Executive Summary

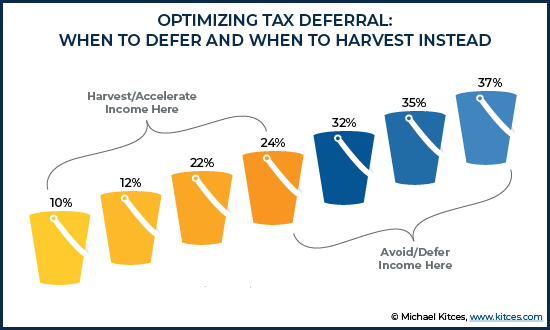

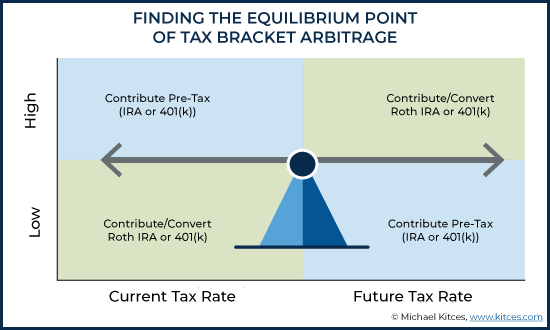

For many high-income clients, financial advisors recommend deferring income as a strategy to mitigate taxes, especially when the client is in a high tax bracket and expects to be in a lower tax bracket in the future as income levels decline (e.g., after retirement). However, in the opposite circumstance, when current taxable income is lower than anticipated future income (e.g., because the client is building substantial wealth), it can be beneficial instead to harvest income instead, take advantage of the taxpayer’s lower tax bracket, and limit the amount of income deferred into the future which would presumably be taxed at a higher rate anyway (as the more income that is deferred to the future, the greater the risk of bumping up the taxpayer into an even higher tax bracket as a result!). But how does the financial advisor choose the best strategy when it comes to avoiding too much tax deferral and harvesting income instead, especially when there are opportunities to harvest both ordinary income (e.g., Roth conversions) and also capital gains (at their own preferential rates and tax bracket thresholds)?

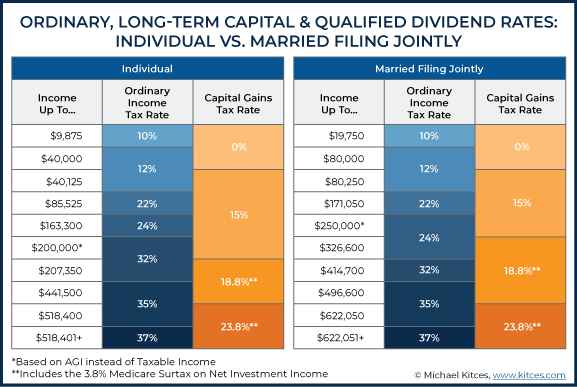

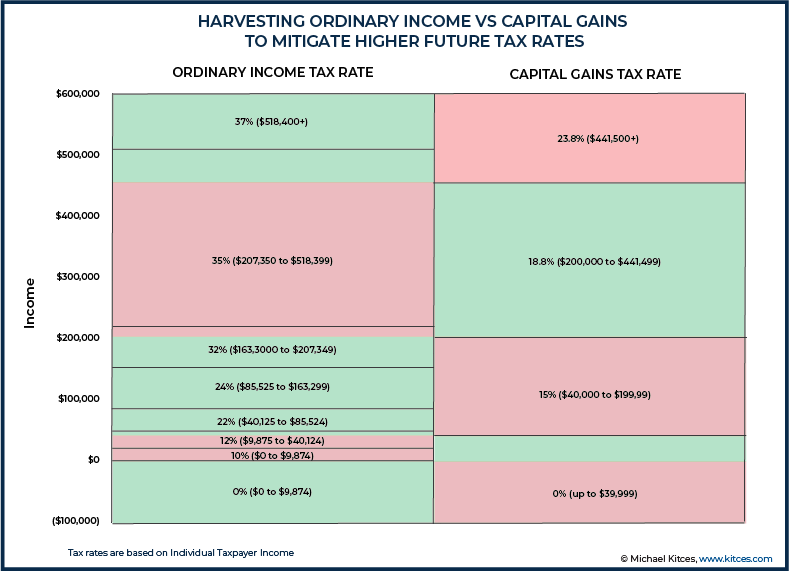

Advisors choosing between these methods – and whether to harvest ordinary or capital gains income – should consider the tax rate brackets associated with each income type to assess how to most effectively minimize overall tax liability (both now and in the future), as well as the “Capital Gains Bump Zone” – where the marginal tax rate on ordinary income can be driven substantially higher by indirectly driving capital gains (along with income generated from qualified dividends) into higher capital gains brackets as well. Because capital gains may be harvested at 0% for those in the bottom two tax brackets… but only if other ordinary income doesn’t ‘crowd out’ those lower tax brackets first!

