Executive Summary

The total addressable marketplace for financial advisor technology is limited, with a ‘mere’ few hundred thousand financial advisors (as contrasted with millions upon millions of potential users with direct-to-consumer software). And while at advisor (and especially enterprise) prices, that is still a healthy marketplace for software, it is further limited by the fact that not all advisory firms do the same thing, and the addressable market for any particular software solution may be even more limited (and is further complicated by the fact that overlapping advisor licenses made it difficult to count the exact market opportunity in the first place!). A matter that is both simplified, but also further limited, by the ongoing trend towards industry consolidation, that is splitting the market between a few behemoth wealth management firms (meaning larger but fewer enterprise opportunities), and a flood of small firms (who aren’t necessarily in the market for sophisticated, complex FinTech offerings, and can be expensive and challenging to reach from a software distribution perspective).

Yet despite the limitations in market opportunity, certain categories in the FinTech landscape – in particular, portfolio management systems – continue to grow each year, as more and more competing vendors vie to provide complete end-to-end solutions for (a not necessarily growing number of) advisory firms. And while this trend is certainly a natural stage in any maturing market, the presence of so many portfolio management systems that aim to support almost every step of the investment management process is resulting in an overwhelming array of choices for advisors… none of which are able to really differentiate themselves beyond a variety of increasingly bloated and often cumbersome user experiences. Especially when advisory firms can simply use the growing breadth of API integrations to cobble together their own “best-of-breed” solution anyway.

On the other hand, for many firms, a less-than-perfect all-in-one solution can still be preferable to cobbling together a smorgasbord of what may be “best-of-breed” solutions to address each stage of the portfolio management process, which in practice almost never results in the desired seamless workflow that really passes along relevant data and tasks through the various steps. Instead, firms – especially enterprises – do seem to be shifting towards all-in-one offerings, opting for the “one throat to choke” solution that (at the very least) makes it easier for them to figure out who to blame when something breaks, and leaving one vendor accountable instead of leaving it up to the advisor to manage whatever problems that may arise.

Still, though, the problem remains that more and more competition amongst both best-of-breed and all-in-one portfolio management solutions has left us with a landscape that is crowded with a whopping 50 portfolio management systems for advisory firms to choose from. And with a limited number of opportunities for vendors to target (especially as various custodians develop their own in-house portfolio solutions, such as Schwab’s Portfolio Connect and Fidelity’s WealthScape), conditions are ripe for smaller vendors to either team up, or look for potential buyers, rather than getting squeezed out of business. The current crisis created by the pandemic and the resulting economic downturn will likely only accelerate this process.

Which, at the end of the day, could result in a smaller playing field of portfolio management systems for advisors, and a higher hurdle for any new offerings that will have an even harder time trying to differentiate themselves. Because in the end, advisor choice is good… but do we really need 50 different portfolio management systems today?

“Our danger is not too few, but too many options … to be puzzled by innumerable alternatives.”

— Sir Richard Livingstone, British Scholar

Overchoice or choice overload[1] is a cognitive process in which people have a difficult time making a decision when faced with (too) many options. The term was first introduced by Alvin Toffler in his 1970 book, Future Shock.[2]

“The presumption is, self-determination is a good thing and choice is essential to self-determination,” according to psychologist Barry Schwartz author of “The Paradox of Choice: Why More is Less“. “But there’s a point where all of this choice starts to be not only unproductive, but counterproductive – a source of pain, regret, worry about missed opportunities and unrealistically high expectations.”

This is true whether the consumer is in the supermarket choosing among peanut butter, if they’re a client trying to choose what financial planning recommendations to implement, or if they are a financial advisor in their office trying (and struggling) to choose software. Back in February, I was at the T3 Advisor Conference (remember when we used to go to conferences?) and looking through the list of vendors and starting counting portfolio management applications, and came up with 13. This was by far the most of any category and got me thinking about how many products existed across the industry.

