Executive Summary

Welcome back to the 187th episode of Financial Advisor Success Podcast!

My guest on today’s podcast is Emlen Miles-Mattingly. Emlen is the founder of Gen Next Wealth, an independent RIA based in Madera, California, that provides wealth management for 70 client households. What’s unique about Emlen, though, is the way he’s decided to focus his advisory firm on working with underserved communities of color, as an advisor of color himself, and in the process is moving his advisory firm business model away from assets under management and toward a monthly subscription model that allows him to expand who he serves, all in pursuit of Emlen’s goal to change the complexion of wealth.

In this episode, we talk in-depth about how Emlen structures his monthly subscription business model. How he started out charging $100 a month but quickly raised it to $300 a month, how he developed bronze, silver, and gold tiers that all provide a baseline of advice but vary in the depth of their tax, insurance, and estate implementation support, why Emlen decided to include filing annual tax returns for clients in his ongoing advice fee but then outsourced the tax preparation work itself, and how the change in business model is now accelerating his growth path.

We also talk about Emlen’s actual financial planning process itself. The key question he asks at the beginning of every introductory meeting to support his sales process, the technology he uses to automate his new client onboarding process, and the outsourcing provider he hired to help build it, why his initial planning process starts not with retirement projections but analysis of the client’s monthly household cash flow and budget, and the ongoing client service calendar that Emlen is developing to support clients year-round and earn the ongoing monthly fees he charges.

And be certain to listen to the end, where Emlen shares the real-world challenges of trying to succeed as an advisor of color serving communities of color. The ups and downs of trying to build your career in the early years and find the personal confidence to charge what you’re really worth, and the importance of finding a support network of advisor peers to get through the inevitable ups and downs of building your firm, and in particular, where to look as an advisor of color.

What You’ll Learn In This Podcast Episode

- What It Means To Be A Financial Advisor Of Color And What It Means To Serve Communities Of Color [04:08]

- Emlen’s Strategy To Serve Communities Of Color As A Business [10:26]

- How He Approaches Conversations To Help Change Money Mindsets [16:16]

- How Emlen Incorporates A Subscription Model Into His Business [22:03]

- How Emlen Set His Pricing For His Various Levels of Service [39:11]

- Emlen’s Journey Into The Industry [54:59]

- The Services That Emlen Provides For His Clients [1:12:26]

- Topics That He Covers With Financial Planning Clients In Monthly Meetings [1:24:51]

- What Surprised Him The Most About Building An Advisory Business, His Low Point, And What He Wishes He Knew Earlier On [1:28:11]

Resources Featured In This Episode:

Did you enjoy the Financial Advisor Success Podcast?

And if you have a moment, please Click Here to leave us a rating and review in iTunes!

Full Transcript:

Michael: Welcome, Emlen Miles-Mattingly, to the “Financial Advisor Success” podcast.

Emlen: Thanks for having me, Michael.

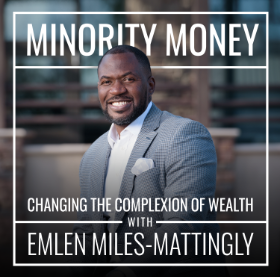

Michael: I’m really excited to have you on today. I’ve really kind of admired from afar for a while now your advisory firm, your path, your trajectory. We’ve crossed paths at a few events over the years, but I’ve really been following lately a podcast that you run as well called “Minority Money,” with this awesome tagline that I love, “Changing the complexion of wealth,” right, and all of the challenging dynamics that we have around the distribution of wealth in the U.S. and the intersection of the racial wealth gap and a lot of other challenges that we have in the country. And so, obviously, we don’t have a lot of advisors of color in the industry. We have I think even fewer that have taken up the way that you have kind of a passion and literally a business focus into serving minority communities, and as you put it, trying to change the complexion of wealth. And so I’m excited to talk today about even just some of these challenging but reality intersections of money, race, what it means to be a financial advisor of color, what it means to serve communities of color, and how all this financial planning stuff comes together when we intersect it with what’s still a very significant racial wealth gap in the country.

What It Means To Be A Financial Advisor Of Color And What It Means To Serve Communities Of Color [04:08]

Emlen: Yeah, it is…as you know it’s no secret to anyone. And when I was coming up with the podcast, and just the name of it, we wrestled with the name because I didn’t know how it would go if we came out and just said, “This is who we serve.” But I felt that I owed it not only to my clients, but I owed it to minorities that didn’t have a place to find information that they may need. And so we kind of just said, “It’s going to be the Minority Money podcast.” And when we did that, that tagline “changing the complexion of wealth” just happened. And it was like, “Wow, that’s really good.” I started listening to it, and people started telling me that they really liked it. And then trying to understand the magnitude of what that meant, right? I think the name came before I understood how big of a…

Michael: Like, “Oh, wait, what have I actually bit off here? All right. All right, let’s go.”

Emlen: Yeah, that’s exactly…I was like, “Oh, wow, this is a big, big undertaking.” And so knowing that I wouldn’t be able to do it by myself, I began to reach out to different people. And then the podcast started happening and the guests kept coming on, and they kept wanting to help. And so most…almost every guest that’s been on has come back and helped in some capacity with things that we’re trying to…initiatives we’re trying to move, and just bringing awareness to people of color and helping them with their finances. So it’s been awesome. I love the podcast, not just because I’m hosting it, but just the mission of it and what it’s trying to do. Yeah, it’s just…I love it.

Michael: Well, and it’s one of these things that’s struck me for a long time about our industry that I feel like, I don’t know, we never quite acknowledge and embrace. The overwhelming majority of the industry has existed in a, “If you want a job here, it’s really simple. Bring your natural market list of the 50 friends and family you know that you will call on in the first 12 or 24 months that you’re here.” And that’s been for “forever” the standard entry pathway into being a financial advisor, maybe only recently changing in the past decade that there are some other career paths now that are not business development to your friends and family list out of the gate.

But just the challenge to me that I feel like is never acknowledged in the industry, like, when our entry pathway is you have to bring a list of your friends and family and we have a humongous racial wealth gap, like, I don’t even understand why our industry is so surprised that it’s very difficult to move the needle on racial diversity when our primary pathway is, “Come from whoever your friends and family are who have money,” and lo and behold, when communities of color have less wealth, they have weaker friends and weaker “friends and family lists,” and then they have more difficulty coming into the industry and surviving and being successful. And then we say like, “We need to recruit more racial diversity” without acknowledging like, unless you’re going to magically solve a racial wealth gap, recruiting more advisors of color isn’t necessarily going to solve the problem when you always make them start with their friends and family lists.

Emlen: And not only that, when you start with the friends and family, like you’re saying, and they don’t have the…normally, you know how it goes, AUM is the big focus. And so now we have advisors going out to try to work with families, and the only way they’re either paid is to sell someone insurance, which we’ll just call it what it is. And so now you have, if you look at it, the disbursement of advisors in the industry is like advisors of color heavily involved in the insurance part of the business because that was the only way that you could get into the business and be successful. Now, after that, then you’ll see people that may get into asset management. And then when that happens, typically, you don’t get to serve the community of people that look like you because they won’t have the assets. And it’s…there’s no way that you…you can’t be successful in that business model without assets. And it’s hard to kind of break through that. So I think it’s just like, it’s just an ongoing thing that continues to be more difficult. So yeah, you’re bringing up some very good points.

