Last October, we were excited to announce the release of our GST/HST returns for Canadian subscribers. Since then, we’ve been actively collecting and monitoring customer feedback to understand pain points, and prioritise the next wave of features requested by the community.

Over the last month, we’ve worked hard to release those features, to help make preparing and managing GST/HST returns easier. Here’s a recap of the latest releases:

Start date

A number of customers had mentioned that their clients’ sales tax period does not always align with their financial year end. This meant it was difficult to set the appropriate dates on the return, and report on the correct period.

So, we’ve released a new Settings button on the GST/HST dashboard, that will allow you to set the start date of your first return, provided you haven’t yet finalized any returns. The options you see will depend on your conversion date, and the tax period you’ve set, whether that’s monthly, quarterly or annually.

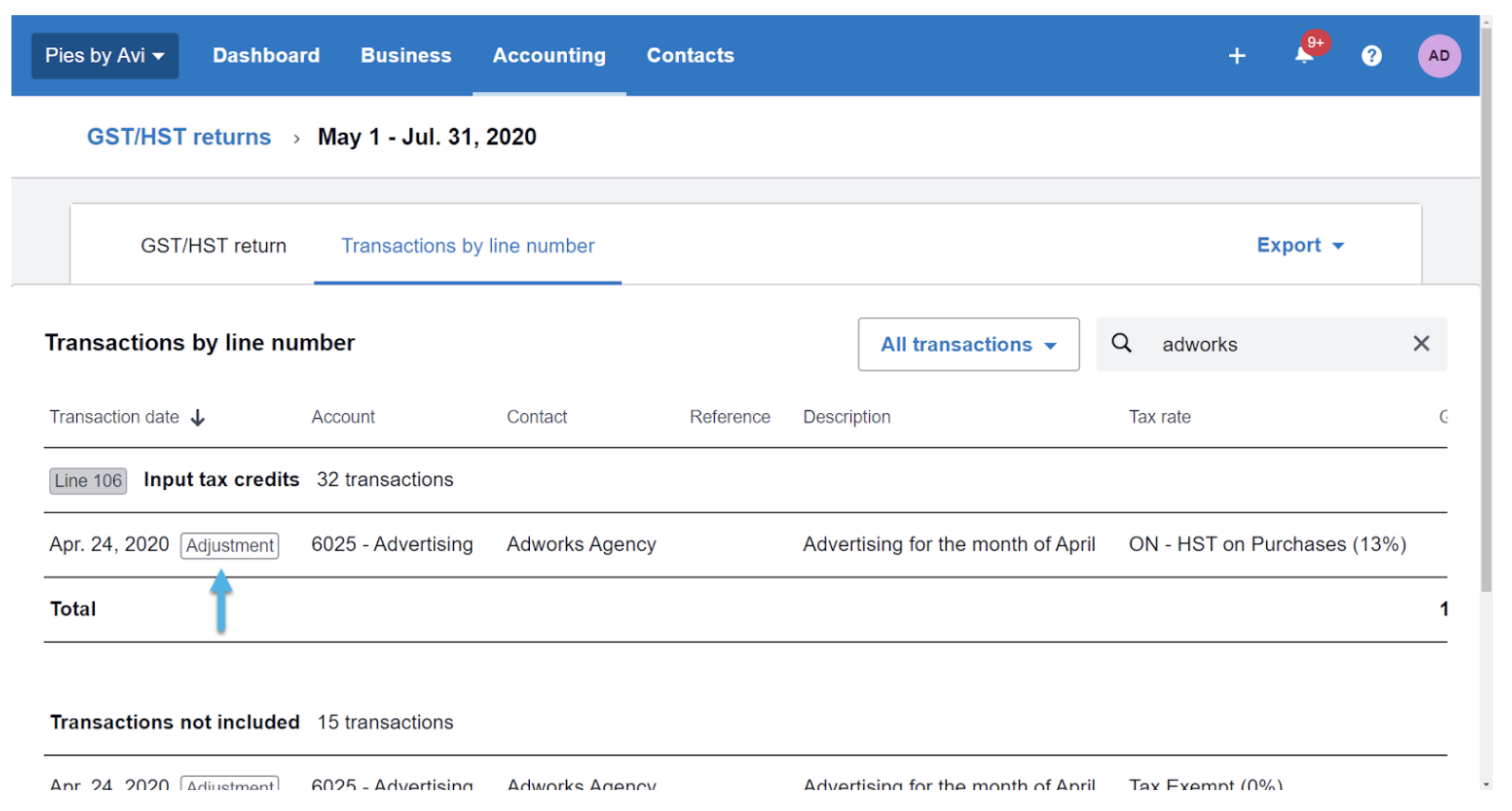

Prior period adjustments

Next up, is the ability to have Xero automatically deal with any prior period adjustments. When a return is finalized in Xero, that period’s return is locked because it’s intended to match the information you’ve filed with the CRA.