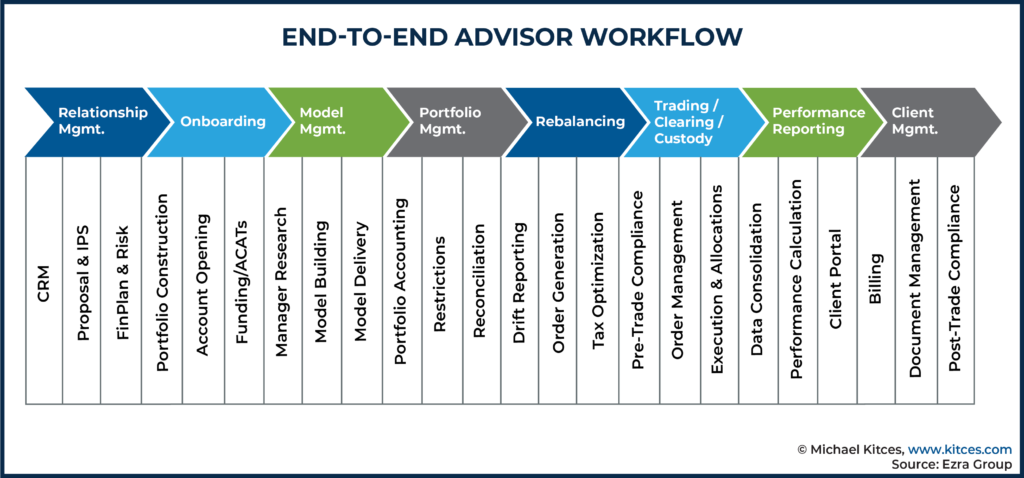

This article started out as a review of portfolio management systems, but I quickly realized that the portfolio management category really doesn’t exist any longer. Except for the few standalone portfolio rebalancing tools (like iRebal, AdvisorPeak, and Smartleaf, and a few others that haven’t been acquired yet), most other products have expanded into end-to-end platforms that support almost every phase of the investment management life cycle from Account Opening through Billing and more.

We see this trend as part of the natural maturity of the market. Vendors are incentivized to add new features, in what we call a “Checklist Race” to check more boxes of desired features when potential clients are evaluating their software or enterprises are bidding out an RFP. Yet while in general, more capabilities are good, as with the Paradox of Choice itself, this often results in systems becoming bloated with menus and configuration screens as they layer on more tools and functionality onto what used to once be a streamlined user experience.

That’s when this article morphed into a look at the overall landscape of end-to-end Advisor Technology Platforms and after extensive research, we came up with a total of 50 products!

What’s Inside An Investment Management Technology Solution?

But what does it mean to be an end-to-end Advisor Technology Platform for investment management? We see a lot of lists that include products that we don’t consider to be portfolio management, or at least don’t have all the elements it currently takes to fully execute the portfolio management process.

Here are the table stakes functionality that we believe need to be included for an end-to-end portfolio management system:

- Account opening

- Model management

- Portfolio construction

- Portfolio accounting

- Portfolio rebalancing

- Trading

- Reconciliation

- Performance Reporting

Additional functionality that some vendors have added beyond this table stakes list includes CRM, proposal generation, billing, financial planning, client portals, and compliance tools, to name a few. I expect the table stakes list to keep growing as vendors struggle to differentiate over the feature list the competition is also trying to keep up with, and clients demand more functionality be integrated into the platforms.

Best-Of-Breed Vs. All-In-One

Why are there so many all-in-one platforms? Doesn’t a large segment of the market believe that selecting the best-of-breed in each category is the best way to go?

The answer is yes, there are many firms that believe in best-of-breed, but plenty more that prefer “one throat to choke” as I once heard an all-in-one platform vendor describe their benefit to clients. In other words, the challenge of the best-of-breed approach is that when something doesn’t work, vendors tend to point at each other and say it’s the other vendor’s fault, and the advisor is left to manage the problem. With an all-in-one solution, there’s one vendor accountable for making it all work together (and it’s no longer the advisor’s responsibility).

