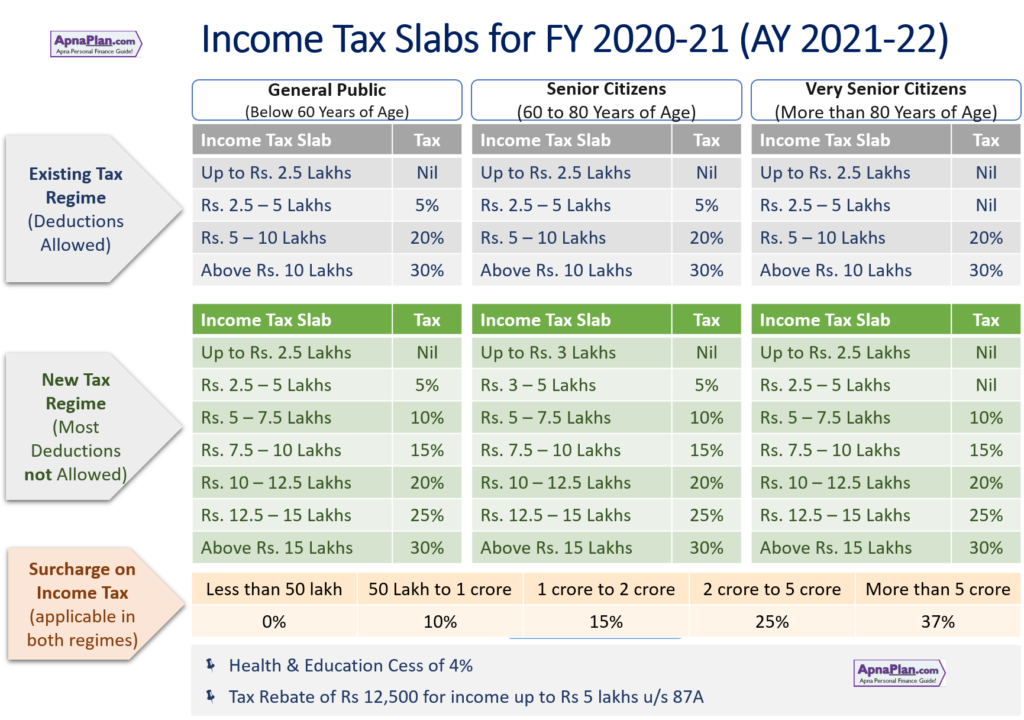

Every year there are changes in the Income Tax rules of India in the Union Budget. Keeping these changes in mind we come up with our Income Tax Calculator India every year. The latest budget was presented in February 2020 and made the following changes.

Income Tax Changes in Union Budget 2020

The biggest change in Budget 2020 regarding income tax was introduction of new tax slabs in case you do not want to take benefit of various tax deductions like standard deduction, Chapter VI A deductions, HRA benefit, LTA, home loan interest for self-occupied homes etc.

Now you have the option to choose on what you want to follow:

- New Tax Slabs but forgoing all tax deductions

- Continue with old tax slabs with all tax deductions

The income tax calculator India calculates the tax outgo using both the above tax slabs and you can choose what suits you.

Download Income Tax Calculator in Excel

You can download the income tax calculator 2020 (for FY 2020-21) in excel by clicking the button below.

