Think back to the last time you visited the office of your corporate services provider. What’s the first thought that comes to mind?

A room full of cabinets? Files? Paper?

Osome, a Xero Platinum Partner with offices in Singapore, Hong Kong and the United Kingdom, prides itself on having a paperless office from day one. With an eye on international expansion, Osome knew from the outset that a cloud-first strategy would be integral towards scaling their client base, expanding their scope of services and taking the brand across borders.

A corporate services firm in line with the times

Osome was founded in 2017 on the basis of three mega-trends:

- Changing client expectations: Client demands are changing with the advancements of new technology. Today, shopping, food and transportation services are readily available for the everyday consumer on-demand and at our fingertips. Even the most traditional businesses, such as banks, have had to adapt to this shift in consumer behaviour by taking banking services online. Today’s customers expect service that is responsive, instantaneous and at their convenience. It was high time for the corporate services industry to catch up.

- Changing employee expectations: Employees today, millennials especially, crave for rewarding and meaningful work. Even new graduates balk at the idea of clocking in from 9 to 5 and doing low value work such as manually entering and/or copying and pasting data.

- Changing regulatory environments: Governments around the world are introducing more rigorous compliance requirements for companies, thereby creating demand and opportunity for affordable and reliable compliance services.

Despite these trends, there was a clear gap in the market that current corporate service providers were not filling. With these, Osome set out on a mission to develop technology-enabled company incorporation, accounting, and secretarial services that suit the needs of businesses today.

Using technology to automate 50% of the accounting workflow

When thinking about the automation of day-to-day accounting tasks, many accountants seem to still believe these are distant claims from the future. By strategically implementing technology today, including the use of Xero’s bank feeds and connected apps such as A2X, Chargebee, Plato and Xero Expenses, Osome has already automated as much as 50% of the accounting workflow.

This level of technological automation is what helps Osome reduce their cost to service clients – Osome has nearly 2,000 accounting clients in their portfolio who are serviced by just 30 employees in the accounting team. Of course, client accounts come with varying levels of complexity, so the current staff to client ratio sits at approximately 1 to 70. “Without the technological suite we implemented, I think we’d need three times as many staff to service our client base!” says Dr. Konstantin Lange, Chief Operating Officer at Osome.

Affordability, speed and quality

Is there really such a thing as cheap, fast and good?

“Yes!” assures Konstantin. Osome is careful to not associate fast, responsive service with poor service quality. In fact, by equipping its global workforce with the right technological tools, including the use of chatbots, Osome has been able to offer daily client support 9:00am to 1:00am, ensuring all its clients receive prompt support regardless of timezone.

While a conventional service that has been around for years, Osome aims to reinvent corporate services by operating like a tech business. Osome is constantly looking out for opportunities to standardise and automate repetitive business processes, and rewards employees for productivity and efficiency – a sharp contrast from the professional services industry who has traditionally billed by the hour. Osome measures the success of their practice based on results-oriented metrics such as margins on client services, revenue per client and time spent.

“Most of the time, our clients don’t want to have to worry about accounting. Similar to when you visit a restaurant, you care ultimately about the taste of the food, not what goes on in the kitchen. As long as we deliver quality, our clients don’t worry about what goes on in the backend,” says Konstantin.

Establishing industry influence and trust

Corporate service firms are seldom known for their sales and marketing efficacies.