Accordingly, financial advisors can design optimal income harvesting strategies for their clients by considering when it’s better to harvest ordinary income at its brackets, versus capital gains at those brackets, depending on the relative outlook for each in the future. For instance, those in the 0% ordinary income tax bracket can benefit more from harvesting additional ordinary income (versus capital gains) at 0%, as the jump to the next ordinary income tax bracket (once income turns from negative to positive) is significant. However, for clients in the 10% or 12% ordinary tax bracket (but still in the 0% capital gains tax bracket), it’s often better to harvest capital gains income (versus ordinary income) to reduce the impact of future capital gains income taxed at the 15% capital gains rate (and thus minimizing a 15% increase in capital gain taxation from 0%, compared to a 10% increase, from 12% to 22%, in ordinary income tax). In other words, the choice to harvest either ordinary or capital gains income will largely depend on how that additional harvested income will impact future income tax rates (for that particular type of income, given that individual’s own income growth trajectory).

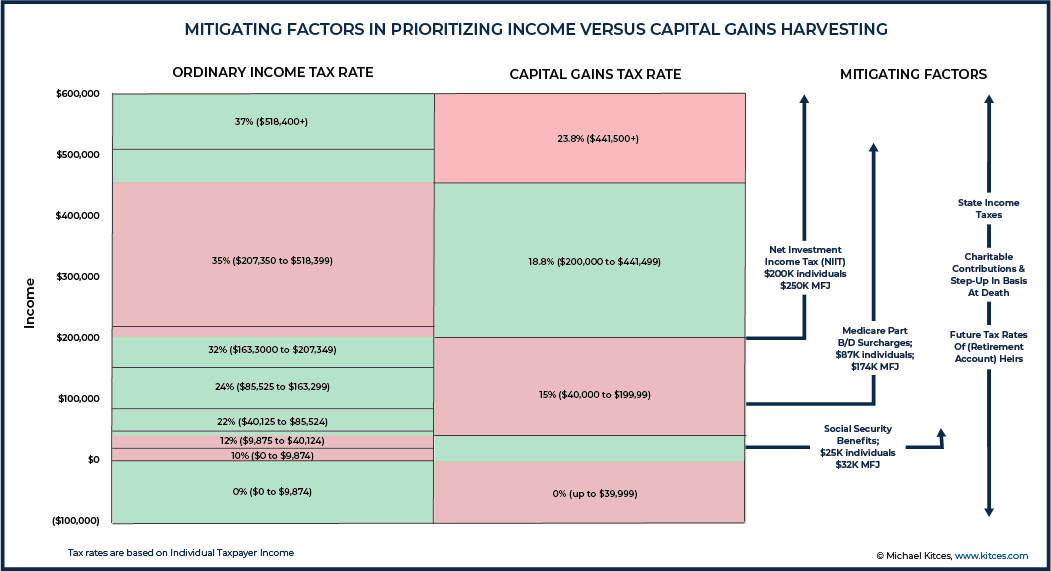

However, the changes in ordinary and capital gains tax brackets as income itself rises (if only through the impact of deferring that income in the first place) are not the only factors to consider when deciding whether to harvest income, though, as there are other mitigating factors that will impact a taxpayer’s overall tax liability. These include the taxation of Social Security benefits, which phases in as income levels rise (such that harvesting income can actually trigger taxation of these benefits); Medicare Part B and Part D Premium Surcharges, which increase with higher income levels; and the Net Investment Income Tax (NIIT), which increases part of the 15% and the entire 20% capital gains tax brackets by 3.8% and applies not just to capital gains income but also to interest and dividend income as well (except for IRA withdrawals, including those carried out for Roth conversions, which are not subject to NIIT). Financial advisors should also consider the impact of state income taxes (especially if the client is planning to relocate to a different state in the future), and charitable contributions, as well as the step-up in basis of inherited assets received by beneficiaries, and even the beneficiaries’ own tax rates.

Ultimately, the key point is that financial advisors whose clients have lower tax rates today should be wary about deferring income at those low rates – often causing higher rates in the future – and instead can soften the impact of higher future tax rates by strategically harvesting ordinary and/or capital gain income today (with their separate tax bracket structures). However, there are several mitigating factors (such as Social Security, Medicare premiums, and the Net Investment Income Tax) that need to be considered when designing a suitable strategy for the client, and because of the unique tax rates (and bracket structures, and strategies) of ordinary income versus capital gains, it’s often necessary to navigate from year to year which is actually the ‘optimal’ strategy to pursue!

The Value Of Harvesting Income (At 0% Rates) Instead Of Losses

The standard approach to managing and minimizing long-term tax liabilities is relatively straightforward: defer, defer, defer, avoid, avoid, avoid. As no one wants to pay taxes any sooner than they have to – in the long run, it’s cheaper to defer those taxes and pay them with discounted future dollars – and in the best of outcomes, the taxes can be avoided altogether.

