BNY Mellon, having recently launched a new suite of ETFs, is taking steps into a fast-growing sector for asset management: model portfolios.

The bank’s foray in the $3 trillion model portfolio market comes as it also implements new price benefits for Pershing RIAs who invest clients in their eight ETFs.

The proprietary models will be available to RIAs “in the coming months,” according to a BNY Mellon spokesman, who noted that the company already provides portfolio services including manager research to RIAs.

BNY Mellon launched its first ETF — BNY Mellon Core Bond ETF (BKAG), the first no-fee U.S. fixed income ETF without fee waivers or other restrictions — in March. Since then, it has released seven more ETFs, including another no-fee fund, BNY Mellon US Large Cap Core Equity ETF (BKLC). Since inception, the eight ETFs have gathered more than $250 million in current assets, according to BNY Mellon.

RIAs using Pershing’s new subscription pricing model, which went into effect in May, have a cost incentive to use these ETFs, according to Ben Harrison, the new head of Pershing Advisor Solutions.

The tiered monthly subscription fee starts at $25 a month per client, and rises as assets grow in the account. However, assets held in BNY Mellon ETFs “will be excluded in that subscription fee calculation as a part of the overall benefit of a relationship with our firm,” Harrison told Financial Planning in March.

Harrison declined to say how many RIAs have signed up for the new pricing model since its launch as well as how many RIAs were using BNY Mellon ETFs in their portfolios.

“We have seen healthy interest in our subscription-based pricing, which has so far been the most popular option,” he said in a statement.

In addition to making its new ETFs available to advisors, BNY Mellon is following many of industry’s largest asset managers by developing proprietary model portfolios.

A new division at the firm, BNY Mellon Investor Solutions, offers outsourced CIO services and custom portfolio capabilities to endowments, foundations, family offices, RIAs and others.

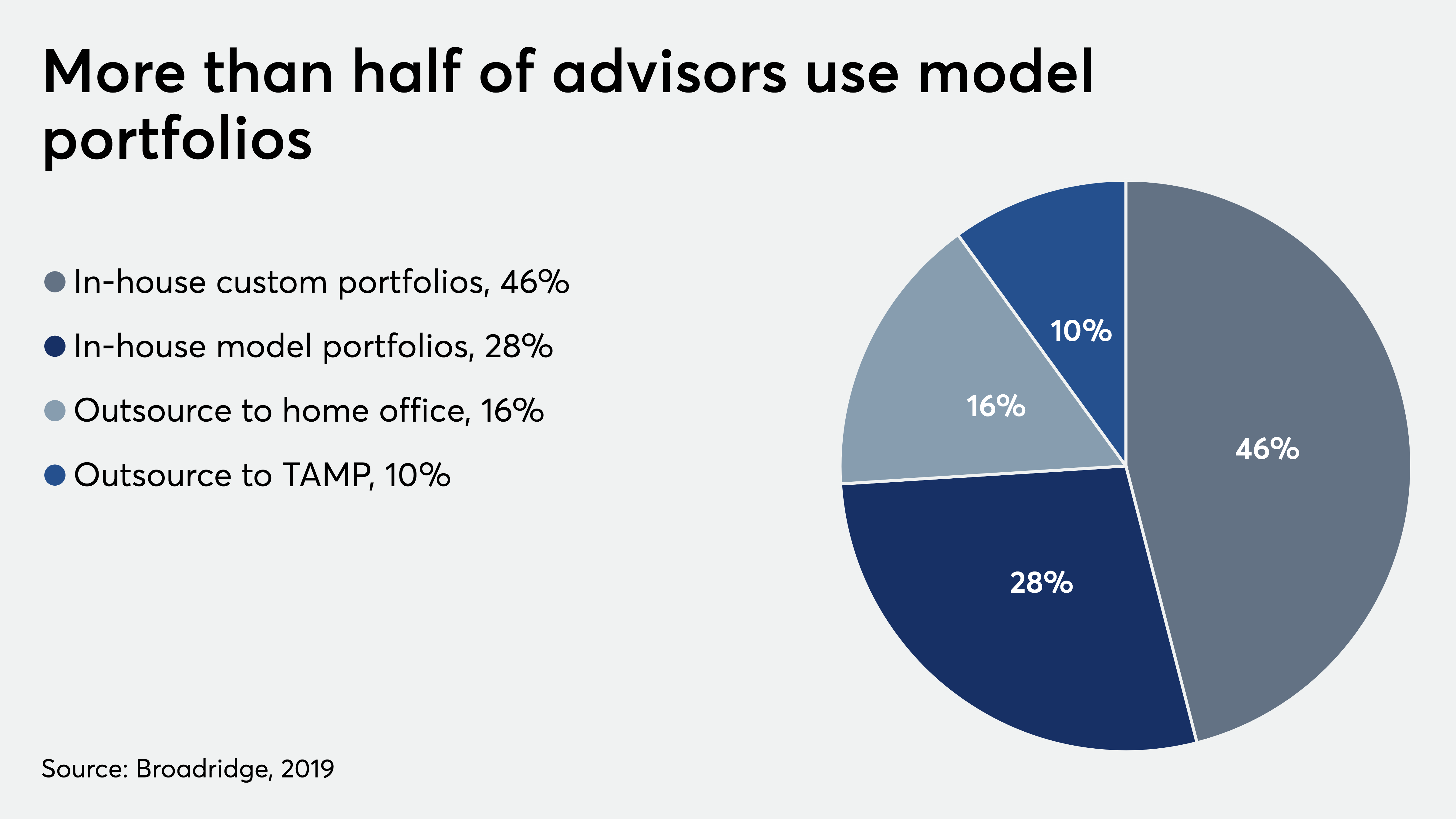

Model portfolios are “one of the top distribution initiatives” among asset managers, according to Andrew Guillette, senior director of Americas Insights at Broadridge Financial. His firm tracks $1 trillion of what it approximates to be a $3 trillion model portfolio market.

Because of the shift to passive funds, “everybody’s interested in models,” Guillette says.

Independent advisors have a wide range of options to choose from, so custodians are cognizant of how they market their own models, according to Guillette.

“They’re not going to jam it down [advisors’] throats, because that’s not the business that they’re in,” he says, adding: “They’re going to be very careful about having it come off as proprietary and a conflict of interest.”

Broadridge estimates that about 17% of the assets in model portfolios are held in proprietary models where 80% or more of funds are proprietary.

The BNY Mellon spokesman said that the company is “in the process of finalizing the marketing materials and website” for the new offering.

Leave a Reply