PPF (Public Provident Fund) is one of the most popular investment in India and rightly so. It’s safe, backed by Government and gives tax free returns. We have designed this Excel based calculator for PPF Withdrawal, Loan and Maturity which you can download.

PPF Calculator Excel

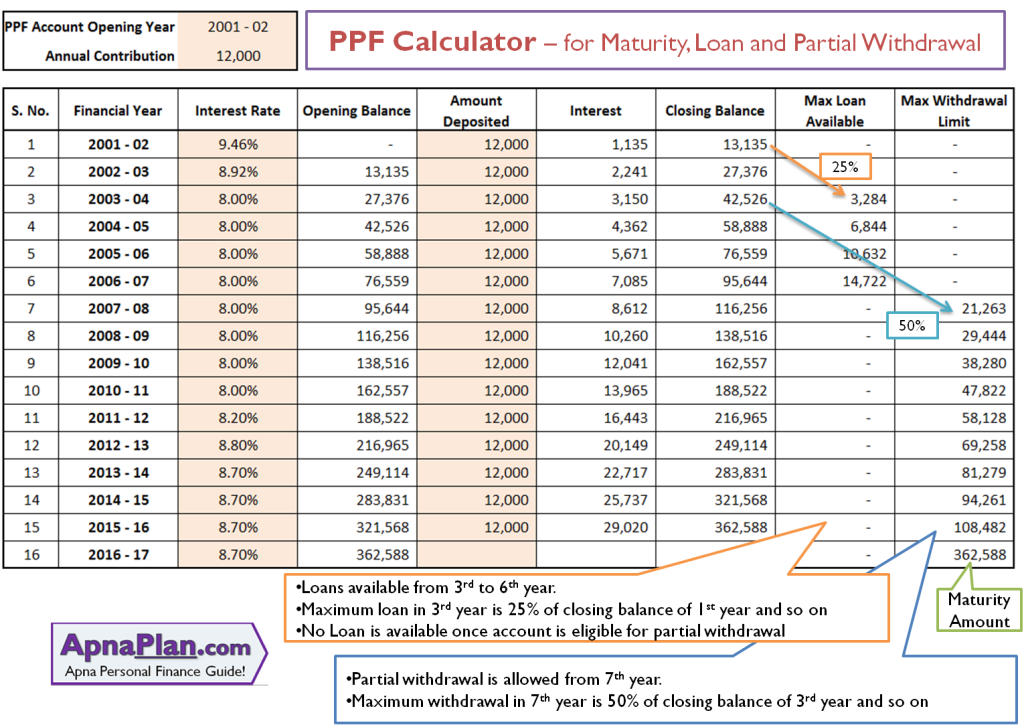

This PPF calculator can calculate the maximum loan eligibility, partial withdrawal eligibility and the maturity value at the end of 15 years.

It takes the historical interest rates automatically depending on the financial year. The future years where the interest rates have not been declared takes the value of last declared rates.

You can download Excel based calculator below.

How the PPF Calculator Excel Works?

The calculator looks like the figure below. You can change the values in Orange cells only.

You can input the account opening year. The year here is financial year. For e.g. 2001-02 means account opened between 1 April 2001 and 31 march 2002.

Next input is Annual contribution. If you contribute same amount every year as in the example below, it will automatically take those values across years. However if your contribution has varied over the years, you can change that in the “Amount Deposited” cells for each year.

Next editable field is “PPF Interest Rate” fields each year. The excel PPF calculator picks up values itself for years the interest rate is declared but you can give your own assumed values for future years. A point to remember the interest rate is declared every quarter now – so you can take the average of all 4 values and feed it against the financial year. This will give you approximate maturity amount, loan that you take against PPF and if you are eligible for Partial PPF withdrawal.

Loan against PPF Rules

Following are the rules for Loan against PPF:

- The loan facility is available from third to sixth financial year of opening the account.

- The maximum PPF loan that can be taken is 25% of the PPF account balance at the end of preceding two financial years. For e.g. for FY 2013-14 you can borrow 25% of the amount present at the end of FY 2011-12.

- The interest rate on loan would be 1% higher than the prevailing interest offered on PPF (since December 1, 2019).

- Inactive accounts are not eligible for loan.

- You can borrow multiple times in the third to sixth financial year, once you fully pay the preceding loan.

- PPF Form D needs to submitted to apply for loan.

Also Read: Everything you wanted to know about PPF

PPF Partial Withdrawal Rules

- Partial withdrawal is available from seventh financial year from the account opening financial year. So if you opened account in FY 2011-12, the earliest you can withdraw is FY 2017-18.

- The maximum amount you can withdraw every year is 50% of the account balance in the preceding 4 financial years.

- Only one withdrawal can be made every financial year.

- PPF Form C needs to submitted to make partial withdrawal.

- In case the withdrawal is from account opened in the name of minor, a declaration needs to be given by the guardian that the amount would be used for the benefit of the minor.

PPF Extension Rules

- PPF account matures at the end of 15 years from date of account opening.

- You can request for extension of PPF account for 5 years at a time. This extension is possible for any number of times. This means that you can continue PPF for a long period of time.

- For extension you need to choose if you want to extend the PPF with contribution or without contribution.

- In case of extension without contribution the balance in PPF account continues to earn interest and you need not contribute anymore. You can also withdraw entire amount anytime.

- In case of extension with contribution you can withdraw only 60% of the balance before the start of this 5 year extension period.

Leave a Reply