Setting product or service prices is arguably one of the biggest yet most challenging decisions you can make. Some businesses use the cost-plus pricing strategy to reach a price that’s justifiable.

What is a cost-plus pricing strategy?

Cost-plus pricing is where a business comes up with prices by multiplying its cost of goods sold by the desired markup percentage. In short, look at how much it costs you to make a product and multiply that by a fixed percentage to get your selling price. Many product-based businesses (e.g., retail) use this pricing strategy for simplicity.

To use the cost-plus pricing strategy, you need to know:

- How much it costs you to make the product

- Direct labor

- Direct materials

- Overhead associated with producing product

- Your markup percentage

But, you may struggle to land on a fair markup percentage that also gives you a decent profit. When choosing a markup percentage, pay attention to industry standards, such as:

- Grocery stores: < 15%

- Restaurant: 60% (food); 500% (beverages)

- Retail: 50% (also known as keystone pricing)

If you use a cost-plus pricing strategy, you don’t have to use the same percentage per product. You can shake up your markup percentage.

Pros and cons

Not everyone is a fan of cost-plus pricing. Many businesses use it as their pricing strategy, but many pricing experts agree that it has its drawbacks.

Weigh the pros and cons before relying on a cost-plus pricing strategy for your products or services.

Pros

So, why would you consider implementing a cost-plus pricing strategy? Take a look at some of the most common pros of this model.

It’s easy to implement: One of the biggest advantages of using this strategy is that it’s easy to calculate … which translates to time savings. And what business owner doesn’t want that?

Cost-plus pricing doesn’t require a thorough market analysis on your competitors’ pricing or what customers are willing to spend (which is also a con that we’ll get to later). Instead, you simply need to identify how much it costs to make a product and use the cost-plus pricing formula to get your selling price.

You can justify your prices: Another reason businesses opt for this pricing strategy is that prices are justifiable. If your production costs increase, you can clearly explain why your selling prices increase, too. This could potentially boost business transparency … and help you raise prices without losing customers.

It’s a stable pricing strategy: Nothing’s worse than a long-standing price war with one or more of your competitors. But with a cost-plus model, you might be able to avoid these price wars.

Why? Because you aren’t setting prices based on competitor research, you are less apt to raise and lower your prices based on your competitors’ decisions.

Cons

Now that you know the advantages of the cost-plus method, we can turn our attention to the flip side. Here are some reasons that might make you hesitate before implementing this pricing method.

You might not cover all your costs: Depending on how good you are at estimating and allocating costs, you might end up setting a selling price that’s lower than all of your business’s costs.

Remember: product costs aren’t the only expenses you have. You may also have other costs, such as employee salaries, that are unaffiliated with production and insurance. Not to mention, you may have inventory shrinkage (e.g., broken products).

If you do use cost-plus pricing, take a look at all of your business’s expenses and prepare for setbacks—like shrinkage—before setting your markup percentage.

You might not be competitive enough: Failing to do market research on what your competitors are charging could wind up being a missed opportunity.

You could be charging too much and losing customers to competitors. Or, you could be charging too little and missing out on potential profits.

It might not be the right price for your customers: Like competitor research, customer research is critical to understanding who your customers are and what they’re willing to pay.

Cost-plus pricing formula

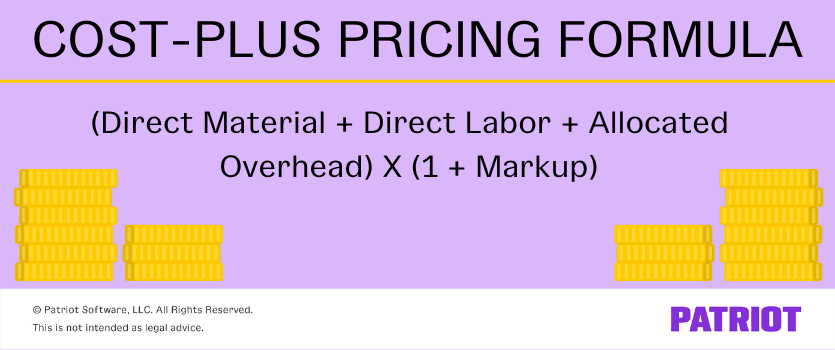

If you decide that the cost-based pricing strategy is the right one for your small business, use the formula to get started.

Cost-plus Pricing Formula = [(Direct Material + Direct Labor + Allocated Overhead) X Markup] + (Direct Material + Direct Labor + Allocated Overhead)

A simpler way to write this formula is to add one to your markup decimal:

Cost-plus Pricing Formula = (Direct Material + Direct Labor + Allocated Overhead) X (1 + Markup)

Confused? Let’s take a look at a cost-plus pricing example to see it in action.

Cost-plus pricing example

Say you are trying to find the selling price for your paintings. You identify the direct material, direct labor, and overhead associated with producing each painting. And, you decide to mark it up by 40%, or 0.40.

Take a look at your costs:

- Direct material: $10

- Direct labor: $50

- Allocated overhead: $12

Use the formula to find your selling price:

($10 + $50 + $12) X (1 + 0.40) = $100.80

You should charge $100.80 per painting under the cost-plus model.

Other pricing strategies

If you’re not sold on the cost-plus method for pricing, you have several other options.

The opposite of cost-plus pricing is value-based pricing. Unlike cost pricing, value-based pricing looks at how valuable your offerings are to your target customers. Rather than examining your costs, value-based pricing requires significant market research (e.g., customer surveys, consumer demographics, etc.).

Another pricing strategy you may consider is competitive pricing. Through this method, you find out what your competitors are charging for similar products or services and price your offerings lower. But again, this could lead to price wars.

You can also do a combination of pricing strategies to cover all your bases. To do this, analyze competitor prices, calculate your costs, and find out what your customers are willing to pay.

First comes price setting. Then comes making sales. And then comes … accounting. Patriot’s online accounting software makes it easy to track income, record payments, create invoices, and more. Get your free trial now!

This is not intended as legal advice; for more information, please click here.

Leave a Reply