Executive Summary

Over the past decade the ongoing evolution of technology, from the rise of robo-advisor platforms to the broader reach of the internet and its ability for APIs to connect “everything”, has spawned both changes to advisor business models, (proposed) major shifts in regulation, and an entire wave of systemic changes to the financial planning landscape.

The end result of this overall industry evolution is a growing pressure on financial advisors to “step up” and add more value for clients, leading to the launch and growth of our own Nerd’s Eye View blog focused in Advancing Knowledge in Financial Planning, and over the years increasingly shared an ever-widening range of actionable insights with our community of financial advisors around broader industry trends (and what that means for both their clients and their careers).

Along the way, I’ve also become a ‘serial entrepreneur’, trying to leverage those industry insights to (proverbially) skate not to where the puck is but to where it’s going, and have co-founded and/or grown several business to not only take advantage of those emerging opportunities, but to (hopefully) help nudge the industry along, with an eye towards forever expanding our reach and impact to help more advisors and their clients by enabling real financial advisors to better hone their craft to become better and more successful.

Accordingly, I announced last week that, after 17 years, I was leaving from Pinnacle Advisory Group to go to Buckingham Wealth Partners, one of the few independent ‘mega-RIAs’ with nearly $50 billion of assets under management and advisement, that offers both wealth management services to consumers and a TAMP and other outsourced investment services for other RIAs. Which, in turn, has raised several questions around why I chose to change firms at this juncture, particularly to a “mega-RIA”, and what my move says about where I see the next batch of opportunities for our industry.

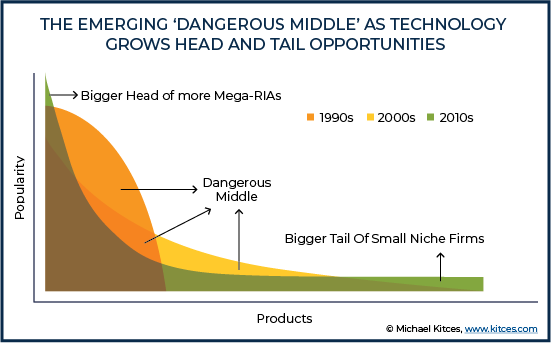

Specifically, I believe there are three broad trends that will determine the next stages in the evolution of financial planning the years ahead. First is that technology and so-called “Turnkey Advice And Planning Platforms” will allow “smaller” advisors to better compete with “large” firms by not only giving them the tools and capacity to provide the same level of service to their clients, but by facilitating new and more focused business models that larger firms can’t easily replicate (into increasingly focused niches and specializations), thus making financial advice available to more people than ever before. At the same time, the emergence of several firms with more that $10B under management suggests that the biggest firms will continue to get even bigger, through both organic growth and inorganic acquisitions, and reach national-scale, attracting a disproportionately large percentage of high-net-worth households, and shifting to a more ‘traditional’ business model where their advisors are employees (versus the legacy independent advisor percentage-of-revenue eat-what-you-kill model). Finally, as the industry moves farther away from being product-focused to advice-centric, advisor education, training, and experience will play an increasingly important role, as clients will demand increasingly complex and sophisticated advice, which advisors will have to be able to deliver if they want to differentiate themselves and defend their fees from amid a sea of advisors who all have the same value propositions.

Ultimately, the key point is that, as financial advice becomes more accessible to a wider audience, there is ample room for firms of all sizes, business models, and fee structures, because each can serve different segments of clients and be a good fit for different sorts of advisors, who each have their own personal/career goals and preferences. At the same time, technology will remain a constant influence, and will allow not only smaller advisors to thrive, but for “mega-RIAs” to achieve the sort of scale that was merely a pipedream just a decade ago… while at the same time pushing advisors to invest in their own expertise.

Of course, there are a number of mega-RIAs that I might have affiliated with, and for me, I chose Buckingham in particular because their emphasis on being technically proficient and willingness to develop a framework of “evidence-based” financial planning that aligns nicely with our own focus here on the Nerd’s Eye View, in addition to having a client-centric planning-centric culture, and a solid base of next generation leadership who are focused on how to do this sustainably for more and more clients over the decades to come. In other words, at some point decision of what firm to affiliate with isn’t just about a particular model or size, but choosing a firm with a clear vision and a concrete plan on how to be at the forefront of the next stages of financial advice.