Michael: It is, to me, a striking thing. And we’ve actually been working on some research on this on the Kitces platform that we’re looking to put out soon. We’ve talked for a long time in our industry now about how the racial diversity of advisors does not look like the racial diversity of America. But if you actually do the math, the racial diversity of advisors looks almost exactly like the racial diversity of wealth in America. Like, the percentage of advisors who are black is almost exactly the same as the percentage of wealth in black families, like, within a percentage point. And so we really have seemed to have kind of cornered our industry into a direction where, ironically, as we’re moving more and more away from product sales and towards other models like assets under management, I think there’s a lot of good that comes around that of just being more advice-based and less product-based. But the downside of that is, if you’re going to focus in an assets under management model, it really only works if you reach out to clients who have A to M in an AUM model. And when wealth is not well-diversified, you don’t end out with a lot of opportunities to make that model work.

So as you look at this as an advisor who has said like, “I want to try to serve communities of color,” like, how are you thinking about this? How are you approaching this? Are you trying to do a different kind of model? Are you simply going to focus and say like, “I’m going to serve the people that I can serve, at least members of the community of color who do have some wealth, and I can fit this model too?” How are you approaching this as you’ve I know have said, like, “I want to serve communities of color as my business?”

Emlen’s Strategy To Serve Communities Of Color As A Business [10:26]

Emlen: So great question. And the way that we do it is we have a subscription-based model for the financial planning, and then we have an investment management model for people that are looking for investment management. So the way that we approach it is we always focus on the family, because we’re trying to change the complexion of wealth. And I believe that changing the complexion of wealth is going to start with working with families. And when we do this, undoubtedly, we will find that there is some people of color, families of color that have accumulated some wealth. And the thing that I’ve seen is that they kind of gravitate towards me. And I’ve been able to find a lot of them because of the content that we’re putting out. But we don’t have the traditional model where it’s just AUM. We focus a lot on the financial planning aspect of this, and changing behaviors, talking about values, aligning those with their money.

And so that’s kind of the approach we get. And we’re really talking about cultural things. I have a large group of Latino clients. And so we’re talking about different things. So I think it’s more about the approach when we’re talking to them. Like if someone wants to plan for a quinceanera, okay, well, that’s a part of the financial plan. We’re putting that in there. I know culturally, that’s some things that some of the Latino clients that I have want to do, and we put that in the plan.

Michael: So you’re going to have to fill in for some listeners who may not be familiar with what you’re talking about.

Emlen: Yeah. So quinceanera is like a sweet 15 for a young lady. And what happens is they have a party for that. And when a family wants to put that party together, it does have a cost to it, there’s an expense to it. And so understanding that my job isn’t to convince them not to do that, my job, as their planner, is to make sure that we plan for that. These parties can go anywhere from $10-20 grand, sometimes $30 grand, it’s like almost like a small wedding. And you have to have some cultural competence to be able to understand how to work with different people. Another thing that we have a lot is, if I’m working with a person that’s first-generation here, they’re part of a family that’s first-generation here to the United States, understanding that taking care of the family is a very, very important thing. I may be working with a child that has some parents that are back in the other country, and they have to send money back to them. That’s okay. There’s nothing wrong with that. I just need to figure out how we’re going to make that work for them. And those are kind of conversations that we’re having with my clients. It’s a little different than your normal financial planning practice because we have to be able to understand where the clients are at and meet them there, and then build their plan.

Michael: And so to some extent, I suppose some people would make the case like, you’re doing financial planning for goals as so many of us do financial planning for goals, you’ve just got a slightly different set of clientele with different goals based on, well, I guess literally, their goals, but more generally, like, their families, their cultural context, what’s important and meaningful for them that they want to plan for as part of the family.

Emlen: Exactly. And there’s just different things. I think a lot of times when I’m dealing with the minority family, we are trying to get them to operate from a place…get them out of a scarcity mentality. We have a thing that we call the “minority money mindset”. And we try to change that minority money mindset. Like I think what I’ve seen when I’m dealing with, I’ll say some of my black clients, going through that process with them and talking about what they value, and then being able to find out why some of the purchases were made on some things that probably didn’t align with their value. And we talk about some of the materialistic things that are purchased as an immediate instant gratification because of the unknown, not understanding that this purchase now is going to impact what my financial future looks like later, because I want this instant gratification. And talking to clients through those experiences and really getting them to unpack why they feel that it’s so important to have this shiny thing that in their mind resembles success.

And I’ll speak for myself. Like when I can tell someone the first thing that I wanted to do after I bought my first car is I wanted to put some rims on it. I wanted to put some big speakers in the back, and I wanted to make sure that it was loud. And not even thinking about “I’m putting extra money into this car that’s not even paid for so it can look good for other people”. And so like, having those conversations and dealing with that right up front, and having them have this self-realization that, “Wow, I didn’t even think about it that way.” I’ve heard that so many times in meetings from clients that they just hadn’t thought about finances in that way, or the impact of the decisions that they make in their finances that way.

Michael: So help me understand, I guess, just what is that…what do those conversations look like in practice? I’m not trying to be blithe about it, but I’m just imagining this like, “Well, I’m going to put some sweet dollars into new rims.” You’re like, “But have you thought about a 401(k) plan?” I’m betting it doesn’t quite go like that. How do these conversations go? How do you come at conversations like this to try to change mindset?

How He Approaches Conversations To Help Change Money Mindsets [16:16]

Emlen: So we’re asking about values, “What’s important to you?” Right? We have a values exercise that I do with my clients, and we use this values deck. So we go through the deck and kind of let them tell me what they value. So they’ll have family in there, they’ll have legacy, they’ll have words like…just things like that will be in their values, right? We get it…whittle down…

Michael: Wait, and what is a values deck? Like, this is literally like a deck of cards? Like a deck of…?

Emlen: Yeah, it’s like a deck of cards, actually. I think it’s the Think2Perform. Now you have me looking at what the name of it is. I just used it. I’ve used it for so long that I don’t even remember the name of the card deck. But basically, it’s like a deck of cards. It has like 50 cards in it. And you can do it electronically because we’re not meeting clients physically right now because of COVID. But you send that to them, and then it has 52. First, you select, I believe it’s 15 things that…there’ll be words in there and you select 15 of them. After you select those 15, then we whittle it down to 10, then we whittle it down to 5. And those five things will be the things that the person values.

And so what I do after we find out what they consider things valuable to them, like one, like education, maybe spirituality, maybe health, happiness, and family. That would be something that someone would say. And so as we’re going through those things, “Why is education important to you?” And I let them answer that question. Maybe it’s, “I think that education is going to provide stability for my family.” Okay. “So, why is spirituality important to you?” “To be in tune with a higher power.” “Why is health so important for you?” Well, this person said that, “After I had cancer, it really made me understand how important it is for me to take care of myself.” Happiness, and the happiness goal was actually tied to family. And then we put family. For the last one, it was because of…the family had given her a purpose, she felt like.

And so when we talk about all those things, like, we have these five different areas, and then we say, “Okay, so now that we’re looking at this, do you really think…how are your finances aligning with these things that you’re saying that you value?” And so now we get to the purchases that they’re making, right? Because I say, if someone shows you their calendar and their bank account, you’ll know what’s important to them. And so now we’re looking at these things that they’ve said that they value, and we can have that conversation about, “Okay, so how are you spending this money?” And now we’re talking about very, very specific things. “Okay, so how is this going to help family? How is this going to add value to this?” And when we start looking at that, I can’t say not to purchase this in…”Don’t get those rims because that’s not what you value,” they’ll say that because now they see what they value. And I say, “Well, how does this align? Does this purchase make sense compared with what you want to actually accomplish?” And then it’s like, “No, it doesn’t. And I really didn’t think about that.” So then we get into that. “Why is that important? Why do you feel that’s important?”

