If you want to make a profit, you need to mark up your products. But, how much is too much? To figure that out, determine a fair markup percentage. Calculating markup percentage helps you get the most out of pricing methods.

Read on to learn what is markup, find out how to calculate it, and see examples of markup pricing.

What is markup?

When you sell an item, you don’t charge the same amount you paid for it. You mark it up to make a profit. Markup is the difference between how much you spent on an item vs. how much more you’re selling it for. The greater the markup, the more you keep as profit once you sell the products. Wholesale businesses and retailers use markup to set product prices. Markup is expressed as a percentage.

Many business owners can’t help but think about margin when talking about markup. You can use both markup and margin to determine prices and measure a product’s profitability. Like markup, margin is expressed as a percentage.

Again, markup shows the difference between selling price and product cost. On the other hand, margin shows the percentage of revenue you earn per product.

You need to know how to calculate markup if you want to do strategic pricing. Strategic pricing helps you to set an attractive price to maximize your profit.

Calculating markup percentage

To come up with a markup percentage, use the markup formula … which we’ll get into soon. But before you can calculate markup, you need to know a few basic accounting terms:

- Revenue: Income you earn by selling products.

- Cost of Goods Sold (COGS): Expenses that go into making your products (e.g., materials and direct labor costs).

- Gross Profit: The difference between revenue and COGS.

Markup formula

Ready to dive into calculating markup? Use the markup formula to get started:

Markup = [(Revenue – COGS) / COGS] X 100

If you want a shorter formula to remember, substitute “Gross Profit” for “Revenue – COGS.” Here is the shortened markup percentage formula:

Markup = (Gross Profit / COGS) X 100

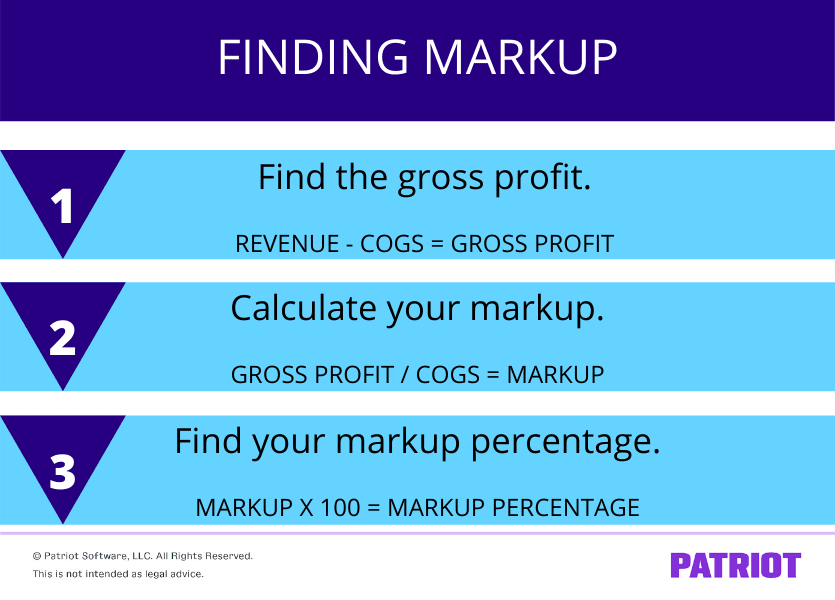

3 Steps to finding markup

To make things a bit easier, let’s break it down step-by-step, shall we? Use the following three steps to find your markup percentage:

- Find the gross profit (Revenue – COGS)

- Calculate your markup (Gross Profit / COGS)

- Find your markup percentage (Markup X 100)

Example

Let’s say you own a furniture store. You sell a chair for $400. The chair costs you $250 to make. Using the markup formula, find your markup percentage.

Markup = [(Revenue – COGS) / COGS] X 100

Markup = [($400 – $250) / $250] X 100

You have a 60% markup. In other words, you sold the chair for 60% more than what you paid for it.

Finding markup pricing

Now, let’s say you know your COGS and the markup percentage you want to charge. You need to calculate how much you should charge (aka revenue).

To do this, manipulate the markup formula to plug in the numbers you know and go from there. For simplicity, use the following formula to calculate your selling price. Keep your markup in decimal form (e.g., 0.40 instead of 40%):

Selling Price = [(Markup X COGS) + COGS] X 100

Example

Pretend you want a markup of 50% (0.50). You know your COGS ($100) but want to figure out how much you should charge customers.

Selling Price = (Markup X COGS) + COGS

Selling Price = (0.50 X $100) + $100

If you want a 50% markup, your markup pricing should be $150. This would be the amount you charge customers.

Markup and profit for your small business

So, how much should your markup be to make a profit? There is no standard markup percentage. Markups vary depending on your industry. And, markup percentages can range within industries.

When deciding your markup, you might opt for keystone pricing. Keystone pricing is where you set an initial markup of 50% for all products.

Setting prices with appropriate markup percentages helps you keep more profit in your pocket. If you don’t learn how to price a product effectively, you could price a product too low or too high.

Knowing how to calculate markup percentage helps you set and meet profitability goals. With the markup percentage formula, you can get an idea of how much profit you will make. You can also see how many products you need to sell to meet your goals.

Do you need a better way to track your income and expenses? Sign up for a free trial of Patriot’s online accounting software to record transactions, accept credit card payments, and so much more. Start your free trial now!

This article has been updated from its original publication date of July 19, 2016.

This is not intended as legal advice; for more information, please click here.

Leave a Reply