Last week, I announced to the industry that for the first time in 17 years, I was making a change in advisory firm, from Pinnacle Advisory Group (that grew by nearly 10X from under $200M when I joined to nearly $2B today, at least before the recent market turmoil!) and its Pinnacle Advisor Solutions TAMP offering, to Buckingham Wealth Partners, which similarly offers wealth management services to consumers (their “Strategic Wealth” team), and a TAMP and other outsourced investment services for other RIAs (Buckingham “Strategic Partners”, including the 2018-acquired Loring Ward platform)… but with far more resources for each, given a collective base of nearly $50 billion of assets under management and advisement.

As a serial entrepreneur in our world of financial advisors that leverages my perspective on broad industry trends to make investments (or “bets”) on future business opportunities – leading me to co-found and/or help to grow a number of different businesses over the years, including not only our advisory firm, but also this Nerd’s Eye View blog (and speaking and consulting and CE platform) at Kitces.com, the XY Planning Network, AdvicePay, New Planner Recruiting, fpPathfinder, and FA Bean Counters – the decision to align with Buckingham Wealth Partners (a “mega-RIA” in the current industry parlance) has spawned a number of questions in the industry of what this signals about my perspectives on the future opportunities for the (small versus big) business of financial advice.

And so I wanted to share my latest thoughts on what I see as the dominant trends in today’s financial advice landscape, and how it led me to the decision to join Buckingham.

Trend #1: Technology And TAPPs Will Enable “Smaller” Advisors To Compete Against Big Like Never Before, Expanding Access To Advice In The Process

Just over 20 years ago, Mark Hurley of then “Undiscovered Managers” (and more recently, Fiduciary Network) issued a rather controversial report on his anticipated future of the independent financial advisory industry, predicting the rise of a handful “mega-RIAs” with $10s of billions of AUM that would become nationally dominant players in the mass affluent marketplace, a coterie of regionally dominant independent firms that would also gain significant market share… and that the size of those firms and their brands, and the associated economies of scale, would largely put the cottage industry of small and especially solo independent advisory businesses out of business (or at least render them uncompetitive and unprofitable).

In practice, though, the past 20 years have unfolded quite differently, driven in large part by the transformational force of the internet that turned the entire ecosystem of advisor software upside down. After all, in the 1990s, the “best” advisor software was wirehouse proprietary software, created by the largest platforms for their own captive advisors because they could amortize development costs over the largest base of advisors, while independent advisors struggled with a handful of “homegrown” solutions (software that independent advisory firms made to solve their own challenges, and then subsequently sold to their peers, including Orion, Tamarac, Redtail, iRebal, and many others). But over the past 20 years, the interconnectivity of APIs facilitated by the internet has allowed an entire ecosystem of independent software solutions to grow and flourish… such that today, the software solutions for independent advisors have tens of thousands of users and far more resources to reinvest into their technology than any proprietary software (e.g., eMoney Advisor has more than 50,000 users, as many advisors as all wirehouses combined!).

As a result of this explosion in technology-driven productivity enhancements, solo advisory firms are quietly surviving and even thriving serving the mass affluent. As tasks that once took a staff member handling a manual spreadsheet are now largely automated by software (e.g., rebalancing), manual staff-driven account application paperwork with mailings, envelopes, and wet-ink signatures are slowly but steadily vanishing into automated digital onboarding with straight-through processing, and the staff savings from technology efficiencies are not only boosting the bottom line profitability of solo advisors but allowing for even more savings (e.g., reduced rent expenses by needing less office space, or the feasibility of operating a location-independent entirely virtual practice!). In other words, what used to take an advisor 2-3 staff members of support to execute for their clients now takes at most a part-time assistant and a few thousand dollars of software, and advisors who now staff a team of 2-3 can support hundreds of thousands of dollars of revenue in a profitable manner.