Of course, there’s also a wide range of middle options where companies start with an all-in-one vendor but enhance it with point solutions in specific areas. And an emerging trend of many enterprise service providers to/for advisors (e.g., broker-dealers, super-OSJs, advisor networks, etc.) is to cobble together a mix of off-the-shelf products and in-house solutions to create (what they believe to be) an even more valued and differentiated solution.

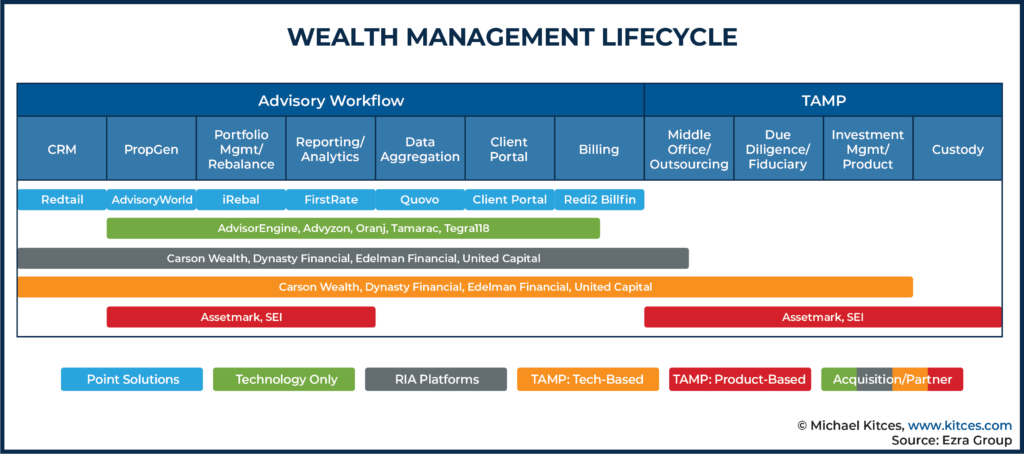

The bottom line is that there is no one right or wrong answer. But we have seen an ongoing trend of vendors slowly but steadily expanding their product functionality horizontally across the wealth management lifecycle to cover more of the advisor’s workflow.

Whether clients can tell the difference or not is another story.

Of course, even the most all-in-one-oriented vendor has integrations to other applications as well. Everybody wants to be at least somewhat “open architecture” now. But they also see the value in having more and more parts of the wealth management life cycle inside their walls.

Advisor experience is becoming more important for firms as well when they make decisions about software. Having a seamless workflow and the ability to pass both relevant data and actual tasks and workflow automations from module to module is a key part of that. While the advancing API Economy has made it easier to share data between applications, it’s still not a cakewalk and requires a strong internal technology team to configure the connections and interface with the different vendors.

I know this because a segment of our consulting business is focused on helping broker-dealers, banks, and asset managers to actually integrate software products that claim to offer seamless integration! I tell all of our clients to forget everything the salespeople told you about how well their application integrates with other vendors, and plan on starting from scratch. It’s difficult and time-consuming to create an architecture and integration plan, work with the vendors to connect their disparate applications, test the integrations, and maintain them going forward.

These vendor promises have been a boon for consultants (like us), but not so great for wealth management firms looking for quick and easy solutions. In other words, even All-In-One solutions have a long way to go to truly be turnkey off the shelf (and Best-Of-Breed approaches just guarantee the integration work that in practice All-In-Ones often end out requiring anyway).

How Many Portfolio Management Solutions For Advisors Are Out There?

The number of solutions in the category of Portfolio Management Systems for financial advisors keeps growing every year, with seemingly no end in sight. It’s a veritable cornucopia of options. Every year I say that we’ve got enough vendors in this space, and we’re ripe for massive consolidation. But we only see a few M&A deals each year, and certainly not enough to even put a dent in the total. And then even more new products appear!

I sometimes wonder how all of these vendors can make enough profit to stay in business? The total addressable market is finite. The potential revenue opportunity is finite. There are only so many RIAs, RIA consolidators, broker-dealers, and other wealth management firms to go around. And broader industry consolidation, amongst both RIAs and broker-dealers, generally means there are fewer new enterprise opportunities every year (and while the growth of the independent RIA market continues, vendors may start with but can’t fully grow and scale by remaining solely focused on new-RIA formation).

