Xero App Partner Guest Blog – written by Vaughan Fergusson, Founder at Vend.

Everyone could use support during these times, but small business owners, in particular, are some who need it most. With lockdown measures enforced in several parts of the globe, small businesses have been hit hard.

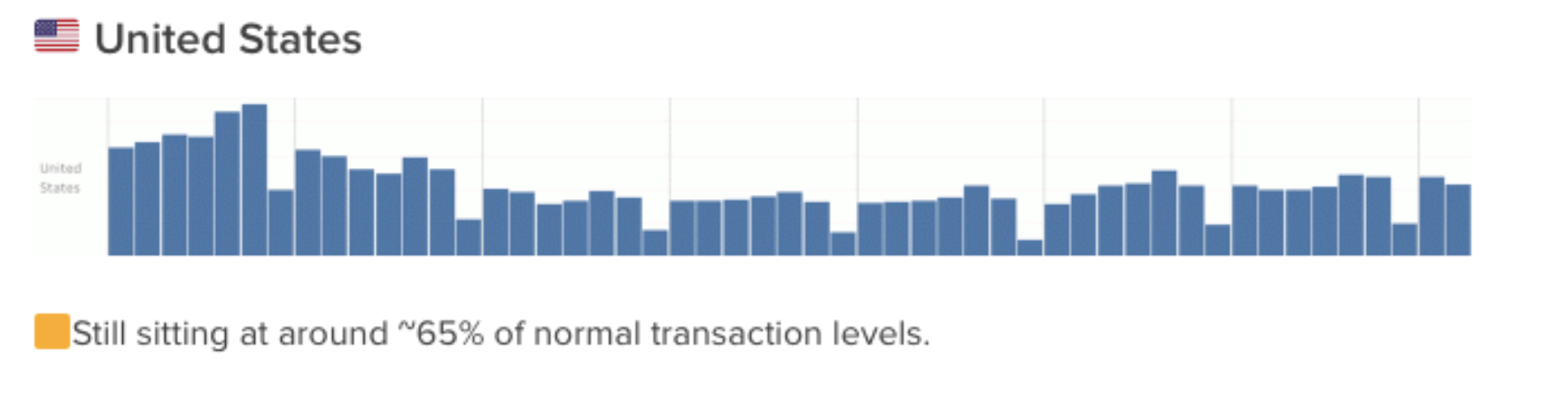

Our data at Vend show that as of late April sales in the US have been at just ~65% of normal transaction levels.

