NRE Fixed Deposit or Non-Resident External FD is one of the popular ard one of the best investments for NRIs/PIOs/OCIs because of two reasons:

- The interest rate is on the higher side as compared to their country of residence and

- the interest earned on NRE FD is tax free in India

This post compares the best interest rates on NRE FDs.

Best NRE FD Rates

The table below compares the interest rates offered on various NRE fixed and recurring deposits along with the penalty on pre-closure of FD/RD across 40 major banks in India.

The highest interest rate on fixed deposit is offered by RBL Bank (36 months to 36 months 1 day) at 7.50%.

Lakshmi Vilas Bank, DCB Bank, The Ratnakar Bank, Lakshmi Vilas Bank and Tamilnad Mercantile Bank offer highest interest rate across most tenures.

| Banks | 1 Years | 2 Years | 3 Years | 4 Years | 5 Years | 5+ Years |

| Axis Bank | 5.45% | 5.45% | 5.50% | 5.50% | 5.50% | 5.50% |

| Bandhan Bank | 6.25% | 6.15% | 6.10% | 6.10% | 6.00% | 6.00% |

| Bank of Baroda | 5.10% | 5.10% | 5.30% | 5.30% | 5.30% | 5.30% |

| Bank of India | 5.50% | 5.50% | 5.40% | 5.40% | 5.40% | 5.40% |

| Bank of Maharashtra | 5.25% | 5.25% | 5.25% | 5.25% | 5.25% | 5.25% |

| Canara Bank | 5.50% | 5.50% | 5.45% | 5.45% | 5.45% | 5.45% |

| CSB Bank | 5.50% | 5.75% | 5.50% | 5.50% | 5.50% | 5.50% |

| Central Bank of India | 5.35% | 5.35% | 5.35% | 5.35% | 5.35% | 5.35% |

| Citibank | 3.00% | 3.52% | 3.80% | 3.90% | 3.90% | 3.90% |

| City Union Bank | 5.50% | 5.75% | 5.75% | 5.50% | 5.50% | 5.25% |

| DBS Bank | 4.90% | 5.15% | 5.30% | 5.50% | 5.50% | 5.50% |

| DCB Bank | 6.75% | 7.25% | 7.35% | 7.35% | 7.35% | 7.35% |

| Deutsche Bank | 4.00% | 4.50% | 4.75% | 5.00% | 7.00% | x |

| Dhanlaxmi Bank | 5.75% | 5.85% | 5.80% | 5.80% | 5.80% | 5.80% |

| Federal Bank | 5.60% | 5.70% | 5.70% | 5.70% | 5.70% | 5.70% |

| HDFC Bank | 5.25% | 5.25% | 5.50% | 5.50% | 5.50% | 5.50% |

| HSBC Bank | 3.25% | 4.00% | 4.00% | 4.00% | 4.00% | 4.00% |

| ICICI Bank | 5.15% | 5.35% | 5.50% | 5.50% | 5.50% | 5.50% |

| IDBI Bank | 5.70% | 5.75% | 5.70% | 5.70% | 5.80% | 5.70% |

| IDFC First Bank | 7.25% | 7.25% | 7.25% | 7.25% | 7.25% | 7.25% |

| Indian Bank | 5.45% | 5.35% | 5.35% | 5.35% | 5.35% | 5.35% |

| Indian Overseas Bank | 5.70% | 5.75% | 5.70% | 5.70% | 5.70% | 5.70% |

| IndusInd Bank | 7.00% | 7.00% | 7.00% | 6.75% | 6.75% | 6.65% |

| Jammu & Kashmir Bank | 5.50% | 5.50% | 5.50% | 5.50% | 5.50% | 5.50% |

| Karnataka Bank | 5.75% | 5.75% | 5.65% | 5.65% | 5.65% | 5.65% |

| Karur Vysya Bank | 5.80% | 5.85% | 6.00% | 6.00% | 6.00% | 6.00% |

| Kotak Mahindra Bank | 5.15% | 4.90% | 4.75% | 4.75% | 4.50% | 4.50% |

| Lakshmi Vilas Bank | 6.25% | 6.75% | 6.10% | 6.10% | 6.10% | 6.10% |

| Nainital Bank | 5.40% | 5.50% | 5.50% | 5.50% | 5.50% | 5.50% |

| Punjab and Sind Bank | 5.55% | 5.55% | 5.55% | 5.55% | 5.55% | 5.55% |