Thus, here we are with two score and ten solutions all vying for attention in an ever-more crowded marketplace.

In fact, by our count, there are currently 50 vendors selling advisor technology platforms in the wealth management space:

- Advisor360

- AdvisorEngine

- Advyzon

- Altruist

- AssetBook

- Betterment for Advisors

- Bridge Financial Technology

- Broadridge Financial

- Capitect

- CGI Wealth360

- Charles River Development

- Comarch Wealth Management

- Croesus Advisor

- D1g1t

- E*Trade Advisor Services

- Envestnet (Enterprise) Platform

- Envestnet PortfolioCenter

- Envestnet Tamarac

- Fidelity WealthScape

- FinFolio

- FIS Wealth Management

- Fi-Tek

- Folio Institutional

- Hanlon Wealth Platform

- INDATA IPM

- Innovest Systems

- InvestCloud

- Investedge

- LPL Financial ClientWorks

- Morningstar Office

- MyVest

- Ndex Systems

- Oranj

- Orion Advisor Tech

- Pershing NetX360

- Portfolio Pathway

- Profile Axia Suite

- RBC Black

- Refinitiv

- Riskalyze AutoPilot

- RobustWealth

- SEI Wealth Platform

- SS&C Advent Black Diamond

- SS&C Advent Portfolio Exchange

- Summit Wealth (not live yet)

- Tegra118 (The vendor formerly known as Fiserv)

- TradePMR

- TradingFront

- Vestmark One

- VISE AI

This is a mix of every vendor, no matter which client segment they serve. Some of these products focus only on RIAs, some on enterprises like broker-dealers, asset managers, and RIA consolidators, some focus on trust business, and some are provided by custodians. Still, the list shows the sheer breadth of products that have crowded into this market (and the fact that many have narrowed into a sub-segment or channel of advisors just emphasizes the challenging need to differentiate in such a crowded marketplace!).

Notably, this list still doesn’t include standalone portfolio rebalancing applications like AdvisorPeak, BlazePortfolio, iRebal, RedBlack Software (recently sold to Invesco), Smartleaf, and Softpak, since rebalancing is only one part of an end-to-end solution. Also excluded are digital advice / digital onboarding tools (what some refer to as robo-platforms) like Jemstep or Harvest. This will probably be changing at some point as Jemstep’s parent company, Invesco, just acquired RedBlack rebalancing, which they will most likely integrated with Jemstep to create their own complete solution.

A Finite Total Addressable Market Of Financial Advisors

As I mentioned earlier, the market for advisor platforms is finite. The industry assets are highly concentrated in the top 10% to 20% of firms. There are almost 17,000 SEC-registered RIAs, but 85% of the assets are held by the top 15% of firms. According to FINRA, there are around 3,500 broker-dealers, but the top 5% have most of the assets and advisor headcount. So, we have a large group of vendors fighting over the same pool of relatively few customers… roughly 2,000 mid-to-large-sized RIAs and about 200 mid-to-large-sized broker-dealers (plus some banks and trust companies).

And yet, more vendors keep arriving. Just this year D1g1t launched with an analytics-based platform that they believe can “disrupt” the HNW RIA segment. Tamarac controls 40% of these RIAs with at least $1 billion in AUM. That’s high for a single vendor and makes them a target for firms like D1g1t. But can they convince enough firms to switch? It’s an expensive proposition for financial advisors to convert their platforms, for a number of reasons:

- Conversion Cost – Most vendors charge for the migration process of converting data and subsequent implementation. These are actual hard dollar costs.

- Implementation Delay Costs – I would estimate that 60%-80% of portfolio management system implementations are not completed in the original time estimated. Many firms cut it too close to the end of their contract by expecting to be fully converted to a new system. When implementation runs over the end of the contract, cost often reverts to the vendor’s list price, which can be 200% or more than their contracted rate! I’ve seen clients get stuck with these unexpected costs for three and even up to six months! And they are never built into the budget, and can seriously impact the firm’s bottom line.

