I had an interesting conversation with a friend this morning about the stocks he holds, and the roller coaster ride they’ve been on over the last few weeks.

I got as much out of the conversation as he did, because it was a helpful reminder about how much stocks move based on feelings versus the actual fundamentals. He pointed out how much the share prices have been regularly rising or falling in 10 and 20% increments, and that it made no sense because nothing about the businesses was actually changing each day at all. He gets it, but it’s still bizarre to watch.

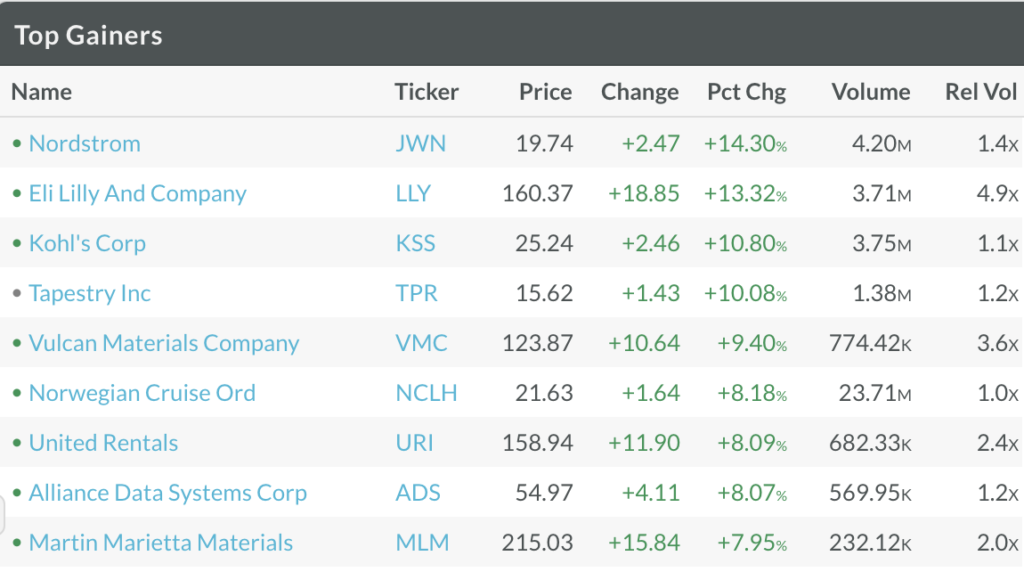

Here are the top gainers in the S&P 500 today:

In not a single case does the increase in share price reflect a 1:1 increase in fundamentals for these companies. Fundamentals don’t improve this much overnight, with the rare exceptions having to do with new drug approvals or court case victories. In the case of Lilly, they had something to say about entering Phase III trials with a coronavirus drug. Nordstrom had no such news to share.

I know this point isn’t profound, but it’s worth remembering. Emotions are the dominant force behind day to day price changes. Fundamentals change slowly and are not accurately represented in every tick higher or lower.

For traders, price is truth and contains information over shorter time frames. For investors, price is only tangentially related to truth in the short-term and mostly represents noise.

And in a moment like this, every aspect of what I’m saying becomes amplified, given the nature of what we’re going through. Who knows what encouraging or discouraging headlines tomorrow will bring as the reopening of the economy battles the resurgence of the virus.

Leave a Reply