And so that is kind of the outline of what happens in our meeting, because we’re getting to the why. I’m asking why three and four times, like, “Okay, so why do you think that’s important? Tell me more about that? Why do you think it is?” And what it ultimately boils down to is, when we’re hearing these conversations that we’re having with people, they are telling us about their first memory of money, is one of the things I ask. I ask some of the Kinder questions. It goes all over the place with how the conversation goes, but I can ask some of the Kinder questions that I use in asking their first memory of money.

And when I’m talking to someone and they share with me their first memory of money is not having any or being poor, or I’ve had people talk about collecting cans, I’ve had people talk about the ice cream man when they came by, and every memory of money they had was not having a lot, and a little bit that they had was to buy something that gratified them instantly. And we go through all of this to get to that. Okay, so this is why you really want to buy that new car that you probably can’t afford, because it’s going to give you the instant gratification in the same way that that ice cream did, the same way that when you went to go collect those cans, that you could go get some toy with the work. So instantly, you’re not thinking long-term, you’re thinking, “I need something now.” And that had never been addressed, and no one had ever talked to them. Even though they had insurance, even though they had a 401(k), even though they had an IRA or they had whatever financial product they had, they hadn’t really gotten down to the root issue. And that was that instant gratification because of the experiences that they had as a child, and their relationship with money was shaped from those things.

Michael: And so I guess this as well is part of what you meant and what you were talking about in saying that so much of this starts with not just values, but addressing scarcity mindsets and some of the challenges that come with that. If money’s only been scarce and that’s the mindset I come from, it’s very hard not to approach everything that way. And that’s part of what gets us stuck into some of these patterns.

Emlen: Exactly. Exactly. And I think just talking through that with someone, taking a little time in the front to just have them map out what they think is important. And this is…we haven’t even talked about money yet. At this point, I haven’t looked at anything. Like, I don’t have any statements. I don’t know how much money they have. I might know how much money they make from my pre-profile questionnaire, but I don’t know much about them. And one of the questions I ask in my pre-profile questionnaire is, “How do you feel about your money situation?” And it’s a scale of one to five. Five, “I’m feeling outstanding. I don’t need anything”. One, “feeling like I don’t really know what’s going on”. And you’d be surprised at how many people really just don’t know. And that question tells me so much about how the person feels about their overall financial health.

Michael: So now bring this back for us to like the business model of giving advice to what you’re doing. You had mentioned that you’re doing this blend of subscription-based financial planning and an investment model for those who want investment. So I guess first and foremost, kind of making the point like, if clients have assets, yes, you do an investment management AUM thing, but if they don’t have assets, that’s not required to work with you because you’ve got a subscription-based financial planning model in the first place?

Emlen: Yes, exactly.

Michael: I’m presuming like that was a deliberate separation for that reason? Like, “I want to be able to work with clients who don’t necessarily have significant investment portfolios, so I’m going to have a subscription model that lets me serve them?”

How Emlen Incorporates A Subscription Model Into His Business [22:03]

Emlen: Yes. So basically what was happening, and this happened when I was working at the insurance company, and you’re hitting on it right, so I was…when I would meet with someone…I kind of figured out pretty quickly how everything was working there at the firm I was at. But the thing that I kept running into was after I have the…after we get to the product portion of what I was doing for the client, they still had questions. “Well, how does my 401(k)…how much money should I be putting into my 401(k)?” Well, we went over that. “Well, what investments should I have inside of my 401(k)?” “Okay, so let’s talk through those.” “What about my health insurance?” “Okay, let’s talk about that.” “What about the life insurance policy that I had from an old life insurance policy, or an old IRA? Or what about my homeowner’s insurance, should I have…?”

So I continued to get these questions after we would have, and I’m doing this with air quotes, the “financial plan” that I was giving from the insurance company that didn’t address any of these things. And so I started to ask some of my clients, I said, “Would you…?” They liked the idea of being able to have financial advice that was ongoing. On-time financial advice, if you will. Like, “I’m going to go buy this car. What do you think about this?” “Well, was it in the plan that we put together?” “No, this was something that just happened.” And we talked through that. So I wanted to have that ability to be able to talk to clients about their finances and make myself available to them in the concept…within the planning for them. I hope that answers the question.

Michael: Yeah, yeah, it does help. So, what does this pricing model look like in practice? Is this monthly? Is this quarterly? Is this like $50 a month? Is this $500 a month? What does the model become in practice for you?

Emlen: Yes. So we are actually in the middle of doing the new website. So the new website will have a little better flow to it. But what we have now is we have three levels of service. We have a bronze level of service, which is $300 a month. You’re just going to get a financial plan with that. And I say just the financial plan, but 12 months of engagement, $300 a month. So we’re looking at $3,600 there. The next level of service is our silver level of service, and that’s going to be $400 a month. That’s going to come with the financial plan, tax planning, and tax preparation. So we will do that portion of it. Then we have the last level of service, which is the gold level of service that comes with an estate plan, a financial plan, and the tax planning and tax prep. And that’s at $500. So it goes $300, $400, $500 monthly for those packages that we’re offering.

Michael: Interesting. So you’ve kind of tiered up, I guess, the depth or like how comprehensive is the plan. Bronze gets me a baseline plan, which I guess is focused around cash flow spending, budgeting, assets and liabilities, and where they are. The next tier adds in tax planning and tax prep. The next tier, the top tier adds in insurance and estate as well.

Emlen: Yep, exactly.

Michael: And just curious, are you…I get on sort of things like estate planning. We can advise clients on estate planning, but then we’re referring out to an attorney for drafting and implementation. When you do this from a tax planning end, and you said you also include tax prep, like, are you tax prep guy and that’s something you do? Is that something you’re hiring? Is that like a CPA you’re partnering with? How are you actually bundling that together?

Emlen: I actually partnered with a CPA. So I have a CPA partner that I work with. So she does all the tax prep for us.

Michael: So in essence, like, it’s part of your bundled fee, but you basically sub it out to another CPA to actually do the return on behalf of your firm and on behalf of your firm’s client?

Emlen: Yes, that’s how we do it.

Michael: And I’m just curious just because so many advisors do these tax arrangements in different ways. Like, is it…does the client only interact with your firm and then you work with the outside CPA to prepare it or is this still like, you introduce it to them because they have to hire the CPA firm to literally do the tax prep, not yours, but it’s like a triangle relationship? Like, how does this come together? Because I know for a lot of advisors that are thinking about tax advice or tax prep, it’s like, “Yes, I would like to help my clients with this. No, I don’t want the liability of doing tax stuff if I’m not actually a CPA or an enrolled agent.” So I’m always fascinated with how this comes together for advisors.

Emlen: Yeah, it is interesting how we worked it out. But what we did was basically, when someone comes in and they’re on that silver level package then I introduce them to our CPA partner. We do that via email. Now, they don’t get any charges from the CPA. The CPA doesn’t bill them, they only bill me. And now they have a data collection process that they put the client through. So they work with the client, and I work with…we all work together. So if there’s information that they need to get from the client that I have, then I will provide that for them. And usually, that’s pretty…some of the stuff that we might need to get. And then there’s an onboarding process that our CPA partner has where they get a lot of that information that they need from the client. Now, in our data-gathering process, we get a lot of that data too. So that’s where it’s kind of…we’re trying to get that fine-tuned so the client is not giving me the same information that they’re asking for. So that’s what we’re working through right now because the 15th is coming up pretty soon. So people are trying to make sure that all this stuff is taken care of.

Michael: Absolutely. But that’s interesting. So in essence, like, the CPA gets introduced, the client will interact with the CPA to get the tax work done. You’re all working together on information sharing, communicating. And then at the end of the day when the tax work is done, the CPA bills you.

