Executive Summary

Growing and improving a financial advisory business is a continuous and iterative process, and in general, firm owners tend to first look for new and better ways to attract and retain clients when taking the next developmental step. However, in order to really capitalize on those efforts, advisors should first ensure that they are also consistently optimizing the operational aspects of their businesses as well.

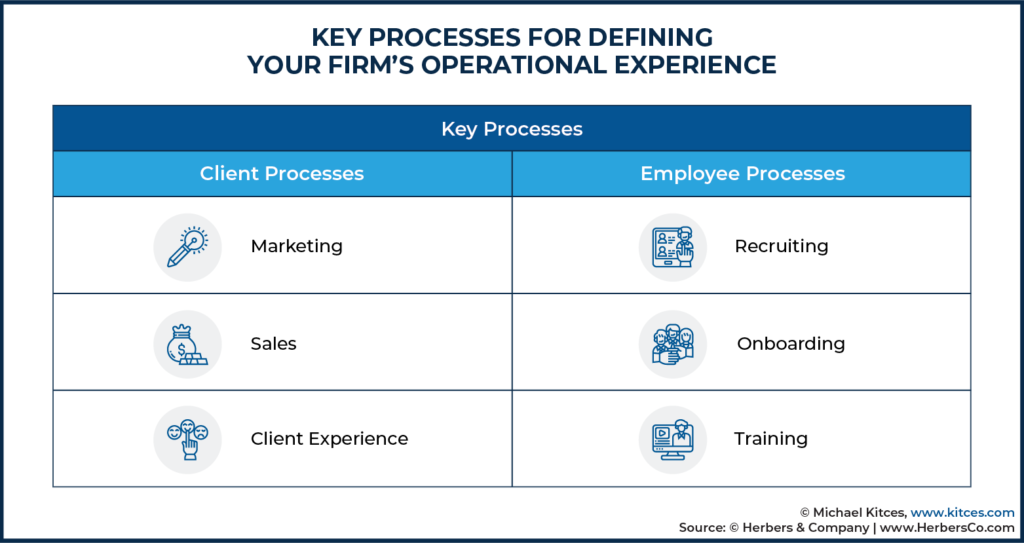

In this guest post, Angie Herbers – Chief Executive and Senior Consultant at Herbers & Company, an independent management and growth consultancy for financial advisory firms – explains how Operational Experience (OX) is a crucial element in all business processes as it is the mechanism that ensures consistent delivery of service. It consists of the back office activities that outline business processes and, for each step of every process, identifies every action that needs to be followed, who is responsible, how long it should take, and any technology requirements. In order to define a firm’s OX, two categories of key processes must be considered: those that involve client processes, and those that involve employee processes. Whereas client processes involve marketing, sales, and the actual client experience, employee processes involve the steps needed to recruit, onboard, and train employees.

The effectiveness of key processes can be measured by various performance indicators, such as those that examine metrics that are most impactful to revenue and profits. These can include factors such as client referral rate, close-ratio, and gross profit margin. As such, process frameworks should be developed in alignment with the overall business goals, ultimately to enhance financial performance, using three key steps: focusing, aligning, and optimizing.

Identifying focus is the first stage of developing an OX framework, and it should be targeted on the reason for making improvements to the process (e.g., to expand the number and rate of client referrals). Next, the framework should be fleshed out with areas that need improvement so that they better align with the focus (e.g., annual meeting reviews are not being conducted consistently by different advisors across the firm, and some clients have expressed that they are upset by the unequal treatment). The final stage is the optimization stage, in which repairs are made to the broken processes identified in the alignment stage (e.g., a three-phase process for conducting annual client meetings is developed to systematize the client meeting experience, which all advisors will be required to follow).

Ultimately, the key point is that having a strong operational experience is the basis on which to build efficient client experience, marketing, and employee processes that will facilitate the successful growth of a firm. Because by establishing a sound, functional operational experience, a firm will be able to develop processes that will facilitate efficient marketing efforts and exceptional client service provided by a team of employees who excel at and enjoy their jobs.