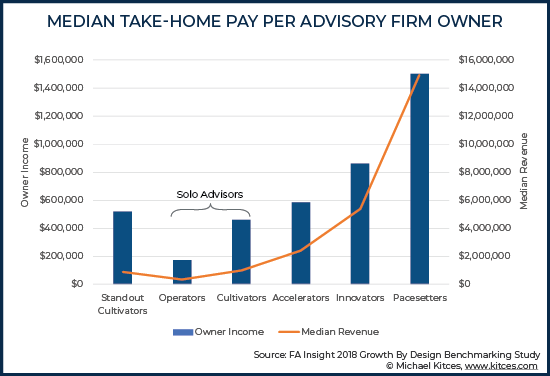

Accordingly, over the past 10 years (and exemplified most recently by the 2018 FA Insight benchmarking study), standout “Cultivators” – top performing firms with a single owner and $500k+ of revenue – were serving an average of 155 clients with a paraplanner and two admin staff, generating $870,000 of gross revenue, and a net of more than $500,000 of income to the sole owner! And many advisors are now creating wildly profitable practices with no more than 50 “Great” clients.

The caveat, though, is that most advisors – and especially small advisors – don’t want to have to (re-)invent the wheel creating everything themselves, and the responsibility to cobble together solutions from an ever-broadening range of options in the AdvisorTech ecosystem is leading to a form of “tech fatigue” instead. Accordingly, even successful “independent” solo advisors have long maintained affiliations to some kind of “platform” that supports their businesses, from the literally thousands of independent broker-dealers, to the custodial platforms of RIAs, and more recently a growing crop of even-more-specialized RIA support platforms (e.g., Dynasty Financial).

From the business perspective, these independent advisor platforms allow those advisors who still want to own and control their businesses to gain some of the benefits of economies of scale from centralized (platform) resources, but without giving up their desired independence. Except while in the past, advisor platforms were primarily aligned around their product offerings – with annuity agents tying to Independent Marketing Organizations (IMOs), those who sold mutual funds and variable annuities with Independent Broker-Dealers (IBDs), those managing assets for a fee with RIA custodians, etc. – in the future, advisor platforms will be oriented more around their advice offerings.

In turn, the need for “advice platforms” is leading to the rise of various outsourcing solutions for advisors, along with the new “Turnkey Financial Planning Platform” (TFPP, or what United Capital’s Joe Duran subsequently dubbed as a more phonetically pleasing “Turnkey Advice and Planning Platform” or TAPP instead). Similar to the Turnkey Asset Management Platform (TAMP), the idea of a TAPP is to offer a more centralized and systematized way to deliver financial advice, often with a particular ‘style’ or planning philosophy, and targeted to a particular type of clientele for whom the approach is best suited. Earlier pioneers in the TAPP model include the Garrett Planning Network’s hourly model for serving the middle class, and Bert Whitehead’s Alliance of Cambridge Advisors (now the Alliance of Comprehensive Planners) model of tax-centric planning advice on the annual retainer model.

Accordingly, in 2014 I co-founded XYPN in this TAPP mold, as one of what I someday anticipate will be hundreds or even thousands of TAPPs; ours built around a particular focus of serving Gen X and Gen Y with a monthly subscription and other fee-for-service models of financial planning (and in turn co-founded AdvicePay to facilitate the emergence of those fee-for-service payments).

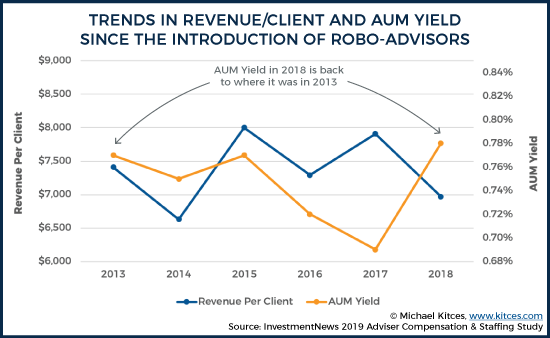

As while the AUM model has been widely criticized and many have predicted its demise as fee-compression takes hold… I’ve predicted throughout that the AUM model will continue to hold, due in large part to its especially effective pricing psychology for clients. Accordingly, it’s perhaps not surprising that in practice the largest advisory firms are more likely to be AUM-based, and the average revenue yield on an advisory firm has not substantively moved in 7 years since robo-advisors showed up (i.e., the long-foretold robo-advisor ‘fee compression’ still is not evident after 7 years of robo-advisor competition!).