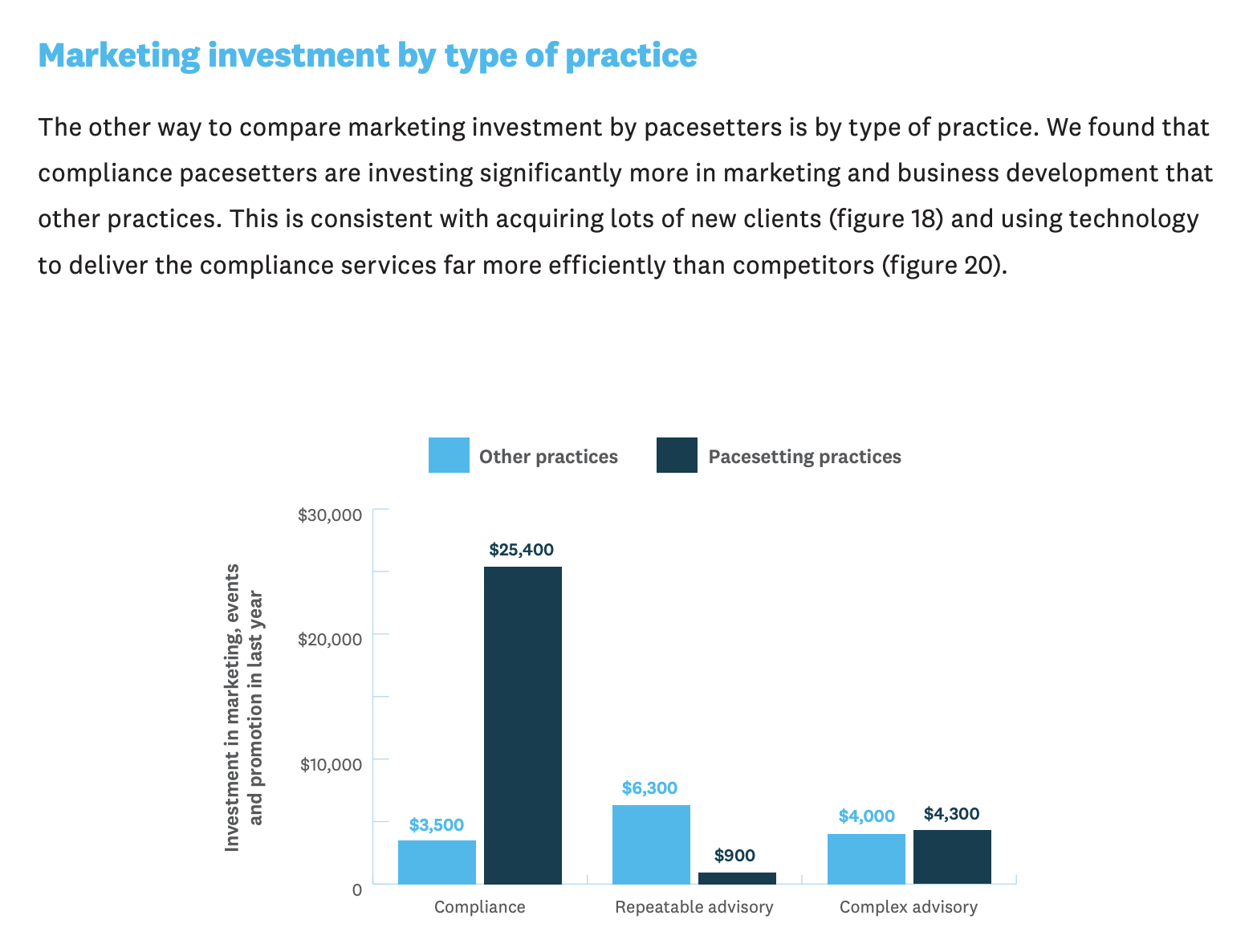

According to Xero’s 2020 Singapore Accounting Industry Benchmarking report, the average compliance-focused practice spent S$3,500 on marketing in the year 2019. The Pacesetters, defined as the top 15% of practices with high growth and revenue relative to their competitors, invested over 7 times more. It was uncovered in the same research that the pacesetting firms were well ahead of competitors in their pace of new client acquisition and their ability to service clients efficiently.

Osome, a pacesetting practice, achieved Xero Platinum Partner status in less than 3 years of joining the partner programme. Konstantin attributes this hyper-growth and success to their willingness to invest in marketing and business development. Osome receives up to 40% of their new business leads from Search Engine Optimisation (SEO), 20% from paid digital advertising and the remaining from client referrals and partnerships. Examples of such innovative partnerships include their offering of same-day online incorporation and business account opening from anywhere in the world with Aspire, and transparent, low-cost payroll, accounting and tax package for OCBC customers for just S$50 a month.

Apart from investing in marketing, Osome also believes in investing in its people. This starts as early as the hiring process, keeping an eye out for the right talent who are eager to make a difference, more than just making a living. “There are many types of accountants in the world; anyone can study to become an accountant,” laughs Helena Flores, Osome’s Accounting Operations Manager. “The key is to hire accountants with the right mindset – the ones that are adaptable to change and bought into Osome’s vision of enabling accounting with technology.”

Digital as a differentiator

Osome’s branding and positioning as an online company incorporation services provider has allowed them to capture market share among the influx of new companies. According to statistics from the Accounting and Corporate Regulatory Authority (ACRA), there has been an increase in the formation of new business entities month-on-month since June 2020. This signals positive bouncebacks from those whose jobs have been impacted by the COVID-19 pandemic. A digital-first approach, once a nice-to-have, is now essential in the post-Covid way of working. We expect tech-enabled corporate service providers, such as Osome, to be in a position to capitalise on even more market share, as these new startups are expected to be digital natives who are ready to embrace new ways of working, without the burden of legacy systems and processes.

Through its integrations with SingPass and Onfido, as well as the implementation of digital biometric verification, signatures and document processing, Osome is able to offer a fully online company incorporation service, with the promise of successful company incorporations within the day.

By bundling Osome’s company incorporation with the use of Xero, Osome has been able to upsell additional services to their existing client base, grow their share of accounting clients and increase overall firm revenue. In taking their client base from the startup to growth phase, Osome also builds a healthy portfolio of clients that stay with them in the long run.

In future, Osome hopes to expand their scope of services to include advisory, and become the number one tech-enabled corporate services provider in Singapore and around the world.

A Xero Platinum Partner in Singapore, Osome is Xero Certified and listed on the Xero Advisor Directory. Click here to learn more.

Start your practice on the digital journey by partnering with Xero. Learn more about Xero’s partner programme and sign up here.

Leave a Reply