Emlen: Yep, that’s how it goes.

Michael: Interesting structure for it. And is this a new thing for you that you’re going to roll out for clients?

Emlen: We just started doing this. This just started happening. Actually, this year is the first year we did it.

Michael: What led you to it?

Emlen: People kept asking questions about taxes, and I was like, “Okay…” I want to say I had like 10 people reach out to me and say, “Hey, Emlen, do you do taxes? Hey, Emlen, do you…” I was like, “No, I don’t do taxes. No, I don’t do taxes.” And then I was like, “Why don’t we look into that?” I had already worked with the CPA previously, and she was on my podcast. We had chatted about some ideas that I had. Her name is Sheneya Wilson. And we had been discussing how this would work, what it would look like sometime last year. And so, just because of the need or the questions from my clients, that led right into, okay, I said, “Well, what do you think about this?” And she’s like, “Yeah, this is something that I want to do.” And so I know she’s partnered with a couple of other advisors too. So it’s not just me that she’s doing this with now. So it’s been really, really well received. But I do not do taxes for people that are not my clients. That’s not something that we do at our firm. You have to be a financial planning client, and you have to be at least in the silver package and then we’ll do your taxes. So that kind of helped out. So we don’t have a ton of people trying to have us do taxes, because that was another thing I didn’t want to have happen.

Michael: Okay. So you don’t want to be in the tax prep business, you want to be in the service of saying for clients at a certain tier, “We will also do your tax preparation as part of our holistic offering.”

Emlen: Exactly. That’s what we wanted more so than anything else. Because I think what happens with this in the minority community, and I think it probably happens in other communities too, but I know this because I can speak to it with what happens here. So what’ll happen is that we’ll get the taxes done, and then we’ll hear…I’ll talk to them and I’ll see, “Who do you have do your taxes?” And they had some tax preparer do it. And I’m not…there’s nothing wrong with being a tax preparer. So let me just say that. But there’ll be some…I’ll look through it because that’s a part of our financial planning information that I need to be able to put the plan together. So they’ll send me their taxes and I’ll look at them and I’m like, “Well, what is this?” Or I’ve heard some of the…I’ll tell you this, Michael, I’ve heard some of the weirdest things come from financial planning clients. Like I had one young girl come to me that was…young lady, actually, not a young girl. One young lady come to me and asked me about taxes. And I was like, “Okay.” She’s like, “I’m paying taxes at the end of the year.” And I was like, “Okay, so, well, why do you think you’re paying taxes? Who did your taxes?”

So we talked through that. And I said, “Well, how much money are you putting into your retirement account at work?” And she’s like, “Well, I put…” She told me the percentage, and I was like, “Well, can you put more away?” And she was like, “Yeah, I could probably.” Because she paid…she probably ended up paying a small amount of tax, not a ton, less than $3 grand. But I was like, “Okay, why hadn’t you thought about just increasing the amount of money that you put into your retirement account to lower your taxable income and blah, blah, blah?” And she was like, “Well, I didn’t even think about that. When I went to go see my tax lady…” This is what she heard from the lady that was doing her taxes, “She told me that I should just have a kid because I can have more exemptions.” I said, “What…?” Yeah, I almost lost my mind when she said that. And I was like, “What do you mean?” She’s like, “Yeah, she said if I had a kid then I would be okay for…I wouldn’t have to pay taxes.” And I was like, “Yeah, but then…” I was like, “No, that’s not the way this works.”

Michael: Oh, and strictly speaking through the narrow tax lens, I guess, like, it is mathematically true for tax purposes, but the whole like, going to school and giving them food and clothing and shelter thing might partially offset the tax savings, maybe.

Emlen: Just a little bit. Maybe. Just a little bit. But I’d hear crazy stuff from people like this all the time around taxes, and I’m like, “Who is doing this?” And so there’s just a firm or a tax preparer group of people that were giving people wrong information. And I kept hearing this from different people that were working with the same person over and over and over, and I was like, “Oh my gosh.” And I wondered, “Okay, is it just here?” And so then I would talk to other clients or potential clients, and I’d ask them questions about their taxes and I’d hear other craziness that they were getting told from people that were tax preparers. And I was like, “You probably need to work with a professional.” And they were like, “Well, what do you mean?” I was like, “Well, have you ever heard of a CPA?” And it’s like, that’s where we’re at in the minority community with some people that don’t even realize that there are designations to talk about being someone that can prepare your taxes, and having a professional do it. And so, yeah. Like, if I went through that, you’d be blown away at some of the things that people don’t know.

Michael: I’m sure for a lot of folks listening, we got a good sense of it, of, “Try having babies to lower your tax bill.” So for you, this is value-add bundling. This is, “I’m just actually going to get clients to a good tax outcome and hopefully some more solid advice.” I am wondering, like, from the flip side of it, though, when you have clients that come in that are “just,” I’ll put that in air quotes, ” just” at the bronze tier, and so they’re not buying up to tax planning to insurance planning to estate planning. I know for a lot of advisors, we kind of pride ourselves on the comprehensiveness of advice and financial planning means, integrating all of these different elements together to give you a holistic picture. Do you stress or worry about like, what happens if I’m working with a client at the bronze tier and I’m not covering insurance and estate stuff and it turns out that’s their gap, and they’re uninsured or underinsured, and there’s an accident or someone dies and someone is saying like, “I was working with Emlen for my financial plan, we never talked about this insurance stuff?”

Emlen: So it is encompassed in talking about the plan. So the difference is that, I guess in the bronze level, you’re getting information about what you need to do. So we’re going to go through your insurance and tell you how much insurance you need to do and tell you exactly how you can get it. So we will advise on that. Now, what you’re getting at the different levels is you’re paying for implementation. I’m going to give you information on your taxes, “This is what you should do based on what’s going on.” But the implementation is where the price difference comes in.

Michael: So the anchor on silver isn’t necessarily the tax planning per se, it’s the tax preparation.

Emlen: Mm-hmm.

Michael: So when you get to the gold tier, if you’re focused around implementation, like, does this mean you’re a blended firm that’s doing advisory fees and then also selling and implementing the insurance or that…you’ve subbed…?

Emlen: No, I’m not doing insurance. Yeah. Yeah, no insurance is being sold. So what we’ll do is usually, we’re using…I’ll say, “This is the amount of insurance you need. You can find that insurance.” We usually will use LISI, or we’ll use a few other insurance places that will…and I have some friends that are in the insurance industry. So it just depends on what the level of the client is at. Like some people are do-it-yourselfers, just like, “Here goes this link, all you’ve got to do. This is what you need, this type of insurance, go ahead, knock it out.” Some people are like that. Some people need a little more hand-holding. So I can say, “Hey, you know what? These are three insurance guys that I know will take care of you. I’ve already told them what you need. You let me know what you think.” And we go from there.

Michael: And then what about on the estate end? Like, do you have a…bring in an attorney and the attorney bills you in the way that you do on the tax preparation side, or how are you handling the estate side of implementation?

Emlen: Good question. So the way we’re doing that is we work with Helios Plans. So Helios Plans is a company that has estate planners, and they put together…it’s like a software that we use. And then they review those plans. And then they’re the ones that execute the documents and all that stuff. So me and the client work together. I’m the one that asks all the questions. I’m the one that goes through it, and then we send it over to the estate planner. And they review it and then we send it out to the client, get it notarized and taken care of that way.

Michael: So Helios is like a online lawyers, LegalZoom type of thing but works with advisors and your clients, as opposed to direct-to-consumer LegalZoom?