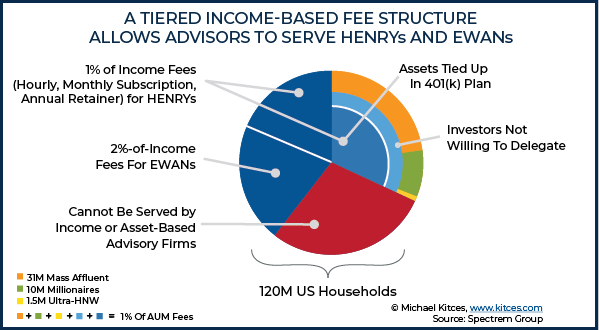

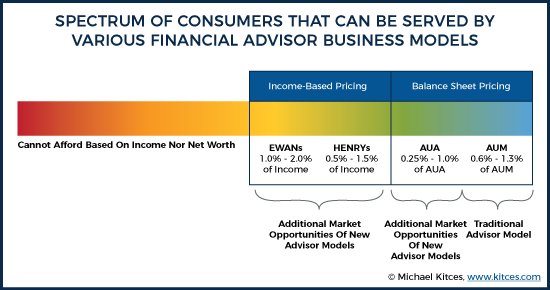

Instead, it appears that the real limitation of the AUM model is simply that it only serves a limited subset of households – those with sufficiently large assets to manage (or more generally, who have enough net worth on their balance sheet to pay a small slice of it for advice on the rest), whose assets are not tied up in a 401(k) or other employer retirement plan, and who are inclined to delegate those assets in the first place.

By contrast, new fee-for-service models – e.g., charging fees that amount to 1% to 2% of income instead of charging based upon (and requiring clients willing to delegate) assets – are better for those who have income but not necessarily assets, or are simply not inclined to fully delegate those assets and instead would like an advisor as their validator or collaborator to support their own financial decision-making.

The key point, though, is simply that the rise of technology is enabling a new generation of independent small and solo financial advisors, operating never-before-possible business models to serve never-before-reached new markets of clients in need of financial advice, who will be supported by a broad range of outsourcing solutions (like Buckingham’s Strategic Partners) and a new form of platform (the TAPP) to facilitate that growth.

And as long as technology continues its inexorable march forward, and facilitates an ever-growing ecosystem of support structures and platforms for advisors, I continue to bet on the ongoing trend of technology enhancing the capabilities and business success of the solo and “small firm” independent advisor.

Trend #2: As The Industry Shifts From Products To Advice, There Will Emerge A New Cadre Of National-Scale (Employee-Based) Advice Firms

Notwithstanding how technology has been an incredible boon to the competitive viability of the small and solo independent advisor, the predictions of Mark Hurley about the rise of mega-RIAs built on a wave of industry consolidation has held true as well, and a subset of ‘breakout’ firms really are trying to reach national size and scale, with multiple $10B+ AUM advisory firms emerging on the scene in just the past few years.

Some have grown largely organically (Edelman Financial and Mallouk’s Creative Planning), others primarily by acquisition (e.g., United Capital), and some with an aggressive combination of both (e.g., Wealth Enhancement Group). Many have been solely advisory firms aiming to directly serve consumers as clients, while others have include “B2B2C” offerings supporting advisors as a TAMP or other form of advisor platform (e.g., HighTower and Buckingham).