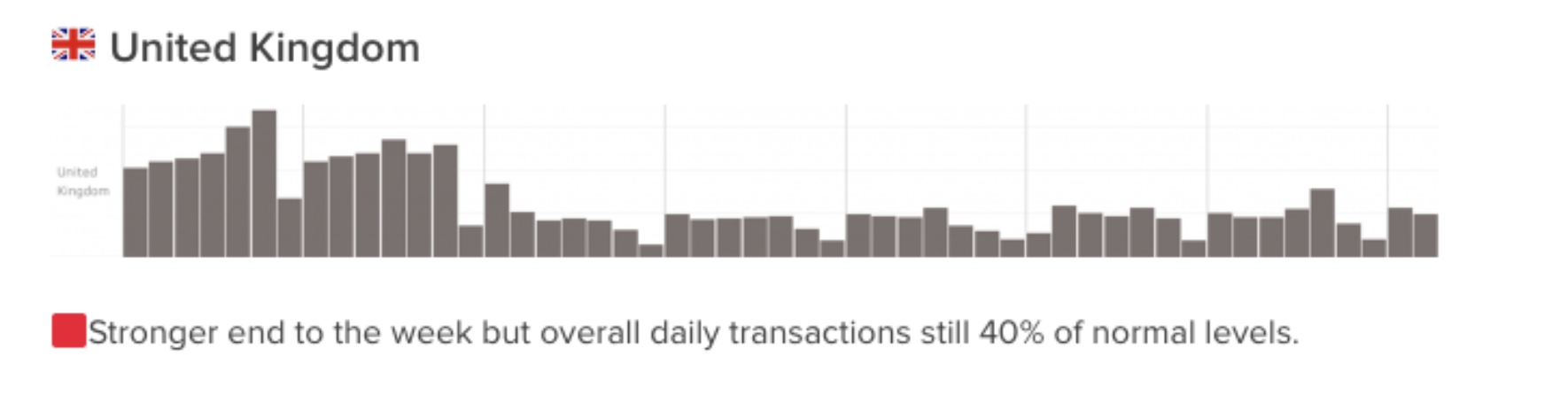

UK SMB retailers had overall daily transactions sitting at ~40% of normal levels.

