Accounting errors are inevitable, especially if you’re rushing to add information into your small business accounting books. To detect accounting errors sooner rather than later, learn how to find accounting errors.

Common accounting errors

Before digging deep into finding accounting errors, let’s briefly recap some of the most common accounting errors out there. When you’re working on your books, avoid making the following accounting mistakes:

- Not reconciling your books

- Making transposition errors (e.g., writing 52 instead of 25)

- Tossing receipts

- Reversing entries (e.g., credit instead of debit)

- Omitting transactions

Making accounting errors can be time-consuming and expensive. You must catch accounting errors early on to avoid more problems down the road.

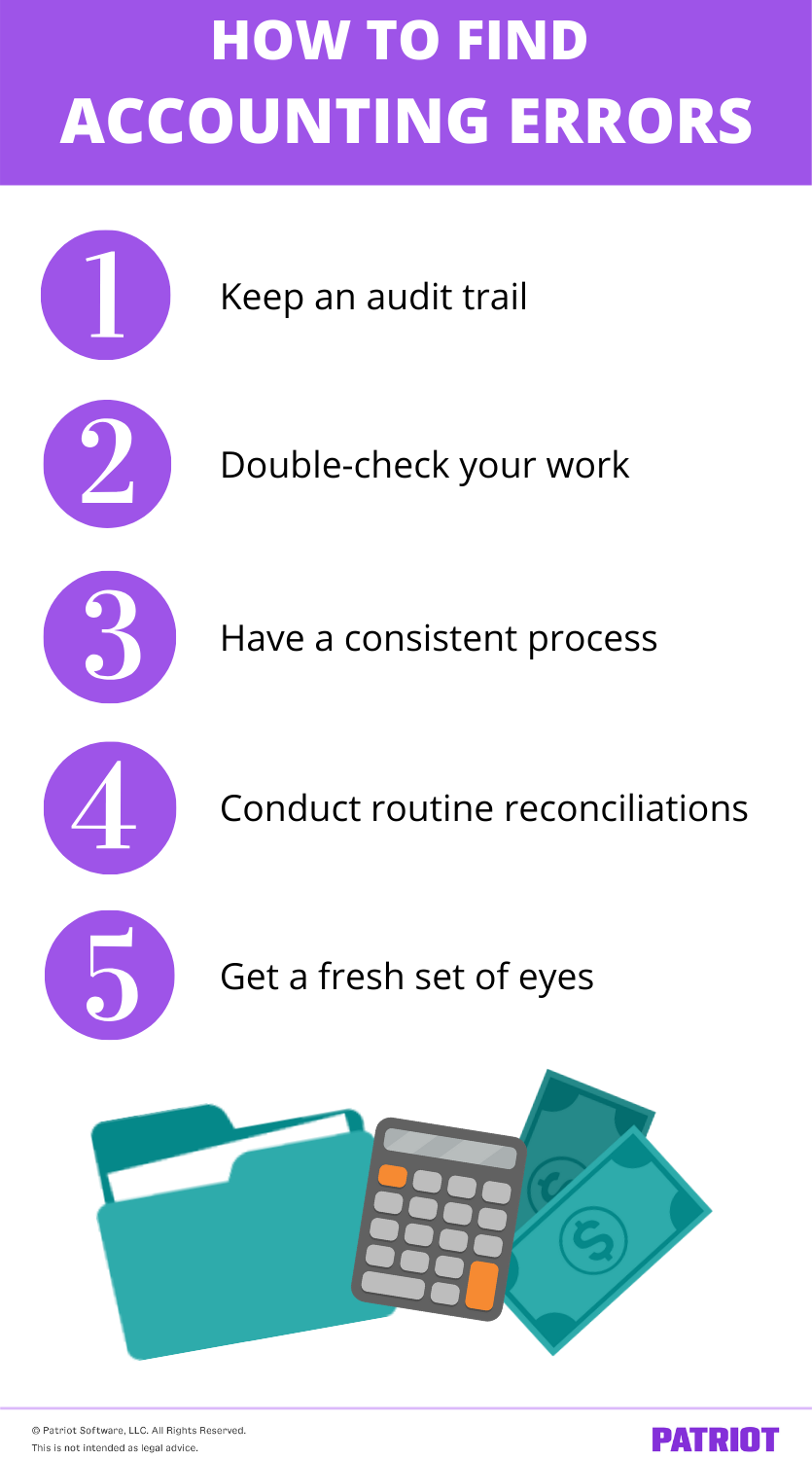

How to find accounting errors: 5 tips

To stop accounting errors in their tracks, know how to detect them in the first place. Use these five tips to scour your books for accounting mistakes.

1. Keep an audit trail

If you’re looking for an easy way to track down accounting transactions and find errors, a good place to start is an audit trail.

For those of you who don’t know what an audit trail is, here’s a brief summary. An audit trail is a set of documents that confirm the transactions you record in your books. When you record transactions in your accounting books, you base the entries on your company’s purchases, sales, and expenses.

If you’re on the hunt to find accounting errors in your books, seek help from your audit trail. Because your audit trail details all of the information about transactions, you can use it to cross-check the information you recorded in your books.

2. Double-check your work

To find accounting errors in your books, you have to be willing to do a little extra legwork. So, what does this mean for you? This means taking extra time to double-check your work.

Go through your transactions and make sure what you inputted matches what you have on your documents (e.g., receipts). If you catch a discrepancy, change it right away.

At some point or another, you may make a mistake while inputting transactions in your books. This could include things like:

- Adding the transaction into the wrong account

- Flip-flopping numbers

- Misentering numbers

- Reversing entries

- Overlooking or forgetting to record a transaction

Mistakes can happen to even the most seasoned business owner or accountant, which is why you should always double (or triple) check your work.

3. Have a consistent process

