India’s two biggest ecommerce marketplaces, Amazon and Walmart-owned Flipkart, expect this year’s festival-season business in smartphones, television sets, refrigerators, washing machines and apparel to nearly double for some categories and increase at least 40% in others, top industry executives told ET.

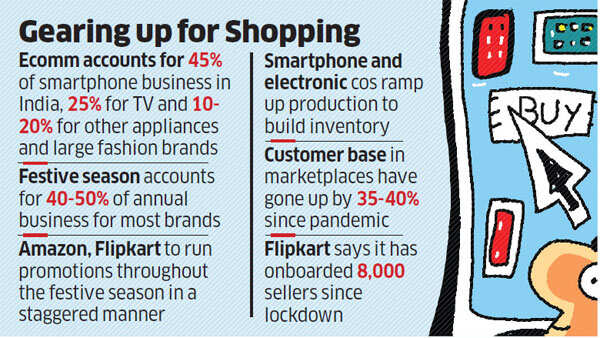

The platforms have accordingly asked sellers to place large orders with the respective brands. Five executives aware of the business projections said the two companies expect consumers will increasingly do their festive-season shopping online due to the pandemic, a trend evident in the success of recently concluded promotions earlier this month. Their customer base has also increased 35-40% since the pandemic, likely boosting business prospects.

In mobile phones, Amazon and Flipkart expect sales to more than double this festive season from the year earlier while in consumer electronics, they expect a 50-60% surge in business. These two categories contribute more than 60% to transaction revenue at the online marketplaces.

Flipkart and Amazon are hopeful of clocking 40-50% growth in apparel and fashion, with categories such as sportswear, footwear and casual wear performing better than formal wear in the last sales, the executives said.

A Flipkart spokesperson didn’t respond specifically on festive season orders but said that it’s focused on addressing the needs of customers in a safe and secure manner and will continue to make investments to keep this a priority in the upcoming period. Amazon didn’t respond to queries.

Online festival-season sales, which start with Navratri and continue until Diwali, will see an even distribution of offers through the entire period, said a senior executive with one of the large marketplaces. A spokesperson of smartphone brand Realme India said it expects over 80% growth in business on ecommerce platforms.

“We expect the Rs 7,000-10,000 and Rs 10,000-15,000 price segments to grow and become 60-65% of the overall market this year,” the person said.

The festive season is the biggest shopping period for Indian consumers, accounting for 40-50% of annual business for most brands. Ecommerce accounts for about 45% of the smartphone business in India. About a quarter of television sets are sold online, while these platforms account for 10-20% of annual revenue for other appliances and large fashion brands.

The platforms expect mobile phone sales to log strong growth due to work-from-home having become the norm across industries and services, including schools and colleges, said a senior executive at a leading smartphone maker. Hence, companies want brands to build inventory to avoid stock shortages.

In the appliances and viewing segments, which include televisions, refrigerators, dishwashers, washing machines and kitchen gadgets, the ecommerce companies have told sellers that demand will be significantly higher this festive season in large-capacity products as more households automate daily chores.

SUPPLY CONCERNS

Avneet Singh Marwah, CEO of SPPL, maker of the online-focused Kodak and Thomson TV brands, said festive season order volumes from the marketplaces have risen 50-60% this year. “The major concern could be supplies, as panel prices have increased 75%,” he said. “Despite this, we are confident of growth and might start a third manufacturing line this season.”

Fashion and apparel brands are looking forward to festive season sales to extricate themselves from a cycle of virtually no business, which led to undue increases in inventory. Sundeep Chugh, MD of Benetton India, said that with 10 states still under various stages of lockdown, the consumer mindset will continue to favour the online channel. Ecommerce is poised for strong growth in the festive season, he said.

Benetton, which last year generated 22% of its Diwali business from online sales, expects it to surge to 30-35% this year. Nitin Chhabra, CEO of ecommerce enabler Ace Turtle, which handles brands such as Puma, Lifestyle, Tommy Hilfiger, Calvin Klein, Michael Kors and Emporio Armani, said brands earlier believed that a surge in business in June – weeks after India allowed ecommerce sites to sell nonessential fashion and lifestyle items – was due to pent-up demand after the lockdown was eased.

“Even after that, online sales have been steady as there has been a big shift of consumers from offline to online. So, brands are quite confident that this year is going to be big for online,” Chhabra said.

Leave a Reply