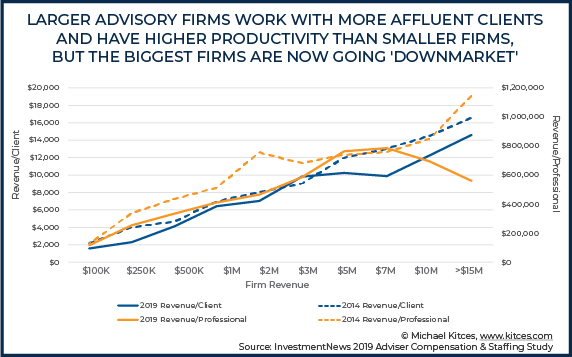

All of the emerging crop of mega-RIAs are in search of the benefits of gaining economies of scale to expand both the reach and profitability of delivering financial planning advice. Which notably may not come in the scalability of financial advice itself – as industry benchmarking studies actually show remarkably little economies of scale or cost efficiencies in scaling financial advisors themselves – but does appear to come in the scalability of almost everything else in the firm, from the investments and operations, to especially the marketing and the branding of an advisory firm (as with intangible services like financial advice where it’s so difficult to evaluate who is a ‘good’ advisor or not, consumers often fall back to relying on brand and social proof indicators like size to decide who is ‘best’ to work with). Such that the largest independent advisory firms are disproportionately able to attract a far higher percentage of the most affluent clientele in the first place (and appear to be increasingly focusing on the ‘Millionaire Sweet Spot’ in target clientele). Or stated more simply: the larger the advisory firm, the larger the average client household they serve (and the more revenue each advisor at the firm is capable of servicing).

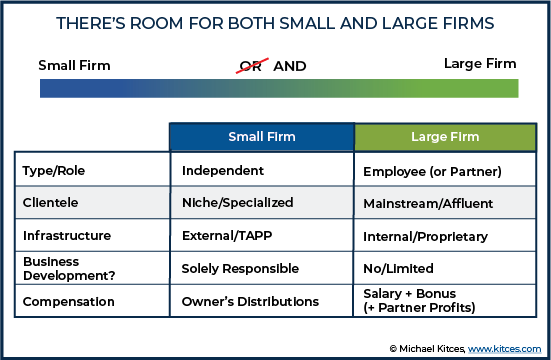

A key distinction of the emergence of national-scale mega-RIAs, though, is that unlike their solo firm brethren, they may be independent firms themselves, but are generally not an “independent” model for their advisors. Instead, the mega-RIAs increasingly operate like more ‘traditional’ employee enterprises, and in fact are growing so quickly that the number of employee advisors in the RIA channel may now exceed the number of independent RIA business owners!

The appeal of this employee model is largely driven by the fact that at scale, mega-RIAs are capable of centralizing marketing, shifting business development responsibilities away from the individual advisors of the firm and instead increasingly generating clients for the advisors of the firm. By splitting business development and client advice and servicing, advisory firm jobs shift to become more salary-based, which lowers the average compensation to advisors (saving ‘cost’ for the firm and improving profit margins), but also reducing the failure rate of advisors (who are no longer at risk of being forced out of the business if they can’t bring in enough of their own clients). Thus making it feasible for mega-RIAs to expand the number of job opportunities for that subset of advisors who do not want to be responsible for business development and getting their own clients and building their own firm, and instead would prefer to simply work for a firm that lets them spend as much time as possible being financial advisors and serving their clients. (Where the subset of advisors who actually can and do create enterprise value become owners/partners of the firm.)

The key point, though, is that unlike Hurley’s vision of a big-versus-small firm future, it’s not a question of whether big or small firms will succeed, and instead about recognizing that both will have opportunities to succeed, albeit in different domains. As a subset of small firms will always have a nimbleness to pivot faster than big firms and explore new business models, new markets and new niches and new specializations, even as large firms bring to bear their economies of scale and brand to pursue the most affluent clients. Accordingly, over the past 20 years, the big have gotten bigger and the small have gotten more profitable, too!

Similarly, there will always be a subset of advisors who prefer to be independent business owners – with all the freedom and control (and responsibility and burden) of making all their own choices – while others will prefer an employee model where they can simply focus on serving clients and let someone else worry about all of that other ‘infrastructure’ stuff. And in fact, the recent growing trend of “tuck-ins” – advisors who were once independent, and merge themselves into a larger firm to get away from all the business management work so they can get back to focusing on clients – is simply a recognition of this trend that some advisors want the work of actually building a business, and others would prefer to “just” focus on their client work instead.