| Punjab National Bank | 5.25% | 5.25% | 5.25% | 5.30% | 5.30% | 5.30% |

| RBL Bank | 7.20% | 7.20% | 7.50% | 7.00% | 7.00% | 7.15% |

| South Indian Bank | 5.70% | 5.90% | 5.70% | 5.70% | 5.70% | 5.70% |

| Standard Charted Bank | 6.20% | 6.20% | 6.00% | 6.00% | 6.00% | x |

| State Bank of India | 5.10% | 5.10% | 5.30% | 5.30% | 5.40% | 5.40% |

| Tamilnad Mercantile Bank | 6.10% | 6.00% | 5.90% | 5.90% | 5.90% | 5.90% |

| UCO Bank | 5.50% | 5.50% | 5.50% | 5.45% | 5.45% | 5.45% |

| Union Bank of India | 5.40% | 5.40% | 5.40% | 5.45% | 5.45% | 5.45% |

| Yes Bank | 6.75% | 7.00% | 7.00% | 6.75% | 6.75% | 6.75% |

Do you Know about Hidden Charges in Banks?

Do you know you pay a few thousand rupees every year to hidden charges of banks. This could range from more known fines for not maintaining minimum balance amount to lesser know POSDEC charge of ICICI Bank. There could be charges for ATM usage, branch visits, cheque books and so on. Do read our article on Hidden Charges in Banks and what you can do about it?

Small Banks NRE Fixed Deposit Interest Rates

RBI on September 2015 had granted licence to 10 Small Finance Banks. Lately these banks have been in news for offering higher interest rates on their fixed deposits as compared to regular banks.

The table below compares the interest rate offered by Small banks to that of SBI. The difference is substantial for low tenure deposits.

| Banks | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | 5 Year+ |

| AU Small Finance Bank | 7.05% | 7.25% | 7.00% | 7.00% | 7.00% | 7.00% |

| Capital Small Finance Bank | 6.65% | 6.50% | 6.50% | 6.50% | 6.50% | 6.25% |

| Equitas Small Finance Bank | 7.10% | 7.15% | 7.35% | 6.75% | 6.75% | 6.75% |

| ESAF Small Finance Bank | 7.50% | 7.25% | 7.00% | 7.00% | 7.00% | 6.50% |

| Fincare Small Finance Bank | 6.95% | 7.10% | 7.30% | 7.30% | 7.50% | 6.50% |

| Jana Small Finance Bank | 7.75% | 8.00% | 8.00% | 7.00% | 7.50% | 6.50% |

| Suryoday Small Finance Bank | 7.25% | 7.50% | 7.75% | 7.75% | 9.00% | 7.25% |

| Ujjivan Small Finance Bank | 6.95% | 6.95% | 6.50% | 6.25% | 6.25% | 6.00% |

| Utkarsh Small Finance Bank | 7.75% | 8.00% | 7.75% | 7.75% | 7.75% | 7.75% |

| North East Small Finance Bank | 7.50% | 8.00% | 8.00% | 7.00% | 7.00% | 6.50% |

| SBI | 5.10% | 5.10% | 5.30% | 5.30% | 5.40% | 5.40% |

Updated: July 5, 2020

Should you Invest in Small Bank NRI FDs?

All the small banks listed above have 2% to 3% higher interest on FDs as compared to SBI and other bigger banks. The question is should you invest in them. My take is all the above banks are new but well regulated by RBI. You can invest up to Rs 5 lakh in these banks as that is the amount insured. The only thing to keep in mind is to keep eyes and ears open for any events that may adversely impact the bank.

