It was the last time Tom Nally would stand on a stage as the president of TD Ameritrade Institutional, addressing RIAs.

Two months earlier, the company had surprised its advisors with an announcement that long-time rival Charles Schwab would acquire it.

After all, the custodian had been around since the 90s and was known for the loyalty it engendered from its clients, as well as its reputation for innovation. How would the new $2 trillion custodial giant transform the industry? And what would TD’s absorption into Schwab mean for its advisors, its clients and its hold on the wealth management industry?

“I think we have a few things to talk about here,” Nally said as he welcomed advisors to the company’s 24th annual LINC conference.

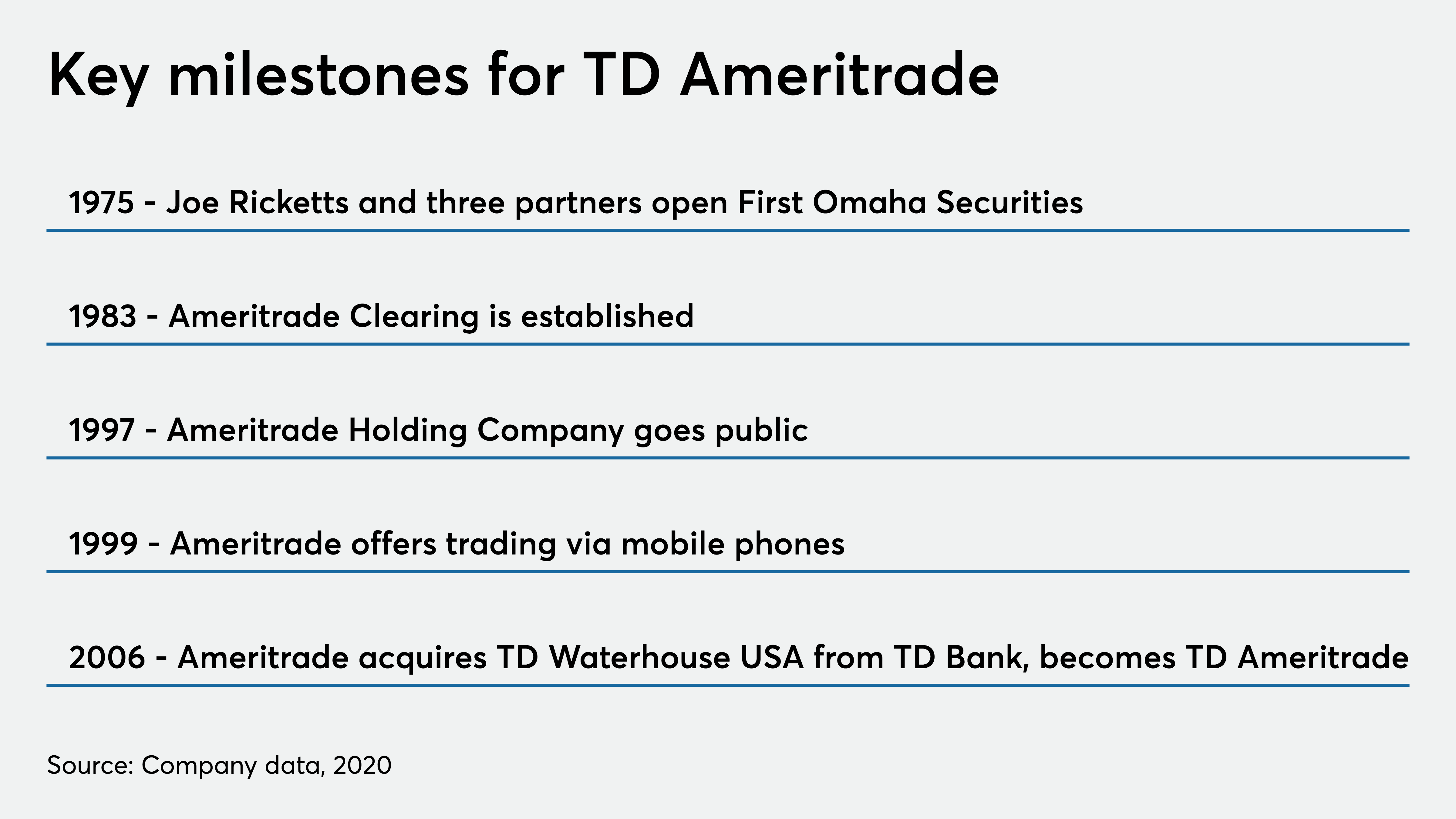

Consumers and clients know TD Ameritrade for its ubiquitous retail brokerage and branches. Or perhaps they remember seeing its contentious Sam Waterston ads criticizing Schwab’s commission costs. But independent financial advisors have had a special relationship with the firm as their custodian of client assets for more than two decades.

When Nally first joined TD in 1994 as a broker trainee, it was of course a very different firm; people still smoked at their desks. “I didn’t even know what an RIA was,” he said in an interview with Financial Planning in January.

NAPFA

Now Nally faced an audience of about 2,000 advisors, who, in important ways, represented a massive shift in the wealth management landscape. The RIA industry has flourished over the past 20 years, growing into a $4 trillion market, as advisors have sought higher salaries, more choice when it comes to tech and services, and primarily, to better serve their clients without conflicts of interest.