- Training Costs – The operations staff, admin team, management, and advisors all need to be trained on the new system. That’s time away from what they are normally doing, which includes prospecting and client service, neither of which should be sacrificed.

- Workflow Migrations – As advisory firms, especially at the enterprise level, increasingly tie all their wealth management workflows into a central CRM system (most commonly, Salesforce in the large-firm environment), implementing a new portfolio management system requires rebuilding company-wide workflows, reprogramming them into the CRM system, and rebuilding data flows and business reporting integrations.

- Lost Productivity/Opportunity Costs – Even after conversion and training, it takes time to be as proficient on the new system as you were on the old. People won’t be as productive, so tasks will take longer, which could impact client service. Also, mistakes could be made while getting familiar with the software, which also has negative impacts in terms of lost time, lost client trust, and even outright legal liability exposure.

Reed Colley, founder of BlackDiamond, announced at the recent T3 advisor technology conference that he was starting a new company called Summit Wealth Systems to get back in the game. BlackDiamond started as purely a performance reporting solution but has been expanded into a complete wealth management platform, first by Advent and then under SS&C ownership. When I spoke to him at the T3 Advisor conference in February, he was planning to have a demo ready around now, but I’m guessing the crisis has thrown a wrench into his plans. Still, does the industry need another platform when there are so many options? Where is the value added?

Bifurcated Advisor-Client Market Segments In WealthTech

The advisor technology marketplace has been bifurcated for some time into two primary segments: independent RIAs, and institutional/enterprise (largely broker-dealers and banks and also some asset managers).

We rarely saw overlap between the segments since the needs of their advisors were so different. Firms like Charles River, Envestnet, Vestmark, and Tegra118 (formerly Fiserv Investment Services) were the dominant players for asset managers, broker-dealers, and banks.

This started to change once breakaway brokers became a thing and started to stand up very sizable independent RIAs, and independent broker dealers (IBDs) started attracting hybrid advisors with their own outside RIAs, although only a few advisor technology firms have been able to cross over from serving RIAs, and when they can, it’s usually only for smaller broker-dealers. Morningstar and Orion Advisor Tech have been able to make the move from RIA-only and close more enterprise deals. In fact, historically the most common growth path to scale an advisor FinTech solution was to build with independent RIAs (where the sales cycle is shorter and the needs don’t have the complexities of large enterprises), and then pivot into the enterprise/institutional market after validating the product with independents.

Yet today, this is another trend where everyone is trying to get into everyone else’s space. Firms targeting RIAs want to sell to enterprise, but the consolidation and crowding out of enterprises also means a newfound desire of enterprise solutions to shift into the RIA channel, believing that there is greenfield for them in the other segment. This is sometimes the case if a vendor can create a unique offering that leapfrogs the competition. But this only lasts a short while until everyone catches up.

A group that I’ve seen referred to as RIA Consolidators / RIA Aggregators / RIA Networks have created a unique segment that crosses over from RIA to Enterprise and back again. Firms like Carson Group, Dynasty Financial, XY Planning Network, HighTower, and Goldman Sachs Personal Financial Management (formerly United Capital) have combined technology, products, services, and funding into their own unique combinations.

I was always a fan of what Joe Duran did with United Capital, and especially the custom development they did to build out the proprietary onboarding solutions GuideCenter and Money Mind. I don’t know why more firms don’t try to copy this. Onboarding is usually the first interaction that clients have with a wealth management firm’s technology. Designing an engaging and collaborative experience builds bonds with new clients, and creates a solid foundation for future relationship growth.

UC used Envestnet for portfolio management, but Carson Group went in a different direction. They not only build onboarding, but an entire platform and U/X on top of Orion Advisor Tech, eMoney Advisor, and Salesforce. Advisors can still access the underlying tools, but the Carson UI is so intuitive and well-designed, there is only a small subset of functionality that they’d need to directly access those applications. Very impressive. But I digress again.