NRE FD Rates

For comparing the best interest rates on fixed deposits over different duration of investment, we have it divided into following 3 slabs:

- FD for 1 to 2 years

- FD for 2 to 5 Years

- FD for 5 to 10 years

Interest Rate for NRE Fixed Deposit of 1 – 2 Years

The highest interest rate is offered by DCB Bank (18 Months) and IDFC First Bank (1 Year to 10 Years) at 7.25%.

| Bank | Description | Interest Rate | |

| DCB Bank | 18 months | 7.25% | |

| IDFC First Bank | 1 year – 10 years | 7.25% | |

| DCB Bank | More than 18 months to less than 36 months | 7.20% | |

| RBL Bank | 12 months to less than 24 months | 7.20% | |

| DCB Bank | 15 months to less than 18 months | 7.00% | |

| DCB Bank | 12 months 1 day to less than 15 months | 6.90% | |

| Lakshmi Vilas Bank | 400 Days | 6.75% | |

| Yes Bank | 1 year to 10 years | 6.75% | |

| Standard Charted Bank | 1 Year – 375 days | 6.30% | |

| Bandhan Bank | 1 year to 18 months | 6.25% | |

| IndusInd Bank | 1 Years to below 3 years | 6.25% | |

| Lakshmi Vilas Bank | 365 Days to less than 3 Years | 6.25% | |

| Bandhan Bank | Above 18 months to less than 3 years | 6.15% | |

| Tamilnad Mercantile Bank | 1 Year to less than 2 years | 6.10% | |

| Tamilnad Mercantile Bank | 2 years to less than 3 years | 6.00% | |

| South Indian Bank | 18 months | 5.90% | |

| Tamilnad Mercantile Bank | 3 years to 10 years | 5.90% | |

| Dhanlaxmi Bank | 640 days | 5.85% | |

| Federal Bank | 15 Months | 5.85% | |

| Dhanlaxmi Bank | 500 days | 5.80% | |

| Dhanlaxmi Bank | Above 2 years upto & inclusive of 10 years | 5.80% | |

| Karur Vysya Bank | 1 year to less than 2 years | 5.80% | |

| CSB Bank | 15 months | 5.75% | |

| City Union Bank | Above 1 year and up to 3 years | 5.75% | |

| Dhanlaxmi Bank | 1 Year and above upto & inclusive of 2 years | 5.75% | |

| IDBI Bank | > 1 year – 2 years | 5.75% | |

| Indian Overseas Bank | 444 days | 5.75% | |

| Karnataka Bank | 1 year to 2 Years | 5.75% | |

| Federal Bank | Above 1 Year | 5.70% | |

| IDBI Bank | 1 Year | 5.70% | |

| Indian Overseas Bank | 1 year to < 10 years | 5.70% | |

| South Indian Bank | 361 days to 10 Years | 5.70% | |

| Federal Bank | 1 year | 5.60% | |

| Punjab and Sind Bank | 1 Year – 10 Years | 5.55% | |

| Bank of India | 1 Year & above but less than 2 Yrs | 5.50% | |

| Canara Bank | 1 year & above to less than 3 years | 5.50% | |

| CSB Bank | 1 Year to 10 Years | 5.50% | |

| City Union Bank | 1 year | 5.50% | |

| DCB Bank | 12 months | 5.50% | |

| Axis Bank | 11 months 25 days < 1 year 5 days | 5.45% | |

| Axis Bank | 18 Months < 2 years | 5.45% | |

| Axis Bank | 1 year 5 days < 18 months | 5.40% | |

| ICICI Bank | 1 year < 18 months | 5.15% | |

| ICICI Bank | 18 months days to 3 years | 5.35% | |

| State Bank of India | 1 years to less than 3 years | 5.10% |

NRE VS NRO Account

As you become NRI, you can no longer use the regular savings account. You need to open NRE or NRO account. We have a detailed post on NRE VS NRO account and which one is the right choice for you?

Interest Rate for NRE Fixed Deposit of 2 – 5 Years

The highest interest rate is offered by RBL Bank (36 months to 36 months 1 day) at 7.50%

