SEC enforcement staff carried out fewer enforcement actions even as it ordered record fines and disgorgements in a year buffeted by the coronavirus pandemic.

Enforcement actions fell 17% from the previous year to 715 in fiscal 2020, according to the SEC Division of Enforcement’s annual report, released Nov. 2. It’s the lowest number of actions in at least six years.

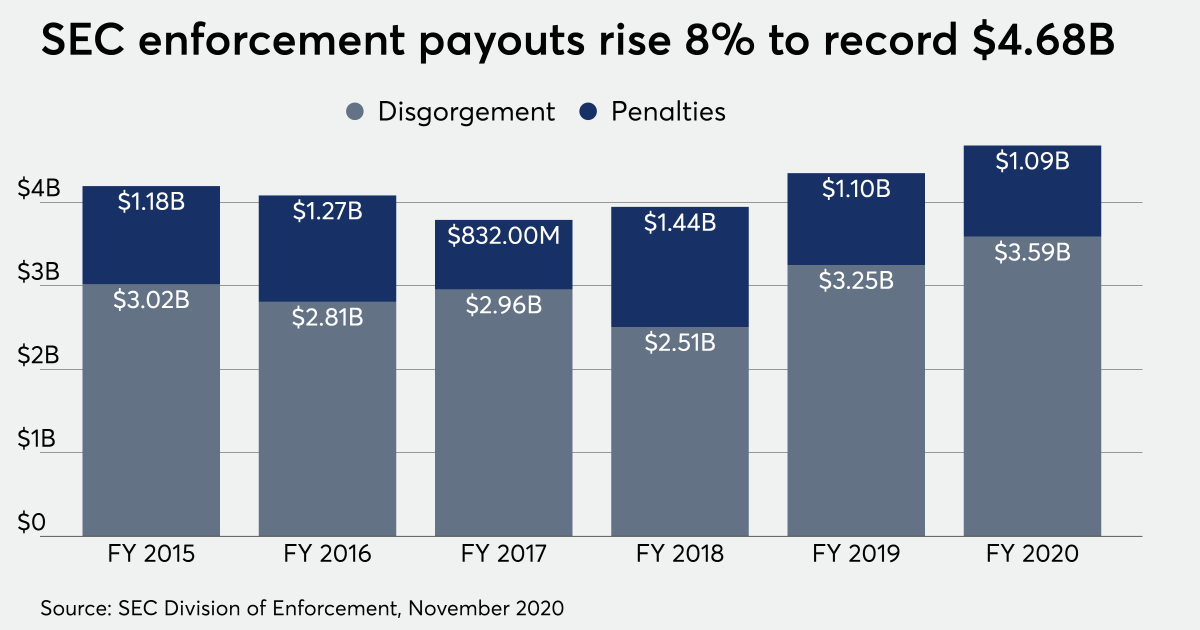

At the same time, the total money ordered in the regulator’s actions increased 8% to a record $4.68 billion — including $3.59 billion in disgorgement and $1.09 billion in penalties. The SEC’s mutual fund share-class disclosure program, which has drawn significant industry criticism, garnered $139 million in restitution from nearly 100 firms.

The coronavirus posed “unique impediments to several important aspects of our work” such as evidence gathering, live testimony from witnesses and court hearings, according to the SEC’s report. As the division adjusted to remote work, it processed some 16,000 tips, complaints and referrals and launched more than 150 investigations related to coronavirus scams.

“COVID-19 made fiscal year 2020 the most challenging year in recent memory,” Director Stephanie Avakian said in a statement. “But the division demonstrated its agility and its commitment to the SEC’s mission as it moved quickly to address the ongoing crisis. This rapid response protected investors and helped preserve the integrity of our markets.”

The enforcement unit completed the self-reporting program in April. At least two wealth managers are currently facing separate but similar cases the SEC filed in federal court last year, alleging they didn’t adequately disclose conflicts of interest. Trade organizations argue that the program was a costly example of regulation by enforcement.

In other areas touching the industry, the SEC cited an August settlement that alleged a small independent broker-dealer and RIA firm didn’t properly divulge the conflicts in its cash sweeps. Morgan Stanley agreed to pay $5 million to settle a different case in May, after the regulator alleged the firm gave “misleading information” to clients using wrap advisory accounts.

Investigators “continued to prioritize identifying misconduct that occurs in the interaction between investment professionals and retail investors,” the enforcement report stated. “Investment professionals occupy positions of tremendous importance to those who entrust them with their children’s college funds, their retirement funds, and other savings.”

One finding from the report may show evidence of reductions in the time devoted to regulatory oversight, though. The median time between the alleged conduct underlying an investigation and how long it took the SEC to file fell to a five-year low of 21 months. The average length of financial fraud and issuer disclosure investigations also dropped to 34 months from 37 last year.

Leave a Reply