PMVVY – Pradhan Mantri Vaya Vandana Yojana is a unique scheme for the senior citizen of India. It is a pension scheme for those who are above 60 years of age. PMVVY – Pradhan Mantri Vaya Vandana Yojana was launched in 2017. The offer period of the scheme was getting expired in March 2020, but recently the extension of this scheme is announced. Now senior citizens can invest in this scheme up to 31st March 2023. Let’s take a look at PMVVY – Pradhan Mantri Vaya Vandana Yojana Key features and changes made recently.

What is Pradhan Mantri Vaya Vandan Yojana – PMVVY?

PMVVY or Pradhan Mantri Vaya Vandana Yojana is a pension scheme launched by the government of India for the senior citizen. The objective of the scheme is to support senior citizens by means of monthly pension.

Key Features & Eligibility – PMVVY

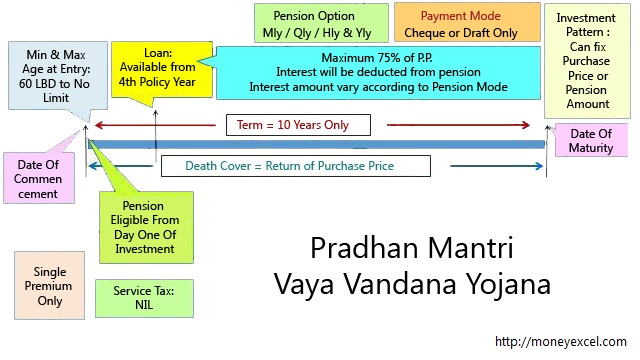

Assured Pension Payment – Senior citizens will get assured pension as per the option selected at the time of purchasing. This benefit is extended for the fixed period with a maximum tenure of 10 years.

Returns on the Investment – This scheme provides good returns to the investor. The return is in the range of 7-8% per annum. The return payout is assured as long as the policy is in force.

Periodic Payout Options – One can select monthly, quarterly, half-yearly or annual pension payout options. The selection can be done as per the financial requirements.

Multiple Benefits – PMVVY comes with maturity benefits as well as death benefits. The benefits are applicable during the tenure of the policy.

Free Look Period – This plan comes with free look period of 30 days. After purchasing plan if you feel that plan is not suitable or not as per your requirement you can return the policy within 30 days. You need to mention the reason for objection while returning policy.

Loan Facility – You can also avail loan facility on PMVVY. The loan facility is extended only after 3 successful policy years. The maximum allowed loan amount is 75% of the purchase amount.

Also Read – Senior Citizen Special Income Tax Benefits 80 TTB and others

Eligibility

- Minimum Entry Age- 60 years (completed)

- Maximum Entry Age – No limit

- Policy Tenure – 10 years

- Investment Limit – Rs 15 Lakh per senior citizen

Minimum Pension

- Rs. 1,000/- per month

- Rs. 3,000/- per quarter

- Rs.6,000/- per half-year

- Rs.12,000/- per year.

Maximum Pension

- Rs. 12,000/- per month

- Rs. 30,000/- per quarter

- Rs. 60,000/- per half-year

- Rs. 1,20,000/- per year

Benefits of PMVVY

The benefits of this plan are as below.

# Throughout the policy period

As a pensioner, you will receive the monthly, quarterly, half-yearly or yearly pension as per selected option at the time of purchase.

# Maturity Benefits

If you survive the policy term, you will get the purchase price as well as the final installment payment as maturity benefit.

# Death Benefits

On the death of the pensioner/policyholder during the policy term, the Purchase Price will be given back to the nominee or legal heirs.

How to purchase Pradhan Mantri Vaya Vandan Yojana Policy?

One can purchase Pradhan Mantri Vaya Vandan Yojana Policy offline as well as online. This policy is sold by LIC. In order to purchase this policy, you need to visit the nearest LIC branch or log on to the official website of LIC to purchase this scheme. You need to submit the application form along with the required documents and premium amount.

The essential documents required for buying this policy is PAN card, Aadhaar card, and bank details where you want to draw the pension amount.

Changes made in PMVVY

#1 PMVVY extension up to 31st March 2023

The PMVVY scheme is extended for 3 years. This scheme was about to end on 31st March 2020. Now the government has extended date up to 31st March 2023.

#2 Change in Interest Rate

The rate of interest for this scheme was 8% in FY 2019-20. For the FY 2020-21, the new rate of interest for this scheme would be 7.4%.

#3 Minimum Investment required is changed

The minimum investment required for PMVVY was Rs.1,44,578 for the maximum yearly pension of Rs.12000. Now the minimum investment amount is revised to Rs.1,56,658 for the yearly pension of Rs.12000. The change is due to a change in the interest rate applicable to this scheme. ( From 8% to 7.4%)

#4 A new rule of change in Interest rate yearly basis

A new rule of change in interest rate is announced. Now the government will announce an interest rate on a yearly basis. The new rule is applicable only to the new policyholders. This means if you are holding old policy you will be able to enjoy a fixed interest rate declared at the time of purchasing a policy. The new rate of interest will be applicable from the 1st April of every financial year.

#5 Linking of Interest rate with SCSS

The interest rate of PMVVY is now linked with SCSS (Senior citizen saving scheme). This means the rate will be announced along with the SCSS rate announcement upto a ceiling of 7.75% with a fresh appraisal of the scheme on breach of this threshold at any point.

My Views

The extension of this policy for the 3 years is a very good move by the government. However, a change in interest rate every year may not be a good idea for this scheme. Earlier this scheme was somewhat lucrative as the interest rate was fix and higher. But, now as the interest rate will be announced every year the scheme may lose popularity.

What is your take on the changes announced by the government?

Do share your views in the comment section given below.

Leave a Reply