In addition to the catastrophic health situation caused by coronavirus, many of your clients are also getting hurt financially, especially in their retirement accounts. You may be able to help them take advantage of several new relief provisions that most of your clients can benefit from immediately.

Here are the highlights of the most recent tax changes found in the $2 trillion coronavirus relief bill, which the Senate has approved and the House passed on Friday. It now goes to President Trump for his signature.

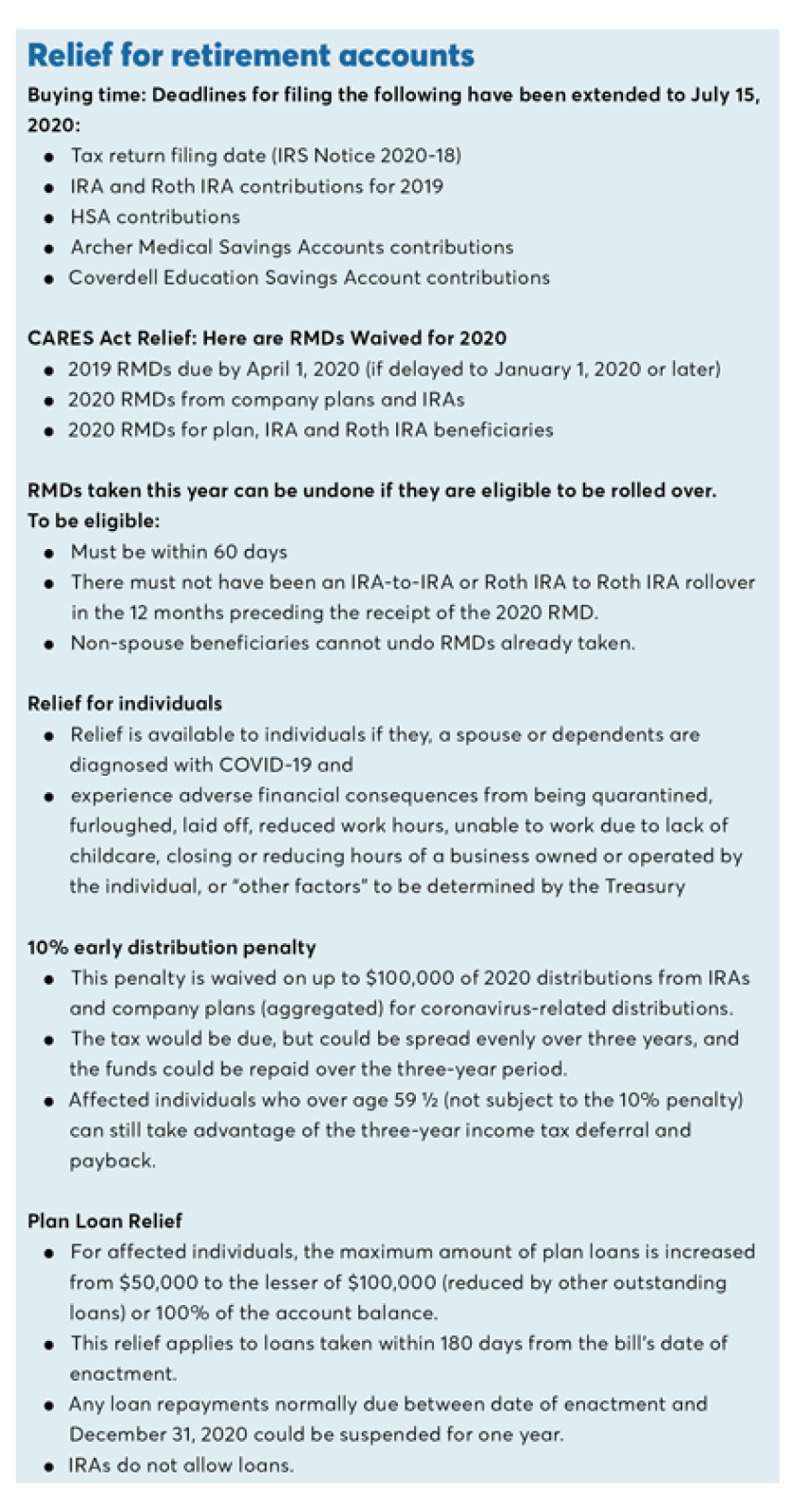

Extended deadline for 2019 IRA contributions

Now that the Treasury has extended the tax return filing date to July 15, 2020, from April 15, 2020, the date for making 2019 IRA and Roth IRA contributions is also extended to the same date.

Normally, IRA contributions for a prior year must be made by April 15th of the following year. There have never been extensions to the IRA contribution deadline, even if the taxpayer filed for a tax filing extension.

When the tax return deadline was extended, some initially doubted this extension would apply to IRA contributions, but the IRS confirmed it by issuing its guidance, “Filing and Payment Deadlines Questions and Answers”. In a boon for clients, these changes give them more time to decide if they wish to contribute. And now is a good time for advisors to ask clients whether they plan to do so, and let them know about the extension. Because clients’ financial situations may have taken a turn for the worse due a job loss or a business downturn, even those who make IRA contributions each year might want to hold off and take advantage of the extra time to contribute for 2019.

Advisors should also be careful to monitor any 2019 IRA contributions made after April 15, 2020. Custodians may automatically code 2019 IRA contributions as 2020 contributions if made after April 15th. Make sure that these checks state that they are for 2019 and then follow up with the custodians to confirm that the contributions are posted for 2019.

In addition, the extended deadline applies to 2019 Health Savings Account, Archer Medical Savings Account, and Coverdell Education Savings Account (ESA) contributions.

RMDs Waived for 2020

The $2 trillion relief package titled, “Coronavirus Aid, Relief, and Economic Security Act,” is expected to be enacted on March 27. Included in the massive bill are several relief provisions for retirement accounts. The one that will affect most retirees is the waiver of RMDs for 2020.

