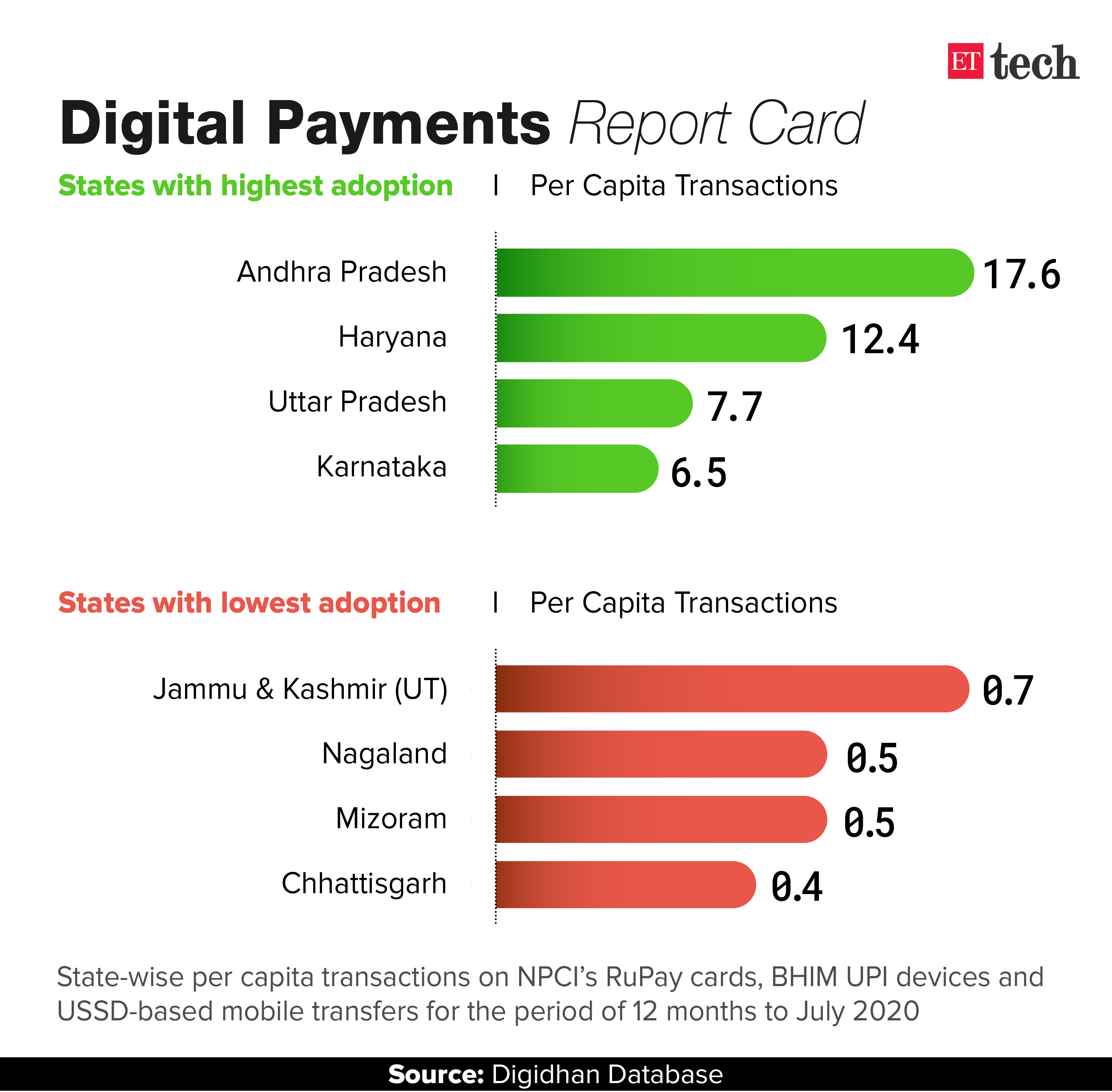

Even as more Indians take to digital modes of payments during the pandemic, central government data reveals stark differences in the rate of adoption across states. While Andhra Pradesh, Haryana, Uttar Pradesh and Maharashtra recorded the highest number of transactions per person, the laggards include Chhattisgarh, Jammu & Kashmir as well as the North Eastern states of Mizoram, Manipur and Meghalaya.

Indians averaged about 3.85 digital transactions per person between July 2019 and July this year with Chandigarh leading at 38.4 transactions per person. Delhi averages about 9.3 transactions per person, according to the Digidhan database maintained by the Ministry of Electronics and Information Technology (MeitY). It tracks digital transactions across National Payments Corporation of India (NPCI) operated channels.

These include RuPay cards, BHIM — the Unified Payments Interface interface of NPCI–and Unstructured Supplementary Service Data (USSD)-based mobile transfers over a twelve-month cycle.

Digital payment industry executives estimate that the grass roots campaigns in states like Telangana and Andhra Pradesh as well as sizable populations in small towns across Uttar Pradesh and Bihar have contributed to the surge in digital payments in these areas. They cited a variety of factors ranging from higher income levels to better internet and banking infrastructure as well as reliable power supply as driving factors.

“Among the most important is the accessibility to high-speed internet and deployment of devices,” said Harshil Mathur, chief executive officer of payment gateway RazorPay, which works with nearly 1 million merchants across the country. It recorded the most transactions from Karnataka, Telangana and Maharashtra, in the three months of the Covid-19 pandemic.

Andhra Pradesh, Haryana, Uttar Pradesh and Maharashtra led the pack with highest per capita transaction rate of 17.6, 12.4, 7.7 and 6.9, respectively, between July 2019 and July 2020, according to Digidhan data.

States with limited internet access and high rural populations are facing challenges in moving from cash to digital, according to both industry and government data.

“Higher per capita income, English language familiarity, availability of good bandwidth, banking and financial infrastructure, internet service, communication devices and 24×7 power supply are key differentiators at the state level,” said Vishwas Patel CEO of CC Avenue, a leading payment gateway.

Digidhan data showed that Chhattisgarh and Jammu and Kashmir had per capita transaction rates of 0.4 and 0.7, respectively, while Mizoram, Manipur and Meghalaya too had a transaction rate of under 1 per person.

While the database doesn’t offer a periodic comparison between months, experts said that the surge in use of digital payments has been a feature across the country during the pandemic.

NPCI saw several of its channels such as UPI, Bharat Bill Payment System and IMPS clock record volumes in June and July.

Volumes on the unified payment interface have surged significantly with the channel recording 1.5 billion transactions worth nearly Rs3 lakh crore in July. This is a jump of nearly 15% from pre-Covid-19 levels, when it recorded 1.32 billion transactions worth Rs 2.3 lakh crore in February.

Industry executives pointed to a sharp rise in transactions from tier 2 and tier 3 towns during the pandemic, due in large part to increased use of online bill payment facilities.

“Over 70% of our transactions come from tier 2 and 3 locations…,” said Karthik Raghupathy, VP Strategy & Business Development at PhonePe, a leading UPI company.

“Among top cities for us are Indore, Nagpur, Aurangabad, Surat, Jaipur, Patna, Chittoor, Kurnool, Vijayawada, Guntur,” he said.

PhonePe saw the most transactions from states such as Andhra Pradesh, Bihar, Karnataka, MP, Maharashtra, Odisha, Rajasthan, Karnataka, Telangana, UP and West Bengal.

Leave a Reply