What makes a business great is not always obvious. More often than not, it’s the things you don’t see happening inside of a company that are the real reasons for its success—or failure. For advisory firms, the Operational Experience (OX) can be the differentiating factor that influences a firm’s growth trajectory, but it is often overlooked and neglected.

Why is it often neglected when it’s so important? The answer is pretty simple. Most people can only identify with what they see. We do not see a firm’s Operational Experience (at least, unless it gets broken) that happens largely behind the scenes in the firm’s ‘back office’. Clients can see the Client Experience (CX) that happens in the ‘front office’, and everyone in the public can often see a firm’s marketing effort. But what goes on underneath the hood can be hidden to the casual observer. As a result, the OX gets overlooked precisely because it is not externally facing.

A firm’s internal systems, however, are what create a healthy organization. If you put all your attention on clients and neglect your business operations, your client experience will eventually fall down and suffer. Paying attention only to a select few areas of your firm will result in missing half of what you need to do to be truly successful.

The fact is that without strong operational processes, you’re only building a hollow shell of an advisory business. This article will help you understand how to define your Operational Experience in frameworks, and show you how to get started with creating and/or improving the one you already have. Without a strong OX, the vast majority of firms will find it difficult to grow their firm, serve their clients, and keep employees happy and fulfilled.

First, though, let’s just fully define what we mean by Operational Experience.

What is An Operational Experience?

An advisory firm’s Operational Experience is a multi-faceted system. It’s what happens inside of a firm, behind closed doors; it is the unseen ‘shadow work’ that a client may never know you do.

Truthfully, about 80% of what happens in your advisory firm will never be seen or directly experienced by your clients. In much the same way that a tip of an iceberg is held up by the massive amount of ice beneath the surface, your back office operational processes go unseen by client eyes.

In the ideal setup, your Operational Experience dictates how you deliver your Client Experience, not the other way around. Practically speaking, the Client Experience details the interactions your firm has directly with clients. You probably can quickly rattle off what processes fall under CX for your firm, but usually, it will include items like prospect meetings, new client onboarding, annual reviews, and other touchpoints.

However, the Operational Experience sits beneath each of those Client Experience activities and outlines the process you go through to conduct those meetings, make the trades, create the investment allocations, etc. It identifies the steps a firm must take to make the CX activity happen. In each step, firms need to identify who is responsible, how long it should take, and what technology is required to complete that step.

Later in this article, we will look at a specific example to show you how to build out that type of detailed operational process in what we call “frameworks.”

Why OX is Essential

Even though it happens behind the scenes, it’s not an exaggeration to say that without a strong OX, you cannot be the company you want to be. While not always sleek or sexy to talk about, strong operational processes are essential. You can have the best business developers and financial advisors in the industry, or the most comprehensive financial planning proposal and the best-customized investment management, but without a defined OX beneath it all, your service will fall down, and your organization will soon follow.

Why? Because the OX is what ensures the consistent delivery of the service.

Think about your OX like you would think about an operating system, like Windows or macOS. The computer’s operating system enables everything else to happen when you use it. You may have a favorite app like Spotify, Google Chrome, or Microsoft Word, but all of those apps need an operating system to function. Without the OS, they’re each useless.

Similarly, your OX enables everything else to happen within your firm. When your OX is stable, you can simply plug in a new ‘app’ (person, technology tool, etc.) and continue working effectively and effortlessly. An unstable OX, on the other hand, might crash when you try to do the same thing.

Because technology is so important to advisory firms, a stable OX makes adding a new technology solution to your firm easy. If you have an OX in place, you can align technology around your new tech and implement it without much disruption. You’ll already know where it fits in because you already know how your firm’s OX works, and finding technology to enhance it is not difficult. What is difficult, though, is finding the technology to create your firm’s OX in the first place. If you don’t know how your OX works, finding and implementing technology will do nothing but complicate your business.

For example, if you have never used financial planning software, it is much easier to implement that new tech if you’ve already defined how your team needs to deliver financial plans and advice to clients. You know where your process can be enhanced by software, so instead of reinventing the way you deliver advice, the new software can fit nicely into those gaps you’ve already identified. You may need to slightly adjust processes, but you aren’t starting over from scratch and trying to make your processes revolve around your new technology.