A Little History (Actually, A Lot of History) On The Evolution Of Advisor Tech Platforms

Advisor Technology Platforms that we know today began with portfolio accounting for investment managers. One of the very early vendors was Security APL, which started in Chicago back in 1978 and built the first enterprise unified managed accounts (UMA) platforms. They were acquired by Checkfree Corp in 1996 and they were later bought by Fiserv in 2007. Last year, Fiserv sold a majority interest in the business unit to private equity firm Motive Partners, who renamed the company Tegra118, continuing a 40+ year legacy in the space.

One of the first PC-based portfolio accounting applications was created by Advent Software in 1983, targeting smaller investment managers that couldn’t afford a system like Security APL. Advent’s AXYS product became the de facto standard and was loved by investment managers for its simple user interface and wide range of report options. However, it wasn’t easy to maintain or customize the reports, which is why I started a side business as an AXYS consultant back in the mid-’90s. (Yes, that’s how old I am.)

Advent had the small to medium enterprise (SME) market all to themselves for a while, and over the next few decades, a trickle of new entrants came in, but the market was far from flooded. (See/hear #WinnersOfWealthTech Ep 20: Steve Strand, Co-Founder of Advent Software, for further context on the evolving marketplace at this time.)

The 1990’s saw new companies launch to try and take advantage of the increased popularity of managed accounts. These included ADVISORport (acquired by PNC Bank in 2003 and sold in 2010 to BNY Mellon), and Placemark Investments, which developed a flexible UMA platform for broker-dealers and banks that in turn was bought by Envestnet in 2014).

One notable point about Placemark was that not only did they have a solid UMA product, they also had the second-largest stable of SMA managers available on their platform that firms could get access to through a single contract. Envestnet spent $66 million, which was a steal considering how it helped them to corner the market on this type of offering (the ‘Platform-TAMP’ business model that has been their core for the past decade).

I can’t tell you how many wealth management firms have come to us asking for help building out their managed accounts business and wanted to know how they could quickly build a universe of SMA managers without having to negotiate a contract individually with every one. After this deal, Envestnet became the only destination. It drove a lot of business to them, which they were able to service through their Model Delivery Network. It helped them to become the largest (platform) TAMP in the industry.

But there’s more than one way to skin this cat. We’ve seen vendors enter this market from all different angles.

FolioDynamix launched in 2007 and grabbed serious market share in the broker-dealer space with a very strong lineup of features including Proposal Generation, IPS, great Rep-as-PM trading tools, a solid lineup of SMA managers, plus a TAMP. They were a strong contender for the better part of a decade going up against Envestnet, Vestmark, and Tegra118 in the enterprise space.

They were acquired by Actua Corporation in 2014, in what I thought was a strange deal, in which they probably overpaid by $50 million or more. But these guys, who had little to no experience in wealth management, had $200 million burning a hole in their collective pockets and were worried they’d have to give the money back to their investors if they didn’t buy something. They held onto FolioDynamix for a few years, while doing nothing useful with it, until selling it to Envestnet for roughly what they originally paid for it. (And not to dwell too much on the past, but why does Actua still have a page on their website about FolioDynamix three years after selling it?)

Orion Advisor Tech began as an outsourced portfolio accounting service, and BlackDiamond was once just a performance reporting engine. But both built out all the features they needed including their own portfolio rebalancers, so they make the list as well. Both vendors have very large RIA client bases that they can cross sell their software. Orion has been especially prolific, releasing a robust compliance module, and a mean-variance optimizer called ASTRO, which they white-labeled from Softpak Financial (one of the best in the industry in our view).

The largest wealth management technology platform provider, Envestnet, was formed by a merger in 2004 when they acquired another turnkey provider called Net Asset Management. This eventually led to (and I’m skipping a lot of time and iterations) what was called the ENV2 platform and is now just referred to as the Envestnet Enterprise platform, which targets the institutional segment and probably has the largest market share.

