The time may come when you want to shut down your business to retire, open a new venture, or start a new career path. Regardless of your reason, the process for closing a business is different than selling it. Although it can be overwhelming, you can de-stress with our closing a business checklist.

There are a number of things you must keep on your radar when shutting your doors for good. From filing federal returns to closing accounts, find out what you need to know to keep your head above water.

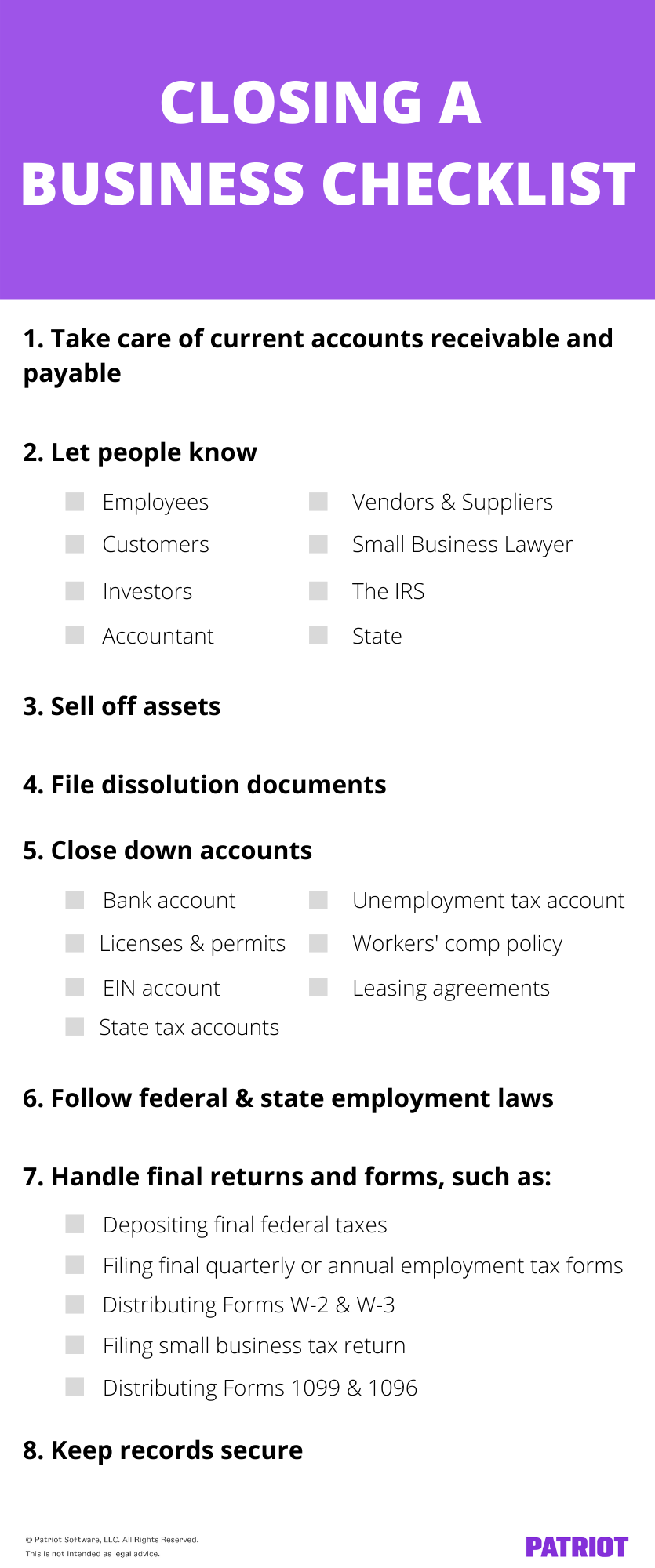

Closing a business checklist

About 8.33% of businesses close every year, according to the Small Business Administration (SBA). And, not all closures are business-related. Many reasons businesses close are due to personal reasons.

So, why do business owners close up shop? Here’s what the SBA found:

- Low sales/cash flow: 25%

- Retirement: 21.9%

- Sold the business: 20.3%

- Opened another business: 6.3%

- Illness or injury: 4.7%

- Business credit: 3.1%

- Death: 3.1%

- Personal credit: 1.6%

- Project ended: 1.6%

Whatever your reason for winding down operations, check out our closing a business checklist for smooth sailing.

1. Take care of current accounts receivable and payable

Have all of your customers paid you? Have you paid all of your vendors or suppliers? Chances are, your accounts receivable (what is owed to you) and accounts payable (what you owe) aren’t quite wrapped up.

Before you do anything, settle your accounts receivable and payable. Consult your accounting records to see what debts you still owe. And, find out which customers still owe you money.

