YCharts has been acquired by LLR Partners as private equity dollars continue to flow into the wealth management industry — particularly the fintech sector.

An investment research and analytics platform for RIAs, broker-dealers and asset managers, YCharts has more than 6,000 users, primarily financial advisors, and the fintech counts firms like LPL Financial, Dynasty Financial Partners and John Hancock Investments among its clients.

YCharts did not share details of the transaction and declined to comment on the terms of deal. The firm earns more than $15 million in annual recurring revenue, a YCharts spokesman said in an email. Current market multiples would likely place the deal between $135 million and $270 million, according to TechCrunch.

Growing market share and recurring revenues make the independent advisory industry an attractive opportunity for PE investment, with fintech firms helping to power that growth, says Jonathan Roberts, managing director of transaction advisory services at accounting and advisory firm BDO.

As the need for financial advice grows, so does the need for modern digital tools that help serve that need, Roberts says.

“Technology is going [remain] in huge demand in the wealth management industry, and it’s obviously a growing industry from an AUM perspective,” he says.

In July, PE firm TA Associates partnered with PE firm Genstar Capital to reinvest in popular portfolio management fintech Orion Advisor Services and merge it with Brinker Capital, an investment management firm.

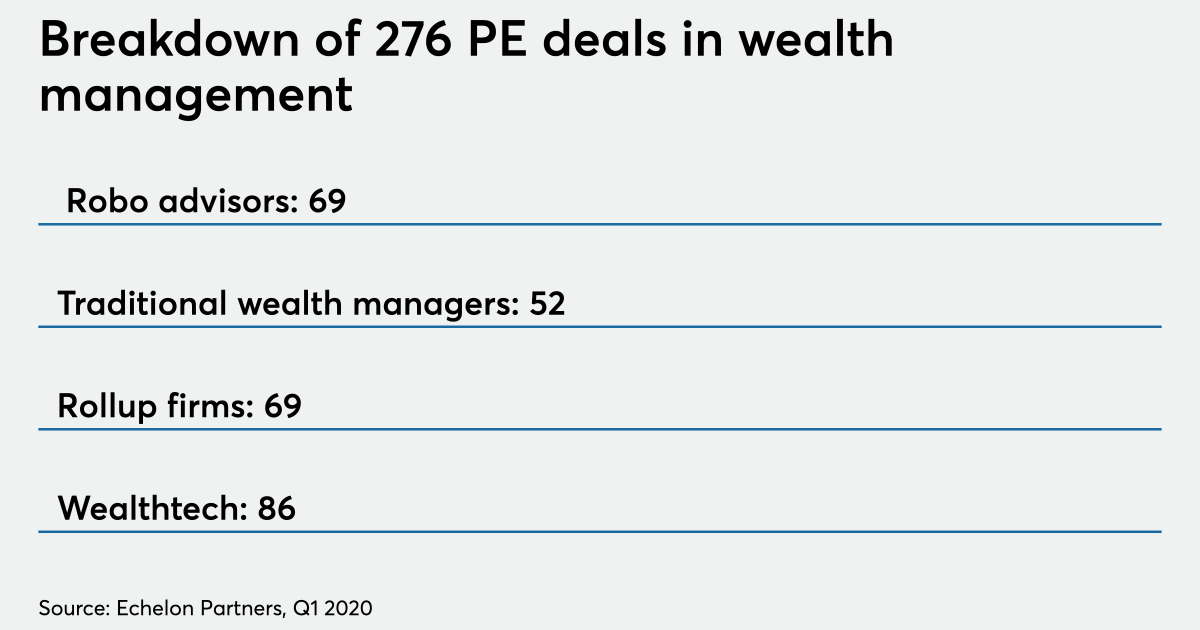

In the first quarter, 276 PE firms were invested in wealth management — nearly four times as many as during the Great Recession, according to M&A research firm Echelon Partners. That number includes 86 firms invested in advisor-facing fintechs like Orion and YCharts.

Fintechs have an opportunity to help the more than 300,000 financial advisors currently practicing in the U.S. today be more efficient and serve clients digitally, according to a statement from LLR Partners vice president Sam Ryder.

YCharts will use the LLR’s investment for continued growth with RIAs, broker-dealers and asset managers, according to a statement from CEO Sean Brown.

Leave a Reply