After keeping member fees unchanged since 2012, FINRA says it plans to raise them, though it’s not saying which ones.

The regulator will file a proposal for fee increases with the SEC, according to its 2019 annual report. That proposal will be filed “in the coming months,” says FINRA spokeswoman Michelle Ong. She declined to specify which fees would be impacted.

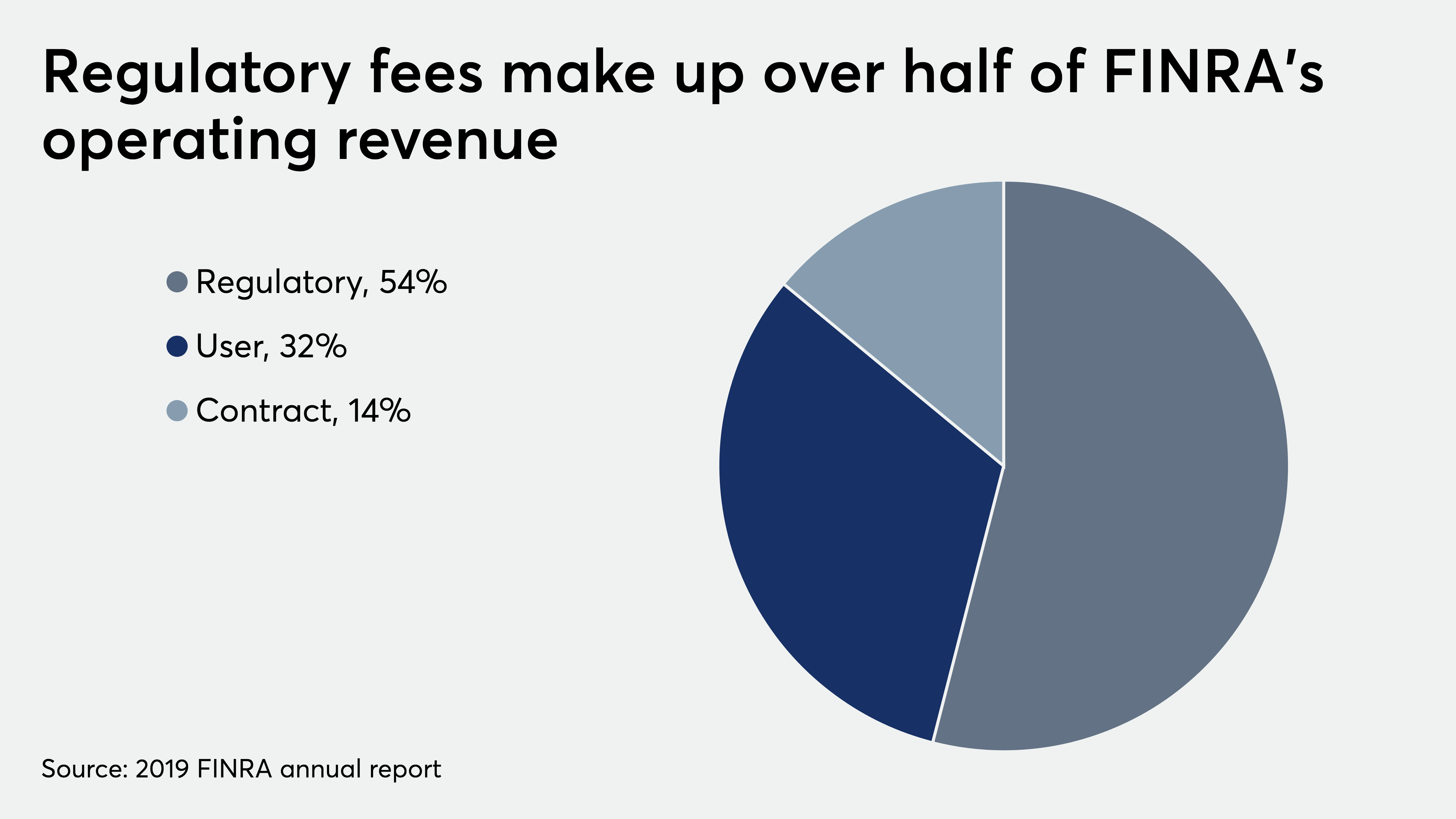

FINRA charges BDs and member firms regulatory fees that collectively made up 54% of its operating revenue in 2019, according to the regulator’s annual report, released July 1.

Included in regulatory revenue: a per-share trading fee and three annual fees derived from a firm’s gross income, number of registered reps and number of branches, according to the report and a former SEC filing.

The increases won’t happen immediately — not before 2022 — and they will be implemented incrementally, Ong says.

