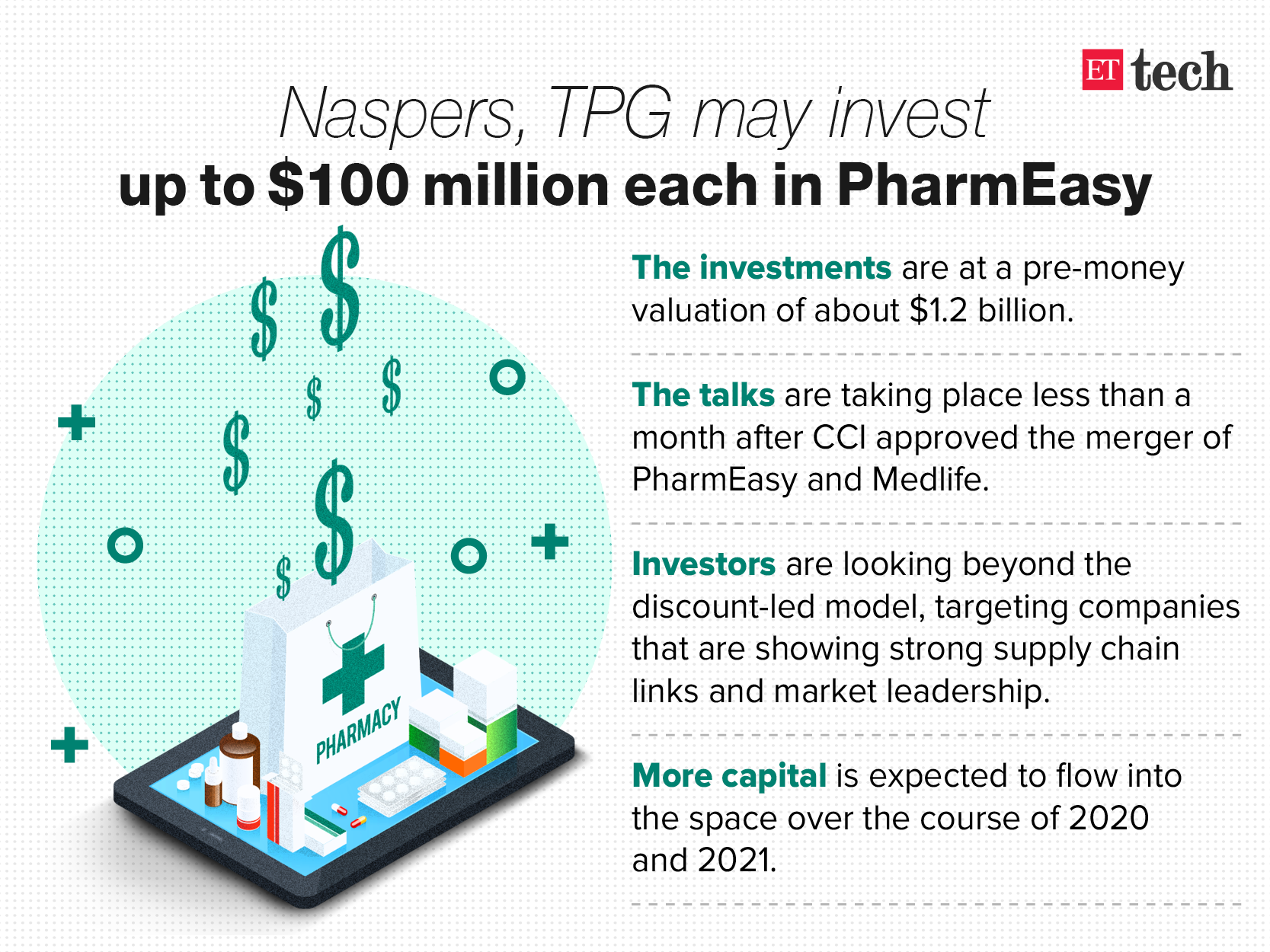

South African technology and media conglomerate Naspers and US-based private equity firm TPG are in talks to invest up to $100 million each in Mumbai-based online pharmacyPharmEasy, three sources aware of the development said.

The proposed investment is likely to be done at a pre-money valuation $1.2 billion, the sources told ET.

The funding talks come less than a month after India’s competition watchdog approved a merger between PharmEasy and smaller rival Medlife, heralded as the first big consolidation play in a sector seeing heightened competition and entry of deep-pocketed players like Reliance Industries and Amazon.

ET was the first to report in August that the merger had been completed. A spokesperson for Naspers did not comment on the capital raising talks.

“It is the company’s policy to neither acknowledge nor deny its involvement in any merger, acquisition or divestiture activity, nor to comment on market rumours,” the spokesperson wrote in response to ET’s email.

PharmEasy did not respond to ET’s queries till the time of going to press.

PharmEasy received $100 million from Singapore’s Temasek in August last year, valuing it at $650-$700 million. It also wrapped up a $100-$120 million equity financing round in July last year, led by a host of new investors, including the second-largest Canadian pension fund CDPQ, and LGT – the private banking and asset management group controlled by the Liechtenstein princely family.

PharmEasy also counts venture capital firm Orios Venture Partners and Eight Roads as its early backers.

That merger of PharmEasy and Medlife saw the latter sell 100% shares to API Holdings, the parent entity of PharmEasy, in return for 19.59% ownership in the combined entity, according to a filing with the Competition Commission of India (CCI), which ET had reviewed.

Top merchant bankers told ET that the broader pharmaceutical sector was expected to see a significant uptick in deal making.

“A lot of capital raising will happen in pharma. People will expand manufacturing capacities across the board. Entrepreneurs are getting more confident about their own businesses. This is a sector which has gone through a crisis of confidence…Whether that will happen through internal accruals, capital, it can be a combination of everything. It’s a big sector to watch out for… I would say this is the beginning phase for pharma again,” Gaurav Deepak, chief executive and co-founder of homegrown financial services giant Avendus Capital, told ET recently.

Online pharmacies such as PharmEasy and 1MG have registered growth outside their core metropolitan markets by rapidly expanding into tier-2 and tier-3 towns and cities, as they look to grab a larger slice of the Indian consumer wallet.

According to a recent report by RedSeer Consulting, India’s top four e-pharmacies, including Medlife, Netmeds, 1MG and PharmEasy contributed 90% to online drug sales.

The average order value has gone up to Rs 1,200 with customers ordering on average 10 times per year.

“Investors are looking beyond the discount-led model. They are looking at companies that have stabilised their supply chain and logistics infrastructure, while also developing their standing as market leaders, and are firmly focused on margins,” one of the sources cited earlier in the story said.

India’s eHealth market, led by the online pharmacy category, is pegged to touch $16 billion over the next five years, from its current market size of $1.2 billion, according to market watcher RedSeer Consulting.

The growth will be driven by a massive influx of customers availing online healthcare services, according to the report — Indian eHealth at a tipping point.

The number of households using eHealth services will grow to a projected 60 million by 2025 from 4.3 million today, it said.

“Online pharmacies are just the trigger and will make consumers explore the second and third use cases,” said Anil Kumar, founder and CEO of RedSeer Consulting. “E-health starts making sense only if you as a consumer look at it as a single-window service.”

Leave a Reply