| Bank | Description | Interest Rate | |

| RBL Bank | 36 months to 36 months 1 day | 7.50% | |

| DCB Bank | 36 months to 120 months | 7.35% | |

| IDFC First Bank | 1 year – 10 years | 7.25% | |

| RBL Bank | 24 months to less than 36 months | 7.25% | |

| DCB Bank | More than 18 months to less than 36 months | 7.20% | |

| Deutsche Bank | 5 years | 7.00% | |

| RBL Bank | 36 months 2 days to less than 60 months | 7.00% | |

| Yes Bank | 2 years < 3 years | 7.00% | |

| IndusInd Bank | 3 years to below 61 month | 6.75% | |

| Yes Bank | 1 year to 10 years | 6.75% | |

| IndusInd Bank | 1 Years to below 3 years | 6.25% | |

| Lakshmi Vilas Bank | 365 Days to less than 3 Years | 6.25% | |

| Standard Charted Bank | 375 days to less than 3 years | 6.20% | |

| Bandhan Bank | Above 18 months to less than 3 years | 6.15% | |

| Bandhan Bank | 3 years to less than 5 years | 6.10% | |

| Lakshmi Vilas Bank | 3 Years to less than 10 Years | 6.10% | |

| Karur Vysya Bank | 3 years and above | 6.00% | |

| Standard Charted Bank | 3 years to 5 years | 6.00% | |

| Tamilnad Mercantile Bank | 3 years to 10 years | 5.90% | |

| Karur Vysya Bank | 2 years to less than 3 years | 5.85% | |

| Dhanlaxmi Bank | Above 2 years upto & inclusive of 10 years | 5.80% | |

| IDBI Bank | 5 years | 5.80% | |

| City Union Bank | Above 1 year and up to 3 years | 5.75% | |

| Karnataka Bank | Above 2 Year to 10 years | 5.75% | |

| Federal Bank | Above 1 Year | 5.70% | |

| IDBI Bank | >2 years to < 5 years | 5.70% | |

| Indian Overseas Bank | 1 year to < 10 years | 5.70% | |

| South Indian Bank | 361 days to 10 Years | 5.70% | |

| Punjab and Sind Bank | 1 Year – 10 Years | 5.55% | |

| Axis Bank | 2 years < 10 years | 5.50% | |

| City Union Bank | Above 3 years and up to 5 years | 5.50% | |

| ICICI Bank | 18 months days to 3 years | 5.35% | |

| ICICI Bank | 3 years 1 day to 10 years | 5.50% | |

| State Bank of India | 1 years to less than 3 years | 5.10% | |

| State Bank of India | 3 years to less than 5 years | 5.30% |

Latest FCNR Rates for USD, HKD & SGD

FCNR is a great investment as its safe and offers higher returns that the country you live in. Also interest earned on FCNR deposits is tax free in India. FCNR deposits also do away from the currency fluctuation risk. You can get the latest rate on FCNR interest rates on our website. Click for lates USD FCNR, SGD FCNR & HKD FCNR.

Interest Rate for NRE Fixed Deposit of 5 – 10 Years

The highest interest rate is offered by DCB Bank (36 months to 120 months) at 7.35%.

| Bank | Description | Interest Rate |

| DCB Bank | 36 months to 120 months | 7.35% |

| IDFC First Bank | 1 year – 10 years | 7.25% |

| RBL Bank | 60 months to less than 120 months | 7.15% |

| Yes Bank | 1 year to 10 years | 6.75% |

| IndusInd Bank | 61 month and above | 6.65% |

| Lakshmi Vilas Bank | 3 Years to less than 10 Years | 6.10% |

| Bandhan Bank | 5 years to upto 10 years | 6.00% |

| Karur Vysya Bank | 3 years and above | 6.00% |

| Tamilnad Mercantile Bank | 3 years to 10 years | 5.90% |

| Dhanlaxmi Bank | Above 2 years upto & inclusive of 10 years | 5.80% |

| Karnataka Bank | Above 2 Year to 10 years | 5.75% |

| Federal Bank | Above 1 Year | 5.70% |

| IDBI Bank | > 5 years – 7 years | 5.70% |

| Indian Overseas Bank | 1 year to < 10 years | 5.70% |

| South Indian Bank | 361 days to 10 Years | 5.70% |

| Punjab and Sind Bank | 1 Year – 10 Years | 5.55% |

| Axis Bank | 2 years < 10 years | 5.50% |

| ICICI Bank | 3 years 1 day to 10 years | 5.50% |

| State Bank of India | 5 years and up to 10 years | 5.40% |

NRI FD Rates Rules

Before you invest in NRE FDs you must be aware of following rules:

1. The minimum tenure for NRE FD/RD is 1 year (as per RBI Directives from July 17, 2003).

2. The maximum deposit tenure offered by most banks is 10 years.

3. The interest earned on NRE FD is tax free in India but it can be taxed in country of your residence. For e.g. USA taxes worldwide income and hence NRIs from USA may have to pay tax in USA.

