Want to garner more client referrals? J.D. Power has three letters for you: ESG.

Clients are more likely to refer their wealth management firm to friends and family if the company excels in incorporating social causes into their investment strategy, according to a new J.D. Power research report which compiled survey data from 2019 and 2020.

Over three-quarters — or 76% — of clients who say their firm ranks well with ESG report they “definitely will” recommend their investment firm to friends and family, according to the report. For clients who didn’t give their firm high ratings on social causes, only 32% said they would definitely give a referral.

ESG is “not something that advisors were necessarily paying a ton of attention to until recently,” says Mike Foy, author of the report and director of wealth management intelligence at J.D. Power. But client demand is changing that.

Indeed, there were $10.4 billion in net flows into sustainable funds in the second quarter alone, according to Morningstar.

Advisors are paying attention to that demand, J.D. Power research shows.

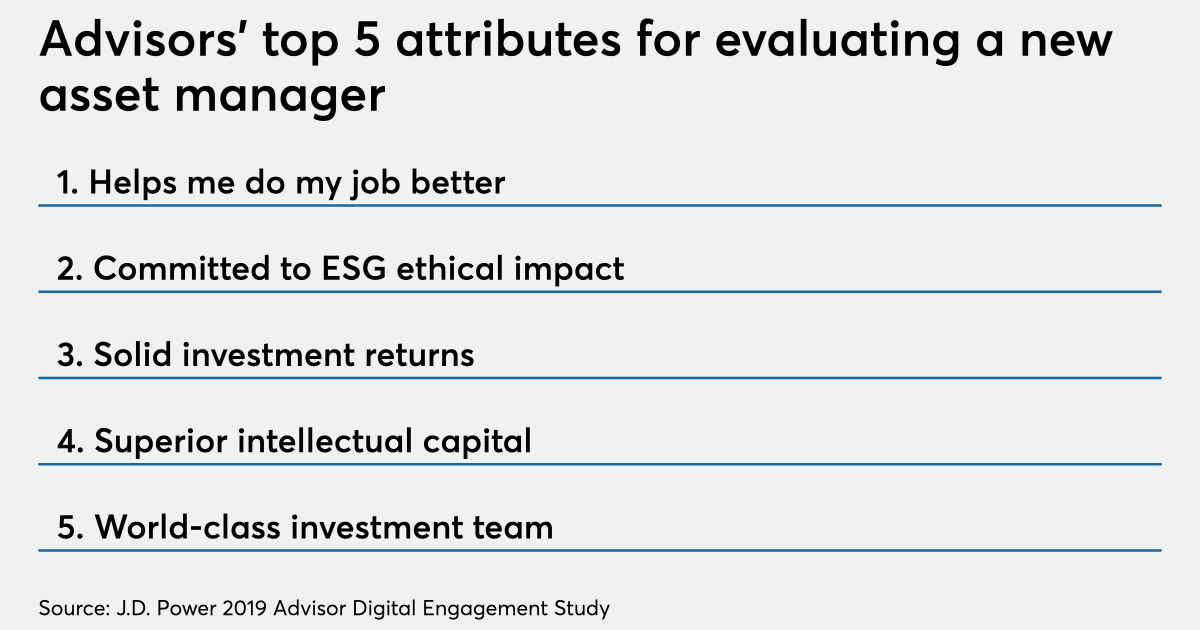

When evaluating a new asset manager, commitment to ESG is the second-most important consideration for financial advisors, right behind whether the money manager helps advisors do their job better, according to J.D. Power.

Mike Walters, CEO of the independent broker-dealer USA Financial, discovered advisors on his platform were eager to use ESG earlier this year when the company partnered with Just Capital to launch four sustainable strategies into their managed portfolios.

“Within just a couple of days, we had $10 million of new AUM in the door on there,” says Walters. “I think we’re onto something.”

Just Capital’s research “took off some of the blinders” advisors had by revealing how honing in on certain factors can improve investment returns, according to Walters. It “isn’t just ESG for the sake of ESG,” he says.

J.D. Power’s Foy says that coronavirus may have heightened investors’ awareness on how social issues can impact investment returns.

Some firms, sustainable investing advocates and others worry a recent Labor Department proposal could stymy adoption of ESG, at least in retirement plans.

In June, the department initiated an amendment that would require fiduciaries to provide a paper trail proving that ESG funds were economically superior to alternatives in their risk and return. Asset managers and financial advisors alike harshly condemned the proposal.

Leave a Reply