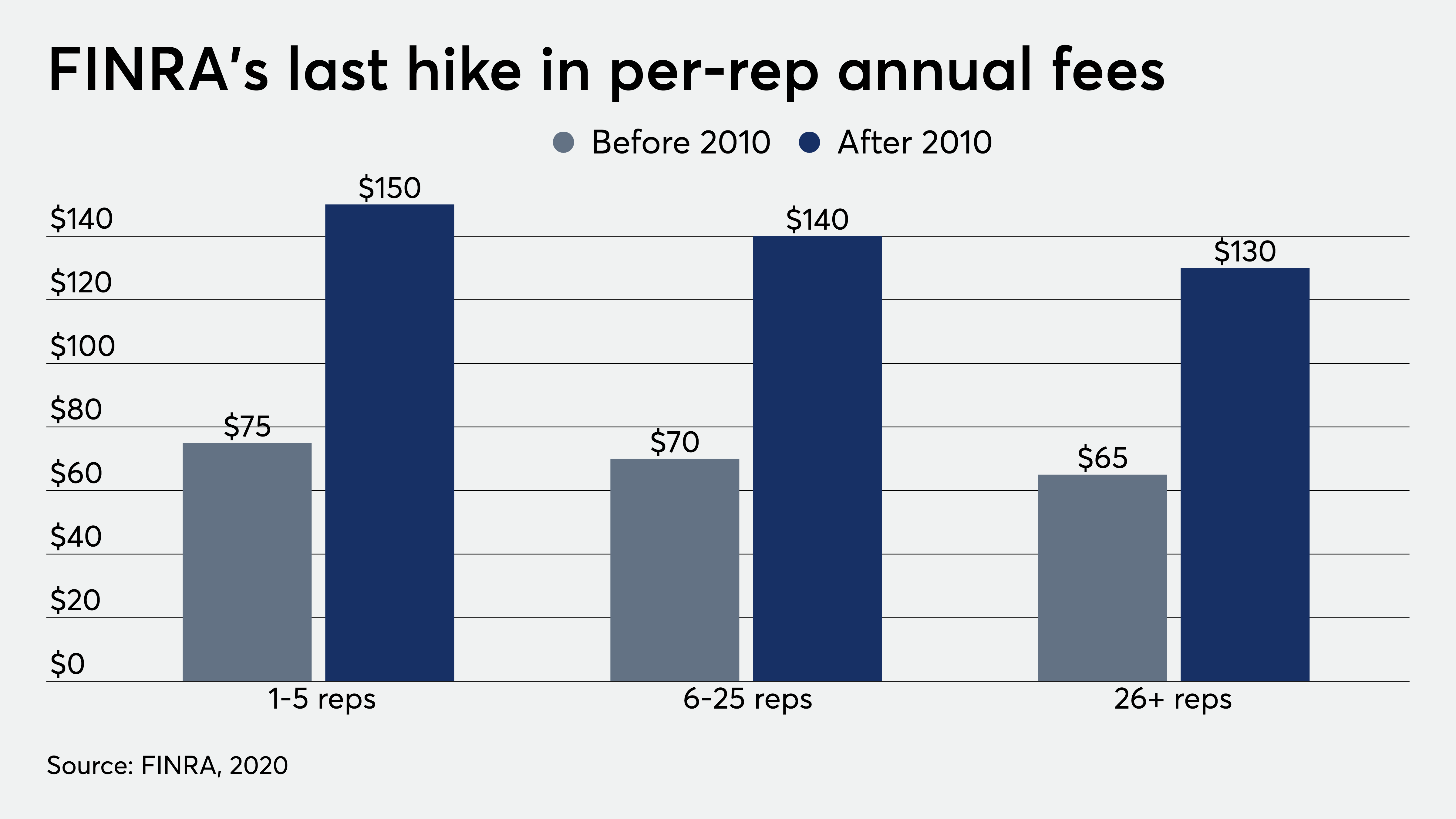

The last time FINRA changed its per-rep fee was in January 2010, when the regulator doubled it. Firms pay $130 to $150 annually per rep, depending on firm size, up from $65 to $75 before the change. At the time, the regulator also adjusted its gross income fee calculation so it wasn’t as closely tied to income fluctuation at broker-dealers.

Following those adjustments, FINRA bumped its trading activity fee on equity securities to $0.000095 from $0.000090 per share in 2012, with a per-transaction cap at $4.75, up from $4.50.

While it may seem counterintuitive, some broker-dealers may welcome the price hike, according to Margaret Sheehan, an attorney who represents investment advisors and BDs.

“FINRA keeps saying they haven’t raised fees, but there’s [sentiment among firms that] they have been more aggressively pursuing enforcement actions and fines to make up for the revenue they’re not making up in fee increases,” she says.

Firms would rather pay fees “in a known quantity” than in the form of “enhanced enforcement action,” according to Sheehan.

“Fines are not based on revenue considerations, and we do not establish any minimum amount of fines that must be assessed for purposes of our annual budget,” according to an emailed statement from FINRA’s Ong.

Fines decreased by $21.5 million in 2019 to $39.5 million from the year-ago period. The regulator issued its first report on how it spends fine money last year.

The anticipated price hike would come after the regulator reported a loss of $45.9 million in 2019.

“Over the last several years, we have relied on our reserves to fund budget deficits instead of increasing member firm fees,” wrote William Heyman and CEO Robert Cook in a co-authored letter in FINRA’s 2020 budget summary.

The regulator has drawn down approximately $650 million from its investment portfolio — known as its financial reserves — since 2010, according to the budget summary. The portfolio provided a 6% return in 2019, compared with a 2.3% loss the year before.

The organization has held an investment portfolio since 2004, when FINRA’s predecessor, the National Association of Securities Dealers, sold off its interest in the Nasdaq Stock Market.

Compensation for FINRA’s staff rose by 10.1% last year, 50% of which spokeswoman Ong said was due to a new voluntary retirement program offered to employees.

FINRA’s regulatory fees fund examinations, monitoring and enforcement, among other activities, according to the annual report.

Leave a Reply