India’s online pharmacy space is expected to see a wave of consolidation, triggered by Reliance Industries’ reported acquisition of Chennai-based Netmeds, with global investors also lining up to back the winners in the fast-growing sector.

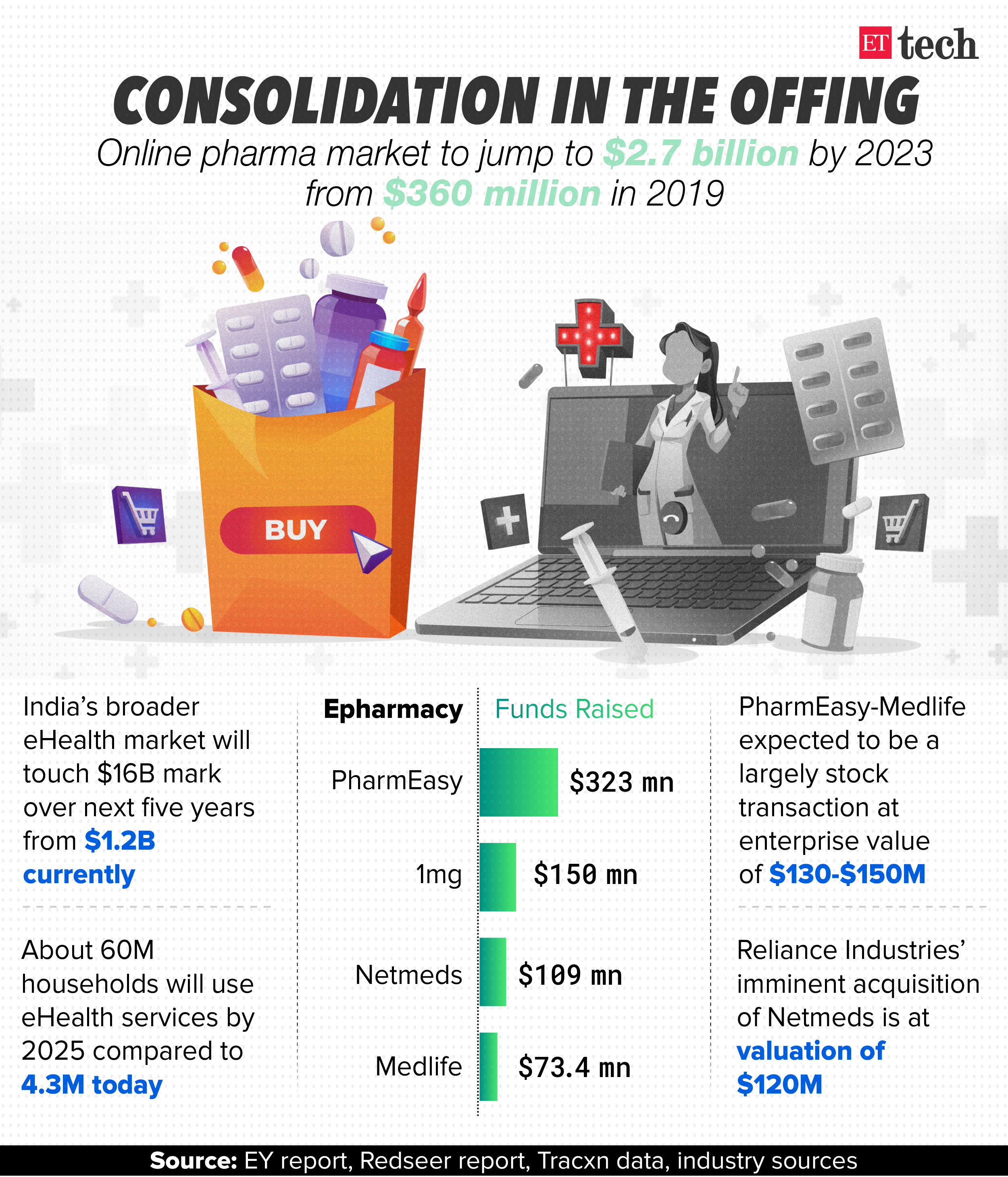

Reliance’s yet-to-be announced acquisition of Netmeds for an estimated $120 million is a catalyst for other players such as PharmEasy and Medlife to explore merger and acquisition negotiations, multiple sources told ET.

The Mumbai-based PharmEasy – backed by Temasek, CDPQ and Orios Venture Partners –could acquire its Bengaluru-based rival in a primarily stock deal valued at $120-$150 million, the sources said. Multiple global financial investors, including US private equity firm TPG which has a strong healthcare focused portfolio, could also invest in the combined entity if the merger goes through.

“Like what took place in the horizontal ecommerce space, where Flipkart and Amazon came out as winners while others fell by the wayside, the same will take place in the online pharma space. Reliance’s entry will give a difficult time to the other players,” an investment banker told ET on condition of anonymity.

The sources declined to speak on record, as they are either part of the ongoing negotiations, or have been briefed on the developments.

“PharmEasy has always been strong in the western part of India, while Medlife has had a good presence in the South. So, consolidation makes sense, because you need deep pockets to complete with Reliance,” a second source said.

Temasek’s investment in PharmEasy, which ET first reported in August last year, values the company at $600-$700 million, giving it a substantial war chest to finance its buyouts.

“It would be good if a few players fold and merge into each other or with larger players..,” said a CEO of an epharmacy firm on the condition of anonymity.

Medlife and TPG declined to comment, while PharmEasy did not respond to emails till the time of going to press.

Additionally, 1mg, which counts Sequoia Capital, Maverick Ventures and HBM Healthcare Investments among its list of institutional investors, is also believed to have held exploratory talks with PharmEasy for a potential acquisition.

The company, according to the sources cited earlier, is also looking to raise fresh funding. Prashant Tandon, chief executive of 1mg, did not respond to ET’s email seeking comment.

The Gurugram-based company, along with prominent startups such as Curefit, Practo and Policybazaar, is also reportedly playing a critical role in stitching together a telemedicine alliance that is part of the Bharat Health Stack, a technology stack being created to digitise patient data and records for hospitals and doctor consultations.

The Swasth Alliance, in turn, is being seen as the third faction that could dominate India’s online pharma and drug delivery space, alongside the Reliance-Netmeds and PharmEasy-Medlife combines, sources indicated.

The developments have come at a time when the online pharma sector is expected to benefit from the Covid-19 pandemic going forward.

India’s e-pharma players are expected to attain a combined market size of $2.7 billion by 2023 from about $360 million currently, according to a report by EY last year.

The key growth drivers for the e-pharma market have been an increase in internet reach and smartphone ownership, along with the ease of ordering medicines through an e-commerce platform, increase in chronic diseases, rising per capita income and resultant healthcare spend.

The sector, however, continues to be beset by legal challenges, in the absence of a clear regulatory framework from India’s policymakers.

The delay in notifying the epharmacy draft rules has continued to cause concern among the industry players, as well as with investors, who have pumped in millions into the sector. Industry associations that claim to represent offline brick-and-mortar players, have accused the online pharmacies of muting competition and contributing to high drug prices in the country.

Leave a Reply