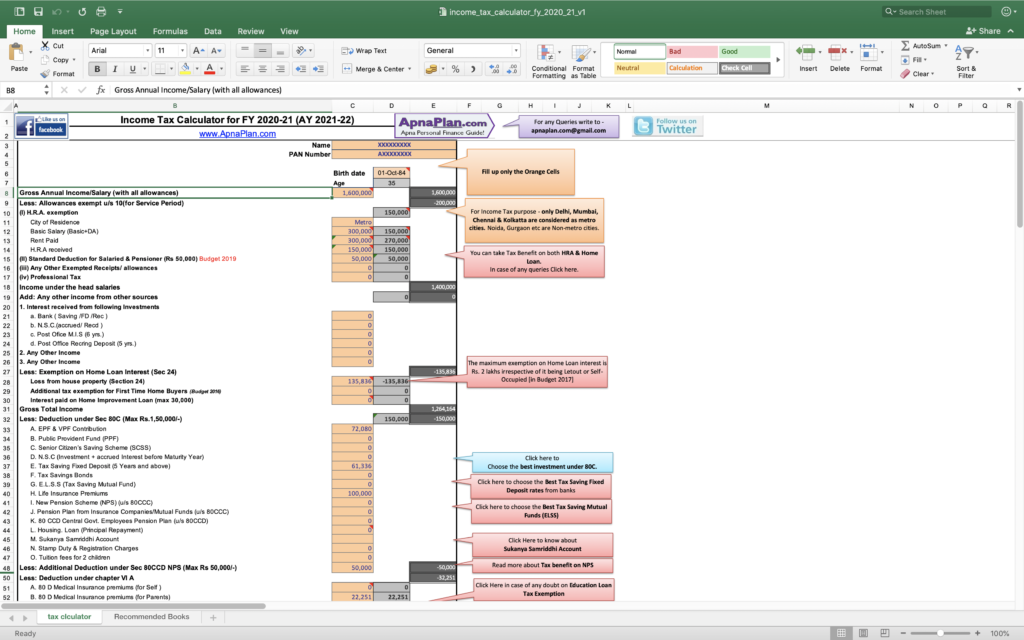

How to use the Income Tax Calculator India for FY 2020-21 (AY 2021-22)?

The picture below shows how the income tax calculator India for FY 2020-21 (AY 2021-22) looks like. You can edit all cells in Orange colour.

Section 1: Basic Details

The top cells ask for your name and PAN Number. It’s optional field and is meant in case you want to use it for multiple people.

Date of Birth is mandatory field as the tax slab is different for people aged below 60, between 60 to 80 years and more than 80 years.

Section 2: Salary Income

The next fields ask information about gross salary income.

- In case you are employed, get HRA and rent out do fill in the details

- Standard Deduction is Rs 50,000 from Budget 2019 onwards and is applicable to salaried and pensioners only.

- Do mention Any Other Exempted Receipts/ allowances like LTA, etc

- In case you have paid Professional Tax as happens in Maharashtra and some other states do mention that. This is tax exempt.

Tax Free Salary Components

There are components in salary which are fully or partially tax exempt. For example HRA is tax exempt if you satisfy certain conditions. You can have the complete list in the post: Must have Tax Free components in Salary.

Section 3: Income from other sources

Input all the other income like Interest income from fixed or recurring deposits. You can also include income from gifts received if its more than Rs 50,000 and from non-relatives.

Section 4: Loss from Home Loan Interest

In case you have home loan, fill up the columns to reflect the same. You get tax benefit on interest under section 24. Budget 2018 onwards there is additional benefit for first time buyers of affordable homes. You can also claim tax benefit on interest paid on home improvement loan.

HRA & Home Loan Benefit at same Time – Possible?

Many employer (& employers) are confused if they can take advantage of both HRA and Home Loan for saving tax. This seems intuitive as how can you pay for home loan and also live on rent. However just for your information its completely legal to take advantage of both HRA & Home Loan as there are multiple situations where you need to live on rent but still pay home loan. You can read more about this our post – Can I claim Tax Benefit on both HRA & Home Loan?

Section 5: Tax Deductions – Chapter VI A

Fill in the tax deductions you want to claim. It covers Section 80C for investments like EPF, VPF, PPF, SCSS, etc.

Additionally, you can claim tax deduction up to Rs 50,000 by investing in NPS u/s 80CCD(1B). this is in addition to Section 80C.

Section 6: More Tax Deductions

There are several cases where you can claim tax deductions like buying medical insurance, etc. Mention the same accordingly.

- Medical Insurance premiums (for Self or parents)

- Interest Paid on Education Loan

- Medical Treatment of handicapped Dependent

- Expenditure on Selected Medical Treatment for self/ dependent

- Donation to approved funds

- For Rent in case of NO HRA Component (Budget 2016)

- For Physically Disable Assesse

- In case your employer contributes to NPS account on your behalf, you can claim up to 10% of your basic salary as tax deductible.

