzi says, adding later: “I think the expectation is that things get worse before they get better here.”

Leave a Reply