Executive Summary

It’s an old saying that “money can’t buy happiness”, but recent research has shown that, in reality, the relationship between money and happiness is more nuanced. Greater income levels are associated with greater levels of emotional well-being (at least up to a certain point); money is associated with higher levels of happiness, at least when it’s spent in certain ways (e.g., on experiences shared with other people or outright on others, rather than spent on ‘stuff’); we are increasingly recognizing the real-world trade-offs between earning more money versus having more time with our friends and family; and in the context of advisory firms, the trade-offs between income and work are of even greater focus as many advisors can outright control how many clients they wish to take on and what ‘Enough’ really means in the context of an advisory business.

Yet, in practice, remarkably little research exists to understand what maximizes the well-being of financial advisors. Instead, industry research overwhelmingly focuses only on what produces ‘More’ – more revenue, bigger businesses, more profitable businesses, with greater and greater productivity – as though the only path to success is through growth, and completely ignoring the growing base of financial advisors who are deliberately building ‘lifestyle’ practices and stopping their growth once they reach the point of having ‘Enough’.

To better understand these trends, we’re excited to announce the launch of our latest Kitces Research Study on Advisor Well-Being, which explores what factors really are – or are not – associated with greater well-being as a financial advisor. Are independent advisors really happier than employee advisors? Are smaller advisory firms really more stressed than larger firms? Does the platform an advisor is associated with impact their own individual well-being? Does advisor well-being actually rise as an advisory firm grows, or is there a point of diminishing (or even negative) well-being returns on growth?

So if you have a few minutes, please take our latest Kitces Advisor Research study on Advisor Well-Being. It is the shortest yet of our Research studies (for those of you who have been kind enough to go through some of our prior longer surveys!), and we’ll be sharing the results at the end of the year, in the hopes of helping the entire advisor community plan out what should be on their New Year’s business resolution lists to make 2021 their best year yet.

Thanks again for your willingness to contribute to this important advisor research!

Understanding The Five Dimensions Of Well-Being

Ask someone how they’re doing, and the most common response is that they’re doing ‘well’. Perhaps they’re doing well because their job or business is doing well, even in the midst of the current pandemic environment. Perhaps they’re doing well because their career has been adversely impacted, but they’ve got enough in financial savings to weather the storm. Perhaps they’re doing well because, despite the economic turmoil, they’re still thankful to be healthy, and it’s their physical wellness that gives them confidence.

For others, doing well is about the fact that their friends and family have been holding up well through the current environment, and their social fabric is strong. And for some, they’re doing well because they’ve even found an opportunity to have a positive impact by giving back to their community in these times of difficulty and feel their life has purpose (perhaps now more than ever).

On the other hand, though, many people are not well, because the challenges they’re facing in one or more of these areas are (negatively) overwhelming the rest.

In fact, a growing base of research, highlighted in the recent book “Well-Being” by Tom Rath and Jim Harter, indicates that what determines whether we’re ‘doing well’ are a set of multi-faceted dimensions. Because in the end, our well-being is about far more than just whether we’re feeling happy in the moment – a feeling that, even when times are good, can be ephemeral from moment to moment and day to day. It’s about more than just whether we’re healthy – financially, physically, or socially healthy. And it’s not just a matter of whether we wake up with a job and purpose each day, or with the strength of the community that we live in.

In fact, a growing base of research, highlighted in the recent book “Well-Being” by Tom Rath and Jim Harter, indicates that what determines whether we’re ‘doing well’ are a set of multi-faceted dimensions. Because in the end, our well-being is about far more than just whether we’re feeling happy in the moment – a feeling that, even when times are good, can be ephemeral from moment to moment and day to day. It’s about more than just whether we’re healthy – financially, physically, or socially healthy. And it’s not just a matter of whether we wake up with a job and purpose each day, or with the strength of the community that we live in.

Instead, Gallup – which has now researched well-being across more than 150 countries – finds that it is really about the intersection of all of these areas. From health and wealth to relationships and purpose and the communities in which we live, what makes life worth living is when we’re thriving in all five of these areas. We may at least feel we’re ‘doing well’ if we’re doing well in a few of them.

But any detractors across the five dimensions of well-being can wear on us over time as well. We may still find some joy in the moment but, in the end, it’s hard to bring full energy to our lives when our relationships are struggling, or our community is struggling, or we don’t have a purpose when we wake up, or our health is suffering, or our finances are suffering (as many financial advisors witness first-hand with our own clients).

The significance of well-being, though, is not merely the understanding of how ‘well’ we’re really doing – or not – but the recognition that the core dimensions of well-being are areas over which we often have at least some control. In fact, often our struggles with well-being are because we have unwittingly neglected one or several of these areas, and regaining our sense of well-being is often about taking the time and/or allocating our resources to (re-)build our relationships, to change our financial habits, to get involved with our communities, to improve our health, and to (re-)discover our purpose.

Which, in turn, helps to explain why research on the connections between money and happiness shows that spending on ‘stuff’ generally doesn’t increase our happiness. Instead, it’s spending on experiences (that we share with others and that enhance our relationship well-being) or outright spending on others, or it’s spending to save us time (that we can then reallocate to our relationship, or our community, or our health, or finding our purpose), that is associated with greater happiness.