Emlen: Something like that. Yeah, it works pretty much like that. So Helios Quantitative Research is…they do a whole bunch of stuff. And one of the things that they do is that estate planning piece. So yes, they take care of it. They have their team review it, they have their attorneys check it out, and then that’s how we’re able to get around sending them to an actual attorney because…this is why we changed it to this way because what was happening is I had an attorney partner that I have, which great guy, nothing wrong with him, it’s just, you know how it is when you’re putting together a plan for a client and you say, “This is what you need to do,” and then sometimes they don’t follow through. So this was a way for me to stay in contact and stay with the client throughout the process and make sure that they’re actually done. Once again, going back to the charges for the implementation.

Michael: So talk to us a little bit more now about pricing. Three hundred dollars a month, $400, $500 a month, like…well, I guess, as with almost anything we spend, whether this seems cheap or expensive sort of is relative to your income and what else you spend money on and at what levels. But how did you come to numbers like $300 a month, $500 a month, that’s $3,600 to $6,000 a year. I think most would say this is not inexpensive. Not to say that it should be, but just like, that’s a good-sized amount of revenue for each client to be on board with financial planning. So, how did you come to numbers like this? How did you set your pricing?

How Emlen Set His Pricing For His Various Levels of Service [39:11]

Emlen: Yeah. So what we did was…this is the third revision of the pricing. So we started out like…and it’s funny because I heard you say it on your podcast, I heard it on the XY podcast. We started out charging way too not enough. So we started out doing like $100 a month. I’m doing tons of work, and I’m like, “Dude, this is…I’m doing a lot of work for not a lot of money.” And so then we went from $100, and then I changed the pricing to individuals, couples, and business owners. And that pricing was…I think it was like…I want to say we went up to like $250 for single people and $350 for individuals. And then I started seeing that not everybody was falling into those two categories. And it just didn’t…it wasn’t working the way I thought it would work. And then when I changed it to this rendition of the fees, this has been the best received by clients. It’s funny because I’m charging more than I charged before, but this one is the one that I’ve had the most clients kind of like. And I think I attribute that to one, being in business longer, two, feeling more confident when I’m able to explain what we’re doing, and giving a true, comprehensive outlook of what we’re doing for the clients.

And so the price point, when I got…when I went and looked at it, basically what I did is I looked at all of my clients and I said, “Okay, so if I’m looking at my AUM,” because there’s a portion that’s AUM, and I looked at what the revenue was per client, and then I thought, “Okay, so these are my top 10 clients. This is the bottom amount of revenue I’m making from these…” Or top 20 clients, “This is the bottom amount of revenue I’m making on the AUM side. If I’m going to take time away from AUM, which isn’t a ton of time, but if I’m going to take time away from that, I need to be making at least this much money to substantiate taking the time away from the other things that I’m doing.” And that’s how I got to the fee at the lowest level.

Michael: So it was kind of a backing in for you of like, “Here’s what I do, here’s is the time it takes, here’s the amount of revenue I need to generate. So if this is a planning only, not an investment-based client, like, this is the number I need to get to as a minimum revenue for each client to justify and validate the amount of work being done.”

Emlen: That’s exactly what I did. And I think it speaks to…this is year three, right, and I’ve seen on the charts, graphs that you can see what happens with an advisor in their third year of running their advisory firm. And I think that was…I can look at two years of data, see what the fees are, and then say, “Okay, yeah, you know what? This is better.” And then it worked much better. So I think it’s important for advisors to understand how their revenue works per client and how that can affect things in the firm going forward.

Michael: It’s a striking thing for me. We’ve seen this with XY Planning Network in particular since so many advisors start their firms there. Not necessarily that they’re new advisors to the industry necessarily, although some are, but just, they’re starting firms from scratch. That we have seen for many years now on our internal studies that literally like 100.0% of advisors raise their fees in their first 3 years. Like, just literally, everybody underprices out of the gate. I think for some it’s, “I’m still getting used to just charging what I’m worth.” Actually being able to say with a straight face to another human being like, “You have to pay me $500 every month for that,” and not choking it up, which just you tend to do when you’re getting started and you really want to get your first few clients.

And just getting a handle on, “How much time does it actually take me to do all this stuff that I’m saying I do?” Because the truth in the first year or two is, you can end out undercharging. Your business will be fine because it’s not like you have a million clients to work with. Like, there aren’t that many people yet on board. We’re just trying to get any revenue in the door. At some point after a few years, it’s like, “No, I know what I do. I know what I’m worth. I’ve actually got a couple of clients now, so I can’t just be free and open with my time. I’ve got to make sure I’m really getting compensated with my time.” And then we see just so many rework their fee schedule, usually ends out being a higher number when all is said and done, and we kind of find that balancing point that really works for us.

Emlen: Yeah. And I think it’s important to do…it’s really important to understand those price points, right? Knowing what’s going to work. Now, I think the biggest thing for me was, when we actually did make the change, and then being in three years, like you were…running the RIA for three years, but there was this professional confidence that had come from having clients and talking to them about stuff like, “I know I’m good at this. I know that if someone becomes a client, I’m going to help them, and I’m going to help them in a tremendous amount.” And not coming across as arrogant, but just having some professional confidence that, “Yes, I’m very good at this, and I’m going to help you.”

And then what that’s done… I was actually on a call with someone the other day, and she was doing a webinar. And I was speaking to some of her clients. She was a financial coach. And I talked through what my process was, how I work with people. And I know she can see the confidence. And then after we get off the call, she sends me an email. She’s like, “I think you got a new client.” And I’m like, “Oh, wow, cool, one of the people that was listening.” I was like, “Well, who was it?” She was like, “I want to be your client.” I was like, “Oh, wow, okay.” It’s like, “All right, well, let’s do it.” And I think that just comes from, that there’s no replacement for time in business. And I’ll say it again, there is no replacement for being in business for a certain amount of time, because what happens with that, you do get the confidence. You have your ups and downs, but you typically begin to build a network, and you get those friendships that… When we’re doing the single…the one-person RIA, sometimes you don’t know what’s going on out there. And to be able to have a community of advisors that you can reach out to and share stories with and successes and understand that it does get better with time if you do things right.

Michael: It’s one of the things that’s always struck me in our…the research that we see when we look at advisor compensation, that the single greatest predictor of an advisor’s compensation is the number of years they have been in a client-facing role. Like, more so than anything, like, more so than degrees, designations, business model, all the other stuff. That stuff matters, like, it has material factors as well, but adding additional years of experience, and just what advisors typically earn after 3 years, 5 years, 7 years, 10 years, 20 years, 30 years and up, number of years is overwhelmingly the single greatest determinant, and with basically no ceiling. Like, just keep going out to 30-plus years, advisors who’ve been doing it for 35 years on average earn more than the ones who’ve been doing it for only 30. It’s a disturbingly straight-line linear relationship.

And as you said, I think so much of it really comes down to not just kind of growing and developing our expertise, right? We do, I think, get better at this as we do it more and longer for more people. But the confidence we get that not only am I worth more, but I know I’m worth more, and I can actually say it straight to people like, “I know I’m really going to be able to help you significantly for the fees that I charge. Yes, they’re not inexpensive, but let me show you the value.” And you build that network of people that you can work with and do business with, and friends and colleagues and centers of influence, and all the other connections that you develop. And just there’s this amazing compounding effect that comes with time, which I know certainly when I was young and getting started myself, right, the whole, like, at least my mentality, and I think for a lot of people was sort of a, “Screw this whole pay your dues thing. I should be able to just get in there and do it.” And to me, it’s not really about paying your dues, but just literally like, this is a hard business and it takes a lot of years to build confidence and build your network, but the more years you do it, the better it gets. And it just keeps going.