Add new technology to a firm without a defined OX, though, and you may end up repositioning and shifting much of what you do around the tech instead of fitting it into your firm’s unique processes and client services. In fact, your firm may very well find itself creating a new way to work to accommodate the technology, rather than seamlessly plugging the technology into the way you already operate.

At its core, a stable OX gives your team the ability to focus. By developing an OX for your employees, you can identify where problems and gaps exist in your firm and easily fix them without major disruption.

How to Get Started with Building and Enhancing Your Firm’s OX

Defining your firm’s Operational Experience requires you to think strategically about your business operations in two primary categories of key processes. Those two categories are processes involving your clients, and the ones involving your employees.

Within the client process, you have three key processes: the marketing process, the sales process, and the client experience process.

On the employee side of the equation, you have three key processes as well: the employee recruiting process, employee onboarding process and the employee training process.

All business performance problems, such as low productivity, turnover, slow growth, poor profit, etc., typically tie back to a problem within one of the core processes that involve your clients and/or employees.

And most growth problems can also be solved with one of these key processes. To begin improving your core processes you must look at your core processes as performance generators. In other words, if you are not trying to improve a performance number, like revenues and profits then why implement a process?

We often analyze Key Performance Indicators (KPIs) prior to recommending that a client improve them. While there are hundreds of KPIs underneath each of these six key processes to examine in an advisory firm, the most impactful to revenues and profits are the client referral rate, close ratio, and gross profit margin which measures capacity. Most often we start with improving the client referral rate and capacity, as improving these ratios is the easiest and fastest way to increase revenues and profits at the same time.

To do that, we begin with the client experience process and the employee training process to impact client referral rate and to expand capacity without hiring. Taken together, we increase revenues while increasing profits.

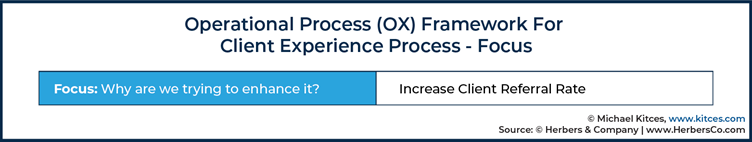

Now that you know the key client and employee processes, we are going to focus, align, and optimize the operational experience process with your business goals to enhance the financial performance of the business. Doing this is called building an “Operational Experience (OX) Framework”.

To illustrate an OX framework, and how it is built, we will use the client experience process as an example, because it is the most powerful process in enhancing business performance.

The client experience process is central to any service-based business. In an already operating business, it does two things: it retains the existing clients, and it expands growth through client referrals. Building, enhancing, and expanding your OX under the client experience process will grow your firm faster than any other process.

To expand the client service process, we build out the OX by focusing, aligning, and optimizing it in a framework that outlines the overarching goals for business performance and maps out solutions to those goals.

Let’s get deeper into the Focus, Align, and Optimize stages of the Operational Experience Framework.

Focus: The “Why” Stage

Building out OX can get very overwhelming if you are not able to compartmentalize what you are really trying to fix and why. The first stage asks you to focus on “why”. Why do you need to make this improvement? Well, if your client referral ratio isn’t as high as you think it can be, the answer is simple. We want all clients to have the same experience within our firm because we know that when we make a process repeatable, our team gets better at delivering it. And if we are better at servicing clients, they’ll be happier. As a result, they tell people about us.

Therefore, our “why”, in the case of the client referral ratio, is to expand the number and rate of client referrals.

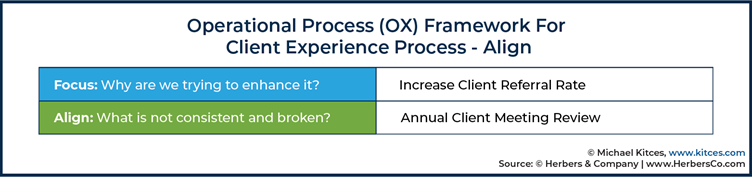

Align: The “What” Stage

What do you need to fix inside of a client experience process that is broken? The things that are broken are the areas that are not consistent among all employees and/or advisors. In other words, if every advisor is not conducting the annual review meeting in the same way, the annual review meeting is broken. The reason consistency is important is because it builds trust and the more the client trusts the process, the more likely they are to send referrals.