4. NRE Fixed Deposit makes excellent investment opportunity for NRIs from lower or NO income tax countries like UAE, Singapore, etc.

5. The principal and interest from NRE FD/RD is freely repatriable.

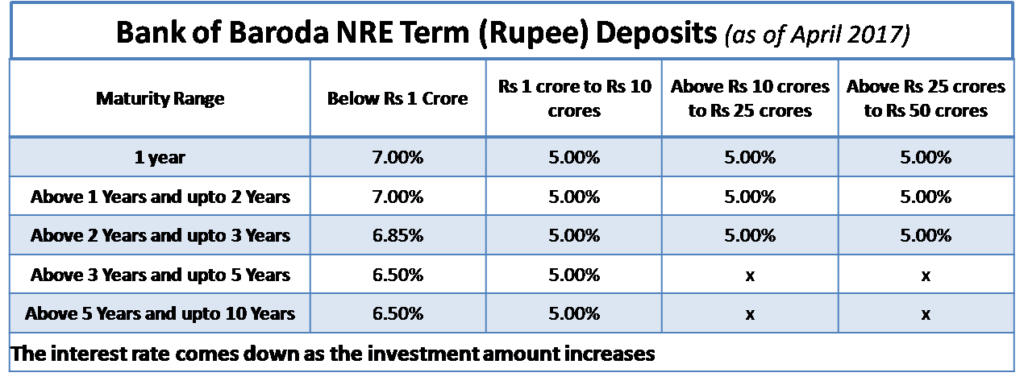

6. Most banks offer higher interest rate on lower deposit amount (less than Rs 50 lakhs/1 crore). It makes sense to split your FD in multiple smaller FDs to get the highest interest rate.

7. There is NO additional interest for Senior Citizens or bank staff for NRE deposits.

8. Premature closure of FD/RD is permitted for with some penalty on the interest (usually 1% lower interest than applicable rates). Some banks waive off this penalty. However there would be NO interest in case the NRE deposit remained invested for less than 1 year.

9. The interest is compounded quarterly for most banks

10. Only funds from overseas income (in foreign currency) can be deposited for NRE FD/RD account. The amount is converted to Indian Rupee on deposit.

NRE Fixed Deposit FAQs

✅Which is the best NRE fixed deposit scheme in India?

RBL (Ratnakar bank) offers the highest interest rate of 7.5% for 36 months to 36 months 1 day NRE FD. Some other banks like Lakshmi Vilas Bank, DCB Bank, Lakshmi Vilas Bank and Tamilnad Mercantile Bank offer high interest rate across most tenures.

✅What is best NRE FD for 1 year?

✅What is best NRE FD for 2 years?

✅What is best NRE FD for 3 years?

✅What is best NRE FD for 5 years?

✅What is best NRE FD for more than 5 years?

✅What is the tenure of NRE fixed deposits?

✅Are NRE FDs safe?

Generally speaking NRE FDs are safe as banks are rigorously monitored by RBI. The NRE FD in Government owned banks like SBI, PNB are the safest. This is because government would intervene and pay the depositors. Next is big private banks like ICICI & HDFC followed by smaller private banks. After this we have small finance banks. Co-operative banks are worst of the lot and I would not trust them with my money. So until there are compelling circumstances keep away from co-operative banks. You can learn from recent example where Yes Bank was rescued by the government and no depositors suffered. However depositors of PMC Bank (a co-operative bank) are still suffering. You can learn more about this in our detailed article about How safe is your Bank Fixed Deposit?

✅Should I choose NRE FD or FCNR?

The good thing about both NRE and FCNR deposit is that the interest received in tax free for both. Also the money from both accounts is easily repatriable.

FCNR is suited if you want to keep your investment in Foreign currency like USD. This gets rid of the currency fluctuation risk. However if you want to convert your money to Indian rupee, NRE account makes more sense as the interest rate offered is also higher.

Leave a Reply