U.S. government debt prices were lower Monday morning as Wall Street looks set to attempt a rebound following another decline last week.

At around 2:10 a.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, was higher at 0.6305% while the yield on the 30-year Treasury bond rose to 1.2511%.

Investors continue to grapple with the fallout from the coronavirus pandemic and rising tensions between Russia and Saudi Arabia over oil pricing, but Dow futures in the early hours of Monday pointed to gains of more than 900 points at the opening bell.

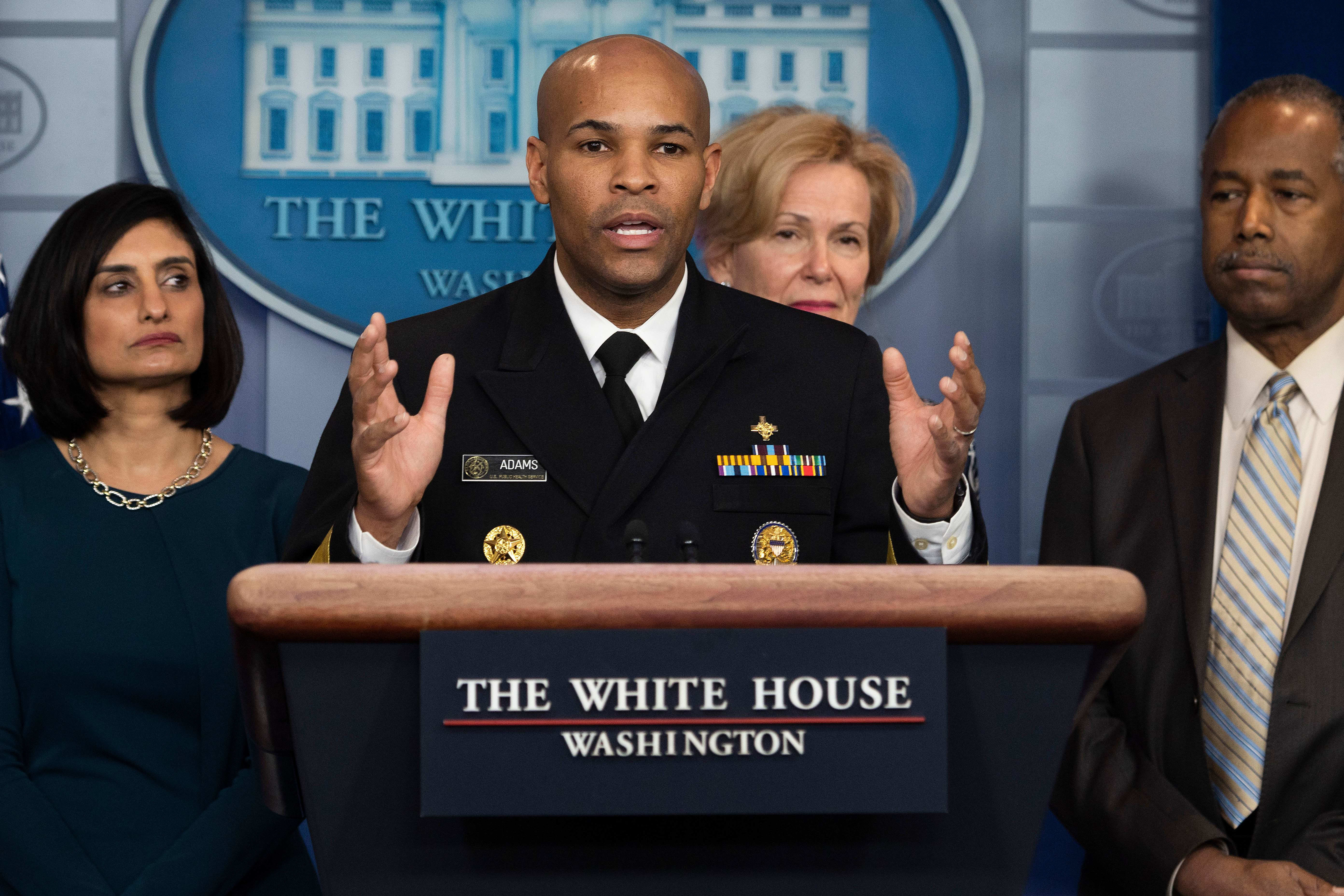

Surgeon General Jerome Adams on Sunday said that the U.S. faces its “hardest” week yet in terms of containing the coronavirus outbreak, which has now infected more than 337,000 people stateside, according to data from Johns Hopkins University.

However, a slight slowing of fatalities in virus hotspot New York has offered some cause for optimism for investors. Internationally, the rate of new cases in hard-hit Italy and Spain have also begun to slow.

On the data front, March consumer inflation expectation figures are due at 11 a.m. ET.

Auctions will be held Monday for $54 billion of 13-week Treasury bills, $45 billion of 26-week bills, $60 billion of 43-day bills and $40 billion of 3-year notes.

Leave a Reply