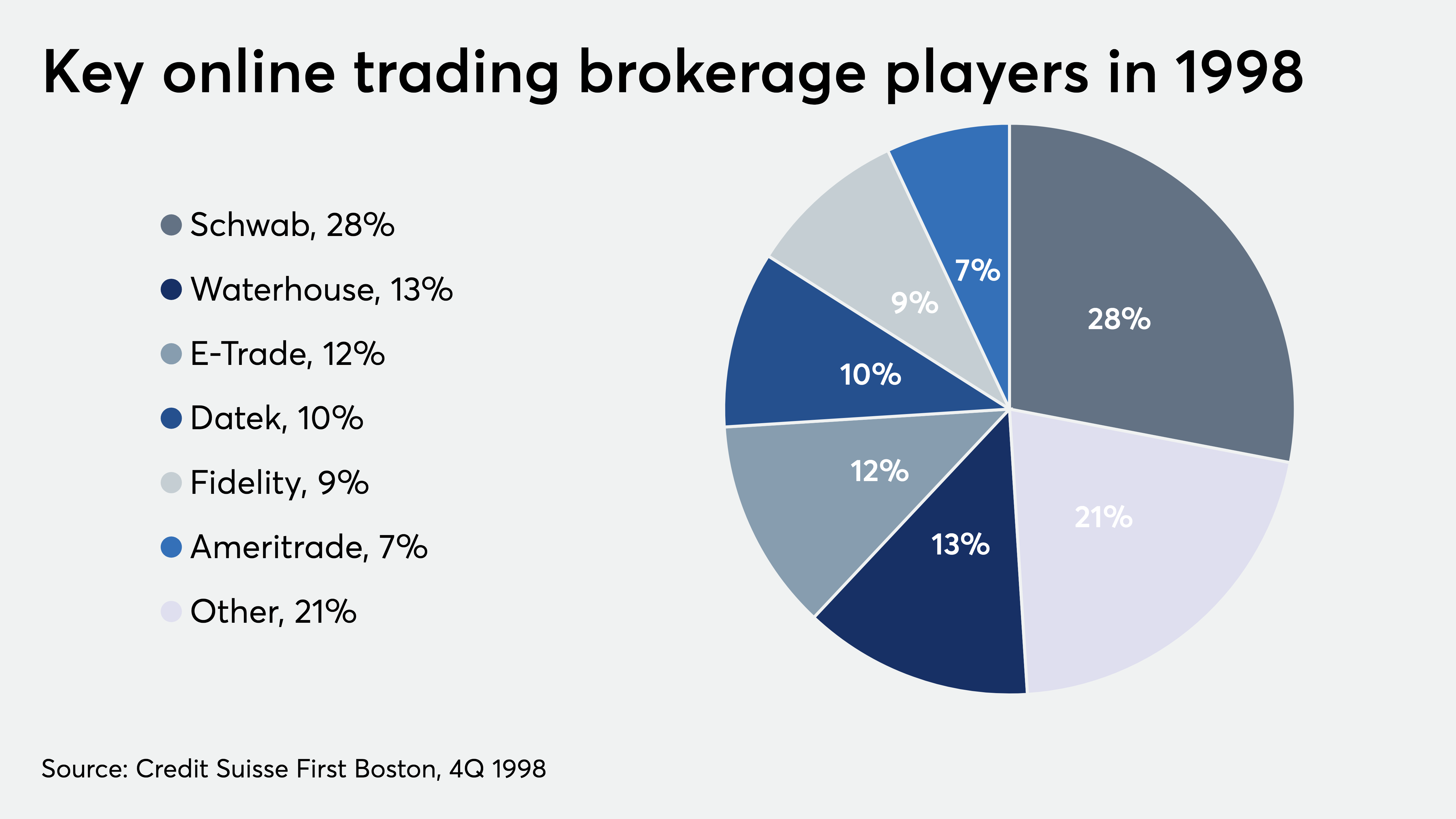

The “Big Four” custodians — Schwab, Fidelity, TD and BNY Mellon Pershing — have helped drive this shift. Together, these firms house about 80% of the assets in the independent advisory space, according to Cerulli’s latest research.

By acquiring TD Ameritrade, Schwab, already the biggest custodian, will have more than $2 trillion in RIA assets. It’s a milestone for a firm that has been a changemaker in the retail brokerage business and, since 1987, custodial services.

TD’s technology, staff, offices and more will become Schwab’s as part of the acquisition. But the custodian also leaves behind a legacy, current and former TD employees say.

TD Ameritrade Institutional, which had custodied assets for more than 7,000 RIAs when the Schwab deal was announced, was known for challenging — and occasionally mocking— its competitors. It was an advocate for advisors, insiders say. And it opened conversations about racism at conferences and supported younger advisors via scholarships and grants.

SIDING WITH ADVISORS

TD Ameritrade has grown alongside the independent channel, as it helped advisors do the same. By June of this year, it had grown into a $1.5 trillion firm — 47% of those assets managed by RIAs, according to the company.

Former executives say the firm’s reputation as an advocate for independent RIAs dates back to the 1999 “Merrill Lynch rule.”

Despite being a broker-dealer, TD Ameritrade — then TD Waterhouse — spoke out against the now-defunct SEC regulation, which allowed brokers to offer fee-based accounts without acting as fiduciaries, as long as they disclosed it. TD Ameritrade issued two comment letters and filed an amicus brief in support of the FPA’s lawsuit against the SEC.

The rule was overturned by the U.S. Court of Appeals for the District of Columbia in 2007, but it was a key moment for the company, Tom Bradley, president of the custodian at the time, said in a Michael Kitces podcast at the end of last year.

“I think, up until that point, [advisors] might have looked at the custodians with a leery eye,” he said. “And maybe they still do, but I think that really gained a lot of loyalty for the company — because we took the side of advisors.”

Skip Schweiss

From the Dodd Frank Act to Reg BI, TD analyzed policy proposals, explained them to advisors via whitepapers and webinars, and represented planners’ opinions in D.C., according to Skip Schweiss, who was the head of advisor advocacy at the custodian from 2010 until his departure earlier this year.

“Often the voices that are heard in Washington are the loudest, the deepest-pocketed ones. If you’re an independent advisor or planner, that might not include you,” Schweiss says. “We took a lot of pride in aggregating their voices and making sure they were being heard in those [policy] debates.”