In other words, the reality is that the needs and demands of consumers, and the myriad of advisor business models and firm types to serve them, means it’s not really a matter of whether the AUM model will “win” or “lose”, or if small firms will beat large firms (or vice versa), or if it’s better to be an independent or under an employee model. Human beings themselves are myriad, with a complex range of needs. That’s why the advisor landscape is so fractured, with more than 300,000 financial advisors but even the largest platforms from LPL to Merrill Lynch having barely 5% market share.

Accordingly, I’m not “betting” on small independents over large enterprises or vice versa… but on both – through my involvement in both XY Planning Network (a TAPP to support independent advisors) and now Buckingham (a ‘mega-RIA’ pursuing the delivery of financial advice at scale – each to thrive in their respective domains, with their respective business models, for their respective ideal advisors, to serve their respective ideal clients.

Trend #3: Increasing Demands For More (Sophisticated) Advice Will Drive A Need For Greater Education Of Advisors And Spawn A More Evidence-Based Financial Planning Approach

It is perhaps one of the greatest ironies (at least to me) that with all the focus in the past 10 years on the importance of a fiduciary duty for financial advice, that the industry and regulators have focused almost entirely on whether advisors have undue conflicts of interest that could influence their ability to give Best Interests advice to their clients… and have spent almost no focus on determining which/whether advisors have enough training, education, and experience to even know what the “Best” advice would be in any particular situation.

In other words, delivering fiduciary advice in the Best Interests of a client isn’t just about the Duty of Loyalty (to mitigate or eliminate any conflicts of interest that could impair the quality of advice), but also a Duty of Care to only give advice in domains in which the advisor is competent to give advice in the first place. In a profession where obtaining a license to give financial advice requires only a high school diploma and a basic 2-3 hour regulatory exam that tests almost nothing the actual delivery of financial advice itself (and technically, the diploma is optional).

As technology marches inexorably forward, though, the reality is that more and more of the “basic” tasks of financial advice will be handled by software, forcing advisors to move further up the value chain and be able to provide increasingly complex and sophisticated financial advice (above and beyond what the technology itself will automate). To some extent, this challenge is already playing out, leading to rapid growth in the number of CFP certificants (even as the total number of financial advisors is projected to decline), and accelerating growth in the domain of “post-CFP” designations as well (for those advisors who want to further differentiate beyond increasingly common CFP certification alone).

In fact, our focus here on Nerd’s Eye View at Kitces.com, including our blog content, The Kitces Report, Member’s Section webinars, and live speaking events, have all been built around the belief that “advancing knowledge in financial planning” would become increasingly important and relevant as financial advisors are required to deliver increasingly sophisticated advice to clients (both to bolster our own value proposition in an advice-centric world, and to differentiate from increasingly capable software providing and automating basic financial advice).

Yet the challenge is that when it comes to financial advice in complex situations, there is still remarkably little consistency and agreement on what constitutes the “best” advice in the first place, and instead financial advice is still largely the domain of beliefs and opinions of individual advisors about what may be “best” for any particular client.

In the investment context, the fact that different buyers and sellers have different sets of beliefs and opinions about investment opportunities is what makes a market; when shares change hands in the investment markets, by definition there’s a buyer for every seller, and what one person decides to no longer own at a certain price, someone else is willing to buy at that same price. In other words, markets “work” in part because everyone has a different view about the “fair value” of what is being bought or sold, and the collective action of that buying and selling enables “price discovery” of what the “true” value is.

Yet while in the aggregate all this buying and selling activity is what helps the market narrow in on the “true” value, for any individual investor it tends to be a losing proposition (at least after considering the cost of trading itself). Thus why, in the aggregate, the average investor (and even the average professionally-managed mutual fund) trying to pick stocks tends to underperform the ‘discovered’ price of the market in the aggregate (i.e., the index).

And the weight of this “evidence” – that individual stock-picking tends to be a losing proposition, and that instead the most straightforward way to generate returns is simply to ensure that you participate in the market, and to ‘tilt’ towards the factors (that drive the underlying risk premia) that the investor wants to participate in – has in recent years become known as “evidence-based investing”, to connote the particular style of investing not just based on investment beliefs and assumptions, but the underlying research and data about what it is that really drives returns and is most likely to achieve the desired outcomes.