It feels good to spend money in ways that enhance our well-being… even if we need a little nudge to realize it!

What Is Advisor Well-Being?

While the five dimensions of well-being are found to be universal – Gallup has studied and tested them literally across the globe – in practice, different people do have different expectations of what it means to do ‘well’ in a certain area. After all, ‘good financial well-being’ is very different for citizens of the world depending on the overall affluence of their country, varying health expectations around the world, the varying nature of communities and social relationships around the world, etc. Even within the US, expectations of well-being vary by a person’s situation and context.

And when it comes to financial advisors, there are many aspects to well-being – and the trade-offs that can and must occur to improve well-being – that are specific to the world of financial advice.

Advisor Well-Being And The Personal Toll of Market And Economic Volatility

While the financial services industry often highlights the strong earning power and economic opportunity of being a financial advisor, the reality is that being a financial advisor can be quite stressful. The connection formed in the advisor-client relationship – and of course the fiduciary obligation that attaches to it – means advisors take on a feeling of (and actual legal) responsibility for the impact of their advice on their clients, and recent research indicates that often one of the primary reasons that clients hire and delegate to advisors in the first place is specifically to help ‘pass the buck’ of accountability for outcomes.

Which means that when economic and market volatility rises, so too does the stress level of clients, and therefore the stress level of advisors. The frequency of phone calls and emails rise, clients venting frustration rises, the pressure on advisors to keep their clients on track rises, and the very real risk of clients blaming their advisors for undesirable outcomes also increases (as even though advisors cannot control markets, lawsuits against advisors for market losses always rise after a recession and bear market rolls through).

In fact, one research study found that in the months after the financial crisis, 93% of financial advisors experienced medium to high levels of post-traumatic stress. In the current environment, the pandemic crisis has played out differently, with markets recovering in a matter of months and not years (curtailing much of the economic pain for advisory businesses compared to the financial crisis), but a greater level of other pandemic-related stress remaining, from disrupted work habits in a forced-work-from-home environment to the real-world challenges of trying to stay productive while working remotely… while also potentially home-schooling children engaged in virtual learning as well, and with a constant and looming health fear!

Which raises the question of how the pandemic is really impacting the overall well-being of financial advisors, how advisor stress levels through this recession and (fast-turnaround) bear market compare to stress levels through prior recessions, what advisors have been doing to cope with the stress and manage their own self-care, and whether or how quickly advisor well-being rebounds if/when/as the world eventually returns to a post-COVID new ‘normal’.

The Complex Relationship Between Advisor Well-Being And Income/Business Growth

The conventional view of careers and businesses is that growth is good, if not an outright imperative. “If you’re not growing, you’re dying” is how the saying usually goes. And the financial services trade publications are rife with rankings of the fastest-growing advisory firms and the ones with the biggest businesses (i.e., the most assets under management).

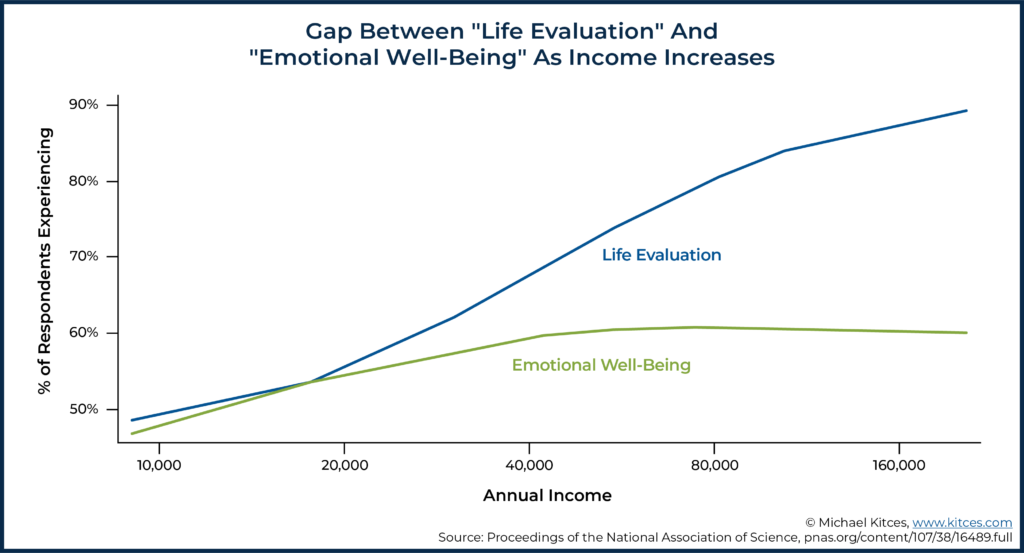

Except recent research has found that in general, higher income is only associated with greater happiness up to a point: about $75,000/year of income (at least in the US). Specifically, research by Daniel Kahneman and Angus Deaton found, leveraging the available Gallup Well-Being data, that emotional well-being rises as income rises, but only up to about $75,000/year in income; beyond that point, additional income may still increase our overall life (and financial) satisfaction, but it no longer improves our overall well-being.