Except the caveat is that there is such thing as being “too good” at tax deferral. Because with our progressive tax system – with higher tax rates on higher levels of income – extensively deferring income results in it bunching together in a manner that drives up the tax rates.

Of course, for those who are already in the top tax brackets, it’s not possible to drive tax rates materially higher in the future anyway, which still makes “defer, defer, defer” the optimal strategy. But for those who are not in top tax brackets, deferring income too aggressively can cause future tax liabilities to increase by more than the discounting benefit of deferring them in the first place! In such scenarios, it’s often actually better to take advantage of lower current tax rates instead!

In other words, while at higher income levels it’s appealing to defer tax liabilities (such as engaging in tax-loss harvesting to offset current gains) and take advantage of the time value of money, at lower income levels it’s often better to harvest the income instead, accelerating the income from the future into the present to avoid the clustering effect that can drive up tax rates in the future.

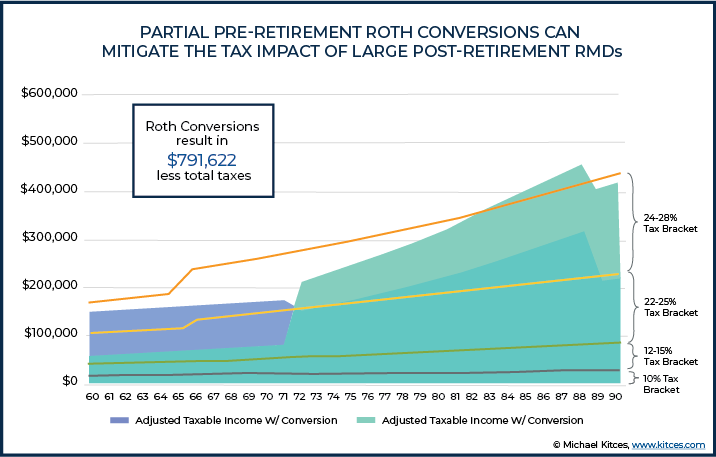

Example 1. Dorothy is a 60-year-old widow who recently retired with $25,000/year in Social Security widow’s benefits and an inflation-adjusting survivorship pension of $45,000/year. In addition, she has a $300,000 brokerage account, and a $1.5M IRA. When Dorothy turns 72, and her Required Minimum Distributions begin, her IRA is projected to be almost $3.4M, which will produce an RMD of almost $132,000… which, stacked on top of her inflation-adjusted pension and Social Security benefits (which will rise to almost $100,000/year at a 3% inflation rate) will drive Dorothy up into the 32% tax bracket, with more and more of her future RMDs taxed at 32% as the RMD obligation grows with age.

To manage the exposure, Dorothy decides to begin doing partial Roth conversions today of $90,000/year, all of which will be taxed in either her current 22% tax bracket or the 24% tax bracket. By repeating this process every year, Dorothy is able to substantially slow the growth of her pre-tax IRA to be ‘only’ $2.1M by age 72, which will result in an RMD of only $84,000… similar to her ongoing withdrawals during the interim years, and leaving her room to avoid ever being subjected to the 32% tax bracket in the future!

In essence, the value of income harvesting strategies is “tax-rate arbitrage” – the opportunity to shift income from higher-tax-rate years (in the future) to lower tax rate years (today) – creating wealth through the difference in prospective tax rates. In other words, for income that was otherwise inevitably going to be recognized and taxable someday no matter what, triggering that income in lower tax rate years instead of higher tax rate years is effectively ‘free’ wealth creation (in that it doesn’t require taking on risk to generate the additional wealth, simply harvesting the available tax rates).

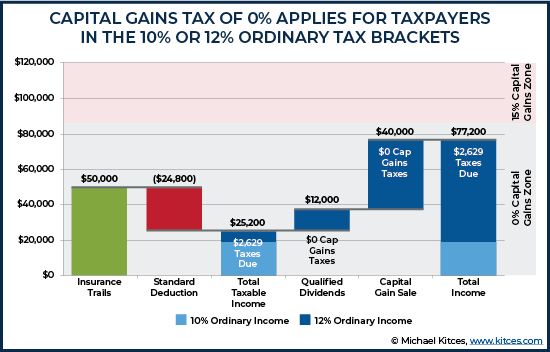

However, income harvesting strategies can be especially appealing in scenarios where the income itself can actually be harvested tax free (i.e., at a 0% tax rate). For instance, those who are in the bottom two ordinary income tax brackets (i.e., the 10% and 12% brackets) are eligible for a 0% long-term capital gains rate on any capital gains (or qualified dividends) that also fall within those tax brackets (at least for Federal tax purposes).

