This weekend’s Barron’s cover story by Reshma Kapadia looks at widening economic inequality that, at some point, will have major investing and taxation consequences for the investor class and Corporate America. The pandemic and related lockdowns took an already ailing situation and made it even worse. 40% of the people who’ve lost their jobs this year earn $40,000 or less. Only 13% of those making over $100,000 have been laid off.

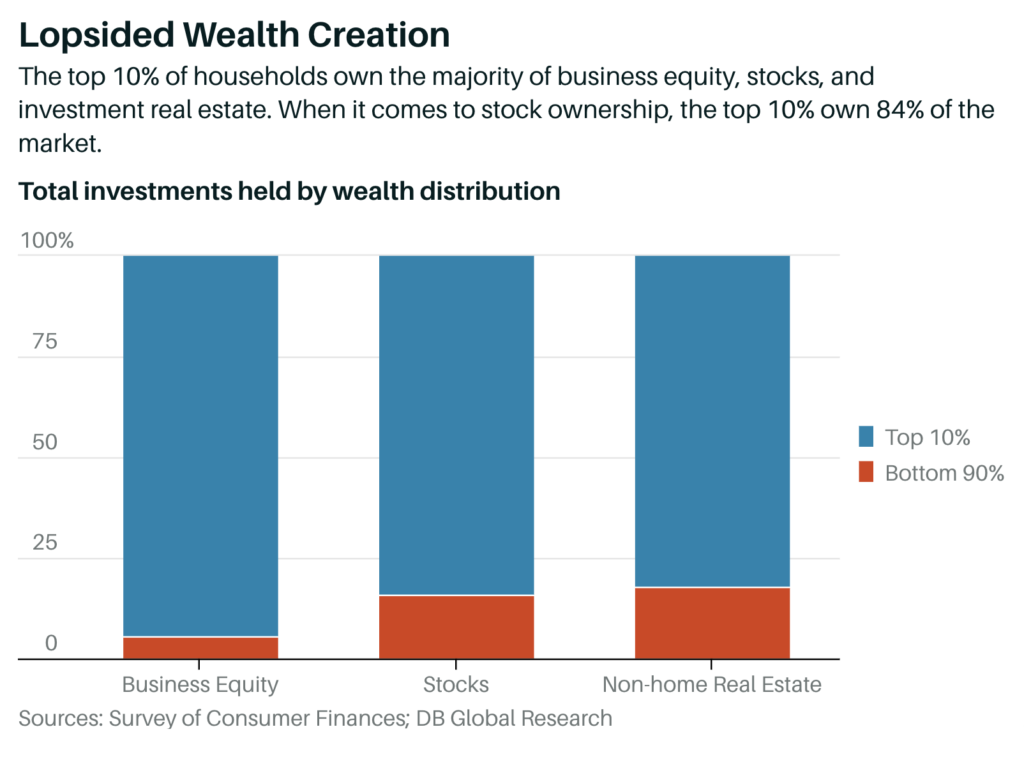

Recoveries for the stock and bond market do not do much for nine of ten households, at least not in the near term. Having a 401(k) with exposure to the stock market is nice for middle class families, but it doesn’t change the need to spend almost everything else that’s coming in each month. Federal Reserve policies that focus on the reflation of business / real estate valuations and asset prices may mean well, but they feed into the disparity between those who can save and invest and those who can’t. There are many other factors at work though – from race to intergenerational wealth transfer to the deification of “shareholder value” to technological disruption.

Eventually, if this trend doesn’t reverse itself, legislators will step in – with all sorts of unintended consequences playing out.

Barron’s asks economists and asset managers about the investment implications of this growing, underlying risk. Hit the link below to read the whole thing.

Why the Widening Wealth Gap Is Bad News for Everyone (Barron’s)

Leave a Reply