WASHINGTON, DC – APRIL 27: The Internal Revenue Service headquarters building appeared to be mostly … [+]

Many US companies that deal with cryptocurrencies are privately held small businesses. Such businesses do not have to follow cumbersome GAAP crypto accounting rules that publicly traded companies have to follow. These businesses can follow a much simpler system for accounting: tax basis.

The tax basis method of accounting is simple to implement, closely follows IRS guidelines, and offers more flexibility to small businesses.

If you run a small business or a startup that accepts cryptocurrencies as a form of payment, primarily, there are two situations where you will have to report income on your books under the tax basis of accounting: (1) at the time you sell your product and receive cryptocurrency and (2) when you subsequently convert those cryptocurrencies into fiat currency (or another cryptocurrency).

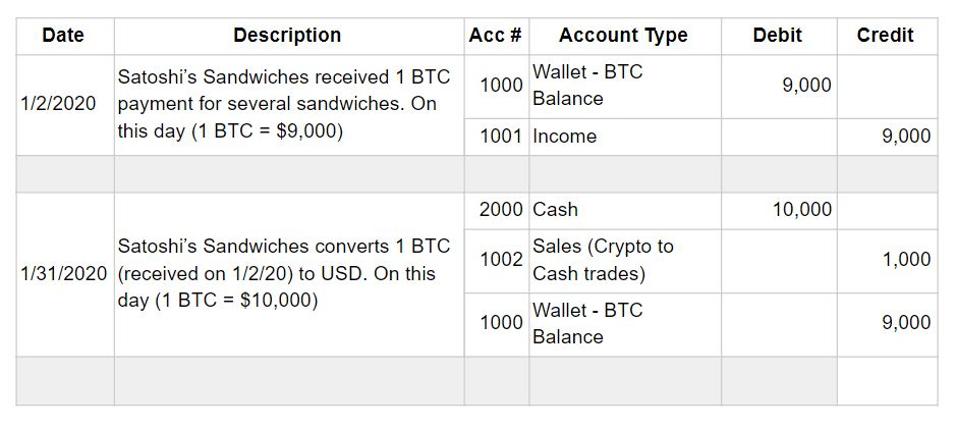

As an example, let’s say Satoshi’s Sandwiches store receives 1 BTC on January 2, 2020 for selling several delicious sandwiches to a customer. One bitcoin is worth $9,000 on this day. At the end of each month, Satoshi’s Sandwiches cashes out BTC for good old fashioned dollars. Assume 1 BTC is worth $10,000 on January 31, 2020. For the month ending January 31, 2020, Satoshi’s Sandwiches should recognize $10,000 ($9,000 + ($10,00-$9,000)) of ordinary income. For the accounting geeks, here is the double entry for these transactions:

Tax basis accounting entries

As you can see, the above entries closely follow the the IRS logic of taxing cryptocurrency as a property per IRS Notice 2014-14.

GAAP Vs. Tax Basis Accounting For Crypto

Tax basis accounting is much simpler than GAAP basis accounting for crypto. Under tax basis accounting, there is no impairment loss to be calculated because cryptocurrencies are not treated as intangible property with an indefinite life. Marking the crypto asset up or down to the fair market value at year end and recognizing an unrealized gain/loss event could also be done for internal reporting purposes under tax basis financial reporting. This would lead to a more accurate picture of the entity’s financial position compared to GAAP policies which do not allow mark-to-market accounting for crypto assets. GAAP-based accounting for crypto assets would also incur additional financial and time constraints, whereas, tax basis accounting can be easily implemented with self-serve cryptocurrency accounting software already available in the market.

Disclaimer: this post is informational only and is not intended as tax or investment advice. For tax or investment advice, please consult a professional.

Leave a Reply