Emlen: Yeah. And I think that one of the things that can get lost in this, because we’re speaking generally, right? And I think this is pretty much across the board with financial advisors. But when we go into…when we talk about the black advisor coming in, can the black advisor make it through those three years, those four years, those first five years and become successful enough that the practice is going to continue? And I think that is the part that, how do you go into a firm where they tell you you have to work with people that have money? That’s typically not people of color. And then we have to sell a certain amount…it’s just so hard to deal with…to try to get through that. And then in addition to that, and we’re not even…I’m not trying to just railroad the conversation, but to deal with some of the racism that you have to deal with in the industry, and maybe even at the firm you work at, to couple that with that, in addition to trying to make it in this business on its own.

So I always say that if a person of color, or I’m saying men and women, if a person of color or anybody that’s made it in this industry has to have a certain amount of resilience to make it, to make it in this industry as a person of color, you have to have more than the average person that’s coming in. Because if you don’t, you just…as we know, this industry is a tough one. And if we don’t have the resources, and as I’m saying this, I’m thinking like, what things can we do to help advisors of color to make it through these first three years that are terribly difficult to navigate? When there’s not enough money coming in, and you don’t have the professional confidence, and you don’t have the network, and you don’t have people to support you.

I was having lunch with the district attorney here in Madera the other day, and she was like, “My brother…” She was telling me about some business things and she was like, “If anyone in my family ever needed to get…all of us have businesses of our own. And if anyone in my family ever needed money to get through a tough time in their business with this COVID thing, if my brother asked me,” she’s like, “My sisters and I could pull up, could round up $100,000 to help him, give that to him for his business so he could continue to go.” I don’t know too many advisors of color that just have family members that are around that can give that influx of cash. So I think that understanding how difficult it is to get into the industry, and then how long it takes to actually be successful in an industry may be one of the reasons why we’re not seeing more advisors of color coming into this industry.

Michael: Yeah, well, again, when it’s all built around, “So here’s how it works, you come into the industry, you bring a list of your friends and family who have money, and then the first three years you make almost no money while your friends and family also probably support you financially while you go and sell them stuff in order to get your business going,” and that’s basically the model and has been for 40-odd years, that’s how you end out with a world where the diversity of advisors ends out looking like the diversity of wealth, because we’ve literally built an institutionalized model that is designed to make advisors look like the distribution of wealth. I don’t think we did it intentionally by any means, but just as long as that’s the primary career track and pathway into the industry, I think that’s why we’ve seen what I think are a lot of well-intentioned efforts for probably 20 years that I feel like advisor diversity has become a growing conversation in the industry, and the needle basically hasn’t moved a percentage point in 20 years because we keep saying like, “We need to recruit more, and we need to get out there more to attract more advisors of color,” but then we don’t change any of the career track pathways that are still built around, “You need to have friends and family who have enough money to do business with you and your natural market list, and also enough family wealth so that you can survive making very little money in the early years until you get to the point where your business is economically viable.” And as we either change business models or change career tracks, to me, that’s where some of the shift starts happening as well, right? When we can hire people into paraplanner and associate planner roles and give them salary for the first three years while they do their job and learn their confidence, and then send them out for business development later, then you change that cycle.

And I think to some extent, just changing the business model to be not so reliant on assets under management. Like, it’s a fine model to serve people who have assets to manage, like, the math works fine, but it doesn’t fit well for communities of color that don’t have the same level of wealth in the first place. We’ve certainly seen that within XY Planning Network. We have a model that’s built around subscription models and not necessarily managing assets. And lo and behold, XYPN is over 15% non-white, and I think the number of African American CFP professionals is under 4%. So you get business models that are more accommodative of a wider range of clientele, you end out with a more diverse base of advisors as well.

Emlen: Yeah, I think you’re absolutely right there. And as you said, we’ve been talking about it, but, like, if there’s a kid out there that…or just a person that wants to get into the industry, what is the pathway that we have? Like I’ve had my wife’s cousin called me and she said, “I want to be a financial advisor.” And it was so tough because I was…and this is a family member and I’m sitting here thinking like, “What do we tell her to do?” Because for so long it’s like, “Okay, well, go work at a…go find a BD or an insurance shop that’s going to hire you, and then grind it out for three years. Hopefully, you make it. And then after you make it, maybe we can start working with you somewhere else.”

And I think, like, people, firms developing a pathway to the CFP would be a great thing to have. Like, you have someone come in, this is our…we’re going to do diversity. We’re going to do some hiring of some people of color. And we’re going to have you come in and we’re going to teach you how to be a paraplanner first. Okay. And we’re going to give you a salary for that. While you’re being a paraplanner, you’re going to go through your training. You’re going to do this. And then after you go there, we’re going to move you up to this next level. And then eventually you can become a lead planner. And I know there are some firms that are doing that, but I’m saying for us as an industry to make sure that we’re getting the right type of talent and the people and then teaching them the things they need to know, we’re going to have to go to the colleges. Maybe we’re going to HBCU colleges. Maybe we’re going to other places and making sure that they have the resources to get in. And I have a fascinating story about how I got into the industry, to tell you the honest truth, because I was rejected a few times. And if that’s something that you want to touch on, I can definitely talk through that quick story.

Michael: Yeah, like, who rejected you trying to get in? What was that journey?

Emlen’s Journey Into The Industry [54:59]

Emlen: Yeah. So I go to, I believe it was…it’s a large firm here, large reputable wirehouse. And so I was 20-…I want to say I was like 23. Anyhow, I hadn’t graduated school. I hadn’t finished school yet. I had some stuff that came up, and it delayed my graduation. But I didn’t have my degree yet. And so I remember I went into this firm, and I interviewed, and they’re like, “Well, we knew you didn’t have your degree, but we wanted to have you come in and just tell you this. We’d love to have you here, but because of the minimum requirements, we can’t have you come in and work for us.” So I didn’t get to go there. Then I went to another firm.

Michael: Wait, I’m just wondering, like, “We’d love to have you here, but because of the minimum requirements,” like, that’s specifically just the degree requirement?

Emlen: The degree, “Because you don’t have your degree, we can’t have you come in.” And I was like, “Okay. All right, well, I’ll figure it out.” And at that time, we were just having…I was just having my first daughter. So just, this is more important to me. I need to make sure that I get some financial stability. So I stopped going to school and started working. So I didn’t get in there. And then I went to another place. They interviewed me. It was a bank channel firm, and they’re like, “You don’t have the experience to get into the industry. We like you, you have great personality, this and that, but we can’t have you…we can’t extend you an offer.” And I was like, “Okay.” So that happened twice. And then I finally get offered a…

Michael: So just to be clear, like, you’re trying to get essentially like an entry-level job which you’re not qualified for due to lack of experience?

Emlen: Yes.

Michael: Okay.

Emlen: Yeah, that’s what they alleged. That’s what the reason was. And I was like, “Okay, all right, well, I guess I’ll…I don’t know how I can get experience in this if you guys don’t hire me. There’s no way for me to get experience.” But I was persistent. So then the opportunity came up at Edward Jones, and I got in at Edward Jones and really didn’t…nothing bad with the company, I just didn’t really like the model that they had. It just really didn’t jive with me, and I said, “You know what? I’d rather go somewhere else.” I was in the middle of going…

Michael: So when you started with Edward Jones, was this like client-facing or at least prospecting traditional advisor role, like, go out and knock on doors and find folks to work with?