For advisors including Angela Bender, who left LPL Financial in 2012 to open an RIA with TD Ameritrade, it ran deeper than advocacy. Bender says TD built a wall between its retail brokerage and advisory divisions, which stood out to her when she compared how custodians advertised to retail clients, she says.

TURNING ON THE LIGHTS

TD Ameritrade cemented a name for itself in a competitive industry, largely due to a commitment to tech innovation — a reputation that has smaller tech vendors questioning their fate following the merger.

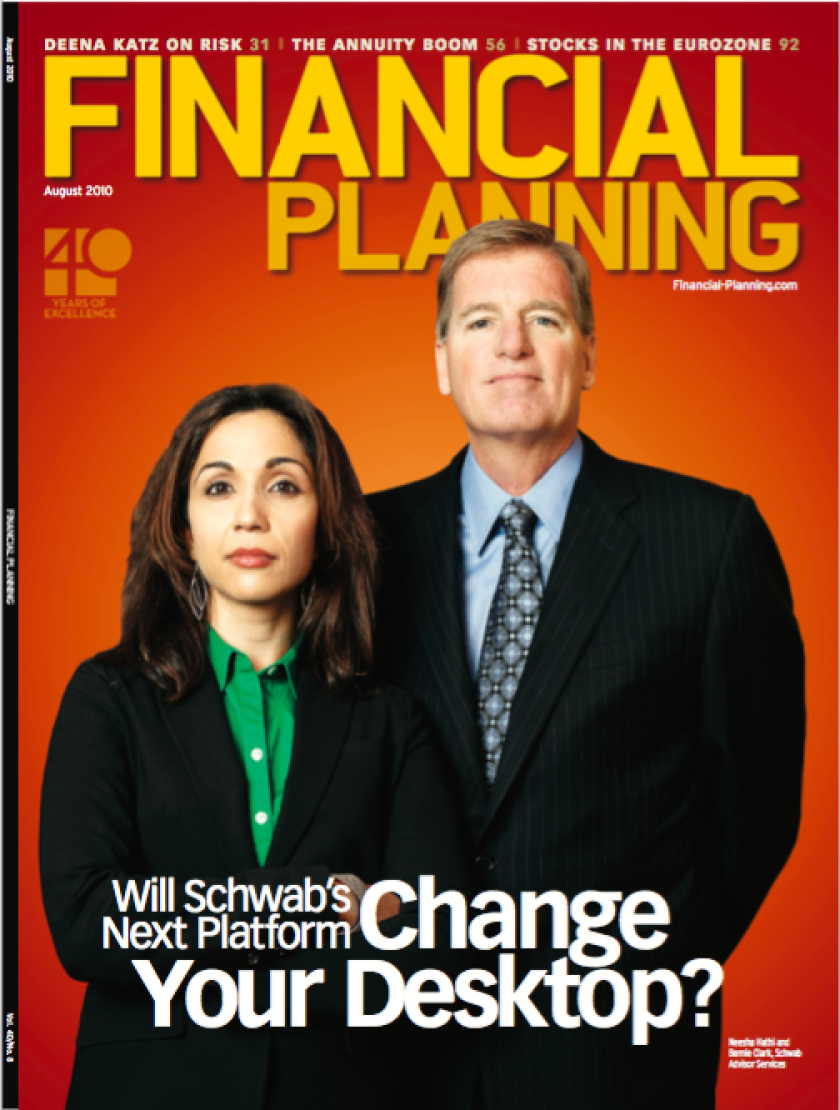

While TD certainly wasn’t the only custodian investing in tech (Schwab’s technology investments were featured on the cover of Financial Planning in August 2010), it was the original tech integration partner for many firms or startups, including portfolio management and reporting platform Advyzon.