So, what can you do to speed up the customer payment process? Consider offering an early payment discount to customers whose invoices are not overdue.

To get customers with overdue invoices to pay you, send reminders, contact the late payer, and offer to set up a payment plan. If the customer still won’t pay you, you may opt to enlist the help of a collection agency.

2. Let people know

Of course, one important step in your closing down a business checklist is to make sure people know about it.

Communicate your business’s closure to:

- Employees

- Customers

- Investors

- Your accountant

- Vendors and suppliers

- Your small business lawyer

- The IRS

- Your state

Keep in mind that this is not an all-inclusive list of the places you need to communicate your closure to. You may also need to let service providers, such as a payroll software company, know.

Although it may be hard to let people know, it is all part of the process. Give ample notice, especially when it comes to your employees.

Give employees enough time so they can start looking for another job. Not to mention, you must comply with the WARN Act and give employees 60 calendar days in advance if you have 100 or more employees.

3. Sell off assets

The next line item of your closing a business checklist is to sell off your company’s assets. This includes your inventory, equipment, and property.

To get rid of leftover inventory, you can hold a going out of business sale. Mark down items and promote the sale on social media to encourage customer traffic.

Use the profits from your sold off assets to pay off debts and distribute to yourself and any other shareholders.

4. File dissolution documents

If you formed a corporation, LLC, or partnership, dissolve the company during the closure process. To do this, you may need to file a Certificate of Dissolution or Partnership Dissolution agreement.

Sole proprietors do not need to worry about filing dissolution documents.

If you have a small business lawyer, they can help you obtain the necessary forms and provide guidance throughout the way.

5. Close down accounts

When you’re in business, it sometimes feels like you have to open and maintain countless accounts. And if you’re closing down your business, you can’t forget to close down those accounts.

So, what do you need to remember to close?

- Business bank account

- Unemployment tax account

- Workers’ compensation policy

- State tax accounts

- Employer Identification Number (EIN) account

- Leasing agreements

- Business licenses and permits

This is not an exhaustive list of accounts you may need to close. Look through accounting records to jog your memory.

Your state’s website should have information about what all you need to do when closing down your business. For more information, contact your state’s Secretary of State office.

6. Follow federal and state employment laws

As you’re well aware, closing down a business means laying off your employees. As a result, you must follow federal and state employment laws.

First and foremost, communicate information about unemployment insurance and COBRA coverage to employees.

Under federal law, you cannot withhold an employee’s final paycheck for any reason. And, you can’t attach a condition of receipt to the paycheck.

You also need to be mindful of final paycheck laws by state. These laws determine your deadline for distributing each employee’s last paycheck. Some states require employers to give employees their final wages immediately, while others give employers until the next payday.

Additionally, you must know about PTO payout laws by state. If your state has a PTO payout law, you must include the value of each employee’s unused accrued vacation time in their final paycheck.

7. File final returns and forms

Closing your business doesn’t mean you can get out of filing your small business tax return or payroll reports or making tax payments. You are still required to do all of these things.

To help you along the way, the IRS offers a checklist to help you wrap up all tax- and employee-related responsibilities.

IRS closing a business checklist

When filing your final returns with the IRS, mark the check-box at the top of each return indicating that it’s a final return for your business.

Although some of these may not apply to you, here’s a checklist of your potential responsibilities:

- Deposit final federal taxes

- File final quarterly or annual employment tax forms (e.g., Form 941)

- Distribute Forms W-2 to all parties (employees, Social Security Administration, state)

- Send Form W-3 to the Social Security Administration

- File small business tax return (e.g., Form 1065)

- Distribute Forms 1099 to all parties

- Send Form 1096 to the IRS

- File final tip income information return (Form 8027)

- Attach Form 8594 to your income tax return to report asset sales

- Attach Form 4797 to your income tax return to report business property sales

- File final employee pension/benefit plan return (Form 5500)

- Report corporate dissolution or liquidation on Form 966

8. Keep records secure

The Fair Labor Standards Act (FLSA) requires employers to keep payroll records on file for at least three years. When you close your business, this responsibility doesn’t disappear into thin air.

You are still required to keep employment records on file, regardless of if your business is operational or not.

Even if you are not keeping the records yourself, someone must (e.g., a partner). And, you must tell the IRS the name of the person keeping the records as well as the address the records are being kept at.

Keep records at a secure location. For example, you might put records in a locked filing cabinet.

The key to managing business finances is keeping your books organized. Patriot’s accounting software streamlines the way you record incoming and outgoing money. Start your free trial today!

This article has been updated from its original publication date of December 15, 2010.

This is not intended as legal advice; for more information, please click here.

Leave a Reply