Example 2. Rose and Charlie retired early at age 55, living off of $50,000/year of Charlie’s insurance trails (as a former insurance agent), plus $1,000/month from the dividends generated by a $400,000 brokerage account (which include $70,000 of embedded capital gains from recent market growth), while they wait for their Social Security benefits to begin (and wait to tap Charlie’s $300,000 IRA).

With a standard deduction of $24,800 in 2020, the couple’s ordinary income (after deductions) is only $50,000 – $24,800 = $25,200, placing the couple at the bottom end of the 12% tax bracket (which in 2020 runs from $19,750 to $80,250 of income after deductions). In fact, even with the additional $12,000/year of dividends, the couple’s income would still be in the 12% tax bracket… which means their (assumed-to-be-qualified) dividends are eligible for a 0% tax rate!

Accordingly, the couple chooses to proactively sell the most appreciated investments (a $90,000 ETF with a $50,000 cost basis) in their brokerage account to “cause” a $40,000 long-term capital gain, bringing their total income up to $50,000 + $12,000 + 40,000 – $24,800 = $77,200.

Because their total income after deductions is still below the $80,250 upper threshold for the 12% tax bracket, they will enjoy a 0% Federal tax rate on both the qualified dividends and the $40,000 of long-term capital gains.

In the meantime, Rose and Charlie immediately buy back the ETF for the current $90,000 market value… effectively stepping up their cost basis from the prior $50,000 to $90,000 instead (without any complications from the wash rule sales, which technically apply only to harvesting losses but not gains!).

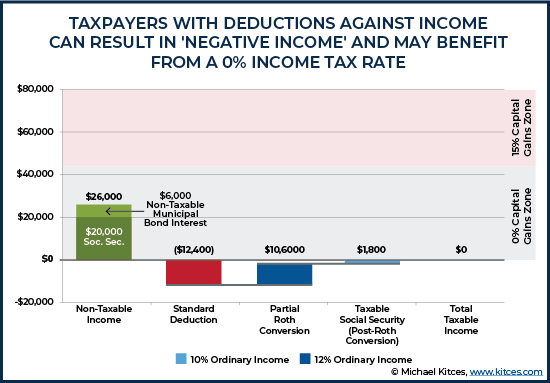

In addition, those who have tax deductions that exceed their total income – in essence, having “negative income” – can benefit from a 0% tax rate on Roth conversions or other ordinary income tax events (as increasing income from negative to zero still won’t owe any taxes on the additional income!).

Example 3. Blanche is a 60-year-old widow who lives in a fully-paid-off Florida home, living primarily off her husband’s Social Security survivor benefits of $24,000/year, plus $500/month that she generates via tax-free municipal bond interest from a $300,000 brokerage account (while she leaves her $300,000 IRA untouched until the RMD phase more than a decade from now).

For income tax purposes, Blanche’s Social Security benefits are not taxable (as her Social Security provisional income is 50% x $24,000 + $6,000 (bond interest) = $18,000, well below the $25,000 threshold that triggers taxation of Social Security.

As a result, Blanche’s total taxable income is $0 (as her $24,000 of Social Security benefits are not taxable, nor is the $6,000/year of municipal bond interest), which means with a $12,400 standard deduction, Blanche’s taxable income will actually be -$12,400!

Accordingly, Blanche decides to do a $10,600 partial Roth conversion, which increases her income by $12,400 (as it causes her Social Security provisional income to rise to $28,600, causing $1,800 of her Social Security benefits to become taxable). Still, though, Blanche’s actual tax liability is not increased at all, as her standard deduction of $12,400 is still enough to perfectly offset the $12,400 of additional income.

Thus, in the end, Blanche is able to move $10,600 from her IRA to a Roth IRA at a tax rate of 0%! (Which is a hard deal to beat in the future, as tax rates can’t really improve beyond 0%!)

Navigate The Capital Gains Bump Zone When Harvesting Ordinary Income And Capital Gains

While there is obvious appeal to harvesting income at 0% rates – whether ordinary income (e.g., via Roth conversions) to offset negative taxable income or long-term capital gains eligible for 0% rates – an important caveat to such strategies is that it’s not always possible to do both at the same time. The reason is 0% income can actually crowd out 0% capital gains or, at worst, trigger a phenomenon known as the Capital Gains Bump Zone.

The fundamental challenge is that while capital gains that fall within the bottom two ordinary income tax brackets (i.e., 10% and 12%) may be eligible for 0% capital gains rates, it is still income for tax purposes in the first place. Similarly, ordinary income that is offset by deductions (even and especially when deductions exceed income, producing ‘negative’ taxable income) is still income for tax purposes as well. Thus why, even as those types of income may benefit from 0% tax rates, eventually the 0% tax rate ends and additional income is subject to higher tax rates (as either the ordinary income surpasses the available deductions and becomes taxable again, or the capital gains fall into higher tax brackets and are once again subject to the standard 15% tax rate on long-term capital gains).