If you later discover you need to add or edit a transaction included in that return, Xero will recognise that the changes relate to a locked period, and automatically reflect them in the next return. This saves you from having to enter manual adjustments. Remember, this only works once you finalize the return so that’s an important step in the process.

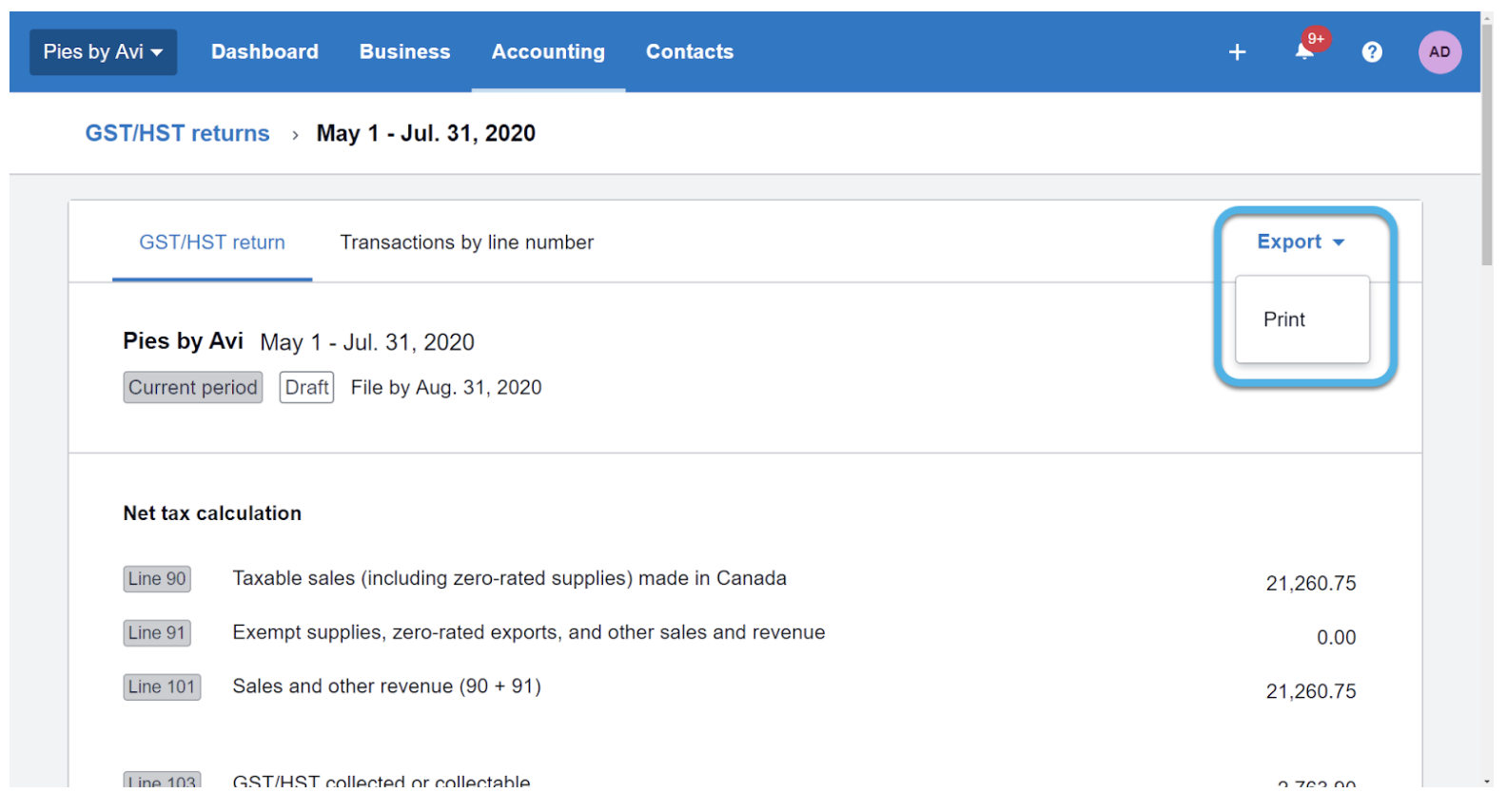

Print and export

We know that it’s useful to be able to save copies of the return and it’s associated line items, just in case you ever need a backup. So the last feature to mention is our Export feature, found in the top right of each tab in the return.

On the actual return itself, you can print the return to PDF. You can also export a list of all the transactions included in this period’s return on the Transactions by line number report to Excel. So once you’ve finalized a return, you may wish to export a copy of what was filed, just in case you need to refer back to it.

These are just a few of the features we’ve recently released. However, we have a dedicated team working specifically on Canadian Sales Tax, and we will certainly be releasing more features in the future. Please continue to provide your feedback on what you like in the return, or what you would like to see next – you’ll find a feedback link at the bottom of each page of the Return.

Check out our helpful article on Xero Central for more information on using the GST/HST Return and watch a demo here.

Leave a Reply