Again, though, when it comes to financial planning … we largely still live in a realm of individual opinions and beliefs regarding the value of various financial planning strategies and techniques. To some extent, this is simply because the range of financial planning goals for which there may be solutions is a wider and more diverse problem than “just” the realm of investments. As while there might be thousands of stocks and bonds to choose from (plus various combinations of them in the form of mutual funds and ETFs), the breadth of investment-based goals is relatively limited (e.g., a short-term or long-term investment goal, whether for house downpayment or college or retirement) to solve for the question of “what provides the best (net) return to achieve the goal(s)”.

By contrast, financial planning goals are more varied and nuanced. How should one weigh the tax-benefits of 529 college savings plans against their costs, as compared to using a Coverdell Education Savings Account, saving in a Roth IRA to withdraw for college, or using whole life insurance loans, gifting appreciated stock to sell at the child’s tax rates while trying to navigate the Kiddie Tax, or planning to try to maximize eligibility for college financial aid instead?

Similarly, while saving and accumulating for a long-term retirement goal might be relatively straightforward from an investment perspective, what’s the best way to draw down on those assets in retirement? What is a sustainable withdrawal rate from a portfolio? Is it enhanced by using an annuity, or diminished by the cost of the guarantees? From which accounts should the retiree draw first if there are multiple types of accounts with different tax treatments? When does it make sense to switch dollar from one type of retirement account to another (e.g., via a partial Roth conversion)? And how do we even decide what constitutes the “best” retirement income strategy in the first place?

In practice, these are all questions that we’ve tried to tackle with research and analysis on the Nerd’s Eye View blog over the years – effectively our form of “evidence-based financial planning” to make decisions based not just on opinions and beliefs, but hard data and rigorous analysis of what really works (or not, or when it does and when it doesn’t).

But now with the depth and resources of the Buckingham team, it’s our goal to both research, study, and publish our evidence-based financial planning analyses on the Nerd’s Eye View blog, but also test and determine how best to put them into practice (at Buckingham) as the world of financial advice increasingly moves in the direction of “evidence-based financial planning”!

The bottom line is that while the advisory industry (and associated pundits) often frame competition in a scarcity mentality of one segment of advisors “vs” another… in practice, I take a more abundance-minded approach that there is room for both large and small firms, independent and employee models, AUM and fee-for-service models. Because they serve different types of clientele, and appeal to different types of advisors based on their own career preferences and motivations, as well as individual advisor personality styles.

At the same time, the inexorable force of technology has and will continue to reshape the landscape of financial advice and the industry participants. It is making small firms more profitable and capable of expanding into new markets and new business models, but also facilitating the scalability of mega-RIAs developing national brands and national reach. It is improving the quality of advice by providing increasingly sophisticated tools to support the analysis of complex client situations, but also pressuring advisors to reinvest more into their own careers, training, and education, to stay one step ahead of what technology provides.

Of course, the reality is that there are still many firms in the emerging group of “mega-RIAs” that I might have affiliated with, in deciding to make a shift. And while these overall industry trends may have led me towards working with a large RIA, it doesn’t necessarily specify which large RIA.

So why Buckingham in particular? In part, it was driven by their roots as being founded by CPAs and taking a deep focus on technical proficiency (aligned to our own focus on Nerd’s Eye View), their appreciation of taking an evidence-based approach (first in investing, and now in developing evidence-based financial planning), a culture of focusing on clients and quality financial planning advice, and a long-term focus with a “next-generation” leadership team largely in its 30s and 40s (who will actually be around running and executing on the basis for decades to come!). And part of the decision was simply that they’re good people I look forward to being around and spending time with for a long time to come! (Life is too short to choose anything different!)

In other words, at some point it isn’t about which type of advisor firm (or model or approach) will win or lose. It’s about the ability of any particular firm to be clear about what it aims to pursue, get and have the right people on board, and successfully execute on that vision. And I’m confident that Buckingham has the right culture and people to be a leader into this next era of financial advice, and a destination for advisors who want to be a part of what a large firm can offer!

Leave a Reply