Importantly, though, this means that income of one type can “crowd out” the favorable tax rates of the other type. For which the Internal Revenue Code actually provides sequencing rules for how ordinary income and capital gains (and the prospective deductions that may offset them) will be applied to determine taxable income:

- Ordinary income

- Deductions applied against ordinary income

- Capital gains (stacked on top)

Which means in practice, engaging in partial Roth conversions (or in general, anything that generates additional ordinary income) reduces the amount of ‘room’ that remains to capture 0% long-term capital gains.

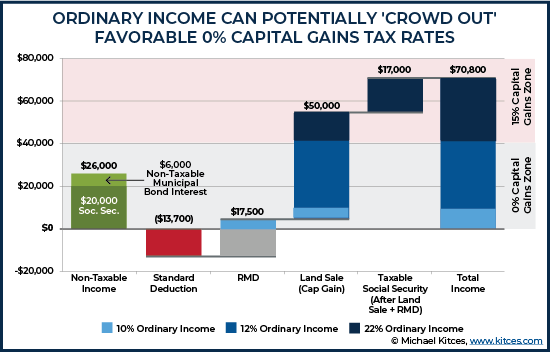

Example 4. Sophia is a 75-year-old widow who receives $20,000/year of Social Security widow’s benefits, generates $6,000/year of tax-free municipal-bond income from her $200,000 portfolio, and has no other income outside of prospective withdrawals from her $400,000 IRA.

In Sophia’s situation, her Social Security benefits would not be taxable (as her Social Security provisional income does not exceed $24,000), nor would her municipal bond income be taxable, which after her $12,400 (standard deduction) + $1,300 (additional amount for being over age 65) = $13,700 of deductions would result in $13,700 of negative taxable income.

Sophia also has an old plot of family land that was originally purchased for next to nothing (i.e., a ‘zero’ cost basis), and is currently valued at $50,000, that she would like to sell and take advantage of the 0% capital gains rate… as even with an additional $50,000 of capital gains income, her total income after deductions would be -$13,700 + $50,000 = $36,300, less than the $40,125 threshold for the 12% tax bracket for ordinary income tax purposes.

However, Sophia has forgotten that she will also have a required minimum distribution this year (of approximately $17,500), which will more-than-absorb her negative taxable income, such that in reality, she will only have about $36,000 of capital gains potential at 0% rates (the excess of $40,125 over $17,500 – $13,700). In other words, Sophia’s ordinary-income RMD crowds out her room for 0% capital gains.

In addition, the combination of long-term capital gain and the RMD are both treated as “income” when determining how much of Sophia’s Social Security benefits will be taxable! In fact, Sophia’s provisional income for Social Security would be $20,000 x 50% + $6,000 (municipal bond income) + $17,500 (RMD) + $50,000 (long-term capital gain) = $83,500, more than enough to cause the maximum 85% of Sophia’s Social Security benefits to be taxable.

As a result, Sophia’s ordinary income would actually be $17,000 (taxable Social Security benefits) + $17,500 (RMD) – $13,700 = $20,800, leaving less than $20,000 of ‘room’ for Sophia’s capital gains to be eligible for 0% rates. Consequently, if Sophia had already taken the $50,000 capital gain, almost $30,000 of it would be taxable at 15% long-term capital gains rates instead!

As the above example of sequencing rules show, it’s extremely important to consider how ordinary income may ‘crowd out’ the available room for 0% capital gains rates, or there is a risk that capital gains may unwittingly be claimed at higher-than-anticipated tax rates.

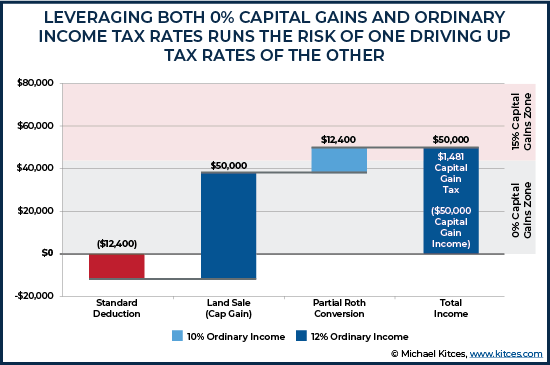

However, the situation can present an even more direct conflict for those who are outright eligible for both 0% ordinary income tax rates and 0% long-term capital gains.

Example 4b. Continuing the prior example, assume instead that Sophia was still 15 years younger, and decided to take advantage of her favorable tax situation, long before her Social Security benefits and Required Minimum Distributions would begin (and throw off her ability to maximize the value of the rules).