For RIAs, Envestnet purchased Tamarac in 2014, which began life as a terrific portfolio rebalancer that spread out horizontally until they could support everything from soup to nuts that an advisor would want to manage their investment portfolios. Envestnet has also launched marketplaces to connect insurance and lending providers with advisors and collect fees on transactions. They have ambitious goals much more than just a provider of technology, services, and investment products, and appear to be turning into an entire Alibaba-style financial services marketplace platform.

Fast forward again, and we saw the robo-advisor-turned-platform-for-advisors providers, now dubbed “digital advice platforms”, expanding their offerings to challenge Tamarac and other providers. Two years ago, I published an article titled, Comparing The Best Digital Advice “Robo-Advisor” Platforms For RIAs. In it I said that it would probably be my last article about digital advice because all of the vendors were expanding their functionality to become end-to-end wealth management platforms.

And they did. You can see firms like AdvisorEngine and Oranj that started out as digital onboarding tools but are now full-featured portfolio management applications unto themselves. Albeit now struggling to gain market share in the crowded space (likely triggering WisdomTree’s recent sale of AdvisorEngine at a loss to Franklin Templeton).

Morningstar has been adding pieces to their Office platform by grabbing data aggregator ByAllAccounts, and tRx for portfolio rebalancing, and building out their own model marketplace and goals-based financial planning. They are running neck and neck with Envestnet for most advisors using their software, with over 120,000.

Broker-dealers have also gotten into the game by customizing third-party platforms, and then building their own overlay software, to the point where they created completely new offerings. LPL Financial has replaced most of the external software that powers its ClientWorks platform with internally developed code, including their own UMA sleeve construction, although they still outsource a few back-end components. ClientWorks is on its third major iteration and supports their 14,000 advisors, as well as 5,000+ AXA Equitable advisors. Their excellent proposal generation functionality is delivered via AdvisoryWorld, which they acquired in 2018.

Advisor360 was spun off as an independent entity last year from Commonwealth Financial when they realized they needed a larger user base to support continued development costs. It too competes in the all-in-one portfolio management solution space. But will they be able to attract enough other broker-dealers (beyond the initial MassMutual deal), to be successful?

Speaking of MassMutual, back in 2005, I was part of a team that built an advisor platform for Standard & Poor’s Investment Advisor Services (SPIAS). I was in charge of designing the portfolio rebalancer, model management, and trading tools, and it was my first project in this space. We were partnering with Tegra118 for portfolio accounting (although they were still Checkfree then) and Envestnet (actually the Net Asset Management part) and MassMutual was our first big client.

Even though we went from zero to over $300 million in AUM in around 18 months, and had a lot more in the pipeline, S&P shut us down in late 2007. They just did not understand the business, since it was nothing like their core credit ratings service. Probably a good idea for them considering the s#!tstorm that was about to hit them with the Financial Crisis. But I digress…

Of course, RIA custodians haven’t been sitting still while all of this technology was been flying around. Almost 20 years ago, they started realizing the benefit of having a technology that they could use as a loss-leader for their custody offering.

Around 2002, Charles Schwab launched PortfolioCenter, one of the first RIA custodians to build out a portfolio management application. It only supported assets custodied on their system. Other custodians followed suit with Pershing launching NetExchange Pro in 2004 (which they later rebranded as NetX360 in 2009), and Fidelity coming out with WealthScape and then spending $50 million to turn it into WealthCentral. TD Ameritrade was relatively late to the party with their VEO One workstation in 2015, though they were early in acquiring iRebal in 2007 before “portfolio rebalancing software” was really a recognized category yet.

And then there is the next tier of RIA custodians (I don’t like using the term “second-tier”) who, while being much smaller than the Big 4, still offer some excellent portfolio management solutions for their RIA clients. These include E*Trade Advisor Services (the old Trust Company of America), Shareholder Service Group (SSG), Folio Institutional, and TradePMR.

These custodians have steadily improved their functionality and support, to the point where these choices are robust enough to support larger RIAs and have pushed software vendors to add more and more features in what we often call the “checklist contest”. Firms use a long checklist of features they think they need, but probably don’t, and if a product doesn’t have a check next to every line, they’re out. Not the best way to select software, but it is common.