Emlen: Exactly. So I left the bank, and the only reason I got in at Edward Jones, let’s be honest, is because one of the guys that…the guy that had the office here in town, I knew, and he said, “Hey, you know what? I’m getting ready to retire. Why don’t you come in? They’ll do all the training, all that stuff, and you’ll just come right into the office. This will be my last year. We’ll work together for this last little bit of time and then I’ll leave.” It’s like, “All right, sounds good.” Well, that was in the middle of me going through a divorce. And this is the one time I get a chance. It couldn’t have been the worst timing ever. So I’m going through a divorce at the time, and I remember taking the test for that. I took my Series 7, passed that one. No problem, took my Series 66. I had already had some licenses because I went to the…oh, I forgot to tell you that. So when I worked at the bank, I actually started to get my…I got my Series 6, my Series 63, and I got my life and health, and I had my Series 26 because I had to manage the advisors that were in there. So the bank gave me a chance to get in. So I had the licenses after those initial two.

Then I went to Edward Jones. So then when I went to Edward Jones, I started as an advisor. So I left the bank as a manager, I was the bank manager, left Edward Jones, went to go be an advisor, trying to start a practice here. And I was eventually supposed to take over the practice of the other advisor that was here in town. Get to the part where I have to take my Series 66. I’m going through a divorce at the time. So we divorce on a Tuesday and my test is on a Thursday. And of course, nothing is going to affect me, right? Nothing is going to affect me. I’ve already passed all these other exams. No, there’s no emotional stress or anything going on. So I failed my exam. I failed by two points, by one question. And I was like, “You’ve got to be kidding me.” Yeah, I failed by one. I shouldn’t have taken the exam anyways, but I failed it. So they allowed me to search for other opportunities.

Michael: They wouldn’t even give you a second shot like, “Hey, I did get divorced 48 hours ago, can I go back and have one more try?”

Emlen: Yeah. So it was just a…it was a bad deal. So yeah, I had that. Then after that, I went to Principal. When I went to Principal, this is the first time that I feel like, okay, so I wasn’t having to knock on doors. I was going to use my natural market list. And I went to go talk to a few people there at the office. And one of the ladies there had built their business from absolute scratch. And I asked her, and she told me about how to get referrals, “Getting referrals is the only way that you’re going to make it in this business.” And I set a record at Principal for the most applications that they had ever had taken in the first 12 months as a new agent.

I said all that to say this, that it took two firms telling me no, finally a firm telling me yes, then me failing another exam to get to another place, and then finally finding the place. This is all just the pre-stuff just to get in. But once I got in, I set a record for the most applications taken at the firm. Like they had an award, it was called pacesetter. And they give you 12 months to do that. And I told the managing partner at my firm, at Principal, I said, “What if I do it in six months? What would you do if I do it then?” He’s like, “You do this in six months and I’ll give you an office.” So we’re in the cubicles everywhere. And I said, “I’ll do this in six months.” I did it like in five and less than…I did it in less than six months. And he was like, “Oh, wow, well, I said I’ll give you an office.” So they put me in the office and I just continued tearing through applications, meeting new people, getting practice.

And I’m saying all that to say this that had I given up back then and not continued to persevere and try to…even after I failed the exam, going back, studying again, passing my exam and then getting into Principal and then starting in this, hitting the ground running and then seeing that I think there’s a better way to do things, starting my own firm, none of that ever happens. This initial thing started in like 2003 when I tried to get into the industry. And here we are 17 years later and I have my own firm, and we’re actually trying to change the complexion of wealth. But none of that happens.

Michael: This is a pattern that I see play out for a lot of advisors in the industry and through their careers, that…and sort of ironic to me, for people that are coming into the industry, I see a huge, huge focus on like, “I have to find the firm, like, the right firm, the one right firm that I land at that’s going to be my like long-term career building one. And I’m not going to go to any other firm that doesn’t fit my ideal list of criteria”. And the truth, I find, in practice is, we almost never get this right in our first job out. Like, it may not be the right firm, it may not turn out to be the right firm, the firm changes, we change. We thought we wanted to do something but then turns out we want to do something else. Maybe it’s just literally a stepping stone job.

That I find for almost everyone that goes through, like, we start somewhere. We do that for a while. We start learning the things we like and we’re good at and the things that we don’t like. We get a little bit of professional confidence. We make some change. We go to a second firm that’s different than the first because the first wouldn’t give us the opportunity that we want. It’s like the second job is always like the polar opposite of the first, right? For you, you went from a stable bank environment to like, “Here’s a cube and a phone, go get some folks.” We do the second job for a period of time. We hopefully get good at that, but we start to really figure out what we like and what we don’t like because we now had two jobs that are pretty much polar opposites.

And then the third job is usually the one that sticks for a really long time. And the number of people that I’ve seen going through the industry that go through this same pattern, like, we start somewhere, we make a jump to the opposite, and then we figure out what we really want to do and build with our long-term careers. That just I’ve taken actually telling people are coming into the industry like, stop freaking out so much about whether your first firm and job is going to be good. I think as you’ve noted here, like, make sure it’s a job that will pay you enough to survive because if you get knocked out of the game, you don’t get to the later years where the good stuff happens. But just find a job. You’ll go from there to a second job, because we all evolve over time. The third one is the one that actually matters.

Emlen: Yeah. And I think it’s… Just to think about, the journey to try to get in is crazy, like, just to get into the industry. And so I thought like…I always say all I needed was an opportunity for someone like me. I would have been successful at the first firm that I went to. It was fine because I showed that track record. When I went to the bank…I didn’t even mention that. When I went to the bank, I was promoted to a manager within 18 months. That was me getting into the industry. I got the Series 6, 63 and life and health and tore through that. Wrote more life insurance applications and financial plans at the time, that’s what they called it. I did more financial plans than any other of the new accounts representatives in our area and led the area in sales within 18 months, and these people had been doing this for a long time. And I kept going back and saying, “All I need was a chance.” Did the same thing when I went to Principal. Didn’t get that far at Edward Jones, but it would have been the same thing there too because I don’t think…the work ethic has always been there.

And it just disappoints me sometimes to know that we, as an industry, are missing out on good talent because of some of the initial…some of the job requirements. And I think how many people are out there, were like me, that didn’t meet the… And I was hired with a group of people when I started at both firms, at Principal and at Citi, they had some other clients that would…other people that I worked with that were more qualified than me on paper but none of them outperformed me. And so I just…if there’s a firm that’s listening and you’re saying, “I don’t know what I can do,” and I’m not saying that you just need to lower the education requirement to let people in, but if someone didn’t take a chance on me, we wouldn’t be having this conversation now.

Michael: I am curious then just what was the driver for you? Like, why financial advisor and the persevering, all the different ways of getting rejected to try to find that job that finally got you in and got you going? Like, why financial advisor? Is this just something you wanted to do since you were a little kid?

Emlen: Yeah, that’s a good question. I think it started as…in the beginning, it was just…I remember working at the bank. Because I started as a teller at the bank a long time before I got into the new account stuff. And there was a financial advisor in the bank when I worked there. And he would come in, he’d always come in late. This is how it started, though. He’d always come in late, he’d always leave early, he drove the nicest car, wore the nicest suit, made the most money. I said, “Man, that’s what I want to do. That’s it.”

Michael: He came in late, left early, had the nicest car and the best clothes, and made the most money. All right.

Emlen: That was it. I said, “I want to do this. That’s what I want to do.” And so then I started…as I’m getting down and I’m starting to meet with people, now I’m getting into their finances and I’m seeing, “Oh, wow, this person doesn’t know this. And this person doesn’t know this.” And these are people that I would perceive as financially successful. And I was like, “Well, how do you not know these principles and this concept? And you don’t know what a mutual fund is, and you don’t understand what a stock is, and you don’t know…” And I’m like, “So that’s why you have all this money in the bank.” That’s what you see a lot of at the bank. I see all these large balances. And I’m like, “Why wouldn’t you invest this money?” And as I started talking to people, I started to see how much the money was impacting their family in a good way. And I was like, “Man, what if we could help people get a better understanding of their money?” And this is my thoughts, like, “Man, people need help. People need help. I’ve got to help these people. I’ve got to help everybody.” And that’s what I started trying to do.

