A Securities America financial advisor allegedly earned 4% on his own account and negative 13% for his clients as part of a cherrypicking scheme that lasted more than a year, according to the SEC.

Corbin L. Lambert used option purchases in his hybrid RIA’s omnibus trading account with Charles Schwab that he allocated between accounts based on their gains or losses, the regulator said in a Sept. 28 civil case it filed in a Nebraska federal court. He generated $37,042 in first-day profits for himself and $141,642 in losses to clients from doing so, investigators say.

“Lambert knew, or was reckless or negligent in not knowing that he was disproportionately allocating profitable trades to his personal account and disproportionately allocating non-profitable trades to his clients’ accounts,” according to the SEC’s complaint.

“The likelihood,” it continues, “that Lambert’s disproportionate allocation of profitable and losing trades resulted from random chance, as opposed to knowing and intentional conduct, is, at best, less than one in 20.”

Neither Lambert, 47, nor his attorney responded to requests for comment. He’s still registered with Continuum Financial, an Omaha-based RIA with $40 million in assets under management, as well as Securities America, which has its headquarters in a nearby suburb.

The allegations focus “exclusively” on Lambert, Continuum Managing Partner John Marasco said in an emailed statement. He noted that Continuum isn’t a defendant in the SEC case.

“The other partners in Continuum Financial are in the process of separating from Mr. Lambert,” Marasco said. “Continuum Financial anticipates having no further comment on the litigation.”

Representatives for Securities America and its parent firm, the Advisor Group independent broker-dealer network, did not respond to requests for comment.

Lambert carried out the cherrypicking between January 2017 and March 2018 using his personal Schwab account, according to the SEC.Compliance cases relating to BDs sometimes involve conduct by reps that occurred in their own external hybrid RIAs. In a different case last year, an ex-Securities America advisor pleaded guilty to defrauding clients for $11 million through his hybrid RIA.

As the individual with “sole responsibility to direct and manage the trading” in his clients’ accounts, Lambert allocated 39 of the 50 most profitable transactions to his account but only 22 of the 50 least profitable ones, according to the SEC. The “disfavored accounts” received 20 of the 50 most profitable trades and 37 of the 50 least profitable, investigators say.

For example, the SEC cites put and call options Lambert purchased in an ETF product issued by State Street Global Advisors, the SPDR S&P 500. Through the allocations in the purchase orders on the two different days alone, he gave himself a “riskless first-day profit” of $1,200 and saddled a client with losses of nearly $950, according to the complaint.

In February 2018, Schwab’s internal fraud alert system detected his use of the omnibus account “to day trade options for his personal account, to the detriment of his clients,” the complaint states. Although Schwab confronted Lambert the following month, he also initially misled his partners about why the firm contacted him, according to the SEC.

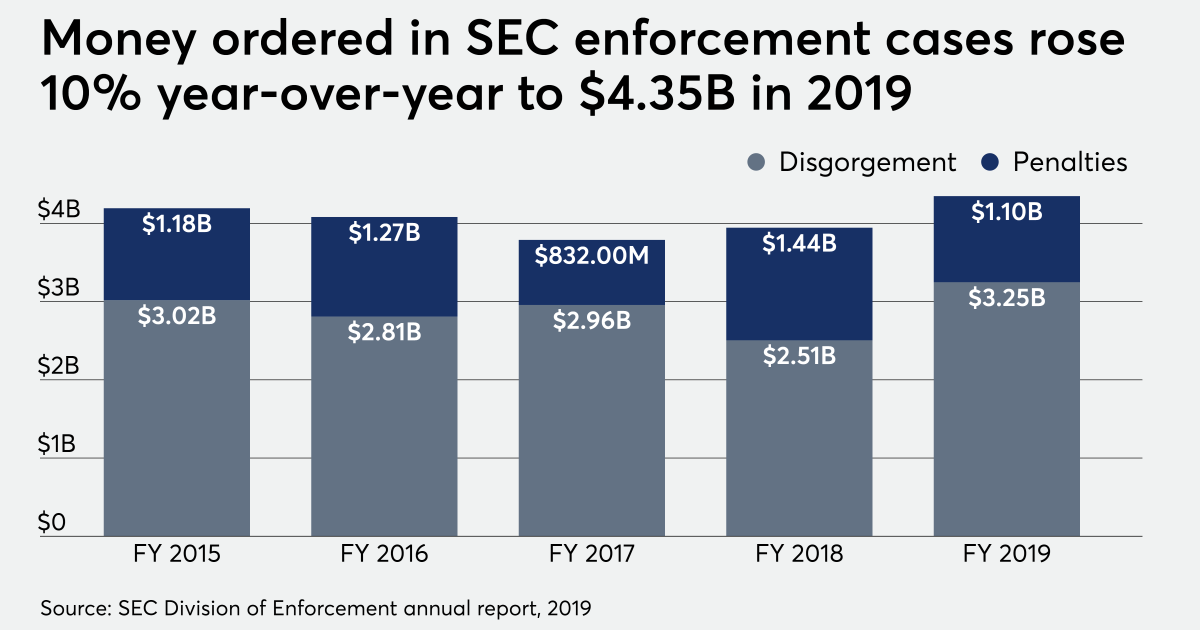

Lambert faces three counts of fraud in the SEC’s filing, which seeks disgorgement and civil penalties. Over more than 20 years in the industry, he has no other disclosures listed on his FINRA BrokerCheck file.

Leave a Reply