Thus instead, as a 60-year-old, Sophia decided to minimize her income for the current year – by drawing for spending solely from existing cash in her bank account, and her municipal bond income – and simply has -$12,400 of taxable income (her Standard Deduction), to leave room to take the $50,000 long-term capital gain on her family real estate sale.

The good news is that Sophia can harvest a $50,000 capital gain at 0% tax rates, a combination of $12,400 that is fully offset by her Standard Deduction, and the remaining $37,600 that is eligible for 0% long-term capital gains rates (as it’s below the $40,125 threshold).

However, the caveat is that Sophia didn’t effectively use her $12,400 standard deduction, as she didn’t ‘need’ the deduction to offset her capital gains to get 0% rates, and could have used it to offset some other ordinary income (e.g., a portion of her IRA withdrawals or a partial Roth conversion) that would otherwise be taxed at higher rates.

Accordingly, Sophia decides before the end of the year to do a $12,400 partial Roth conversion to absorb her Standard Deduction, correctly recognizing that the deduction will be applied (favorably) against her ordinary income first, while her long-term capital gain subsequently stacks on top.

However, the end result is that once the $50,000 long-term capital gain stacks on top of income of “just” $0 (and not -$12,400 with her Standard Deduction), Sophia’s total income of $50,000 will exceed the $40,125 threshold of the 12% tax bracket, resulting in the $9,875 excess triggering $1,481 of capital gains taxes at the 15% rate!

Consequently, even though Sophia’s $12,400 partial Roth conversion was eligible for a 0% tax rate, it ended out causing $1,481 of indirect taxes anyway (an effective rate of almost 12%), as the ordinary income “bumped up” the capital gains tax rate!

In other words, while it’s possible to take advantage of 0% capital gains rates and 0% ordinary income tax rates, doing both at the same time can cause the favorable treatment of one to drive up the tax rates of the other.

The Hierarchy Of Sequencing Roth Conversions Versus Harvesting Capital Gains

The fact that harvesting ordinary income (e.g., via partial Roth conversions) can crowd out long-term capital gains means that in practice, it’s crucial to consider when each should take priority over the other (or not). Which is relevant not only in situations where either or both may be eligible for 0% tax rates, but more generally in any situation where it may be appealing to harvest income at current tax rates in order to avoid potentially higher tax rates in the future (e.g., harvesting capital gains at 15% to avoid 18.8% or 23.8% rates in the future, or harvesting ordinary income at 22% or 24% rates to avoid 32%+ rates in the future).

As while the optimal Tax Equilibrium point may vary from one client to the next, anyone and everyone faces the potential challenge that deferring “too much” income into the future will drive up their future tax rates (but that harvesting too much income today just increases their tax rates too much today!).

Because the underlying benefit of income-harvesting strategies is tax rate arbitrage – creating wealth through the difference in tax rates by attempting to trigger income at lower tax rates today than it would have been subject to by deferring into the future – the “optimal” outcomes will generally be those that produce the largest change in tax rates by choosing to harvest the income today.

Accordingly, harvesting ordinary income at 0% tax rates is often the most appealing when available, as doing so will generally at least save 10% in ordinary income tax rates (the first tax bracket), but can potentially save at a 12%, 22%, 24%, 32%, 35%, or even 37% tax rate, depending on whatever the future tax rate was projected to be. Especially since a deduction today that results in negative income is permanently lost to the extent it’s not used (whereas capital gains eligible for 0% rates that are not used may at least be potentially harvested again in a future year where other income simply remains ‘low enough’ to remain in the bottom two tax brackets).

Next is to fill up the bottom two (10% and then 12%) tax brackets with 0% capital gains rates if available. As the next capital gains tax rate is 15% – which is a 15 percentage point increase – while ordinary income rates increase by “just” 10 percentage points to the next 22% ordinary income bracket. And, again, it’s hard to ever beat “0%” in the future (even if the tax laws someday change!).

Once into the “mid-tier” tax brackets – 22% and 24% – the priority shifts again, as capital gains quickly become subject to an 18.8% tax bracket (at $200,000 of AGI for individuals, or $250,000 for married couples), leaving only a potential 5 percentage point increase at the top capital gains rates (23.8%), while ordinary income tax rates jump by 8 percentage points to the next (32%) tax bracket (and can climb further from there to 35% and 37%). Especially since the increase in ordinary income rates comes sooner (the 32% tax bracket begins at $163,300 for individuals or $326,600 for married couples) than the increase for capital gains (which doesn’t kick in until $441,500 for individuals or $496,600 for married couples). Which makes it more appealing to capture ordinary income at those 22% and 24% rates to ensure the 32%+ rates that may loom larger never actually come.

