Happy Thursday!

E-commerce deliveries of non-essentials haven’t been smooth sailing in smaller towns and cities that fall under the green and orange zones. That’s because some states are still ambiguous about reopening of fulfilment centres and warehouse in the red zone districts or Covid-19 hotspots, causing bottlenecks for online retailers.

In the red

Amazon and Flipkart have been able to recover only a fifth of their pre-Covid-19 demand even after they opened up sales of non-essential goods in green and orange zones. These areas accounted for 30-35% of e-commerce sales before the lockdown.

Why it matters

A report by RedSeer Consulting suggested that customers in smaller cities and lower-income groups are cutting back on discretionary spending. People have mostly bought items that they deem essential, including electronics, laptops and home appliances, partly due to pent-up demand from the last 40 days. Read more.

Amazon partners BMC

Amazon on Thursday said it is partnering with the Brihanmumbai Municipal Corporation (BMC) to enable delivery of essential items to people who are stuck inside containment zones of Mumbai. This comes after the online retailer piloted the services successfully in partnership with the city’s municipal body.

The Jeff Bezos-led e-commerce giant said it will deliver packages ordered by customers within the containment zones and drop them off at the common delivery points located at the periphery of these areas. Volunteers would then deliver the packages to customer doorsteps. Read more.

Eye on Future’s stake

Kishore Biyani-led Future Retail is offering to sell a significant stake to Amazon as one of India’s largest brick-and-mortar retailers looks to pare debt.

Future Group is planning to demerge the food business of Future Retail into a separate entity to make it compliant with India’s foreign direct investment norms. India allows 100% overseas capital in retail entities that deal only in locally sourced and packaged food items. Currently, food accounts for more than half the sales of Big Bazaar hypermarkets, the flagship chain of Future Retail.

If the deal goes through, this would be Biyani’s second deal with Amazon. Last year, Amazon had purchased a 49% stake in Biyani’s Future Coupons, which owns 7.3% of Future Retail, with an option to buy the entire holding at a later stage. Read more.

Hiring freeze

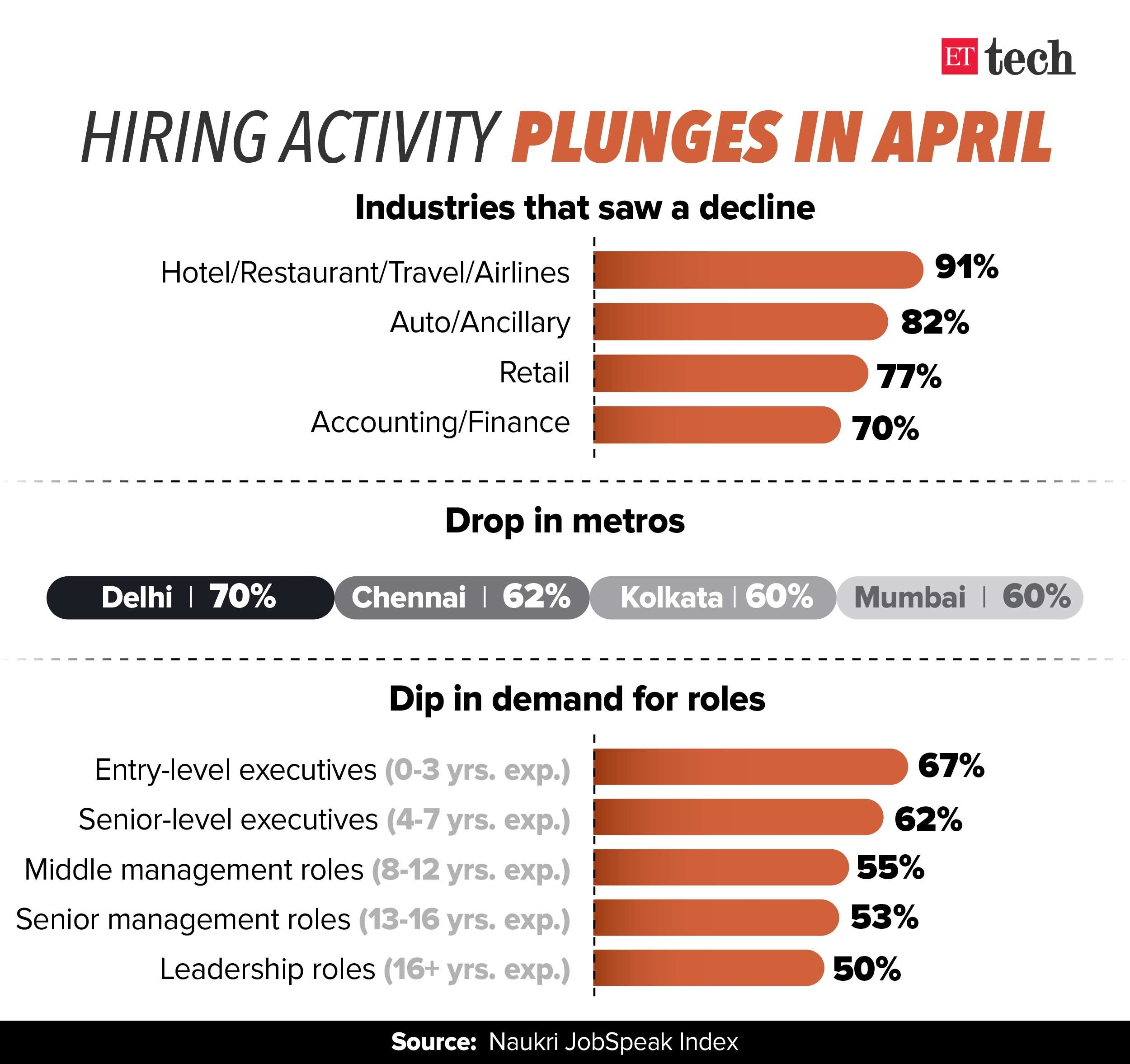

India’s hiring activity tumbled 62% year-on-year in April as the Covid-19 lockdown tore through the economy. The decline in recruitment was seen in industries like hotels, restaurants, travel, airlines, automobile, auto ancillary, retail, accounting and finance.

Job market across cities registered a double-digit dip in hiring, led by metros. Delhi posted a 70% dip followed by Chennai at 62%, Kolkata and Mumbai at 60% each. Read more.

Drones flying high

The Civil Aviation Ministry has granted exemptions to 13 consortia to operate drones on an experimental basis without the need for unique identification numbers and operator permits till September 30.

The move paves the way for these businesses, which includes ones floated by budget airline SpiceJet, Nandan Nilekani-backed ShopX, Google-backed Dunzo and drone maker Throttle Aerospace, to pilot the use of drones to transport goods once approved.

Dunzo and Swiggy want to build drone-based capabilities to deliver packages to consumers, while ShopX is looking at B2B delivery of packages that enable a concept of liquid inventory, where products can be moved with extremely low variable cost and extremely high speed.

SpiceJet, on the other hand, wants to enable first- and last-mile movement of packages to support its air-cargo business SpiceXpress. Throttle Aerospace is looking at medical deliveries using drones, including transporting live organs quickly for transplantation. Read more.

Leave a Reply