To layer onto the OX Framework, we isolate one area that is broken, so we know what we are trying to fix within the business.

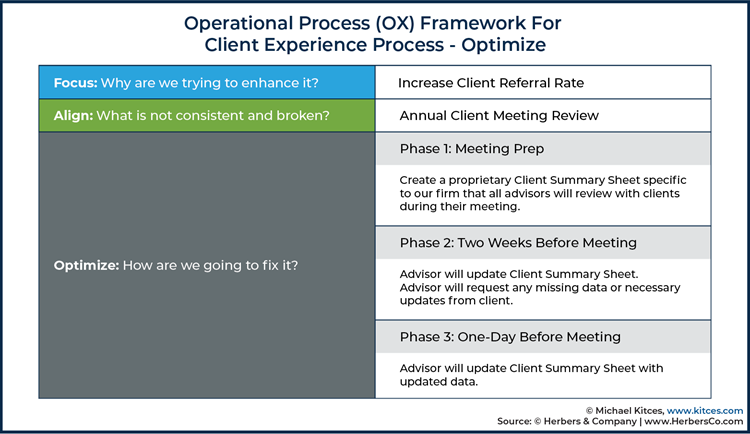

Optimize: The “How” Stage

And the final stage is the optimize stage; you already know what to fix and why you need to fix it—now it’s time to get down to doing it in the third stage. How are you going to fix this issue you have identified?

At this point, you will outline the steps you need to take to fill in the missing pieces in your Operational Experience. The Optimize stage will have an incredibly detailed overview of the steps you are trying to fix. For illustration purposes, here is a simplified OX Framework:

A Strong Operational Experience is a Continual Process

In a traditional OX, an advisory firm will have hundreds of OX Frameworks that are built over time and continue to be enhanced. Even if you and your team create an OX to be proud of, a strong operation is not a ‘one-and-done’ project.

Your team will take a Continuous Process Improvement mindset. If you work with the mindset that you should expect your business to improve over time, the process of updating OX becomes a part of your culture and not a chore that happens every few years.

For the firms that we work with to build OX, we get started by enhancing one area of the client and/or business process per month. The process of creating your firm’s OX might take years, and that’s ok. Your timeline will depend on how large your firm is and how much time you can dedicate to documenting your processes.

But a strong OX empowers your people to be their best. If you take an all-star football player like Green Bay Packers quarterback Aaron Rodgers and don’t design any plays for him or his teammates to run, he won’t be an all-star—he’ll be average. Give him plays he is comfortable with and has practiced a thousand times, though, and he can perform at an exceptional level because he knows his role and what to expect from everyone around him.

In the same way, a strong OX ensures that even new employees and team members with average skills can be all-stars in your organization. Remember, though, that building a stable OX is not a quick process. It requires dedication, a willingness to accept that you may not be doing everything right, and commitment to revisit your processes continually so you can always improve. If you can build a culture to embrace the importance of your OX, you will be well on your way to creating a successful and sustainable advisory firm.

If you get good at it, well, you can gather up all the frameworks you have built over the years and build your own financial planning software. In doing so, you will be totally unique in the marketplace. To begin the process of creating it, you begin with Operational Experience (OX) Frameworks.

Today, the wave of the independent financial advisory industry future is customization – customized financial planning software backed by amazing human capital programs. For the past twenty years, Herbers & Company has been the engine that has created the operational processes and the human capital programs that have propelled so many firms into the future. And, what we know for sure is, customization of your financial planning and investment management process – unique and specific to your firm and what you do for clients, but systematized across every member of the team – skyrockets your business valuation.

The good news is every advisory firm can do it, and it all begins with OX.

Author’s Note: Angie would like to thank Jarrod Upton, CFP®, MBA, senior partner at Herbers & Company, for his expertise and assistance in helping to write this article.

Leave a Reply