Abu Dhabi Investment Authority has joined active discussions for a minority stake in Jio Platforms as cash-rich sovereign wealth funds from the Gulf proactively seek out deals around the world, people familiar with the matter said.

ADIA follows Mubadala, the sister firm of the UAE’s largest sovereign wealth fund, which has already been in negotiations with Reliance Industries (RIL), the parent of Jio Platforms.

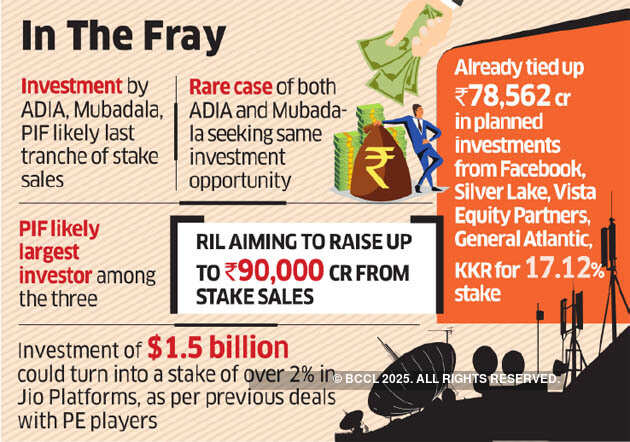

It is not clear how much each of the funds will invest. Both entities, along with Saudi Arabia’s sovereign wealth fund Public Investment Fund (PIF), may invest close to $2 billion (Rs 15,000 crore) in RIL’s digital business unit, the people said. PIF, though, is keen to deploy $1.1-$1.5 billion while the two UAE funds are open to putting in $1-1.25 billion. An announcement is expected shortly, even as early as this week.

“This is probably the last tranche of stake sales in Jio Platforms. It’s likely to be announced shortly,” one person said. “PIF could be the largest investor in this group.”

Even though ADIA invests in technology assets, both publicly listed and private, it is an area where Mubadala plays a far more dominant role. Technology is one of the five sectors being targeted by ADIA’s private equities department, said people familiar with the firm’s plans.

ADIA is part of a consortium that has been engaged with RIL for months to buy into its pan-India fibre network. It is also a rare case of both UAE funds scoping the same investment opportunity.

RIL has targeted raising Rs 85,000-Rs 90,000 crore from stake sales in Jio Platforms, another person said. It has so far drawn Rs 78,562 crore in planned investments from Facebook and private equity funds Silver Lake, Vista Equity Partners, General Atlantic and KKR for a combined holding of 17.12%.

An investment of $1.5 billion could get a stake of just over 2%, experts said. KKR paid Rs 11,367 crore for a 2.32% stake in Jio Platforms, pegging its equity value at Rs 4.91 lakh crore and enterprise value at Rs 5.16 lakh crore.

ADIA declined to comment on speculation. ET’s emailed queries to RIL, Mubadala and PIF went unanswered at press time.

Shares of RIL rose 3.8% to Rs 1,520.45 on the BSE, outperforming the 2.7% gain in the benchmark Sensex.

Investment bankers say SWFs from Gulf countries are on the prowl as global valuations have crashed and they are keen to deploy capital in sectors such as technology, communications, healthcare and retail/logistics, which are expected to bounce back faster than many others. Both the UAE and Saudi Arabia are also key political and economic allies of the Narendra Modi government.

Leave a Reply