“That’s in their culture, I would say — being open,” Hailin Li, CEO of Advyzon, told Financial Planning earlier this year on the sidelines of the company’s LINC conference.

Before its sale to Schwab, TD shared its data with some 180 third-party tech tools and applications with Veo Open Access, showing the custodian’s willingness to give small players a shot should advisors wish to use their services.

This ethos was on full display when Scott Collins, TD’s former head of institutional sales consulting and brokerage independence, came to the custodian in 2013 after spending over a decade in the independent broker-dealer side of the industry. “It was like somebody turned on the lights, and I realized how much was in the room,” he told Financial Planning in January.

The plethora of tech vendors available on the Veo platform gave financial advisor Bender negotiating power when building her tech stack, despite the small size of her RIA. “You need the technology, but you know, those budgets can just eat you alive on the margin,” she says.

I am now ready to dish everything about @TDAmeritrade

It was an incredible place to work. And what made it incredible was the people. The innovative, client-first mindset will forever be part of the fabric of my DNA. Onward! https://t.co/xju3dxCfMO

— Dani Fava (@ENVDani) September 30, 2020

TD launched Veo One in 2015, a platform where advisors could update information in one program and see those changes automatically in other systems. Among other tech investments, TD was an early adopter of voice technology and a spender in both artificial intelligence and analytics.

“Checking your account balances via the Alexa app — that’s sweet,” says Brice Carter, chief investment officer of the $294-million RIA Financial Strategies Group, which custodied with TD Ameritrade.

‘FULL CIRCLE’

A big push at custodians over the last decade has been promoting careers for the next generation of advisors via internship programs and awareness. TD has been an outspoken proponent for diversifying the industry.

Since 2013, TD Ameritrade Institutional has brought 432 students to its annual conference and given out nearly $470,000 in scholarships to 94 students and $1.2 million in grants to 17 universities, according to the firm.

“It really is coming full circle,” Kate Healy, who became the managing director of Generation Next at TD in 2017, told Financial Planning in January, adding that she is seeing students who attended the conference in the first years of TD’s program now at career fairs, hiring new candidates.

NYSE

Conferences have helped Craig Lemoine’s students find onramps into the industry and, at times, made them think more critically about wealth management. Lemoine, who is director of the University of Illinois Financial Planning Program, which received a grant from TD Ameritrade this year, says TD’s LINC conference pulled his students into conversations about race and the challenges BIPOC advisors face.

“What happens when the client is racist? What do you do then?” Lemoine says. “That’s not something we talk about a lot in financial planning. We don’t talk about it nearly enough.”

‘END OF AN ERA’

Since 2005, TD Ameritrade expanded to over 7,000 RIAs from about 1,500. In part, that growth can be attributed to chutzpah, such as when the institutional team asked the SEC for a list of financial advisors via a CD-ROM, then had the sales team “pound the pavement and get on the phones.”

“If you go back 20 years ago, independent investment advisors were considered to be just a band of rebels,” Bradley told Financial Planning in a February interview, soon after accepting a new position at Schwab ahead of the acquisition.

In 2019, nearly 436,000 of those rebels were giving investment advice.

It was a long run for TD: 24 LINC conferences, 7,000 RIAs, 180 integration partners, $470,000 in scholarships. At least 15 of its own completed acquisitions.

The independent space continues to evolve as more deals close, brands disappear, new players emerge — all while more advisors register with the SEC.

Ultimately it’s the people behind a new Alexa feature, a comment letter, or the faces behind a panel that are shaping the industry.

“It feels like a little bit of an end of an era,” Carter says. “Features and service are great — you might miss those, but you miss the people, right? You miss the culture.”

Whether it’s continuing on at Schwab or heading off for a new opportunity, many of TD’s alumni have opted to stick it out with independent advisors.

“Change is always inevitable,” Nally tells Financial Planning. “You just have to embrace that change, make the best of it and move forward.”

Leave a Reply