When it comes to financial advisors, though, the situation is likely even more complex. As not only does it appear that financial advisors may anchor to different income and affluence goals – given the average income of a financial advisor is already well above this ‘happiness threshold’, but most have a strong goal to keep growing – but deciding to grow income for most advisors means getting more clients. And more clients means more relationships to keep track of, more service work, and potentially more staff to manage to expand capacity to service those clients. Which in turn can limit the growth in income (or at least increase workload and business stress by far more than the associated increase in income that comes with adding the next 100 clients after the first 100!).

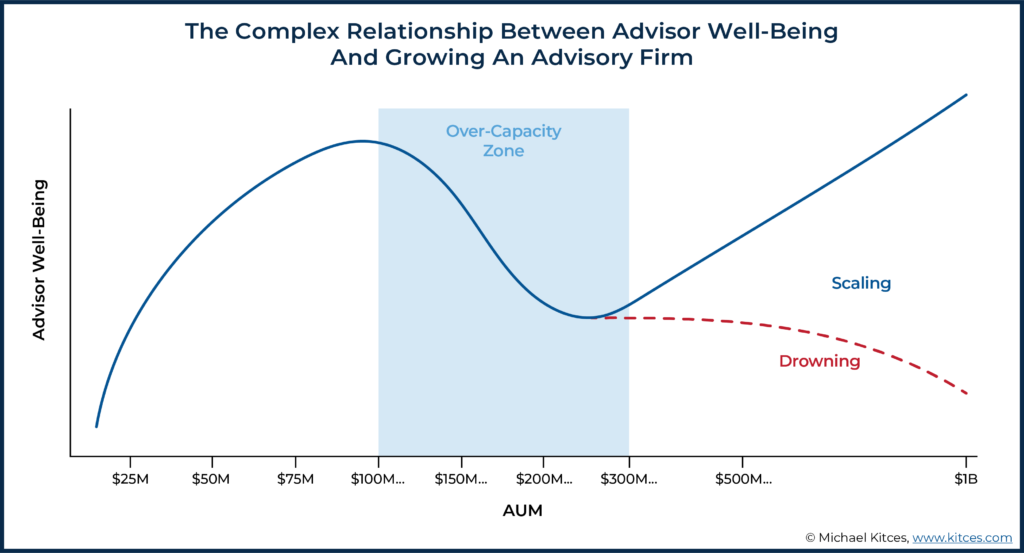

And the problem with the growth path of more clients (and more staff to expand capacity to service more clients) is that not only are there often diminishing returns on the additional income potential of adding more clients, but the additional management burden for the advisor (between the number of clients and the number of staff to service those clients) can actually result in decreased well-being for advisors. In fact, similar to the trough found in the “Happiness Curve” for consumers (where life satisfaction is higher when we’re young, troughs in middle-age, and only recovers again in our later years), some preliminary Kitces Research has found that the unhappiest advisors are those with a few hundred million of AUM!

In other words, it appears that advisors may experience greater well-being by limiting the number of clients to their personal advisor-client capacity and focusing on finding their ’50 Great Clients’ who pay enough in fees to make the income add up with a manageable workload (and limited staff management responsibilities). As only a few advisors may truly be wired to function as ‘enterprise builders’, drawing energy from having more and more employees to manage to serve an ever-growing (or even exponentially-growing) number of clients… while the rest may actually be happier with ‘lifestyle’ practices that maximize well-being over just clients and revenue?

Participate in the Newest Kitces Research Survey On What Really Drives Advisor Well-Being

Money can’t (or at least doesn’t always) buy happiness. Greater income is not necessarily associated with greater well-being. Advisors with $50M of AUM are often happier than those with $200M of AUM.

How has the pandemic impacted financial advisor well-being, given that the pandemic has been economically less stressful for advisory firms than the financial crisis of 2008-2009, but far more stressful personally from health risks to social (both family and community) disruption?

These are just some of the many issues we hope to explore in our latest Kitces Research study on Advisor Well-Being. With a focus on everything from the factors that most drive an advisor’s overall well-being, to whether well-being varies by industry channel (are advisors happier at large firms versus smaller ones, as employees versus independents, on salary versus ‘eat-what-you-kill’ compensation?), or by income or revenue or number of clients (or limitations thereof)… our goal is to understand not just what makes advisors ‘more successful’ (from the perspective of practice management benchmarking), but what kind of ‘success’ actually contributes to advisor well-being!

We hope you are as excited as we are about this new research, and will support the broader advisor community and us by participating in our new Advisor Well-Being survey. This survey is shorter than some of our prior ones and should take about 20-25 minutes to complete. All participants will receive a free copy of the final Kitces Research Report that we produce.

The survey will remain open until Thursday, September 17th, with the full Research Report due out in December, and can be completed in pieces over time (i.e., you can begin the survey, save your progress, and come back later to finish!).

Thank you in advance for taking a little time to participate in this important financial planning research study!

Leave a Reply