This will be a huge help because 2020 RMDs would generally be based on the substantially higher account values at December 31, 2019. Here’s how: The Dow closed at 28,462 on December 31. As of March 26, the Dow was hovering around 22,000. If not for this relief, IRA owners would be forced to withdraw and pay tax on a much higher percentage of their IRA balance. Eliminating the RMD for 2020 can help clients reduce their 2020 tax bill. However, this won’t help those who need the funds and must take withdrawals anyway.

What it means for 2019 RMDs not yet taken

The RMD waiver also applies to 2019 RMDs that are normally due by April 1, 2020. In another bit of positive news, the waiver applies to IRA owners who turned 70 ½ in 2019. This could be a surprise to some because the Secure Act had increased the RMD age to 72 for those who turn 70 ½ in 2020 or later. Those who turned age 70 ½ in 2019 were still required to take their first RMD by April 1, 2020. Now, that RMD is waived.

When clients begin taking RMDs, they have an option of taking all or part of the first year distribution in the year they turned 70 ½ (under pre-Secure Act rules) or deferring any part of that RMD until April 1st of the following year. If they wait until the following year, they must take their first two RMDs in the following year, resulting in a bunching of RMD income in the same year and an increased tax bill. To alleviate this situation, we often advised clients to take their first RMD in their 70 ½ year so they can spread the income from their first two RMDs over two tax years. Unfortunately, if they took this advice last year, they won’t benefit from the RMD waiver for their first RMD since they already took that in 2019. Their 2020 RMD, though, is waived. Clients who didn’t listen to us and deferred their first RMD to 2020 may now be able to have their first two RMDs waived.

IRA Beneficiaries subject to the 5-year rule

A less-obvious group that can benefit from this waiver are beneficiaries who inherited in 2015 or later and who are subject to the 5-year payout rule. Generally, this only applies to non-designated beneficiaries who inherited before the deceased IRA owner reached his required beginning date (April 1st following the age 70 ½ year).