On the other hand, for those in the 35% ordinary income tax bracket, the potential ordinary income rate increase is at least only 2 percentage points more (from 35%to 37%), while those subject to the 18.8% capital gains tax rate may soon face a 5 percentage point increase (to 23.8%). Which makes it more appealing to once again harvest capital gains at “just” 18.8% and avoid 23.8%. Until the upper end of the 35% bracket is reached (and 23.8% capital gains rates have already been breached), at which point any remaining room in the 35% tax bracket is the best deal remaining (albeit only a 2 percentage point savings before the top 37% tax bracket kicks in).

Mitigating Factors In Prioritizing Income Versus Capital Gains Harvesting

While tax brackets are the primary driver of one’s tax rate – in order to figure out whether it’s better to harvest at current tax rates instead of future tax rates – the tax bracket alone is not the only determinant of the true marginal tax rate. As in practice, a number of other factors may come to bear, which can change the relative value of harvesting ordinary income versus capital gains… or eliminate the value of harvesting income (or capital gains) altogether.

Relevant mitigating factors include:

– Social Security Benefits. For those who receive Social Security benefits, the potential taxation of those benefits – which phases in based on income – is itself an indirect form of marginal tax rate that can substantially increase that tax rate. In practice, the taxation of Social Security benefits will generally occur for those in the 12% ordinary income tax bracket, where each additional dollar of income harvested will not only trigger a 12% tax rate but may also cause $0.50 to $0.85 of every Social Security benefit dollar to be taxed at 12% as well… effectively causing a marginal tax rate of 18% to 22.2% instead, and making the income harvesting far less appealing. Notably, the phase-in of taxable Social Security benefits also applies to additional capital gains (which are still income, and still included in the formula for taxability of Social Security benefits), making the ‘true’ capital gains tax rate 6% to 10.2% (from 50% to 85% of taxable Social Security benefits subject to 12% ordinary income tax rates) instead of just the 0% of the capital gains themselves. On the other hand, it’s notable that the impact of taxable Social Security benefits applies only until the maximum 85%-of-benefits are taxable, beyond which it is no longer a factor anymore (as all the benefits that were going to be taxed have already been impacted at that point).

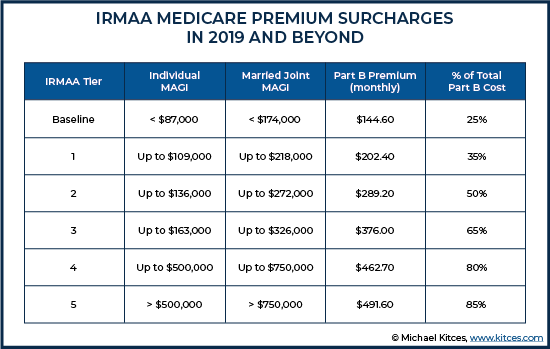

– Medicare Part B and Part D Premium Surcharges. While the monthly premiums of Medicare Part B and Part D are not trivial, in reality, the typical consumer only pays approximately 25% of the underlying premium, with the remainder covered by the Federal government (funded primarily by the Medicare payroll tax). However, higher-income households are required to pay a larger percentage of their Medicare premiums – potentially as high as 85% of the actual premium cost – which in practice means households with more income may be obligated to pay a ‘surcharge’ on their premiums, known as the Income Related Monthly Adjustment Amount (IRMAA). Relative to the income levels that are affected, the IRMAA surcharges do not necessarily materially alter tax strategies – as even the highest surcharge of $321.40/month, which amounts to $3,857/year would only apply to income above $500,000 (for individuals, or $750,000 for married couples) – making it an effective tax rate surcharge of less than 1%. However, the IRMAA surcharges are a form of “cliff” tiers, which means that even $1 across the next threshold triggers the next surcharge. Consequently, while the aggregate impact of IRMAA might be less than 1%, at the margin, an additional $1 of income (to cross the threshold) could trigger nearly $1,000/year in additional surcharges (a -1,000% marginal tax rate!). As a result, it is especially important when considering income harvesting strategies not to cross the IRMAA thresholds (unless they will be crossed by so much that the aggregate impact is diminished… as a $1,000 surcharge on $1 of income is disastrous, but a $1,000 surcharge on an extra $50,000 of income might well be deemed worthwhile to avoid a 5%+ potential change in income tax rates that could cost $2,500+ in taxes instead).

– Net Investment Income Tax (NIIT). The Affordable Care Act of 2010 first introduced a new 3.8% Medicare surtax on “net investment income”, which applies broadly to most types of investment income, including interest, dividends, rents, royalties, annuities, and capital gains. The NIIT causes a portion of the 15% capital gains tax rate to increase to 18.8% and makes the 20% rate a 23.8% capital gains rate in practice. Which both makes it appealing to potentially harvest capital gains below the NIIT threshold to avoid being subject to it in the future. Notably, the NIIT applies more broadly than ‘just’ to capital gains, as it also applies to interest and dividends as well. Also of note, though, is that IRA withdrawals are not subject to the NIIT, which makes strategies like partial Roth conversions exempt from the 3.8% Medicare surtax. However, similar to ordinary income filling lower tax brackets and driving up capital gains, so too can ordinary income fill in the income threshold before the NIIT (which applies at $200,000 of AGI for individuals, or $250,000 for married couples), potentially pushing capital gains over the line to become subject to the NIIT (and making it less appealing to engage in ordinary income harvesting strategies when it may trigger capital gains NIIT indirectly).