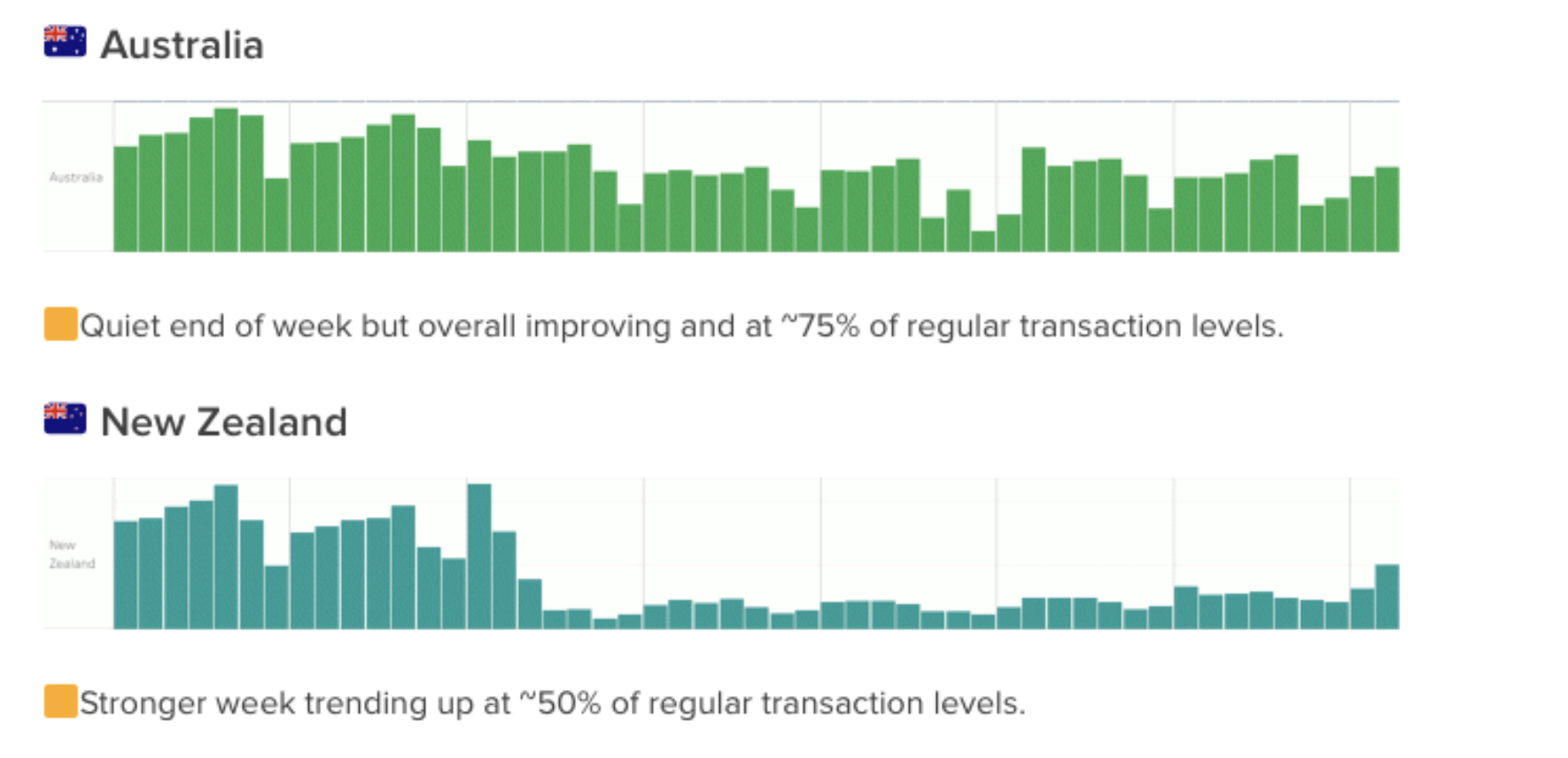

Meanwhile, those in Australia and New Zealand were at ~75% and ~50%, respectively.

Things have certainly been better, but there are signs of hope. Certain parts of the world are flattening the curve and could slowly reopen their economies.

While we’re waiting for that to happen, here are a few things you can do to help your clients through this period.

Check-in with clients regularly

Stay in touch with your clients regularly by checking in on their business and even their mental health. Your clients are facing a great deal of uncertainty at this time. Having a reliable bookkeeper or accountant who’s looking out for their business can help alleviate some of the stress they’re feeling.

Depending on how your clients are doing, you may need to recommend action steps to keep (or get) them on the right track.

Let’s say you check in on one of your retail clients and find out that they’re feeling extra anxious about their finances. You can take the time to go over their books and look for ways to save money. Or, maybe you have a business owner who’s gearing up for reopening their retail store. You can step in and ensure that their financials are in check.

Whatever the case, you won’t really know these things unless you proactively touch base with your clients, so take the time to do it regularly.

Update clients on loans, grants, and relief programs

Governments all around the world, as well as various independent brands, social media platforms and large corporations, have stepped up to create programs to help small businesses stay afloat financially during these turbulent times.

You and your clients may have likely applied for these grants, loans, and relief programs. However, things are changing fast and developments that may affect you and your clients are being announced practically daily.

For instance, in the United States, the IRS updated its Get My Payment portal over the weekend, to make it easier for people to check their eligibility status and track their economic impact payments. Meanwhile, Congress recently approved an additional $310 billion to fund SBA PPP loans.

It’s critical to stay on top of these developments so you can inform and assist your clients so they can get the funds and relief they need.

Assist clients in preparing for the re-opening of their business

Retailers will start seeing business pick up again (some will experience this sooner, but it will eventually happen for everyone), so merchants will need to be prepared.

To that end, why not provide advice or services to help them gear up for reopening? You can look at their financials and offer recommendations on how to properly allocate funds. You can help pull the right data so that your clients can make the right business decisions.

Another way to help them hit the ground running is to arm them with tools that can streamline their operations. Identify any manual or tedious processes in their business and find ways to automate them.

For example, if they’re still doing manual financial reconciliations, it may be time to connect their accounting software with their POS system so their records stay in sync. Are they still running manual calculations around their finances? If so, arm them with the right software or teach them how to generate the reports they need.

Final words

How you assist clients during these challenging times will vary from one business to another, as everyone is different. That said, taking immediate action is critical and will help companies stay on top of the drop sooner rather than later.

So, take action. Do what you can today so you and your clients can build stronger businesses for tomorrow.

About Vend

Vend is a cloud-based retail software platform that enables retailers to accept payments, manage their inventories, reward customer loyalty and garner insights into their business in real time. Vend is simple to set up, works with a wide range of point-of-sale devices and operates on any web-capable device with a browser. Whether it’s simplifying the inventory process, cutting 30 minutes from their end-of-day bookkeeping or making it simpler for them to sell their products on multiple channels, Vend’s mission is to make retailers’ lives easier.

Leave a Reply