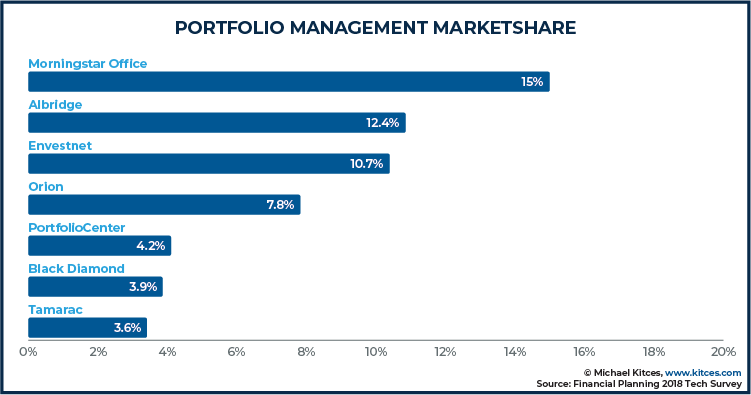

One thing that’s surprisingly difficult to come by is accurate data on the market share of technology vendors amongst advisors. This isn’t just for Advisor Platform software; it’s a challenge for any software in our industry. Whether it’s CRM, financial planning, or any kind of software, accurate market share data just doesn’t exist given the sheer level of fragmentation in the industry (which makes representative market share sampling especially difficult).

I have to give a shout out to organizations that try to provide this data. They are doing a great service to the industry, even though the data they gather isn’t always accurate. As there are some aspects of business where no data is better than bad data but this isn’t one of those areas. I’d rather have something that shows some aspect of how many advisers are using a product then try to guess with no data.

I happen to think that Financial Planning Magazine does a great job with their annual tech survey, and I included one of their charts above, which happens to be from 2018. It shows Morningstar Office as being the number one advisor platform, which I believe is accurate just based on the data that I’ve gathered on my own, especially directly from Morningstar where they claim they have over 100,000 advisers using their tools and technologies (so a 15% market share seems reasonable, or even on the low side).

But the inclusion of Albridge in this particular survey category is wrong because they are not a portfolio management vendor, they are a provider of reporting and data aggregation services. I see this all the time with surveys putting vendors in the wrong categories; it is understandable since this stuff is complicated, but still problematic to understand market share dynamics! In the end, while trade publications try their best, it takes a nuanced understanding of the marketplace to understand where every firm fits in its particular category.

In fact, our research team often ends out spending a lot of time in consulting engagements helping vendors to know what products are offered, and the specific functionality they provide, to understand how they really compare to their competition.

Are There Just Too Many Advisor Technology Platforms?

Two-thirds of RIAs use multiple custodians, according to a recent report by Aite Group. A majority of broker-dealers also use more than one custodian. This has been a huge driver of growth for many of the third-party platforms listed above, that differentiate specifically because they’re not custodian-specific and can independently work across several/all of them.

Still, while many firms work with multiple custodians, the vast majority have only one advisor platform! This places a hard cap on the number of opportunities, especially as custodians increasingly offer their own all-in-one in-house capabilities (e.g., Schwab’s PortfolioConnect, Fidelity WealthScape, TD Ameritrade’s VEO, Pershing NetX360).

The great Yogi Berra once said, “It’s tough to make predictions, especially about the future.” The advisor technology platform market is no different.

Still, my gut reaction is that smaller vendors, in particular, are most likely to be squeezed by the current crisis and look for a partner or sell themselves rather than going out of business. But this is true in any saturated market. There’s going to be M&A activity in this space sooner rather than later. The COVID-19 crisis and economic downturn will only bring this on more quickly. Though even in the long run, the question still remains for the ongoing new stream of entrants coming into the space as well: where, exactly, will the 51st portfolio management system differentiate that the first 50 haven’t already accomplished?

Craig Iskowitz’s firm, Ezra Group, has delivered successful projects for the following firms at some point in the past: BNY Mellon, Envestnet, FolioDynamix, Invesco Jemstep, Orion Advisor Tech, Pershing, and Tegra118.

Leave a Reply