These beneficiaries may have inherited through a will or were a beneficiary of a trust that did not qualify as a designated beneficiary. For example, for IRAs inherited in 2015, under the 5-year rule any balance remaining in the inherited IRA would normally have to be withdrawn as the RMD for 2020. Under the just-passed act, beneficiaries now have one more year, until Dec. 31, 2021, to empty the account. For beneficiaries who inherited from 2015 to 2020, the 5-year rule becomes a 6-year rule. Advisors should see if they have any clients in this situation and alert them to this development.

Can you undo RMDs already taken?

One question is whether 2019 or 2020 RMDs already taken in 2020 can be put back in the IRA and have the tax bill eliminated. The relief package does not include any repayment provisions, so the IRS may have to issue guidance on this issue.

Pending IRS guidance, there may be a way for some clients to undo 2019 or 2020 RMDs already taken this year, but only if they can pass ALL three of these tests:

1 – Not an RMD

An RMD cannot be rolled over. It is not an eligible rollover distribution. However, since the new law waives RMDs for 2020, then technically an RMD already taken is not an RMD anymore. This means it should be eligible to be rolled back into the IRA, thereby eliminating the tax bill. It’s likely the IRS will rule that these distributions are not RMDs and are eligible to be rolled over, but only if they pass the next two tests.

2 – 60-day rule

To be eligible for the funds to be rolled back to an IRA (or company plan), the rollover must occur within 60 days of receipt of the funds. Those who took RMDs very early in the year may have already missed this window, but many clients may still have this opportunity available to them, but only if they pass the third test.

3 – Once-per year IRA rollover rule

Only one IRA to IRA or Roth IRA to Roth IRA can be done per year, and that year is 365 days, not a calendar year. If another distribution taken during the 12 months prior to receipt of the RMD was already rolled over, then the rollover option is off the table for the now unnecessary RMD distribution, even if the other two tests are passed.

Although the RMD waiver applies to inherited IRAs, the ability to undo RMDs already taken would not be available for non-spouse IRA beneficiaries since they cannot do 60-day rollovers.

If all or part of the RMD was transferred to a charity as a QCD (qualified charitable distribution), then there’s no problem since that amount is excluded from income anyway. In fact, once an IRA owner reaches age 70 ½ they can still do a QCD whether they are subject to RMDs or not.

Additional relief provisions for retirement accounts

The new act waives the 10% early distribution penalty on up to $100,000 of 2020 distributions from IRAs and company plans for “affected individuals”. The tax would be due, but could be spread evenly over three years, and the funds could be repaid over the three-year period.

While the 10% early distribution penalty is waived, the amount withdrawn is still subject to tax and it removes funds that may be needed for retirement. This should be used only as a last resort.

We’ve seen this provision in previous disaster relief bills, but that relief only applied to people affected by the particular hurricane, wildfire or other disaster. Here, given the scope of the current coronavirus pandemic, “affected individuals” could include a great many people, so plans should brace for an onslaught of hardship requests.

For those over age 59 ½, the 10% early distribution penalty is not an issue, but for those facing financial hardship the ability to take a distribution now and spread the taxes over three years may be helpful. If their situation improves, the opportunity to repay the funds during the three-year period could be a useful way to rebuild otherwise lost retirement savings.

Finally, the new law affects company plan loans taken by affected individuals.

First, it increases the maximum amount of plan loans to the lesser of $100,000 (reduced by other outstanding loans) or 100% of the account balance. [The usual limit is the lesser of $50,000 (reduced by other outstanding loans) or 50% of the account balance.] This rule applies to loans taken within 180 days from the bill’s date of enactment.

Second, any loan repayments normally due between date of enactment and December 31, 2020 could be suspended for one year.

Advisors need to be ready to answer lots of questions about these new provisions as they will impact virtually all your clients. This is when they need you the most.

Leave a Reply