– (Changes In) State Income Taxation. While the primary focus of this discussion has been on the Federal taxation of ordinary income and capital gains, the reality is that state tax rates matter, too. In general, though, state tax brackets tend to be flatter and less progressive – i.e., many states have a single flat tax rate, and for many others, it takes very little income to quickly reach a flat, top tax rate. And in many cases, state tax rates simply stack on top of existing Federal income taxes, which means the overall tax burden may be higher, but the relative benefit of accelerating (or deferring) income is equally relevant (i.e., state taxation wouldn’t actually change when/whether it’s better to harvest income, or capital gains, or neither, it simply happens to make the tax bill bigger in the end). Nonetheless, some states do have more progressive rates – where there again is an opportunity to accelerate income at today’s lower rates to avoid higher rates in the future. Though in other cases, an individual may be considering whether to relocate someday and move to another state with an entirely different tax rate altogether – which may make it appealing to harvest more now (i.e., to capture the income at a low-tax-rate state before moving to a state with a higher rate), or to completely unravel an otherwise-appealing harvesting strategy (i.e., saving 10 percentage points on Federal taxes by accelerating income may be fully offset by the fact that the client’s state tax rate today is 10 percentage points higher than the one they plan to retire/relocate to in the future).

– Charitable Contributions And Step-Up In Basis At Death (Alternative Means Of Receiving 0% Capital Gains Rates). When it comes to long-term capital gains, harvesting gains within the bottom two tax brackets is not the only way to be eligible for 0% tax rates; long-term capital gains are also eliminated if held until death (receiving a step-up in basis), or when those appreciated investments are donated to charity (either directly, or via a donor-advised fund). Of course, those outcomes aren’t necessarily relevant for those who aren’t charitably inclined (or don’t plan to donate enough to make a significant dent in their capital gains), or for those who are relatively young (where death and a potential step-up in basis is so many years or decades away that portfolio turnover will likely trigger those capital gains long before step-up in basis may ever apply). Nonetheless, for those where the potential for donating appreciated investments to eliminate capital gains, or hold them until death, is a feasible scenario, the benefit of harvesting capital gains is greatly diminished, and the value of harvesting ordinary income instead may become far more appealing.

– Future Tax Rates Of (Retirement Account) Heirs. For relatively affluent retirees who don’t anticipate needing to use most or any of their retirement accounts beyond the moderate obligation of Required Minimum Distributions, most of the retirement account won’t actually be distributed at their tax rates at all. It will be distributed to their heirs at the beneficiaries’ tax rates instead. Which is important because it means the proper comparison of tax rates to evaluate potential tax rate arbitrage is not the current versus future rate of the account owner, but the account owner’s future tax rate compared to the heir’s tax rate in the future. This cross-generational tax rate comparison may make harvesting strategies even more appealing (e.g., if mass-affluent parents are leaving the funds to their children who are high-income doctors and lawyers), or less appealing (if ultra-high-net-worth parents are distributing the funds widely to children, grandchildren, and charities, at lower tax rates). In addition, state income tax rates may again play a role, where the biggest differential in tax rates may be the difference in state tax rates for heirs living in different states. Which means, again, that the future tax rates of heirs may make income-harvesting strategies like partial Roth conversions more, or less, appealing (at least when it comes to pre-tax retirement accounts… as capital gains being left to heirs are virtually always subject to a 0% future tax rate due to the available step-up in basis).

Ultimately, the benefit of income harvesting strategies is to take advantage of (relatively) lower tax rates today, to avoid the potential of higher tax rates in the future… especially since deferring income itself can cluster income into future years and cause higher tax rates.

However, the fact that ordinary income and capital gains each have their own tax rates, and their own tax bracket thresholds, means that a more nuanced approach is necessary to determine when and whether it is better to harvest ordinary income (e.g., via partial Roth conversions) or capital gains instead… based on an individual household’s own circumstances (and potential mitigating factors).

Fortunately, the fact that financial planners routinely make long-term retirement projections – which helps to show the trajectory of wealth accumulation, and the likely future tax brackets that a household will be subject to – makes it easier to figure out how likely it is that the household’s tax rates really will be higher in the future (making income harvesting appealing) or not.

Either way, though, it’s necessary to monitor the situation from year to year, as relatively moderate changes in the tax situation, or key mitigating factors, can materially alter whether it’s better to harvest ordinary income, or long-term capital gains instead!

Leave a Reply