Whether you record transactions and review your books daily, weekly, monthly, quarterly, or annually, you need to have a consistent process in order to find accounting errors.

Each time you review your books, be on the lookout for accounting errors. Try to keep your process as consistent as possible. That way, you can find accounting errors before they snowball into bigger problems.

If you don’t currently have a regular accounting process, consider starting one to catch accounting mistakes early on and prevent future issues.

4. Conduct routine reconciliations

This next tip goes hand in hand with having a consistent process. To find accounting errors, you also need to conduct routine reconciliations (e.g., bank statement reconciliation).

When you reconcile your accounts, you compare the numbers in an account with another financial record (e.g., bank statement) to ensure the balances match.

If you find a mistake when you’re reconciling your accounts, adjust the affected journal entries. To do this, create a new journal entry to remove or add money from the account.

You should compare an account to things like your:

The more often you reconcile your accounts, the more likely you are to find accounting errors. Carve some time into the week or month to compare your accounts and ensure accounting errors aren’t going over your head.

5. Get a fresh set of eyes

You’re a business owner, not an accountant. So, you’re probably going to make accounting mistakes (especially when you’re just starting out) at some point. To help find errors in your books, have someone else review your work.

Maybe you’ve looked over your books two, three, or even four times. But sometimes, all it takes is a fresh set of eyes to catch an accounting mistake. Consider asking some of the following people to check over your books:

- Business partner, if applicable

- Manager/supervisor

- Employee or co-worker

You are less likely to let an accounting mistake slip through the cracks if you have someone else reviewing your books.

Keep in mind that although it’s a good idea to have someone else look over your books, you should still limit how many individuals have access to them.

Searching for a way to keep track of income and expenses in order to avoid accounting errors? Patriot’s accounting software is easy-to-use and affordable. Try it for free today!

Have questions, comments, or concerns about this post? Like us on Facebook, and let’s get talking!

This is not intended as legal advice; for more information, please click here.

Leave a Reply