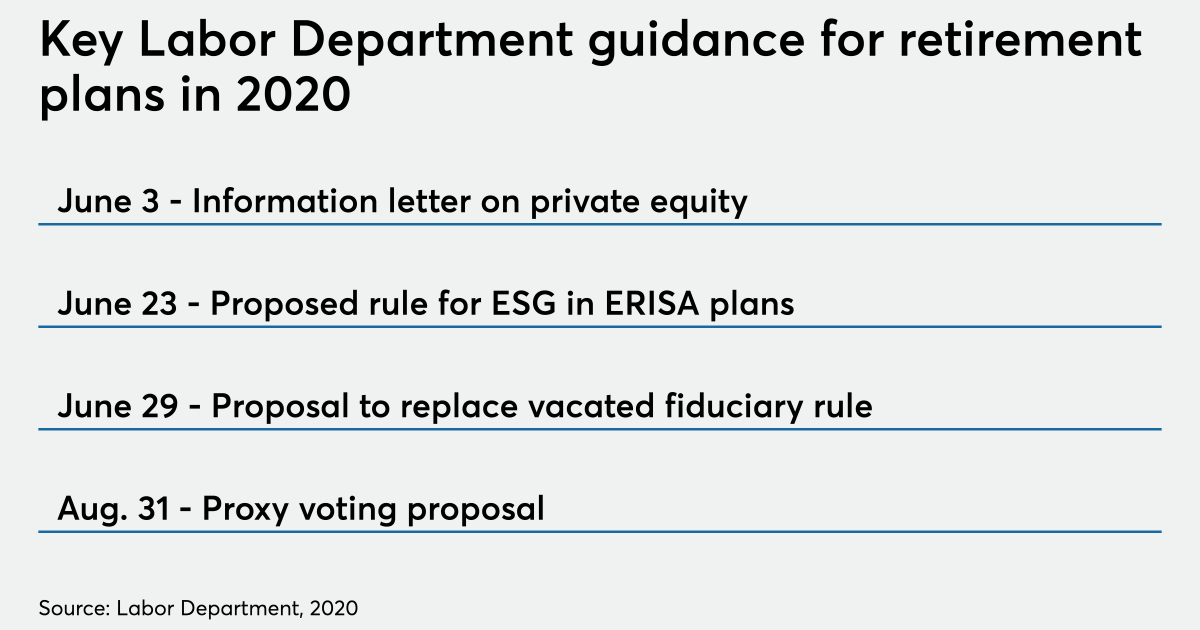

Just as advisors had wrapped their brains around private equity in retirement plans and a fiduciary rule replacement, the Labor Department is proposing even more regulation — and with a short turnaround time, too.

Under its latest proposal, issued Aug. 31, the department is turning its attention to proxy voting in a rule that would restrict when fiduciaries can vote for retirement plans.

The rule would add a list of requirements for fiduciaries to meet their duties of prudence and loyalty, including that they maintain records on proxy voting activities and the basis for particular votes. It would also prevent fiduciaries from voting on subjects including environmental, social or public policy agendas that don’t have a financial impact on the plan, according to the proposal.

The restrictions echo another department proposal earlier this year, in which it advanced that fiduciaries could only consider pecuniary factors when making decisions related to ESG fund selection in retirement plan lineups.That proposal received widespread criticism during the 30-day comment period, which ended July 30.

Under the latest plan, the department addresses its concerns that fiduciaries and proxy advisor firms may be “unwittingly allow[ing] plan assets” to be used for environmental or social purposes, thereby unnecessarily increasing plan expenses, according to the proposal.

This recent proposition is intended to clarify pre-existing guidance that may have confused fiduciaries, a senior Labor Department official said on a call with reporters.

“There appears to be a view amongst some stakeholders that the department’s guidance requires fiduciaries to vote on all proxies presented to them,” the official said, although that isn’t the case, they added.

Advisor John Frisch says it was already clear to him fiduciaries weren’t required to vote.

Frisch’s $200 million RIA, Alliant Wealth Advisors, selects funds for retirement plan sponsors and makes recommendations to employers for proxy voting. He says he spends approximately 30 minutes each quarter reviewing proxies for retirement plans and advising employers how to cast their vote. Since mutual funds comprise the retirement plans, he says, proxy voting is utilized primarily for board of director or auditor approvals, he says.

“It’s not a lot of moving parts,” Frisch says. For index funds, “they can try to change the fees. They can try to change the directors. They can try to change the auditors. That’s about it.”

The department opened a 30-day comment period for its proxy voting proposal.

Leave a Reply