- There is also tax deduction for interest paid on purchase of electric vehicles.

Section 7: Income Tax Calculation (Old Tax Slabs)

This section is auto-computed based on your inputs and displays your final tax outgo. There

Section 9: Calculating Income Tax with New Tax Slab under new Regime

This section computes the Income Tax with Lower Tax Slab under new Regime announced in Budget 2020. This would help you to determine which tax regime suits you.

How to Calculate Income Tax in India?

In case you want to calculate your income tax without using the Income Tax India calculator, it’s not very difficult. You need to follow following steps using the below example.

Amit is salaried employee with following salary structure.

- Basic Salary: Rs 6,00,000

- HRA: Rs 3,00,000

- Special Allowance: Rs 60,000

- LTA: Rs 40,000

- Total CTC: Rs 10,00,000

Step 1: Calculate Gross total income from salary:

The table below shows the calculation for gross taxable income from salary.

| Component | Amount (Rs.) | Exemption/ Deduction | Old regime | New regime |

|---|---|---|---|---|

| Basic Salary | 600,000 | – | 600,000 | 600,000 |

| HRA | 300,000 | 240,000 | 60,000 | 300,000 |

| Special Allowance | 60,000 | – | 60,000 | 60,000 |

| LTA | 40,000 | 40,000 (bills submitted) | 0 | 40,000 |

| Standard Deduction | – | 50,000 | – 50,000 | |

| Gross Total Income from Salary | – | – | 670,000 | 1,000,000 |

Step 2: Tax Deductions

Amit had made the following investments to save tax. These will be deducted from the gross income to arrive at net taxable income.

- EPF deduction from salary – Rs 60,000

- PPF Investment – Rs 1,50,000

- Medical Insurance Premium – Rs 25,000

- Total Tax Deduction = Rs 1,50,000 + 25,000 = Rs 1,75,000 (PPF & EPF both come under section 80C and have a tax deduction upper limit of Rs 1.5 lakh)

Step 3: Other Income

Amit also had Rs 20,000 from interest from fixed deposits with banks.

Step 4: Net Taxable Income

The table below shows the Net Taxable Income for Amit

| Nature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income from Salary | 670,000 | 1,000,000 |

| Income from Other Sources | 20,000 | 20,000 |

| Tax Deduction | -175,000 | 0 |

| Total Taxable Income | 515,000 | 1,020,000 |

Step 5: Calculating using Income Tax Formula

Old Regime:

| Tax Slab | Calculation | Tax |

|---|---|---|

| up to Rs 250,000 | Tax Exempt | 0 |

| Rs 250,000 to 500,000 | 5% || (5% * (500,000 – 250,000) | 12,500 |

| Rs 500,000 to 1,000,000 | 20% || (20% *(515,000 – 500,000) | 3,000 |

| Income Tax | – | 15,500 |

| Cess | 4% || (4% of 15,500) | 620 |

| Total Tax Payable | – | 16,120 |

New Regime:

| Tax Slab | Calculation | Tax |

|---|---|---|

| up to Rs 250,000 | Tax Exempt | 0 |

| Rs 250,000 to 500,000 | 5% || (5% * (500,000 – 250,000) | 12,500 |

| Rs 500,000 to 750,000 | 10% || (10% * (750,000 – 500,000) | 25,000 |

| Rs 750,000 to 1,000,000 | 15% || (15% * (1,000,000 – 750,000) | 37,500 |

| Rs 1,000,000 to 1,250,000 | 20% || (20% * (1,020,000 – 1,000,000) | 4,000 |

| Income Tax | – | 79,000 |

| Cess | 4% || (4% of 79,000) | 3,160 |

| Total Tax payable | – | 82,160 |

As you can see the tax liability changes hugely depending on what tax regime you choose. So you should plan carefully. You can also check the official Income Tax website for calculating your income tax.

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh (FY 2020-21)?

As you can see with the above income tax calculation, salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Excel based Income Tax Calculator India for Previous Years

You can download the Income Tax Calculator in Excel for Previous financial years from the links below. Here is the link

Leave a Reply