And so through me, just saying, “I need to help everyone,” I started to see that making myself available to help everyone, more people of color started coming to me. Because I didn’t pick the niche, it just started kind of happening that way. So now I’m like, okay, so now I’m going…it was almost like, I’m going out, and I’m going out and I’m learning about these different financial concepts. And now I’m bringing them back to the community that I had come from. And that’s when I started seeing the impact. And people would come back and say, “Hey, Emlen, that life insurance really, really helped me. This really, really helped me. You said something about this, and that really made an impact in my life.” And I started seeing the impact that I was having. And then the shift in focus from the money completely shifted from that. Because I was like, “I’m making impacts on people’s lives.” It’s not about the money. Yeah, we’ll get paid. And we’ll figure that out when we get there. But I’ve really fell in love with making an impact in the lives of people that I was talking to. And that’s where the real…I was like, “I have to make it. I have to be able to be in this industry because there’s someone out there that looks like me, that’s depending on me to make it. And I can’t fail for someone that I…I can’t fail. I just can’t. I have to drive through this. I’ve got to push through it.” And that’s where it came from.

Michael: So then, as you evolved that into an advisor business model that now starts at $300 a month, how do you think about this I guess just affordability-wise? Like, is this a palatable price point to the community that you serve? Does this only hit a certain segment of the community? How do you think about that $300 a month and up price point?

Emlen: So what I’ve noticed is, as my prices have gone up, I’m helping more…I’m continuing to help people of color. I’m just helping people of color that are earning more money. And so what it showed me is that, yes, there are people of color out there that earn the dollar amount that this isn’t even a…this is a non-issue for them to be able to pay, but they still had some of the same…they needed the same financial information of the people that couldn’t afford it or that may have made less money. So I think the podcast is part of the reason why I feel okay having my price points because the people that can’t…people that might not be able to afford it, I think I have enough nuggets of information on the podcast to where they can actually get themselves in a better financial situation, just from going through some of the topics we have. And we’re actually…I’m actually getting ready to partner with a financial coach that is going to offer a little less service, a lower price point for people that can get into her program to start working with her and have a pathway to working with a financial advisor. So we’re trying to address it that way for the people that can’t afford it. But what I’ve been getting to find is there’s more people than I thought that will afford this price point.

Michael: And I guess the key distinction is just they…it’s not that they can afford it because they have more per se, because then they can also work with the AUM model folks as well, like, they can afford it because they make more? Like just, because they’re paying it from income, but there’s folks of above-average income in all communities. And so you end out serving above-average income folks with one model and below-average income folks with the podcast and a coach partner. Out of curiosity, as you restructured fees, did you raise it for everyone, including the existing clients, or was this just new clients, new model, new pricing going forward?

Emlen: It was new clients, new model, new pricing going forward, but I’m coming up on my annual meetings on some of my clients that I’ve had prior to the price increase. So when I meet with them, we will have that conversation about the new stuff that we’re doing and if they want to move over into those packages. I’m not going to force them out because one, it’s not been too long since we started that. But yeah, we’ll be having the meeting. And I know, largely in part, the reason why we started offering taxes, because a lot of the people that were already in the planning program were asking for it. So I anticipate them just taking the increased cost and saying, “Yeah, let’s do this, and let’s keep going with where we’re going.”

Michael: And then talk to us a little bit more about just like, what is the full process? When you’re doing this for, I guess, a base fee of $300 a month that we talked about, like the upper tiers are implementation of tax and insurance and estate, but this kind of baseline, $300 a month, every month, 12 months through, what is the process? What do you do for people upfront and ongoing for $300 a month?

The Services That Emlen Provides For His Clients [1:12:26]

Emlen: Good question. So when we start, the first thing we do is we have our introductory call to see if we’re going to work together. That’s always the first thing that we have. We have a 30-minute call, we get on, I ask them a few questions, we just see if we’re going to jive. Because I think it’s more of a…it’s a personality fit as well as the income fit and relationship stuff. So that’s the first call we have. Then I give them a week to make their decision. I don’t want a decision in the first call. I tell them, “You need to take your time with this. Just think about it.” And I literally schedule the next call for the decision at that time. So when we schedule that call, we get the decision, then we have our onboarding call.

Michael: So you’re literally like, in the first intro call meeting, like, we’re talking on a Thursday afternoon at 2, you get towards the end of the call, having gotten to know them a little and talk a little about what you do and say, “Hey, I’d like to schedule a follow-up call for you right now on this call. Can we talk again at 2:00 next Thursday and we’ll check-in and see if you have any other questions or are you interested in moving forward?”

Emlen: Exactly. So typically, what we’re doing in that first meeting is I have about five or six questions I ask them. It’s only 30 minutes. And I give them time for questions. I ask them in the beginning of the meeting, “What do we need to know?” Like, first question I ask is, “At the end of this meeting, how will we know that this was a good meeting at the end?” That tells me everything I need to ask them. So I ask them that, “How are we going to know if this meeting was a success?” So we go from there. And then we get into the pricing, we get into the tiers, we get into this. And I’ll tell them, I said, “Based on what you’re telling me now, you probably would be best fit for the bronze package,” or, “Based on what you’re telling me now, you’d be a best fit for this. And what I want you to do is I want you to think about this. I want you to take some time and we’ll get back together next week. How does that sound?” They’re like, “Oh, you don’t need me to make a decision today?” I said, “No, I don’t want you to make a decision today. I want you to feel comfortable with this.”

And I closed…I’ve had what, five new clients this month? That’s the model I use. They just come on after that. They take time. They get to listen. Sometimes I’ll get a follow-up email from my summary of our conversation, like, “Hey, what about this?” And then I answer the question. I send them three to four podcast episodes in that so they can get to know me a little bit. And when they come back, we’re signing up, typically. I was five for five this month, by the way. So closing ratio is good.

Michael: Yeehaw, congratulations.

Emlen: Thank you. So from there, we go to onboarding. And we call it the client GPS system. And when we onboard them, we use RightCapital as our onboarding system or as our financial planning software. So we get them all loaded up. I walk them through what it looks like. I’m sorry. Before we do that, we do the onboarding. And that’s when we go through all the contracts and all that good stuff. And then our first actual working meeting will be that onboarding meeting where we go through, make sure we get all that stuff, all their accounts linked in, all the stuff that goes on with that.

Michael: So signatures and contracts, I’m just wondering, like, you do that in a closing meeting or you do that coming off of the follow-up call, like, introductory call, “We’re going to talk a week later to decide if you want to move forward.” If they say, “Yes, we want to move forward” in that follow-up call, and you say like, “Great. When we hang up the phone, I’m going to start emailing you paperwork to review and you do it digitally?”

Emlen: I do it with them on the phone. I do it on the phone while they’re on that phone in that call. So if they’ve made the decision on that call, I’m like, “We’re going to send you the stuff.” And so I have an automated system that has all that stuff…that has the workflow ready. If they make the decision to say yes, then I just…typically, it’s a, “Yes, we’re going to do it,” then we send all the contracts, then we…

Michael: I can see what this must really be like, “Well, I’m glad you said that. Please open your email now and, like, I’m hitting a button to start sending the stuff to you.”

Emlen: Exactly.